Sprinklr for Financial Services

13 of the top 14 finserv institutions bank on Sprinklr to build customer trust and loyalty

Sprinklr's Unified-CXM platform helps financial service institutions personalize customer engagement, deliver delightful customer service and unlock deep customer insights.

Leading financial service institutions collaborate with Sprinklr for their CX needs

Digital Engagement and Sales

Boost revenue from social channels by up to 40%

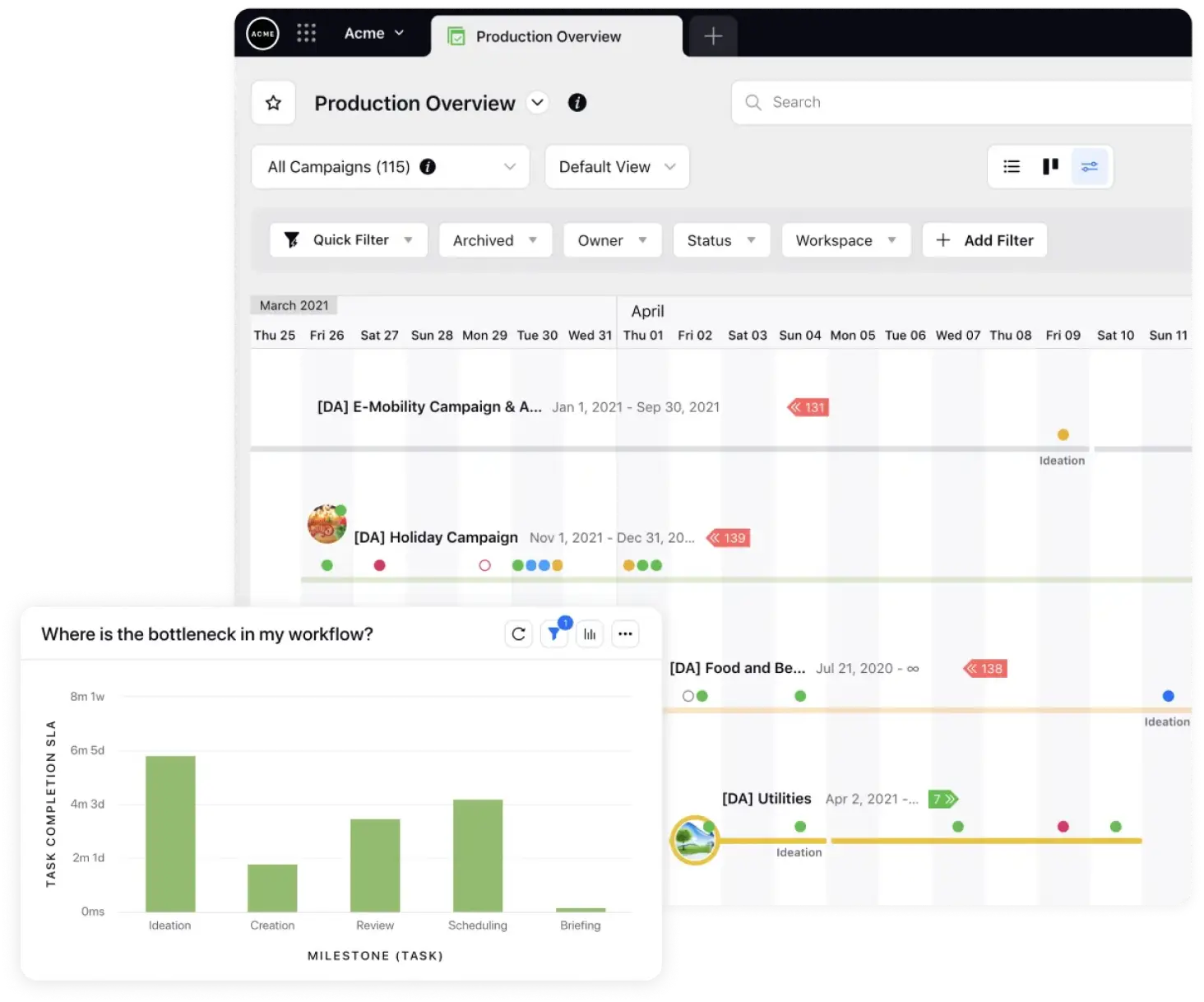

Enable localized marketing campaigns at scale

Provide pre-approved, customizable content to your advisors so they can meet their sales quotas consistently with impactful social media posts.

Discover 49% more leads on social channels

Identify customer engagement and sales opportunities across 30+ social channels with Sprinklr AI. Route these leads to the most suited advisors to improve conversion rates.

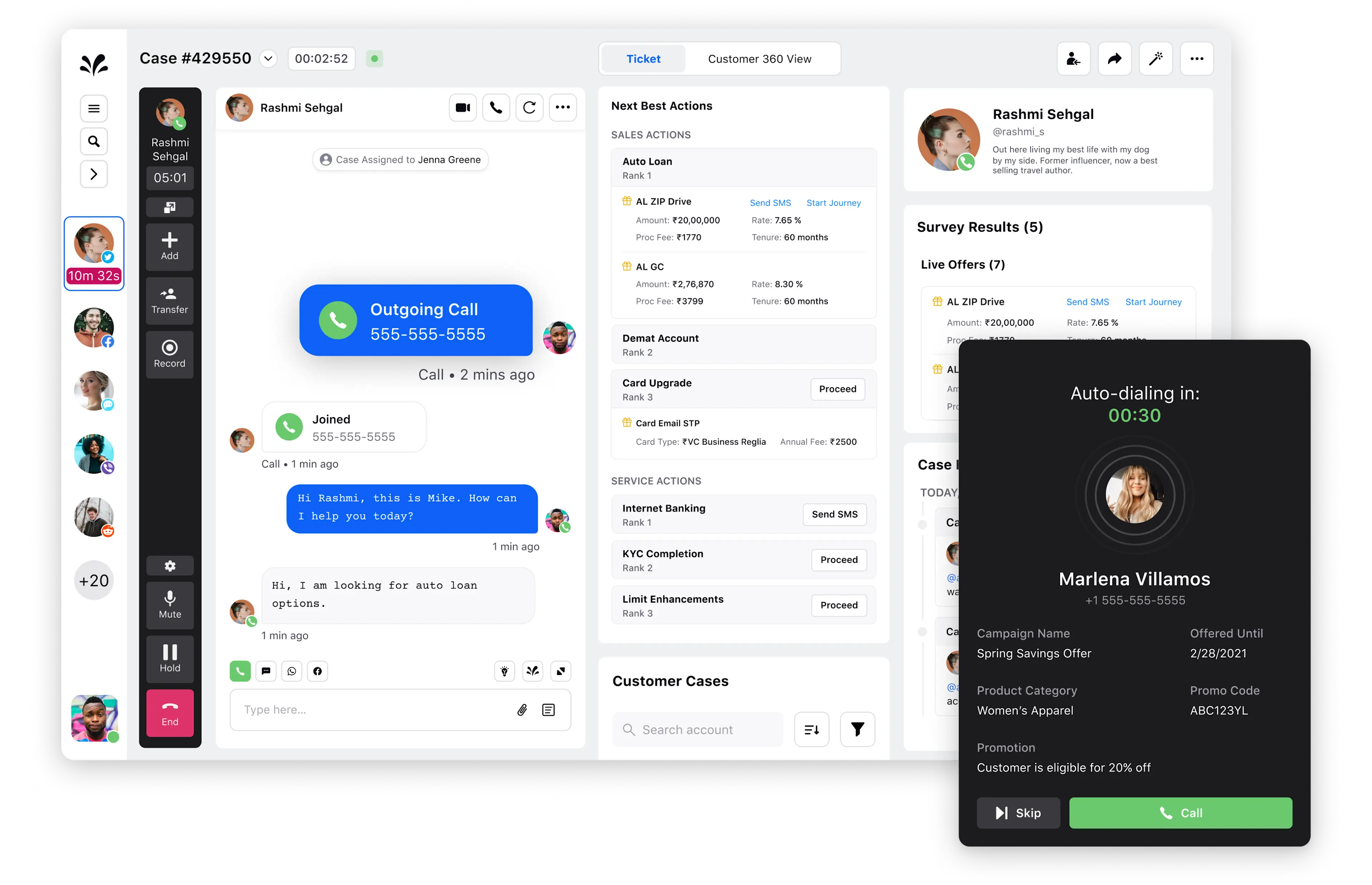

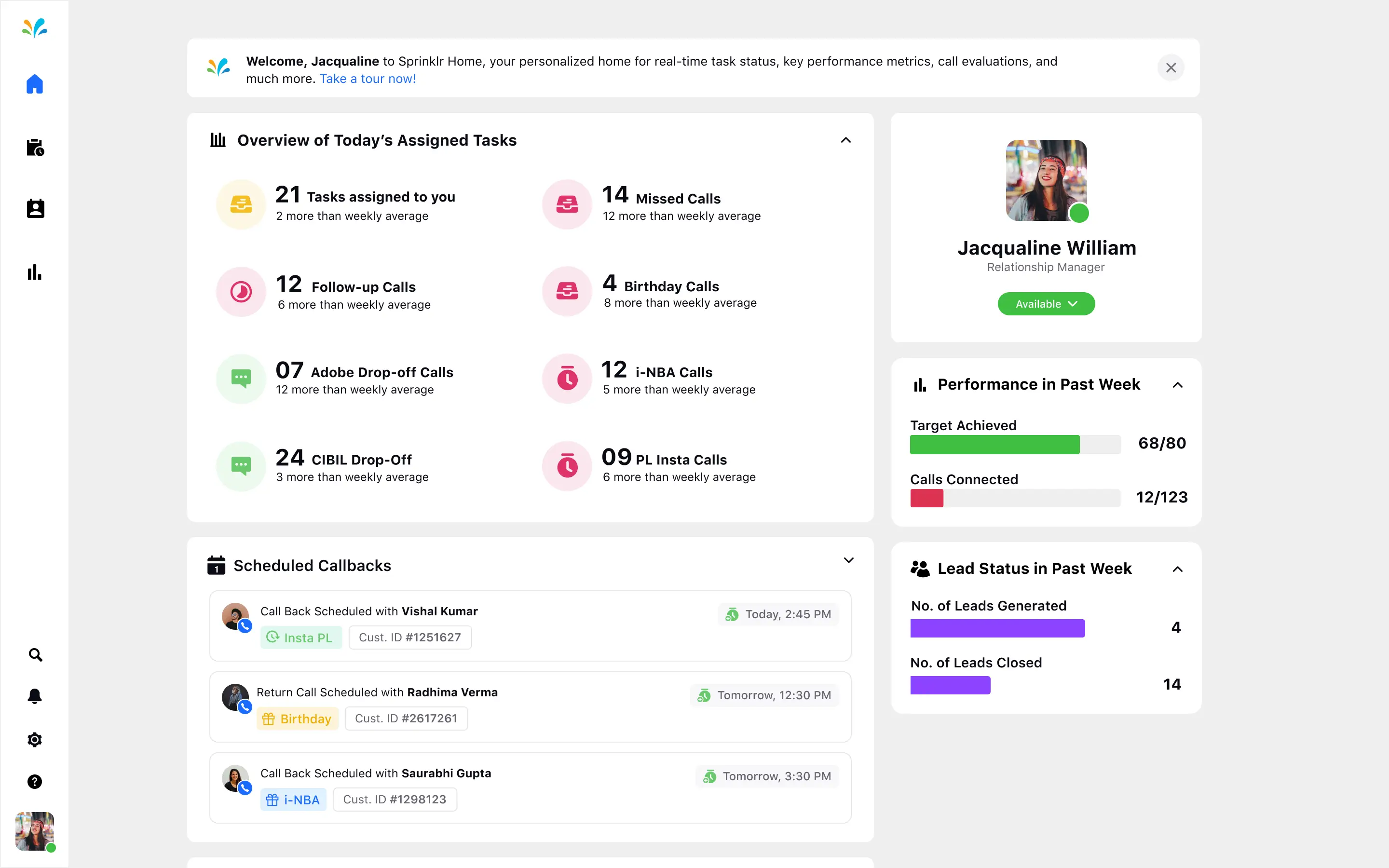

Stay connected with your portfolio

Bring all essential information for your advisors into one unified view. Advisors can prioritize interactions, check offer eligibility, initiate outreach efforts, and track progress against targets.

Omnichannel Customer Service

Improve CSAT by up to 50% with a frictionless omnichannel experience

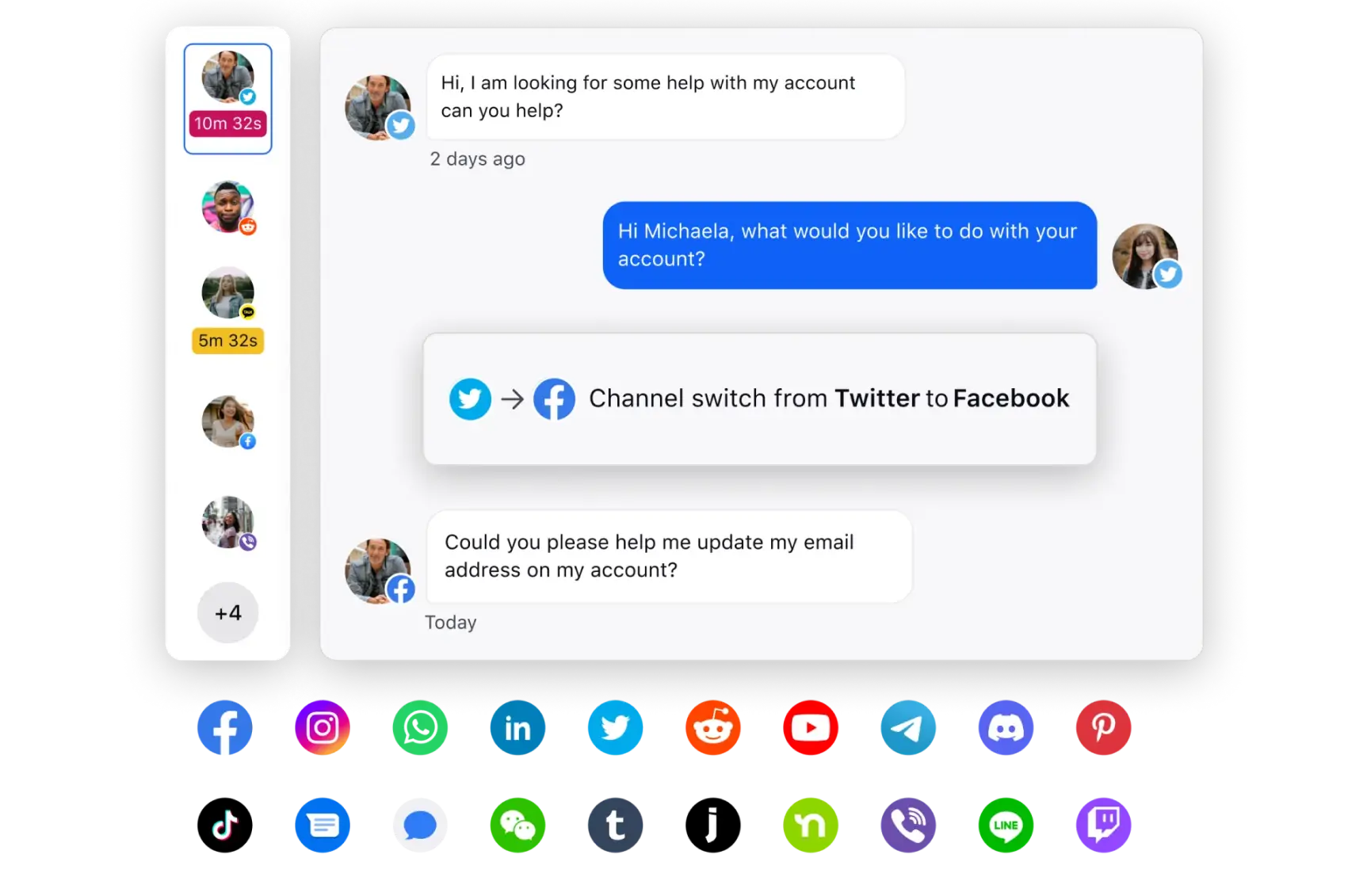

Extend customer service to 30+ channels

Provide consistent customer service across 30+ channels, such as social media, telephone, website, mobile app, email and more for greater reach.

Facilitate customer self-service across all channels

Quicken resolution of queries about borrowing rates, insurance claims, etc., with 24/7 live chat, voice bots, SEO-optimized help articles and AI-moderated communities.

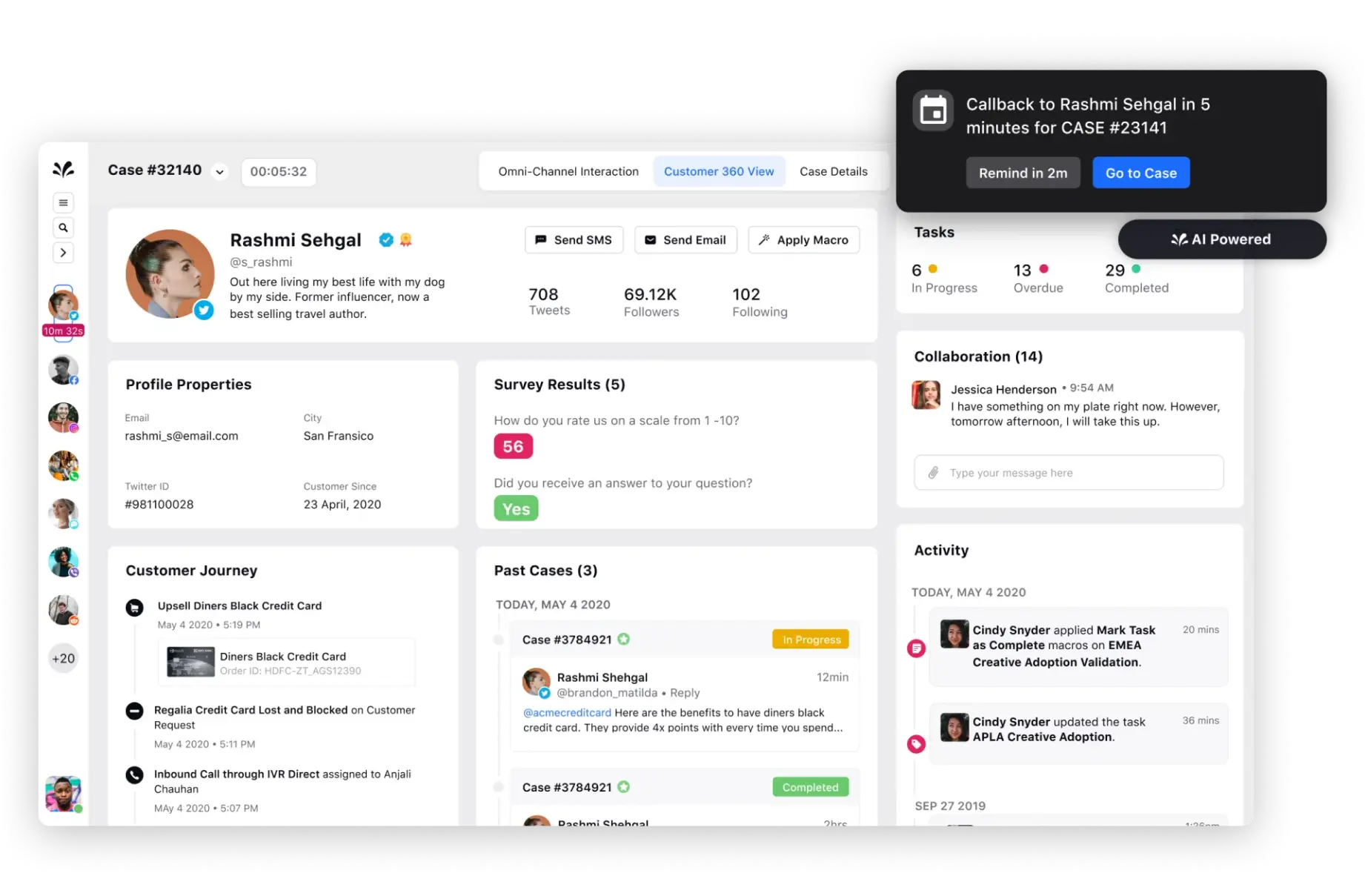

Get a unified view of the customer journey

Build stronger customer relationships by providing agents with a 360-degree view of customer activity across 30+ channels in a single window.

Customer and Industry Insights

Stay ahead of competitors with AI-powered insights on customer behavior

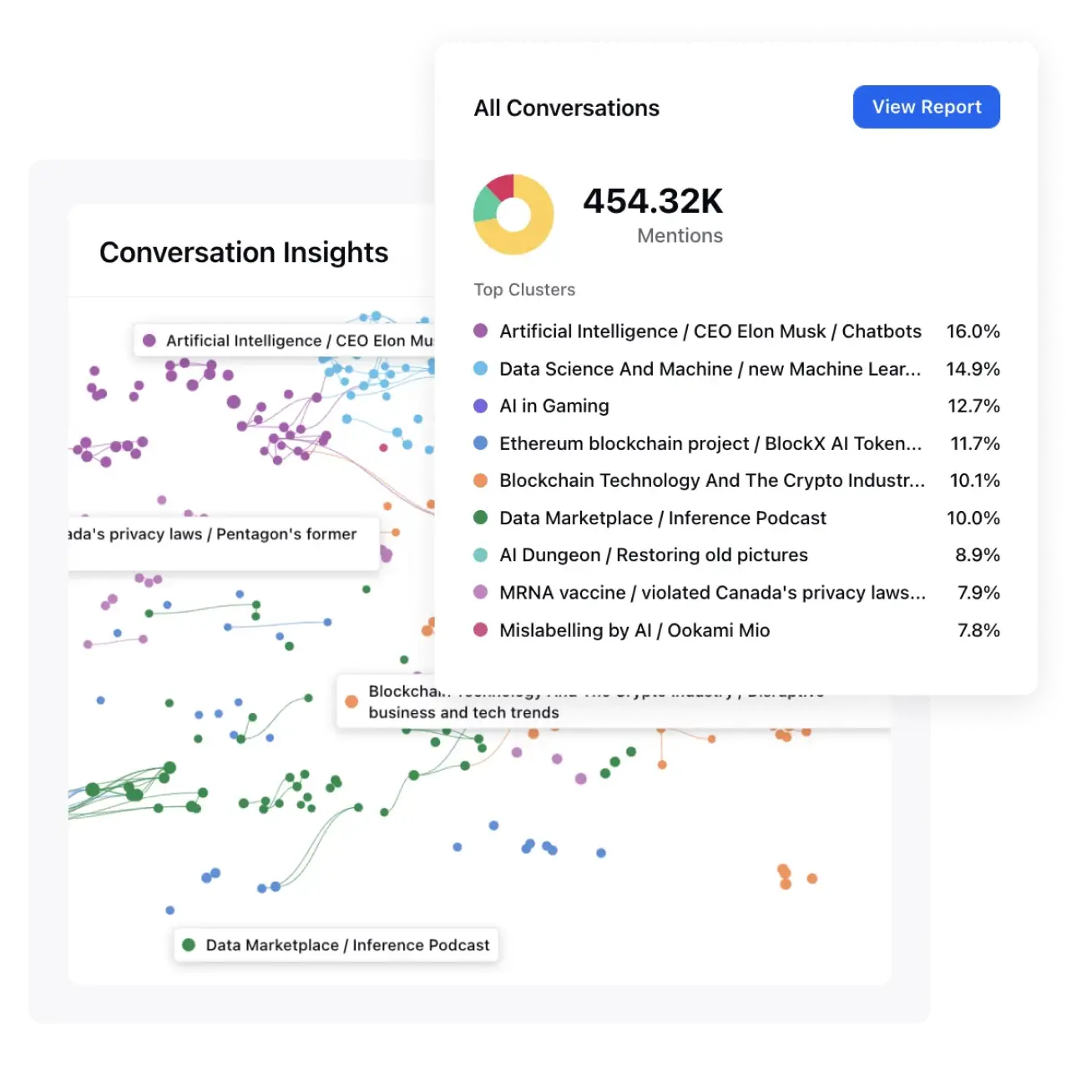

Predict the next big thing in your industry

Listen to topics of interest related to inflation, NFTs, buy-now-pay-later, ESG investing and more. Enrich your data with Sprinklr AI to surface actionable insights.

Know the needs and wants of your customers

Capture the complete voice of the customer across social channels, geographies and lines of business. Take data-driven decisions by leveraging actionable insights.

Build products and services your customers adore

Get insights on the performance of your branches and products from social and web sources. Supplement them with insights from internal and owned channels.

Compliance, Reputation and Crisis Management

Build unwavering customer trust with stronger governance and compliance

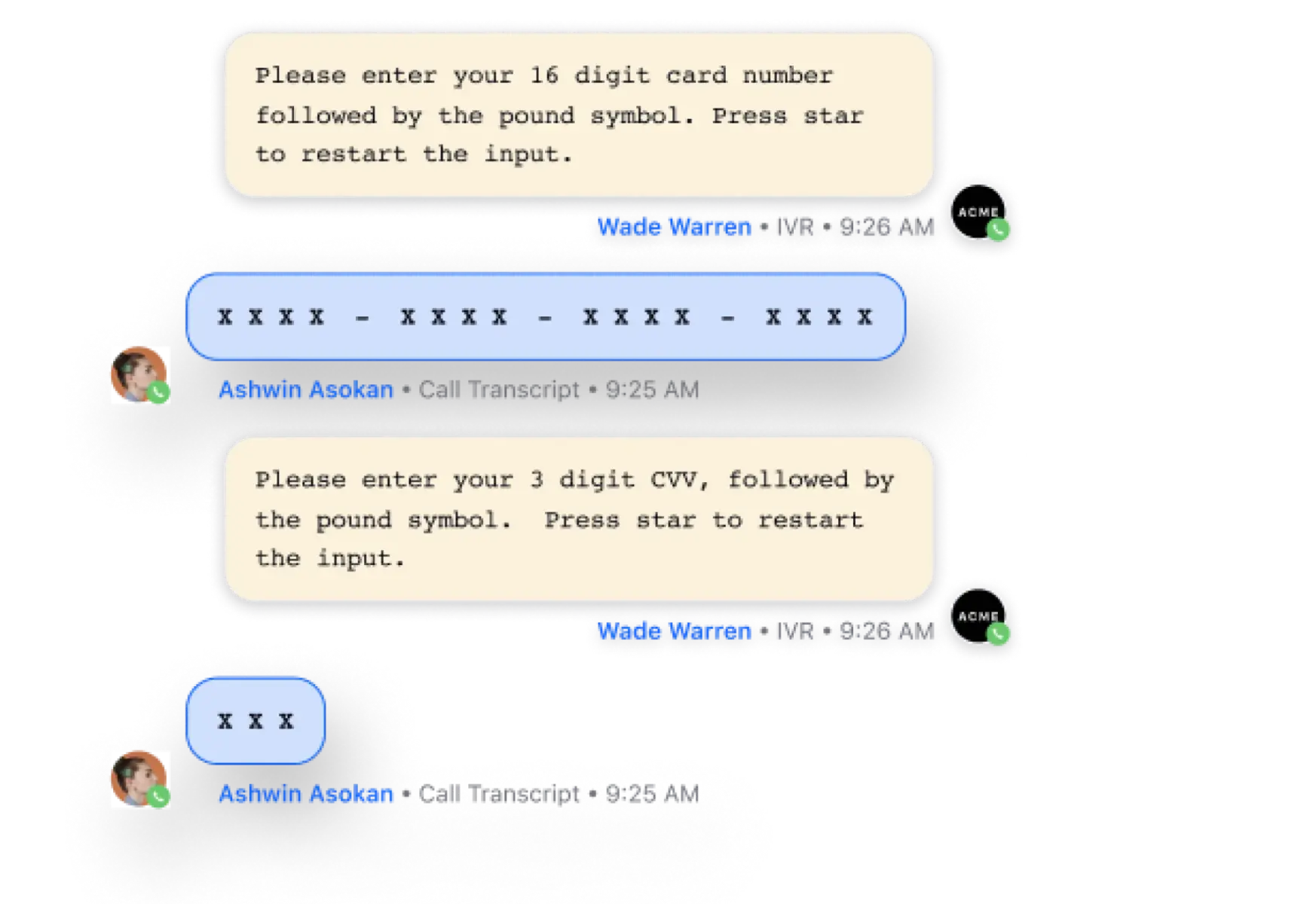

Provide compliant and secure customer service

Enable agent login via SSO and deflect users to secure chat while capturing PII in PCI-compliant forms. Notify customers about any possible fraudulent activity.

Ensure on-brand engagement, every time

Centralize brand governance across 30+ channels with automated approval workflows and restricted data access. Ensure brand consistency with AI-powered response compliance.

Detect and respond to crises proactively

Configure AI-powered listening alerts to monitor spikes in negative sentiment or brand mentions. Route critical insights to the right team for swift resolutions.

Ready to unify your customer experience? Try Sprinklr.

Sprinklr resources

85% of consumers expect financial services companies to offer the same level of digital experience as companies like Amazon and Google.

learn more