The undisputed leader in social media management

For over a decade, the world’s largest enterprises have trusted Sprinklr Social for its in-depth listening, unmatched channel coverage, enterprise-grade configurability and industry-defining AI.

BFSI: 3 steps to build a killer social media brand and grow your sales from GenZ

It’s no secret that your tech-savvy Gen Z and Gen Y customers rank social as the top channel for connecting with brands in the financial service industry. They use it to obtain financial advice, product updates, and quick support and resolutions.

Taking cognizance of this trend, financial institutions have begun to look at social media as an exciting way to grow sales and build personal connections with customers.

But it’s not enough to just have a brand presence on preferred social platforms and post ad hoc content to keep the new generation of online customers — infamous for low attention spans — engaged.

The key is to focus efforts on publishing brand-approved posts and replies that are consistent, well-scheduled, targeted, and personalized to each individual and platform.

Sprinklr’s Social Publishing & Engagement (SP&E) automates your publishing, engagement, and analytics workflows to help your organization create positive customer experiences across all digital touchpoints while fully complying with industry regulations.

Our advanced AI algorithms also enable your social media teams to gain enough bandwidth and data to create and post more engaging content at scale.

Trends transforming the BFSI industry

The majority (75%) of consumers in this post-pandemic world care deeply about a consistent experience. This rule applies to the financial service world too. For example, a customer should receive the same response to a question, whether it’s asked at the bank branch or on a mobile app or social platform.

Hence, more and more financial institutions are focusing on standardizing messaging across customer touchpoints.

Key digital media trends affecting the banking, financial services, and insurance (BFSI) industry today

- By 2025, 80% of B2B sales interactions are expected to occur on digital channels. Your business, too, needs to get social media marketing right — after all, that’s where your future investors and customers are.

- 94% of financial advisors, who use direct messaging on social networks to communicate with clients and prospects, reported new asset gains. And LinkedIn and Facebook emerged as their most favored platforms for building new customer relationships.

- Financial service businesses ended up paying around $10.4B in fines in 2020 for not complying with money laundering (AML), KYC, data breach, and Markets in Financial Instruments Directive (MiFID) regulations. Your business also must have a plan to reduce risks of non-compliance and poor governance.

- 51% of financial service businesses consider improved customer experience one of their top three priorities in 2020-21. And for 75% of them, the priority is digital banking transformation.

- Introducing Social Publishing & Engagement for the financial services industry

- 1. Leverage existing systems to create personalized customer experiences at scale

- 2. Manage brand risk through enterprise-grade compliance & governance

- 3. Accelerate digital transformation & maximize team productivity

- Do all of the above on the go & build brand loyalty

Introducing Social Publishing & Engagement for the financial services industry

Day in and day out, your social media teams are likely publishing posts and engaging with audiences at scale. But it can often get overwhelming to do so.

Social Publishing & Engagement — with its automated workflows — can save the day.

Powered by AI, the platform supports the drafting, scheduling, publishing, analyzing, and repurposing of campaign content to deliver consistent and positive customer experiences. Thus, we improve your staff’s productivity and free up their time to focus on more strategic tasks.

Also, each message is automatically categorized and sent to the relevant teams for action. Meanwhile, hashtags, response suggestions, and platform insights are auto-generated for your team to leverage.

Ultimately, with a little help from us, your brand stands to attain a whopping 180% increase in engagement levels across 30+ digital touchpoints.

And here is the best part: SP&E also comes with an enterprise-grade governance and compliance framework that ensures that no off-brand messaging or sensitive data ever gets leaked or published online.

1. Leverage existing systems to create personalized customer experiences at scale

A lot of people think that finance is boring, complex, and confusing. Spoiler alert: it's not. And neither should your communication be.

With engaging and personalized social media static posts, AMA sessions, Q&A, and polls it is possible to keep your customers hooked. And the secret to always delivering human and relatable content that drives sales lies in securing and leveraging the right campaign insights.

If you wish to offer tailored thought leadership content or financial advice to thousands of online customers, it helps to have automated social media scheduling, publishing, and posting solutions.

Current Challenges

What are your top-performing content pieces?

Who should they be targeted at? And when should they be posted?

Most social media managers don't have the answers to these questions simply because they just don't have the bandwidth to check and analyze each post and its performance manually. And if you don't know what works, how can you replicate the magic or repurpose the content?

Also, most social media management tools tend to offer limited channel coverage, which leads to brands missing out on identifying key opportunities or risks. What’s more, most of your customer’s messages remain unanswered on owned channels such as WhatsApp, Google RCS, and Apple iMessage.

How Social Publishing & Engagement helps

Build a powerful social media strategy{{How to create a social media strategy?}} with our Campaign Dashboard and Reporting Dashboard. These features let you collect data from different platforms and build customized views of preferred social media metrics{{Social Media Metrics to Track}} and analyze them. Meanwhile, the Unified Reporting feature collates data from different sources to deliver actionable insights in real-time.

To improve publishing efficiency - as you post on 30+ channels - pin accounts and easily scroll between post drafts with SP&E’s Quick Publisher tool. And to speed up the journey from drafting to publishing you could always rely on our handy smart hashtag recommendations.

2. Manage brand risk through enterprise-grade compliance & governance

Your business exists in a heavily regulated and dynamic sector, with the penalty for wrong or non-compliant customer communication ranging from hefty fines to rating downgrades. There is just no room for off-brand, inaccurate, and outdated information across all your customer-facing digital touchpoints.

At the same time, as your business becomes larger and more complex, make your best efforts to ensure that sensitive business and customer data stays strictly under your organization's control.

Current Challenges

Sometimes, your social media agents will say one thing to the customer on one portal and share a completely contradictory message on another. This may be because of human error. Or, your teams work in silos, resulting in agents not getting access to the latest or region-specific brand/regulatory updates.

Such inconsistent brand messaging impacts social media compliance.

Poor collaboration between teams or delays in supervisor approvals also lead to delayed brand response to customer concerns. Here, customer experience suffers. And you may even lose clients to competitors.

The other thing, especially with bigger businesses, is that content governance is a time- and resource-intensive task. And if data gets leaked to bad actors, the brand is exposed to expensive penalties and PR crises.

How Social Publishing & Engagement helps

In the financial service industry, rules and regulations change very frequently. This is why you need SP&E’s AI-powered Response Compliance tool to run automatic checks on each response to see if they are relevant and compliant, avoid profanity and bias, and meet brand tonality guidelines and latest product specifications.

The platform also does away with inconsistent, unsupervised, and unaudited channel management. Thanks to our Roles & Permissions feature, it's possible to simplify the task of controlling user permissions and capabilities of your social media manager, CMO, social media analyst, etc.

Finally, to correct the "silo mentality" and speed up the publishing of content, our Tiered Approval feature kicks in. This ensures all posts journey through a preset approval workflow so that nothing is ever published without a go-ahead from the relevant stakeholders.

3. Accelerate digital transformation & maximize team productivity

For your business to ace the social media game, it's essential to step away from the ‘old school’ mindset and readily embrace technologies that boost productivity and collaboration.

These advanced technologies will not only keep your social media operations agile but also reduce agent time spent on replies to customers.

Also, your social media managers needn’t waste time collecting and analyzing data and creating content from scratch.

Current Challenges

Teams across your organization may use different point solutions, to manage everything from content creation, campaign planning, and reporting to channel management. This leads to “point solution chao” orlimited exchange of data and communication between teams or functions.

It's also a real challenge to manually reply to large volumes of inbound messages or analyze customer data secured from multiple channels - resulting in missed social media opportunities and risks.

How Social Publishing & Engagement helps

Get your teams to work together better with Sprinklr’s Editorial Calendar which offers a centralized view of social media events, campaigns, outbound messages, and tasks — especially useful in an omnichannel setting.

Meanwhile, the Asset Manager tool acts as a unified storehouse of approved brand content (including UGC Assets).

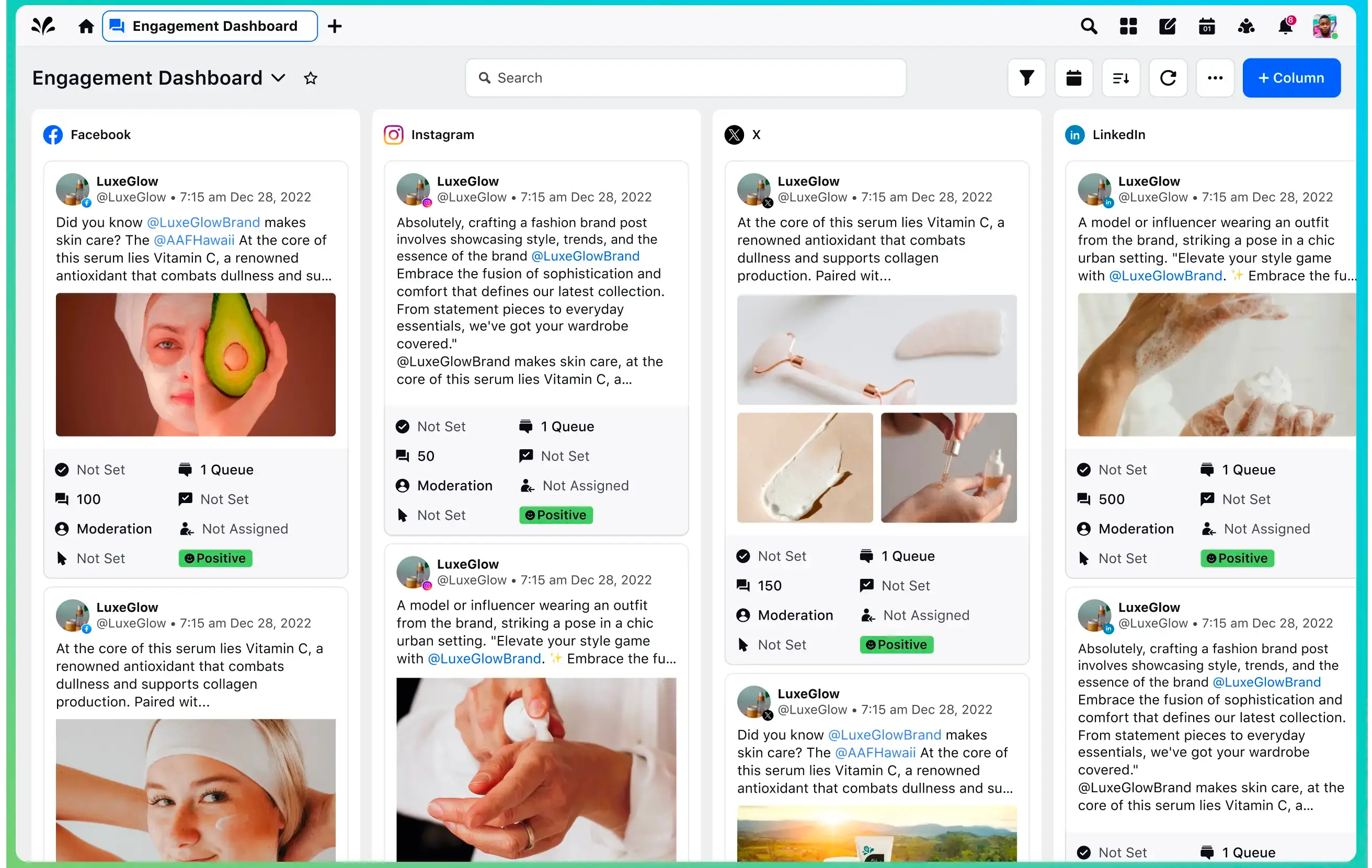

Financial institutions must also use SP&E’s customizable Engagement Dashboard to view, engage with, respond to, and take action on different pieces of social content.

Further reducing the manual work is the Smart Responses feature that auto-generates reply suggestions for agents to quickly and compliantly engage with customers. And the AI-powered Intuition Moderation tool sorts messages by priority and then routes them to the relevant teams for action.

Success Story

Allstate, a US-based insurance company with over 75,500 employees, wanted to attract a new and diversified crop of employees from the Gen Z and Millennial cohorts. Recognizing the potential to headhunt via social media, the company initiated a social recruiting campaign powered by SP&E.

Our AI technology helped automatically gatekeep the brand’s outbound messages and streamline the drafting, publishing, and customer service at scale. Simultaneously, its posts were regularly analyzed to arrive at the most effective and optimized messaging.

By offering a unified social platform to Allstate’s recruiting and employment brand team, it became possible to maximize efficiency and build a uniform brand voice throughout the enterprise.

Our Reporting Dashboard and Social Publishing tools played a significant role in growing the UGC production from 23% to 74% on their Instagram account. Additionally, Allstate credited us for helping them connect organically and credibly with a diversified bunch of applicants.

Do all of the above on the go & build brand loyalty

Running social media accounts is a 24/7 job. The only way this can be sustainably done, without your agents and managers burning out, is with an intuitive SP&E mobile app.

Sprinklr’s new Mobile App for iOS and Android enables your team to edit posts quickly, view reports, and get task notifications from anywhere and at any time.

It optimizes every user’s experience with personalized shortcuts, a faster and more intelligent Publisher, an updated Engagement Dashboard, detailed reporting, and prioritized notifications.

And to be more intentional about building brand loyalty on social media, use SP&E. We will surely be there in support of your social media marketing efforts to deliver maximum impact — right from the awareness stage all the way to advocacy.