Elevate CX with unified, enterprise-grade listening

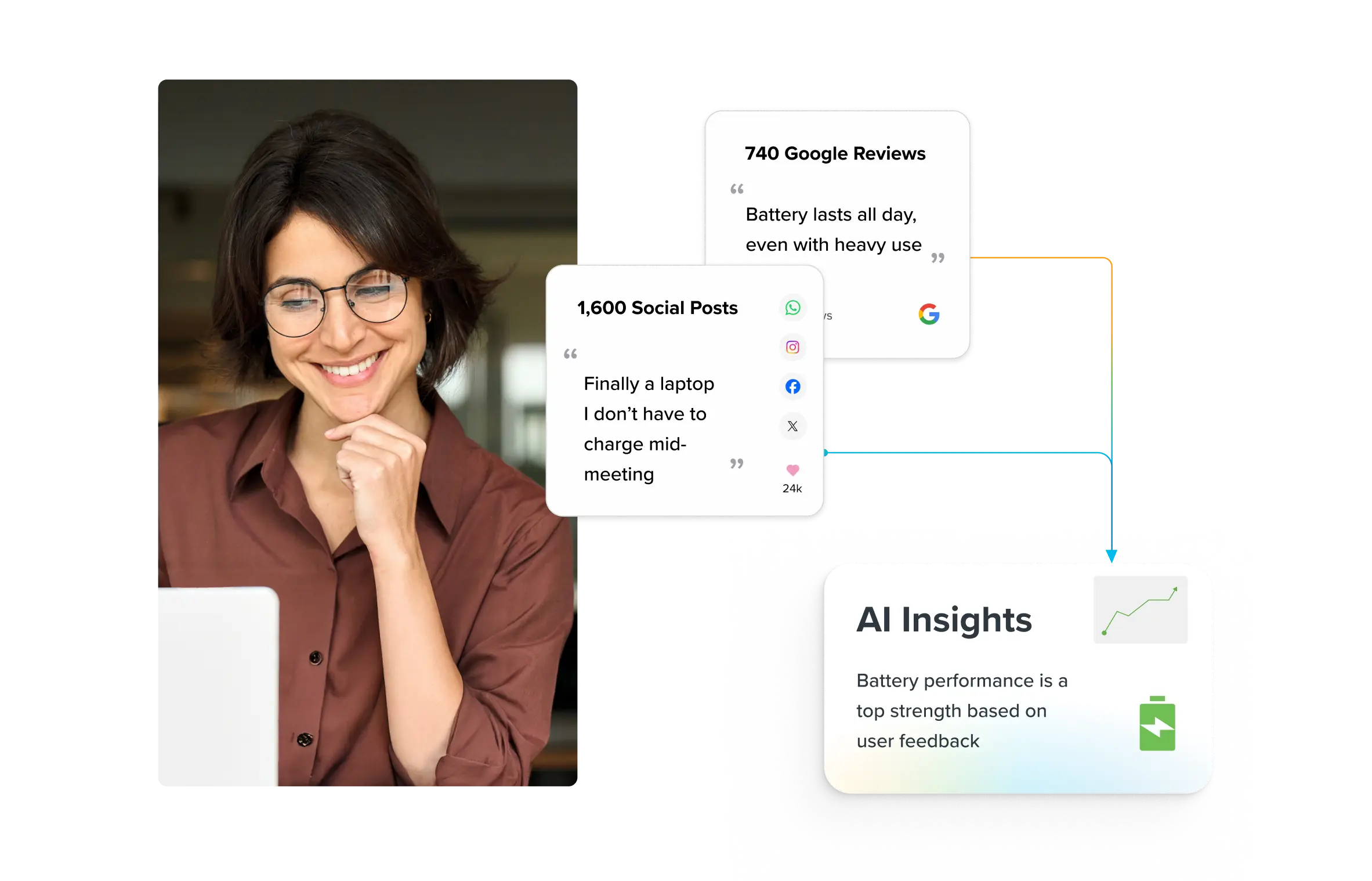

Sprinklr Insights gives you real-time consumer, competitor and market intelligence from 30+ channels without the noise. Make smarter decisions, strengthen your brand, and stay relentlessly customer-led.

Brand Awareness Survey: 35 Questions To Get Started

Do your customers know your brand?

It’s a question that haunts the biggest of brands and the most experienced CMOs! Thankfully, you can find out with a brand awareness survey.

Leading global CMOs use surveys to catch shifts in perception early. When insights reveal a message isn’t resonating or competitors are gaining ground, they pivot quickly, adjusting messaging, reallocating budgets, or testing new channels.

You can do the same, using these insights to keep your brand relevant and competitive.

In this piece, learn how to run a high-impact brand awareness survey, from setting goals and asking the right questions to distributing it smartly and acting on the results.

- What is a brand awareness survey?

- The right types of brand awareness survey

- 35 Must-ask survey questions to measure brand awareness

- What metrics and KPIs does a brand awareness survey actually measure?

- How to distribute your brand survey questionnaire

- Best practices to turn brand awareness survey insights into action

What is a brand awareness survey?

Marketing expert Sam Killip states: “Brand awareness is the foundation all your marketing efforts have to rely on, from social media to SEO. It’s what helps you make people aware of your brand and what you have to offer.”

A brand awareness survey gauges how well your target audience recognizes or recalls your brand. Are your customers or target audience familiar with your brand? What sentiments does your brand evoke among consumers?

The data helps shape marketing strategies and measure your campaign effectiveness.

🚀 Instantly launch brand awareness surveys and distribute them in 7 ways from 1 platform!

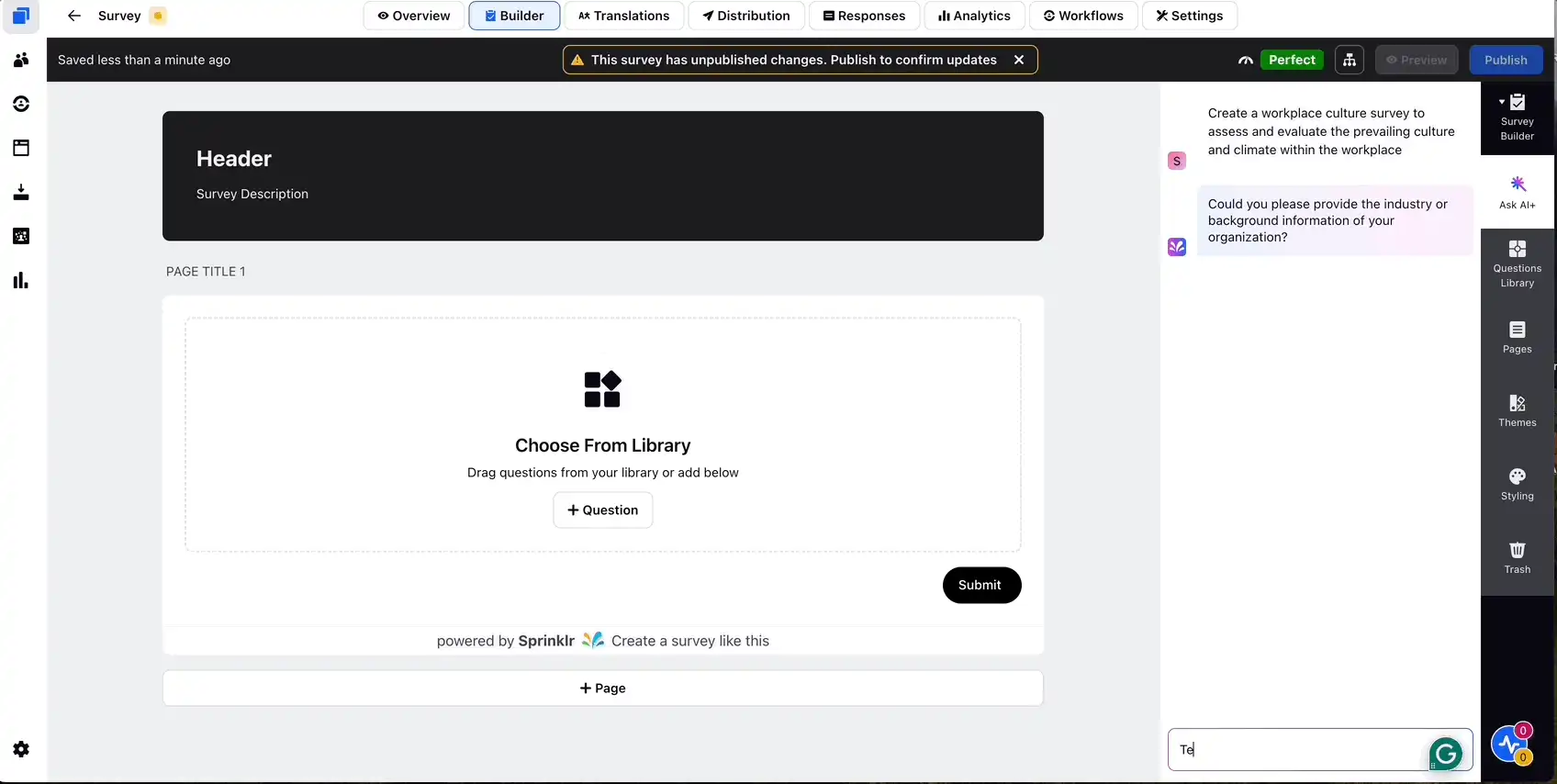

Set surveys as simply as commanding ChatGPT! Sprinklr’s AI+ considers your target audience when setting questions. It then interrogates you further for insights into survey goals and refines the output until you’re happy with the questions, structure, tone of voice, and design.

✅ Design until on-brand

✅ Build entire surveys with simple prompts

✅ Distribute viz seven channels, including QR Codes

✅ Get AI-powered survey reports for instant sharing

✅ Close feedback loop on Sprinklr Unified-CXM

The right types of brand awareness survey

Understanding brand awareness is the goal of your survey. However, there are different dimensions to it, which require different survey questions.

Here’s a quick guide to help you learn about the different types:

1. Unaided recall survey

This survey asks open-ended questions like “Which brands come to mind when you think of [category]?”

→ Purpose: Measures spontaneous brand awareness without prompts

→ Used when: You want to see if your brand is top-of-mind in a competitive space

→ Types of questions: Open-ended

→ Results in: A clear picture of how strong your organic brand presence really is

2. Aided recall survey

This format gives people a list of brands or visual cues to recognize.

→ Purpose: Tests recognition when your brand is shown

→ Used when: You’re running visual campaigns or want to test familiarity

→ Types of questions: Multiple-choice, image-based selection, or “Have you seen/heard of this brand?” type prompts

→ Results in: Data on whether people remember your brand when prompted

3. Campaign-based survey

This brand awareness survey is conducted around a specific campaign or product launch.

→ Purpose: Measures short-term shifts in awareness and perception

→ Used when: You want to track the immediate impact of marketing initiatives

→ Types of questions: Before-and-after awareness questions and message recall

→ Results in: Quick feedback on campaign effectiveness

4. Continuous brand tracking survey

A long-term survey is run at regular intervals.

→ Purpose: Tracks changes in brand awareness and sentiment over time

→ Used when: You want to measure long-term brand health

→ Types of questions: Repeated recall and recognition questions, brand sentiment ratings, and periodic perception checks

→ Results in: Trend data you can use to shape strategic decisions

If you’re unsure where to start, use this handy table below ⬇️

🎯 If your goal is to | 👇 Use this type | 🔬 What it helps you understand |

Measure spontaneous awareness | Unaided recall survey | How top-of-mind your brand is |

Test logo, name, or ad recognition | Aided recall survey | Recognition when prompted |

Assess campaign impact | Campaign-based survey | Short-term brand lift and message effectiveness |

Continuous brand tracking survey | Trends in awareness, sentiment, and positioning over time |

💡Pro tip: Choosing your audience matters just as much:

- Survey the general public if you’re measuring broad awareness or market penetration

- Focus on your target segment when you want actionable insights that support positioning, messaging, or demand generation.

Next, we’ll discuss the brand awareness survey questions that you can use to uncover insights.

35 Must-ask survey questions to measure brand awareness

We’ve crafted a categorized question bank designed to guide you in building a high-impact survey.

Each question includes a suggested format to ensure clarity and actionable insights:

1. For brand recall

Brand recall or awareness survey questions assess whether your brand comes to mind without prompts.

Question | Format |

Q1. What brands come to mind when you think of [product/service category]? | Open-ended |

Q2. Which brand do you think of first when considering [product/service category]? | Open-ended |

Q3. Can you name any brands that offer [specific product/service]? | Open-ended |

Q4. What is the first brand you think of when thinking of [product category]? | Open-ended |

Q5. Name the first three brands you think of for [Product Category]. | Open-ended |

2. For brand recognition

These questions test recognition when your brand is pitched among others.

Question | Format |

Q6. Which of the following brands have you heard of? | Multiple choice |

Q7. Do you recognize this logo? [Show logo] | Yes/No |

Q8. Have you seen advertisements for any of these brands recently? | Multiple choice |

Q9. Where did you first hear about [Brand Name]? | Multiple choice |

Q10. How familiar are you with [Brand Name] compared to your competitors? | Scale (1 = Not familiar, 5 = Very familiar) |

3. For brand perception

These questions explore how your brand is perceived in terms of quality, trust, and other attributes.

Question | Format |

Q11. How would you describe <brand> in a few words? | Open-ended |

Q12. Which of the following words best describes <brand>? | Multiple choice |

Q13. On a scale of 1 to 10, how trustworthy do you find <brand>? | Scale |

Q14. What is your overall impression of <brand>? | Multiple choice |

Q15. What emotions do you feel when considering <brand>? | Multiple choice |

4. For brand association

These brand awareness survey questions identify the attributes and values consumers associate with your brand.

Question | Format |

Q16. What comes to mind when you think of <brand>? | Open-ended |

Q17. Which of the following attributes do you associate with <brand>? | Multiple choice |

Q18. How does <brand> compare to competitors in terms of innovation? | Scale |

Q19. If <brand> were a person, how would you describe them? | Open-ended |

Q20. What values do you associate with <brand>? | Open-ended |

5. For purchase intent and loyalty

These questions gauge the likelihood of purchase and customer loyalty.

Question | Format |

Q21. How likely are you to consider purchasing from <brand>? | Scale |

Q22. Have you purchased from <brand> in the past? | Yes/No |

Q23. How likely are you to recommend <brand> to others? | Net Promoter Score (0 = Not at all likely, 10 = Extremely likely) |

Q24. Which of the following brands would you consider buying from? | Multiple choice |

Q25. What factors influence your decision to purchase from <brand>? | Multiple choice |

6. For brand differentiation

These brand awareness survey questionnaires assess how distinct your brand is in the marketplace.

Question | Format |

Q26. What makes <brand> stand out from competitors? | Open-ended |

Q27. Which of the following brands do you perceive as unique? | Multiple choice |

Q28. On a scale of 1 to 10, how different is <brand> from others in the industry? | Scale |

Q29. What unique value does <brand> offer that others don’t? | Open-ended |

Q30. How would you rate <brand’s > uniqueness compared to competitors? | Scale |

7. For communication and messaging

These questions evaluate the effectiveness of your brand’s communication strategies.

Question | Format |

Q31. Have you seen any of <brand’s> recent marketing campaigns? | Yes/No |

Q32. Where did you encounter our marketing messages? | Multiple choice |

Q33. What message did you take away from our recent advertisements? | Open-ended |

Q34. How clear is our brand messaging to you? | Scale |

Q35. Do you feel our messaging aligns with your values? | Yes/No |

Grouping your brand awareness survey questions by goal helps see the full picture: how people recognize your brand, what they associate with it, and how you stack up against competitors.

From there, you can tailor questions to your industry and audience to get sharper, more relevant insights.

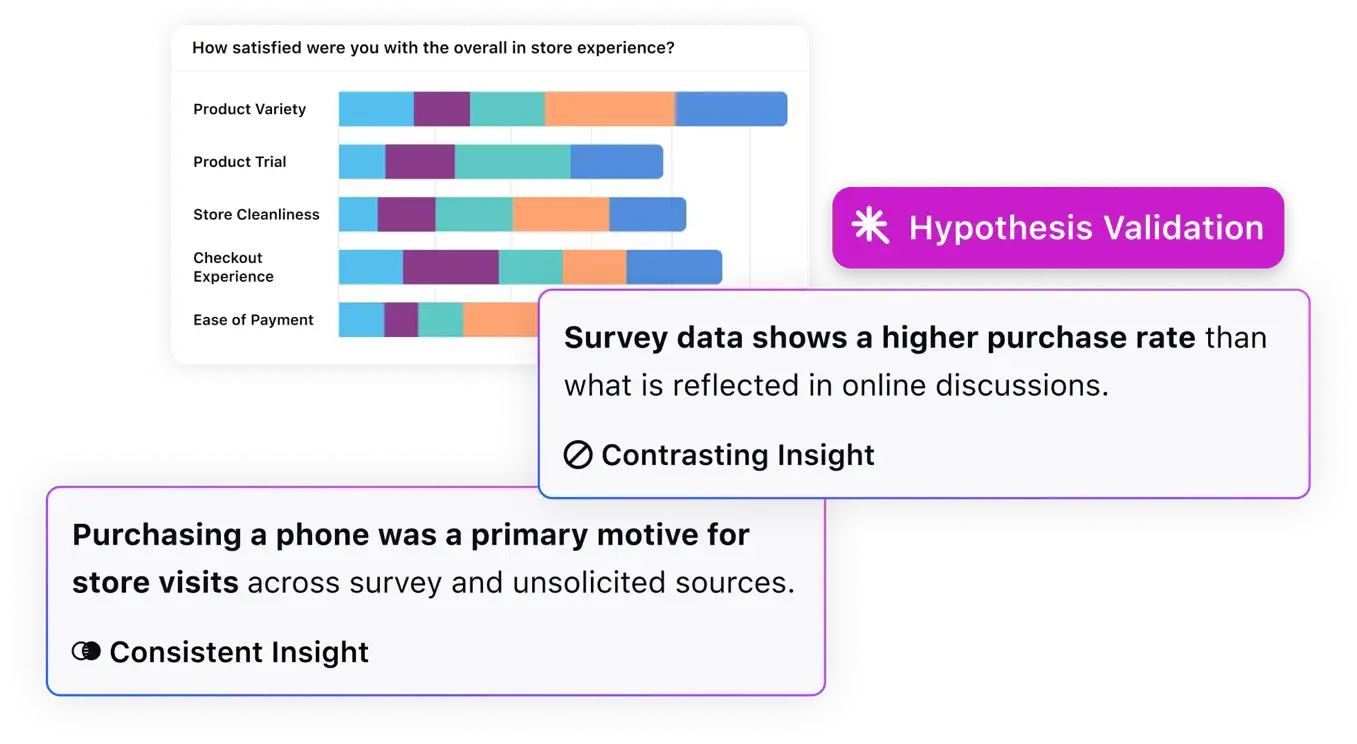

🔥What is between the lines of your survey responses? Let AI slice and dice the insights for you!

Use AI in Sprinklr Insights to compare survey outcomes with social, digital, review sites, and service data and have AI offer instant validation of your survey responses.

If you use Sprinklr Unified-CXM, you can close the loop on customer feedback by assigning tasks to human agents.

‼️You may want to learn this: How to measure and improve brand awareness

What metrics and KPIs does a brand awareness survey actually measure?

A brand awareness survey focuses on three key areas: Recall, recognition, and brand perception. Besides, there are other KPIs you can measure.

Here’s a quick look at all of them:

Metrics | What it is | How to measure |

Unaided brand recall | The ability of consumers to remember a brand without any prompts. This is a strong indicator of top-of-mind awareness. | Open-ended questions like, "When you think of [product category], what brands come to mind first?" |

Aided brand recall | The ability of consumers to recognize a brand from a given list. This measures familiarity. | Multiple-choice questions listing your brand among competitors. |

Brand recognition | The ability of consumers to identify a brand's logo or slogan. | Image-based questions showing a logo and asking respondents to name the brand. |

Brand image and associations | The qualities, emotions, and characteristics that consumers associate with a brand. | Questions ask respondents to select attributes from a list or describe the brand in their own words. Sentiment analysis can boost this metric further |

Brand differentiations | How clearly does your brand stand apart from competitors? | Questions such as "Which attributes do you associate with [your brand] that you do not associate with [competitor brand]?" |

Comms effectiveness | How well your messaging is landing with your audience | Questions on clarity, recall, and impact of your message: how well they understood the information, what key points they remember, and what action, if any, they took as a result. |

Brand trust and loyalty | The level of confidence consumers have in a brand and their likelihood to choose it repeatedly. | Questions about purchase intent, likelihood to recommend (Net Promoter Score), and perceived trustworthiness. |

These aren’t just vanity metrics. These metrics will directly impact your business outcomes like demand generation, customer loyalty, and market positioning.

Beyond these KPIs mentioned above, you can also add more dimensions and insights into your brand awareness survey outcomes by measuring these additional KPIs, provided your survey platform supports:

Additional metrics | What it is | How to measure |

Share of voice (SoV) | Helps contextualize aided and unaided brand recall by comparing your brand’s visibility to competitors across media and digital channels | SoV is an out-of-the-box metric in consumer intelligence platforms like Sprinklr Insights. |

Complements perception and association questions (e.g., "What comes to mind when you think of this brand?") with an emotional tone behind the awareness | Sentiment analysis and net sentiment score (NSS) of survey responses are out-of-the-box metrics in consumer intelligence platforms like Sprinklr Insights. | |

Customer satisfaction score (CSAT) | Complements overall brand awareness with insights on the depth of the relationship, that is: are aware customers also satisfied? | CSAT score of survey responses is an out-of-the-box metric in consumer intelligence platforms like Sprinklr Insights. |

👉 Also read: How to build brand awareness (with 10+ tips)

How to distribute your brand survey questionnaire

You’ve crafted thoughtful questions. Now it’s time to disseminate them across suitable target subjects and make sure the responses are reliable, relevant, and representative.

Here’s a step-by-step approach to distributing your brand awareness survey questionnaire in a way that delivers actionable and valuable insights for your use.

Step 1: Define who you want to hear from

Before picking a channel, be clear about your target audience:

- Are you looking for general public perception or just your ICP (ideal customer profile)?

- Do you need responses from specific geographies, industries, or job roles?

- Are you trying to reach customers, prospects, or unaware audiences?

This clarity will shape your outreach strategy. Plus, it would help you avoid data that looks nice but tells you nothing useful.

BlackBerry, for instance, needed to shift perception from phones to cybersecurity. By zeroing in on security professionals through targeted surveys, they ensured their outreach was sharply aligned with the audience they needed to influence.

Step 2: Choose the right distribution channels

Next, use a mix of channels to match the audience you’re targeting.

Channel | Best for |

Current customers, newsletter subscribers, or leads | |

CRM-based outreach | Targeting high-value segments directly |

B2B professionals, role-based targeting | |

Facebook and Instagram | Consumer audiences, broader demographic reach |

In-product surveys | Gauging awareness post-engagement |

Niche interest groups (e.g., Reddit, Slack, Discord) | |

On-site pop-ups | Capturing feedback from website visitors |

Paid survey panels | Quick, segmented reach at scale |

The Dominican Republic Ministry of Tourism blended video exposure with post-campaign surveys, measuring brand lift through a Millward Brown panel. This helped them prove campaign impact and sharpen their positioning for U.S. travelers.

💡Hint : Blend 2–3 channels to balance reach and quality. For example, pair LinkedIn ads with a CRM email push to validate responses from different angles. Bonus resource: 10 Ways to use social media for brand awareness

Step 3: Time it right

Getting the timing right for your brand awareness survey is key to getting quality responses.

Instead of focusing on specific days or hours, think about avoiding survey fatigue by spacing out your outreach and choosing optimal windows when your audience is most receptive.

For example, avoid sending multiple surveys back-to-back or during busy periods like holidays or product launches.

If you’re measuring campaign impact, aim to send your survey soon after key exposure (within a few days) while the experience is still fresh in respondents’ minds.

Step 4: Decide sample size

Choosing the right sample size is key to getting meaningful, reliable insights from your brand awareness survey:

- Larger samples provide more confidence and allow you to analyze specific segments like regions, demographics, or customer personas in detail

- Smaller samples can still reveal important trends and are useful for quick, directional feedback, especially for smaller businesses or early-stage research

Ultimately, balancing sample size with your research goals helps ensure you collect data that’s both actionable and statistically sound, without wasting resources.

💡Hint : Focus on quality over quantity. A small, well-targeted sample beats a large but generic audience.

Step 5: Choose the right survey tool

Use tools that match your needs, whether that’s speed, design, or analytics depth.

The right platform can significantly impact both your response quality and analysis efficiency. Some examples are:

- Sprinklr Insights: End-to-end, AI-powered survey management platform

- SurveyMonkey/Typeform: Easy to use, good for branded surveys, but lacks AI features that make the job easier

- Google Forms: Quick and free, but limited customization

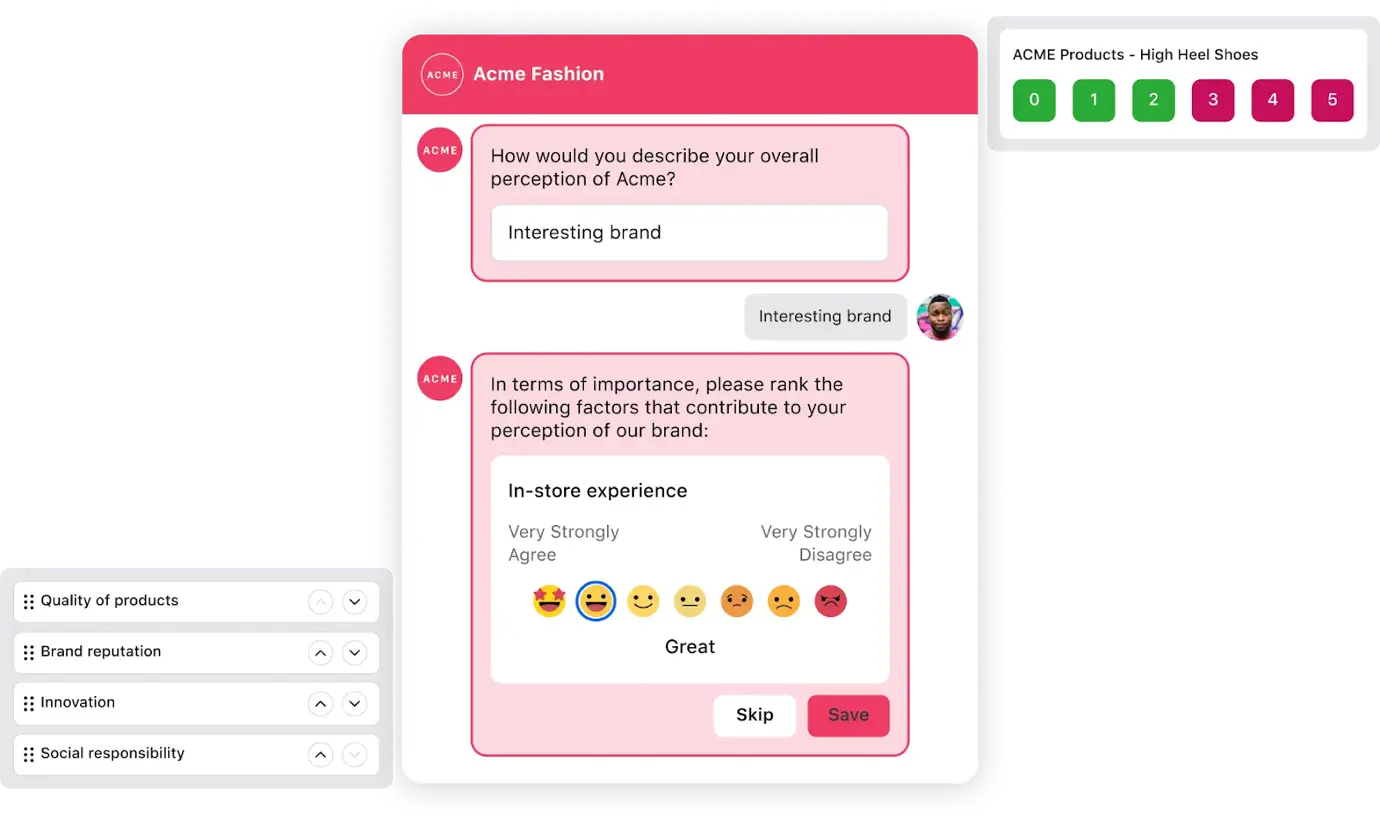

⚡ Pro tip: Pick a survey tool that works with your chatbot!

Users are more likely to respond to questions when they’re already in a chat environment — rather than cold start surveys from emails or other channels.

Use Sprinklr’s conversational surveys to integrate questions into existing chatbot sessions. AI adapts the questions as respondents answer, extracting deeper insights without overwhelming them!

Best practices to turn brand awareness survey insights into action

Collecting brand awareness survey data is just the start. The next step is using data to develop insights that help improve your brand strategy.

While the distribution process focuses on getting reliable responses, best practices help you translate that feedback into clear, actionable business outcomes:

1. Align campaigns with awareness gaps

If your audience doesn’t recall your brand (or confuse it with someone else), you have a message gap.

Use survey insights to refine your positioning and tailor campaigns for the segments that need it most.

If awareness is strong in healthcare but weak in finance, double down your messaging for financial audiences.

Unilever's Lifebuoy soap faced challenges in Indonesia, where traditional hygiene practices and local competitors dominated the market. Brand recall surveys revealed that while Lifebuoy was recognized, it wasn't top-of-mind for many consumers, especially in rural areas.

To address this, Unilever launched the "School of Five" program, promoting handwashing in schools and tying Lifebuoy directly to health and well-being. This culturally relevant campaign improved brand awareness and positioned Lifebuoy as a public health champion in Indonesia.

2. Equip your CX and support teams

If customers are confused about what your brand offers or expect something different, that’s a sign your messaging isn’t sticking.

Loop in your CX and support teams early. Use survey insights to update FAQs, tweak scripts and build enablement content that reflects what you want to be known for.

It keeps the experience consistent and helps your teams answer with confidence, especially when expectations don’t quite match reality.

3. Feed your product roadmap

Use perception and association data to guide product innovation.

- Are customers excited about sustainability?

- Do they associate your brand with outdated features?

Let feedback shape what comes next. For you, this means building features and experiences that resonate with audiences.

It’s how you stay relevant, competitive, and focused on customers.

4. Establish a continuous measurement cadence

One survey isn’t enough. Set up a quarterly or biannual cadence to track awareness trends, measure campaign impact, and fine-tune your approach over time.

For you, this ongoing rhythm builds a reliable benchmark for brand health, helping you detect shifts early, validate strategic moves, and course-correct before issues scale.

It’s how you turn insights into long-term ROI and greater brand visibility.

5. Share insights across teams

Make survey results visible and accessible across marketing, product, sales, and support teams.

When everyone is aligned around the same customer insights, your brand delivers a more consistent, impactful experience.

🔥If you use Sprinklr Unified-CXM platform - You can automatically alert or assign cases to your brand managers, marketing, and sales teamsbased on survey responses, so they can stay informed, do the needful, and close loops — without leaving the Sprinklr platform.

Ready to turn awareness into an advantage?

Brand awareness surveys help you understand how your brand shows up in the market across audiences, regions, and touchpoints.

When done right, they surface insights you can use to shape strategy, strengthen messaging, and drive real business outcomes.

Sprinklr Insights brings everything under one roof — from building surveys and distributing them across channels to analyzing results and turning them into action.

You get faster decisions, fewer silos, and a direct line between feedback and impact. Schedule a demo now to get started.

Frequently Asked Questions

Key metrics include brand recall (aided and unaided), recognition, perception, and consideration. These helps measure visibility and how your brand is positioned in people’s minds.

Keep language clear, culturally neutral, and tailored to each region. Use a mix of closed and open-ended questions to capture recall, recognition, and sentiment across diverse markets.

Many CMOs use post-campaign brand tracking to measure shifts in recall and sentiment. For instance, Adobe ran global surveys to fine-tune regional messaging strategies.

A comprehensive brand awareness survey report covers KPIs like recall, recognition, and sentiment, plus segment-wise insights. It also offers clear recommendations for marketing, CX, and product teams.

Most enterprises run them quarterly or biannually, depending on campaign cycles and regional needs. Regular cadence helps track shifts and course-correct in real time.