Transform your Banking

Experience with Sprinklr

Service

Enable customer to self-serve most of the banking transactions, drive more sales with personalised services across channels & improve agent efficiency with AI automation

Why Banking Leaders prefer Sprinklr Service

Reduce Operational Costs by 20%

Gain insights on Voice of Customer & engage proactively resolving key emerging issues

Improve Self-Serve Rates by 70%

Empower customers to resolve queries on their own with frictionless self-service tools.

Enhance Agent Efficiency by 40%

Enable agents to resolve customer queries in the very first contact through AI and Automation.

Accelerate Time to Market with Pre-built Banking Solutions

- Omni-Channel Banking

- Pre-Configured Workflows

- Plug & Play Banking Systems

- Multilingual Support

- Pre-Trained Library

- Pre-trained library

Backed by the Highest Security & Compliance Standards

Manage Customer Experience with Out-of-the-box Banking Use Cases

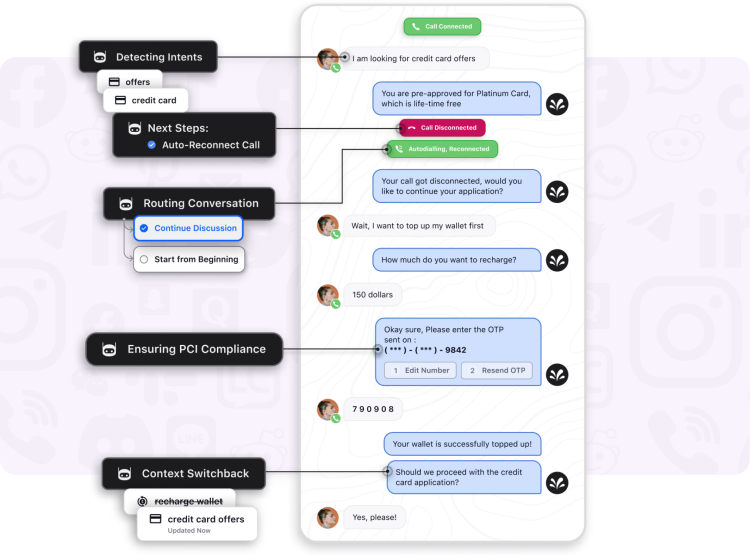

Empower Customers to Self Serve within minutes

Conversational Bots

Knowledge Base

Peer to Peer Assistance

Automate queries & enable customers to self-serve. Sprinklr bots are designed to handle 200+ pre-trained banking use cases, reducing the need for a human agent

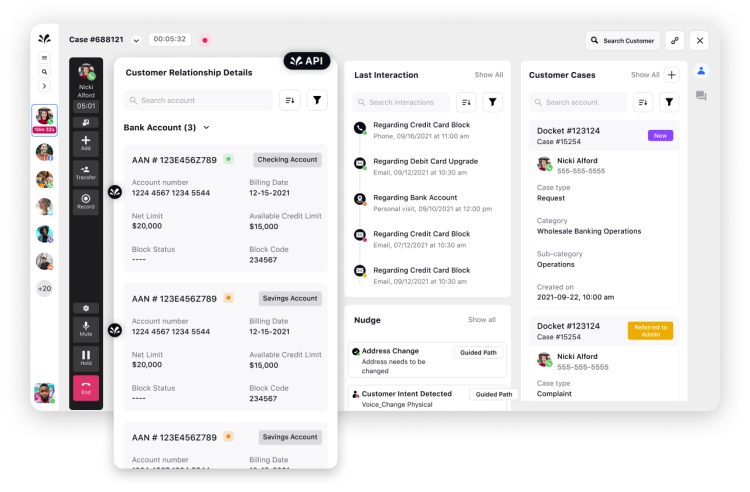

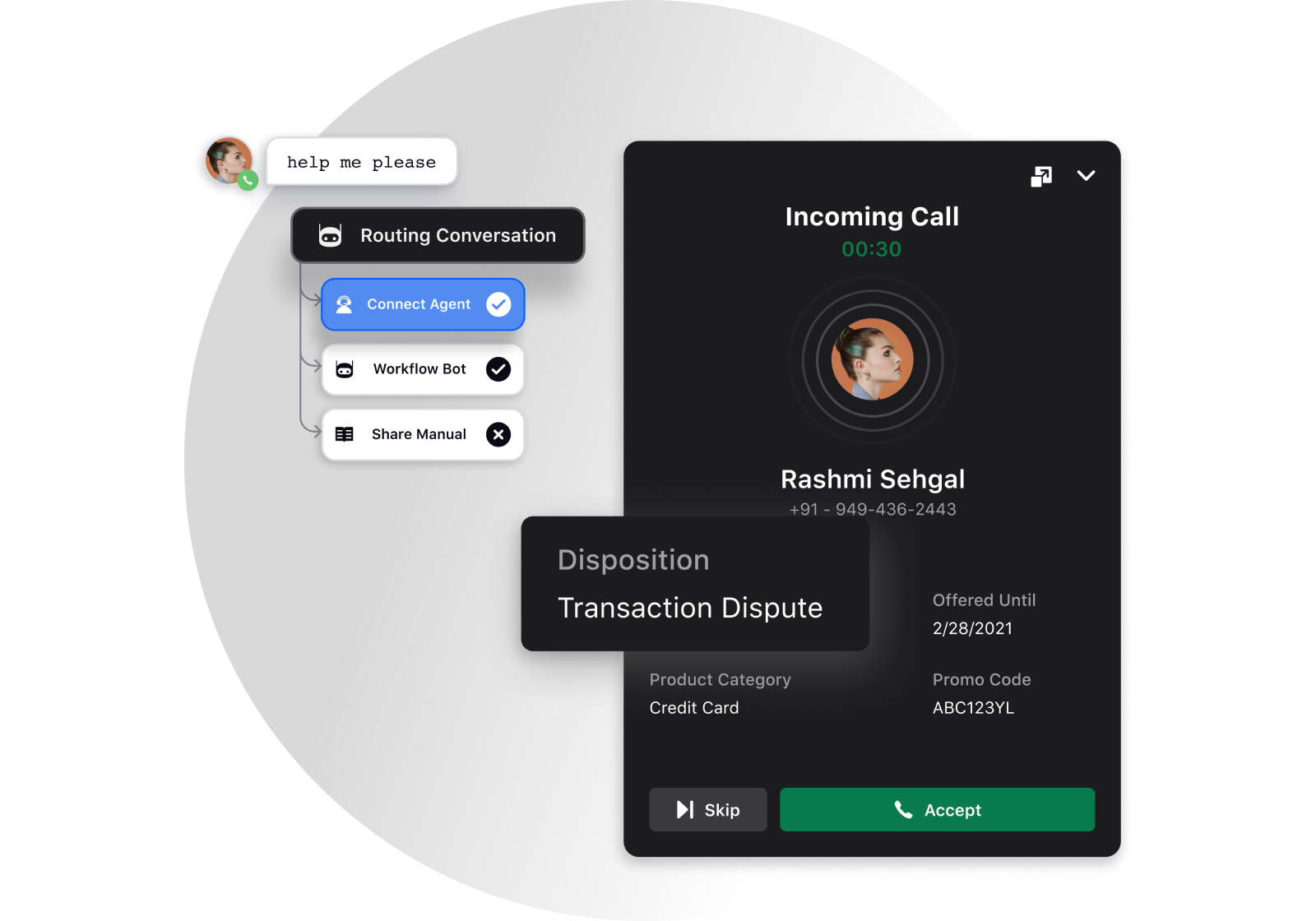

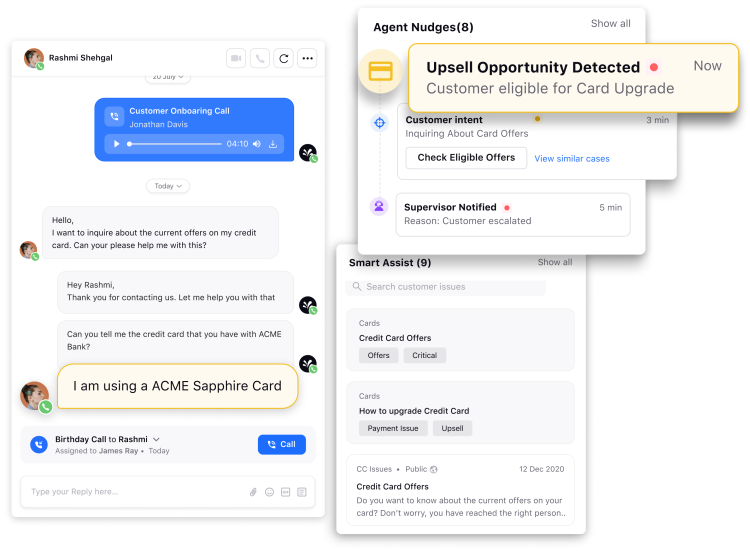

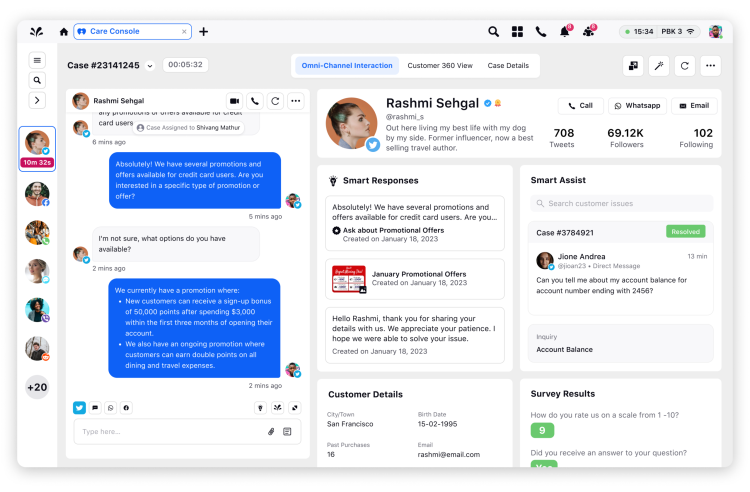

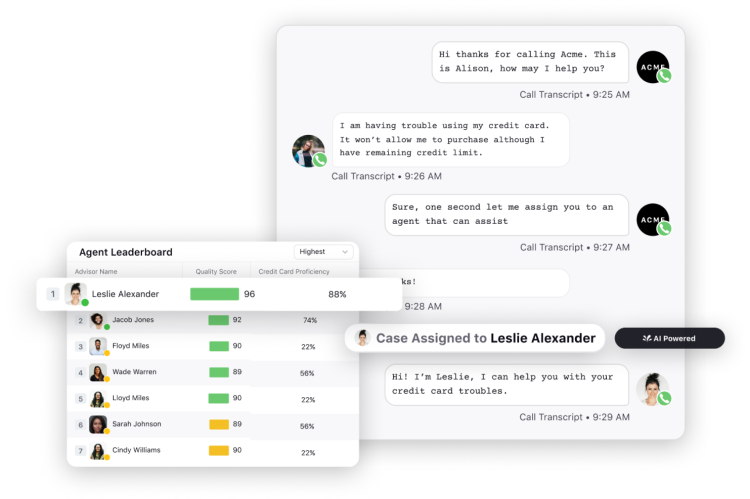

Increase First Contact Resolution with AI-powered Agent Assist

Omnichannel Routing

Unified Agent Desktop

AI Powered Agent Assist

Map customer requests to the right agent based on skill and prioritization. Prioritize requests like claims, credit card blockage etc

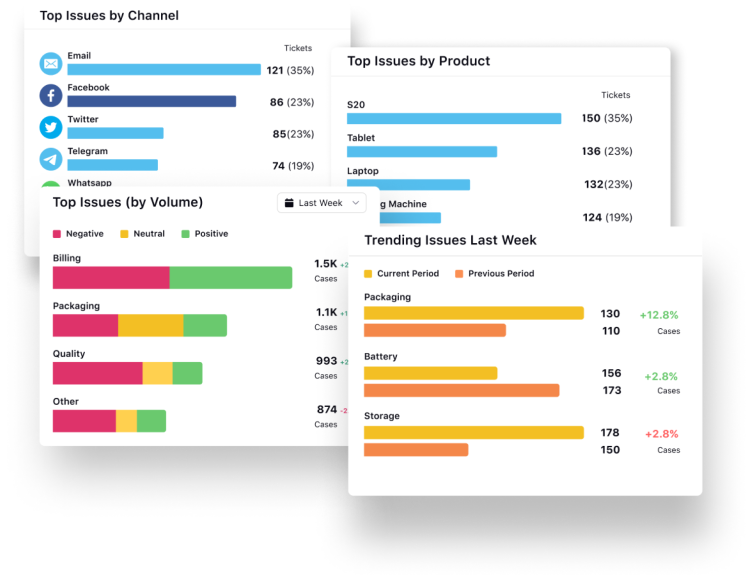

Get Unified Analytics from all your Data

Voice of Customer

Quality Management

Workforce Management

Gather real-time actionable insights by listening to 30+ channels to identify emerging trends & issues early on

Using any other CXM?

Seamlessly migrate to Sprinklr with our exclusive offers and a 30-day free trial.