Elevate CX with unified, enterprise-grade listening

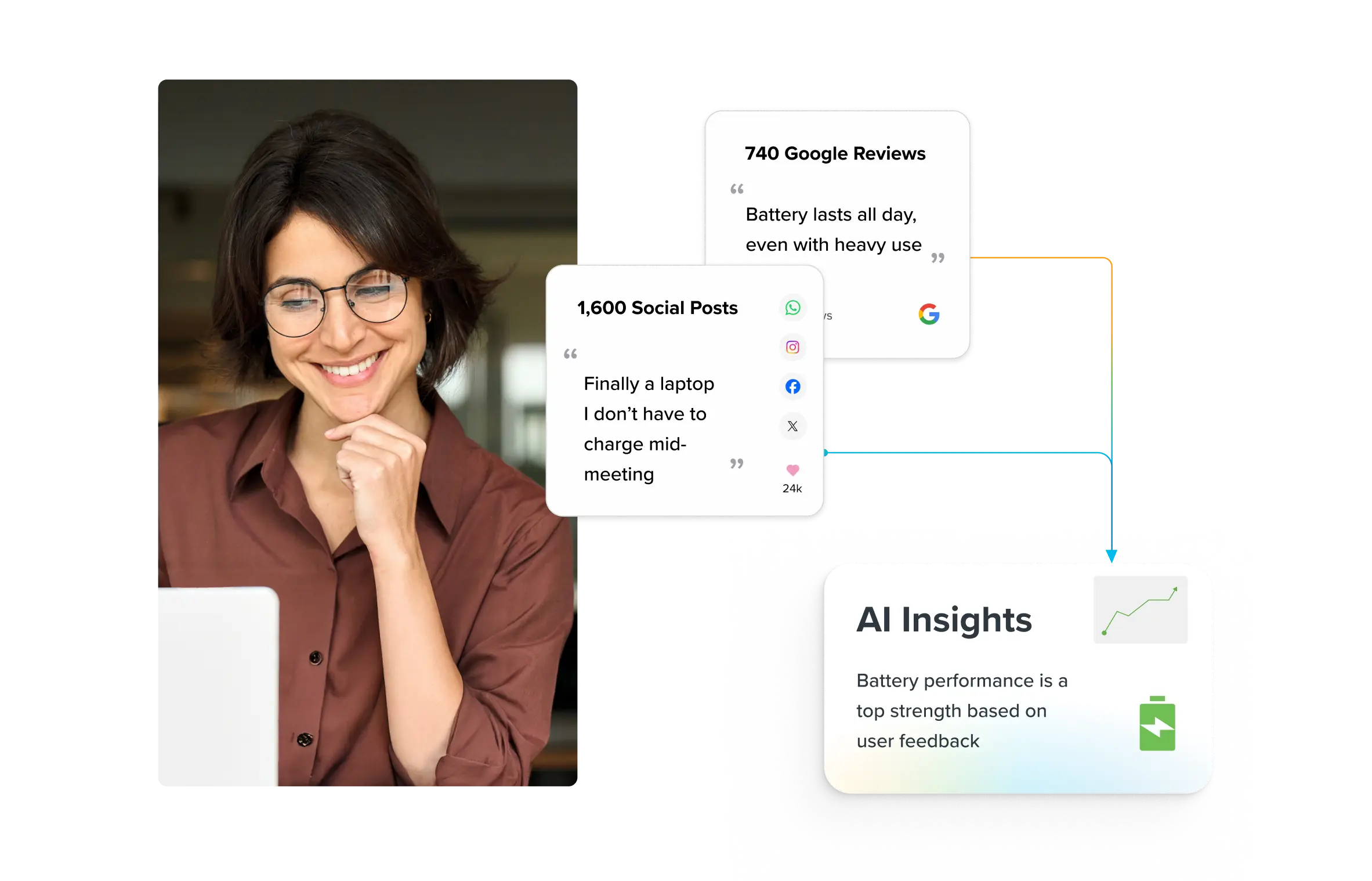

Sprinklr Insights gives you real-time consumer, competitor and market intelligence from 30+ channels without the noise. Make smarter decisions, strengthen your brand, and stay relentlessly customer-led.

What Is Survey Fatigue? Causes, Impact, Best Practices

“We’d love your feedback to help improve our products and services,” an email on Anna’s phone read. “It takes only 12–15 minutes to complete the survey.”

“Twelve to 15 minutes?!” Anna thought, then hit delete. She never saw a single question.

This is pre-survey fatigue in effect when respondents back out before they even begin.

In Anna’s case, the time commitment was a deal-breaker. For others, it might be overly complex questions, too many simultaneous requests, or just the unappealing design — each one chipping away at the willingness to participate.

Walking the tightrope between gathering meaningful insights and annoying your audience is all too common, especially when you can’t control how other businesses will use surveys, and respondents will treat your request as “one of them.”

But is there a way to collect feedback without driving respondents away? Turns out, there is! Find out how in this post.

- What is survey fatigue?

- How to identify survey fatigue

- 6 Causes of survey fatigue — and how to overcome

- 7 Best practices and strategies to avoid survey fatigue

- Business impact of survey fatigue on customer experience and marketing performance

- Gather sustainable customer feedback without survey fatigue with Sprinklr Survey

What is survey fatigue?

Survey fatigue, also called survey exhaustion, is a response in participants who become wary, disinterested, or overwhelmed by the survey-taking process and may abandon the survey altogether.

The fatigue in question kicks in from several factors, which you can categorize into pre-, mid-, and post-survey fatigue drivers:

Pre-survey fatigue - respondents decide not to start a survey at all. It’s often invisible but has a big impact on response rates. Causes could be:

- Perceived time commitment and the inaction of the surveyor

- Frequent or too many survey requests

- Poor timing of the survey

- Bad first impression

Mid-survey fatigue - respondent starts a survey but loses interest, slows down, rushes through, or quits before finishing. This hurts data quality and completion rates. Causes could be:

- Lengthy or cognitively taxing questions

- Lack of progress indicators

- Poor design and UI/UX

- Irrelevant, generic, repetitive, or redundant questions

Any type of survey exhaustion can potentially lead to abandoned sessions, which causes degraded data quality as people rush through or give straight-line responses.

Finally, pre- and mid-survey fatigue can also instill post-survey fatigue, where respondents avoid future surveys due to these experiences.

How to identify survey fatigue

There are several markers of survey exhaustion in the responses that you can categorize into cognitive and behavioral signals.

Look out for these signs when analyzing your next surveys:

Cognitive indicators

A. Degraded open-ended responses - Shorter, less insightful free-text answers that signal respondents conserving mental effort under cognitive load

B. Increased item non-response - Skipping difficult or time-consuming items (selecting “Prefer not to answer”), indicating cognitive fatigue in parsing or valuing those questions

C. Long pauses between questions - Unusually long delays suggest respondents are mentally stuck or overwhelmed

D. Patterned “satisficing” (straight-lining) - Picking the same option repeatedly on Likert-type scales, which is a classic sign of cognitive shortcutting to reduce processing demands

Behavioral indicators

E. Declining response rates - Turning down or ignoring survey invitations over time, indicating (PDF) growing aversion

F. Rising break-off (abandonment) rates - A higher share of surveys started but were not finished, indicating that respondents gave up partway through

G. Speeding through surveys - Overall completion times are well below your established benchmarks, pointing to respondents rushing to exit

H. Lower opt-in for future surveys - Fewer people agreeing to follow-up or panel invitations, signaling accumulated behavioral fatigue from prior survey experiences

6 Causes of survey fatigue — and how to overcome

Across industries, survey fatigue seems to stem less from question count.

Rather, broken feedback loops, over-surveying, poor design, and lack of relevance may be the culprits, research from McKinsey, PwC, Gallup, Forrester, and Deloitte suggests.

Of course, you must nail the user experience basics as a key driver of surveys.

But what these findings indicate is that the real solutions lie in smarter cadence, clearer action, and more respectful survey experiences than just adjusting the number of survey questions or even frequency.

Here are the top potential reasons for survey fatigue and tips to overcome them:

1. Perceived inaction and broken feedback loop

When was the last time you participated in a survey and felt satisfied? … 👀

If you cannot recall any such moment, chances are that’s how most survey participants feel — their inputs disappearing into a vacuum because there’s no sign of acknowledgment, much less improvements!

This perceived inaction also eats away at the motivation to participate or complete a survey.

McKinsey’s review of 20+ studies found the number one driver of survey fatigue is the perception that stakeholders won’t act on results, regardless of survey length or frequency, which are often vilified as top survey drop-off factors.

Sitting on survey data without follow-up frustrates respondents and erodes trust in future pulses.

🏋️Tips to overcome

- Forrester suggests increasing transparency in your feedback loop. Share roadmap plans, a newsletter detailing feedback-driven updates, or even an explanation of why feedback couldn’t be considered and what you will do instead

- Invest in a survey platform that integrates with your larger customer support and service software. This helps close the loop in the same survey environment by creating and assigning cases to your agents based on the outcome

- ✨Here’s a resource to manage customer feedback, in case you need it

2. Excessive frequency and redundancy

Bombarding your audience with too many requests leads to “pre-survey fatigue.” Overwhelmed by constant requests, recipients ignore or treat your surveys as spam.

Pre-survey fatigue can impact your business even if you don’t oversurvey because recipients will likely get requests from other businesses, and as a result, they’ll lump yours into the “not again” pile.

But since you can only optimize your outreaches, opting for an alternative source of feedback other than surveys is a clever way to offload some fatigue from your audience.

For example, if you’re using surveys for employee feedback, be wary of using them for trivial pulse checks (e.g., coffee and snack preferences).

Also, cross-verify if other teams are sharing surveys at the time you’re planning to so that there’s no overlap and you end up sending multiple survey requests in a short time.

If you want to learn about what users think about your new launches or services in general, try social media monitoring instead of surveys.

The goal is to ensure that each task has its “time dividend.”

🏋️Tips to overcome

- Invest in alternative methods of feedback — while reserving surveys where other options are inapplicable, such as NPS, CSAT surveys, etc

- Explore the voice of the customer program, which is a feedback strategy that mixes active, passive, and inferred feedback, reducing reliance on only surveys

- Try social listening to analyze unstructured data from online and traditional channels for feedback. This can reduce dependence on surveys while diversifying the feedback source

✨See how the Dow Chemical Company went from relying on online reviews to using social listening to inform their global market strategies with thousands more data points

3. Survey length and complexity

Long, tangled surveys kill participation rates. And the reason is obvious: our attention span is shrinking.

In a study, 60% of U.S. respondents refused surveys longer than 10 minutes, and 87% balked at anything over 20 minutes.

So, when you rely on long surveys, each additional minute of expected competition rate is thought to knock off response and completion rates significantly.

Along the same lines, asking convoluted or difficult questions or presenting the survey in a poor layout (missing screen breaks, progress indicators, etc.) further exacerbates fatigue by increasing cognitive load.

🏋️Tips to overcome

- Craft short, personalized questionnaires — brevity coupled with relevance can lift start rates toward 40–50%

- Keep surveys under 10 minutes, a justifiable time in most industries. You can go for 12 minutes at most!

- If you’re primarily relying on mobile users, keep even shorter surveys (5-8 minutes) — longer scroll depths negatively impact competition rates

- Keep your surveys to ≤ 10 questions per page on desktop

- Try to reduce the number of survey requests with conversational surveys. This method uses AI to automatically ask questions during active conversations with chatbots or human agents. Since it utilizes a familiar environment to ask survey questions, there is no need to send additional survey requests

4. Poor design and user experience

Survey-specific UI and UX factors can affect the performance for better or worse.

Imagine launching a survey with an estimated completion time of five minutes, but there is no option to skip a question!

When a user is being forced to answer every question, they’d rather drop off than stick around. A simple “Skip” button could do the trick to encourage participants to complete the survey as they want.

Nielsen Norman Group suggests that complex layouts, confusing navigation, and irrelevant questions can also amplify cognitive load and prompt respondents to bail out mid-survey.

🏋️Tips to overcome

- Keep qualitative surveys in a mix of open-ended and MCQ questions. If you’re gathering quantitative data that involves multiple questions, add a button to skip a question

- Add a progress bar to reduce mid-survey drop-offs. This acts as a light at the end of the tunnel, preventing feeling “stuck”

- Optimize surveys for mobile. Aim for a consistent user experience across devices. You don’t want hard-to-read, slow-to-load surveys that can piss most users responding to surveys on mobile

- Avoid multi-part and matrix questions. Cognitive load theory warns that each added element increases fatigue, so keep questions focused, clear, and limited to one issue at a time

5. Broken logic and irrelevant survey questions

Generic, poorly targeted, and ill-phrased questions feel like a waste of time and trigger survey fatigue.

Broken logic will misroute respondents through inappropriate question paths. For example, vegan respondents seeing questions about meat preferences after indicating they never eat meat is a classic broken logic that confuses and alienates users.

Poorly targeted questions will ask about topics that don’t apply. Imagine a customer-satisfaction survey that asks, “What type of pet do you own?” and then, due to a misconfigured branch, still shows “How often do you walk your dog?” to respondents who selected “None.”

Ill-phrased questions could range as follows:

- Double-barreled - asking two questions but demanding one answer. E.g., “How did you like our service and delivery?”

- Leading - subtly indicating preferred answers through the question. E.g., “If you liked the device, would you recommend it to others?”

- Loaded - contains an unjustified or controversial assumption, often leading respondents toward a particular answer. E.g., "How much better is our service compared to competitors?”

- Negative - questions that require a negative answer for a positive response and vice versa, making them confusing. E.g., asking “I don’t enjoy the events” and giving “yes” or “no” as a response.

All these instances of broken logic and poorly phrased questions will frustrate your participants, inflate drop-offs, and erode your data quality.

🏋️Tips to overcome

- Tailor surveys to known customer data — not just generic asks — to increase both response rates and the quality of answers

- Use disqualifying logic (e.g., screening out non-pet owners for a pet survey) to keep questions strictly relevant and avoid wasting respondents’ time

- Use Sprinklr’s AI survey platform with skip and branch logic to dynamically control the flow of questions based on the respondent's answers and prevent asking illogical or irrelevant questions

6. Data privacy and sensitivity concerns

Widespread anxiety about data collection — 60% of Americans feel monitored — and confusion over control fuel skepticism toward surveys, especially when you force someone to submit personal data.

Depending upon the part of the world your respondents live in, oversights like GDPR make transparent data privacy notices both a legal and engagement necessity.

Moreover, the kind of questions you ask can also raise red flags in your users’ minds. A web-based experiment found that asking about personal health or political beliefs can cut survey participation by up to 40% when respondents perceive a high disclosure risk.

🏋️Tips to overcome

- Display data privacy policies and security notices front and center before the survey begins

- Present a concise privacy policy with a single consent checkbox for informed participation. Terminate the survey if users don’t consent to your data agreement

- Collect minimal data — only as much as it’s needed or make personal data optional. This helps reduce perceived privacy risk and improve completion rates

- Avoid leading questions about specific details for sensitive information, such as income. This anonymization fosters a sense of security while also giving you insights

👉 You may like: Customer satisfaction survey: Questions + templates

7 Best practices and strategies to avoid survey fatigue

Designing effective customer surveys is crucial for gathering useful survey insights. Enterprises must focus on planning, structuring, and communicating surveys thoughtfully to ensure high response rates and reliable data collection.

1. Set precise goals so your surveys ask the right questions

When you approach surveys with goals and outcomes in mind, you make better decisions on survey frequency, structure, and target audience.

Clear objectives and expectations are helpful for your team, but their impacts trickle down to survey respondents in the form of precise questions.

Set clear, measurable, time-bound goals. For example, instead of “improve customer satisfaction,” aim to “increase CSAT scores by 15% in the next six months.”

2. Personalize surveys using your CRM

We have spoken about how conversational surveys turn traditional ones on their heads by asking questions directly in active conversations instead of presenting static forms.

You can take this a step further by integrating conversational surveys with CRM for more personalized and context-aware questions and follow-ups.

For example, instead of asking “Tell us about your last buying experience,” a conversational survey integrated with a CRM can ask “What did you like about the stainless-steel water bottle you purchased on <date>?”

To achieve this, you have to use a survey platform like Sprinklr that can integrate with major CRMs such as Salesforce, Microsoft Dynamics 365, Oracle B2C Service, SAP Service Cloud (C4C), ServiceNow, and Zendesk.

Once you integrate the CRM and build the survey, you can set workflow logic, such as triggering the survey as soon as a Salesforce case is closed.

Sprinklr will automatically handle the rest of the process of asking questions, probing for answers, and tagging a human agent if required.

Personalizing surveys not only helps make the experience human, but it also reduces your time to process the feedback with reporting capabilities built in.

📽️ See how you can launch personalized conversational surveys using Sprinklr and CRM integration

3. Manage the survey length and complexity

Concise surveys have low drop-off rates compared to lengthy ones.

Asking fewer questions prevents survey fatigue and maintains engagement. As a rule of thumb, create surveys that take no more than five to 10 minutes to complete.

Stick to 7-10 questions for most surveys. Provide the option to skip sections needing open-text and descriptive answers.

For example, during in-depth CX studies which require asking contextual questions, use skip logic.

It is a feature that guides respondents through the survey by routing them to different sections or ending the survey prematurely based on their answers.

Here’s an example of a skip logic setup window on Sprinklr Insights 👇

You can also cap the number of questions based on the user’s probability to answer using Display Logic.

Display Logic determines which questions or answers options to show to the respondents based on their previous responses👇

Test for clarity with a pilot group to identify confusing or irrelevant questions before a wide release.

4. Communicate the purpose of your survey

Highlight the benefits of responding to the survey, explaining how it will drive improvement. For example, “Your feedback will help us improve our return process.”

Ensure that the responses are kept confidential and convey this to your audience to build trust and transparency.

Mention success stories of how respondents have already contributed to improvements. For example, "Over 10,000 customers have helped shape our product roadmap."

If you can incentivize participation with a coupon, gift card, or anything else, it will go further to increase the participation rate and trust.

5. Incorporate visual elements

Visual elements and interactive features in surveys will make the experience intuitive and engaging rather than a rush to finish it, which impacts the quality of responses.

For example, consider adding a progress bar to keep customers visually informed about how close they are to completion. Here’s an example of a survey with a progress bar created on Sprinklr 👇

The progress bar acts as the light at the end of the tunnel, keeping customers engaged.

You can also explore emojis and graphics in the survey to make the experience intuitive. Customers tend to remember visual prompts better than textual information.

⚡Pro tip: Kantar says, “A good icon, once read, acts as a quick visual prompt that can be processed in a fraction of a second. The icons reduce the memory load of choices for the respondent, making the question much more straightforward to answer.”

6. Segment customer profiles

You now know about the negative impact of generic customer surveys. And if you don’t have deep audience understanding, your survey questions have a good potential of being generic.

Segmenting your customers helps curate unique surveys for different profiles and get actionable insights.

Enterprises typically divide audiences into segments based on shared characteristics, such as:

- Demographics - who they are

- Geographics - where they are

- Psychographics - how they think

- Behavioral - what they do

- Need-based - what they need

- Value-based - how much they’re worth

- Technographics - what technology they use

- Channel - where they engage

- Lifecycle stage - how far along they are in their journey

- Loyalty/NPS buckets - how they’ve rated you before

Your survey efforts must ideally abide by these targeted slices of the audience. This ensures respondents receive surveys that they’re best positioned to answer, rather than catch-all or irrelevant questions.

👉You may like: Customer segmentation: Types, analysis, and strategy

7. Monitor feedback continuously

Look out for cognitive and behavioral signs of fatigue in your survey responses and optimize them in terms of frequency, design, number, and types of questions asked, among other aspects.

Here are some core survey aspects that you can analyze and continuously monitor to ensure the best outcomes:

- Survey frequency – How often do you survey audiences

- Survey length – Total number and complexity of questions

- Question clarity – Directness and singular focus of each question

- Relevance and personalization – Tailoring content to the respondent’s context

- Flow and logic – Use of skip-logic and question grouping to streamline completion

- Timing and triggers – Delivering surveys at the most contextually appropriate moments

- Incentives and motivation – Thoughtful rewards and clear participation value

- Accessibility and channel – Ensuring ease of access across devices and platforms

- Action transparency – Showing respondents how their feedback was used

- Response management – Follow-up communications and closing the feedback loop

🔥If you use Sprinklr - You can add an extra layer of validation to survey data by correlating it with customer sentiment across data from social media and service channels.

After your survey results are in, use the auto-generated reports in Analytics for quick AI-powered survey insights, comparing the responses with data from other sources, as you can see in the example below 👇

👉Don’t miss: How AI-powered insights can boost your omnichannel CX strategy.

Business impact of survey fatigue on customer experience and marketing performance

If you rely heavily on market data to inform your customer loyalty and CX strategies, survey fatigue will hinder scaling and implementing them. Here’s how:

Impact on customer experience

1. Skewed NPS score - For example, if only a third of customers respond to NPS because of pre-survey fatigue, the score will reflect the extremes and miss the silent majority’s views.

2. Undermined trust - Sending out too frequent survey requests is akin to spamming. Customers will begin to question the reputation of your brand, which undermines trust.

3. Increased churn - Customers might cancel subscribing to your emails altogether as a response to survey fatigue. This impedes your marketing efforts and casts a bad brand impression.

4. Damaged brand reputation - Imagine frustrating customers by over-surveying and making your brand appear indifferent to their time! That happens. Since surveys are a part of your brand, a negative experience here will affect your brand image elsewhere.

Data suggests that customers directly share their bad experiences with friends rather than communicating with the brand.

Survey fatigue could be a cause of their bad experience. The same is true for a good experience.

Impact on marketing performance

5. Low-quality data - Rely on surveys to inform your marketing strategies? Survey fatigue increases the risk of skewed data. Survey fatigue is equal to low participation or biased responses from only highly motivated or dissatisfied individuals. That directly impacts the statistical representations.

6. Wasted resources - If participants are not completing surveys based on industry standards (thanks to fatigue), you will have to spend additional time and money cleaning data or launching other survey initiatives, reducing ROI on customer feedback.

Despite the bad rep of over-surveying, we know that 89% of customers expect brands to seek their input. It’s not paradoxical. People just want brands to ask the right question, at the right time, and act upon it.

Gather sustainable customer feedback without survey fatigue with Sprinklr Survey

The worst part of survey fatigue is that it is a pre-existing condition among your respondents, even if you never contributed to it. But thankfully, you can avoid triggering it by following the solutions and best practices we discussed in the post.

When it comes to building, designing, distributing, reporting, and even routing surveys, you can do it all on one platform — Sprinklr.

Using simple commands, you can set questions and share them across seven different channels, including QR codes. There’s also a rich library of pre-designed survey templates that you can start from or build one from scratch.

Book a free demo to see how you can create surveys that elicit responses on Sprinklr.

Frequently Asked Questions

Declining response rates, increasing mid-survey drop-offs, and inconsistent/rushed answers signal fatigue and are some of the early warning signs. Over-surveying and repetitive questions lead to disengagement, which impacts data reliability.

Yes, survey fatigue leads to incomplete responses, biased samples (e.g., only extreme feedback), and unreliable insights, risking misguided strategies. Skewed insights can lead to poor decision-making, as enterprises may act on unreliable feedback that misrepresents customer sentiment.

Digital transformation strategies bring in tools and technologies that use AI to personalize surveys, optimize timing, and analyze feedback across channels. AI and automation capabilities reduce manual effort and ensure surveys are relevant and engaging, minimizing fatigue and improving response rates.

Yes, audience segmentation ensures surveys are tailored to specific groups based on demographics, behaviors, or roles (e.g., IT professionals vs. CMOs). Targeted surveys resonate more with respondents, reducing fatigue and increasing engagement by addressing relevant concerns directly.

Automation enhances response rates by delivering surveys at optimal times via preferred channels (e.g., SMS or in-app prompts). Automation allows personalization and follow-ups, reducing cognitive load for respondents while ensuring higher-quality feedback collection.