Elevate CX with unified, enterprise-grade listening

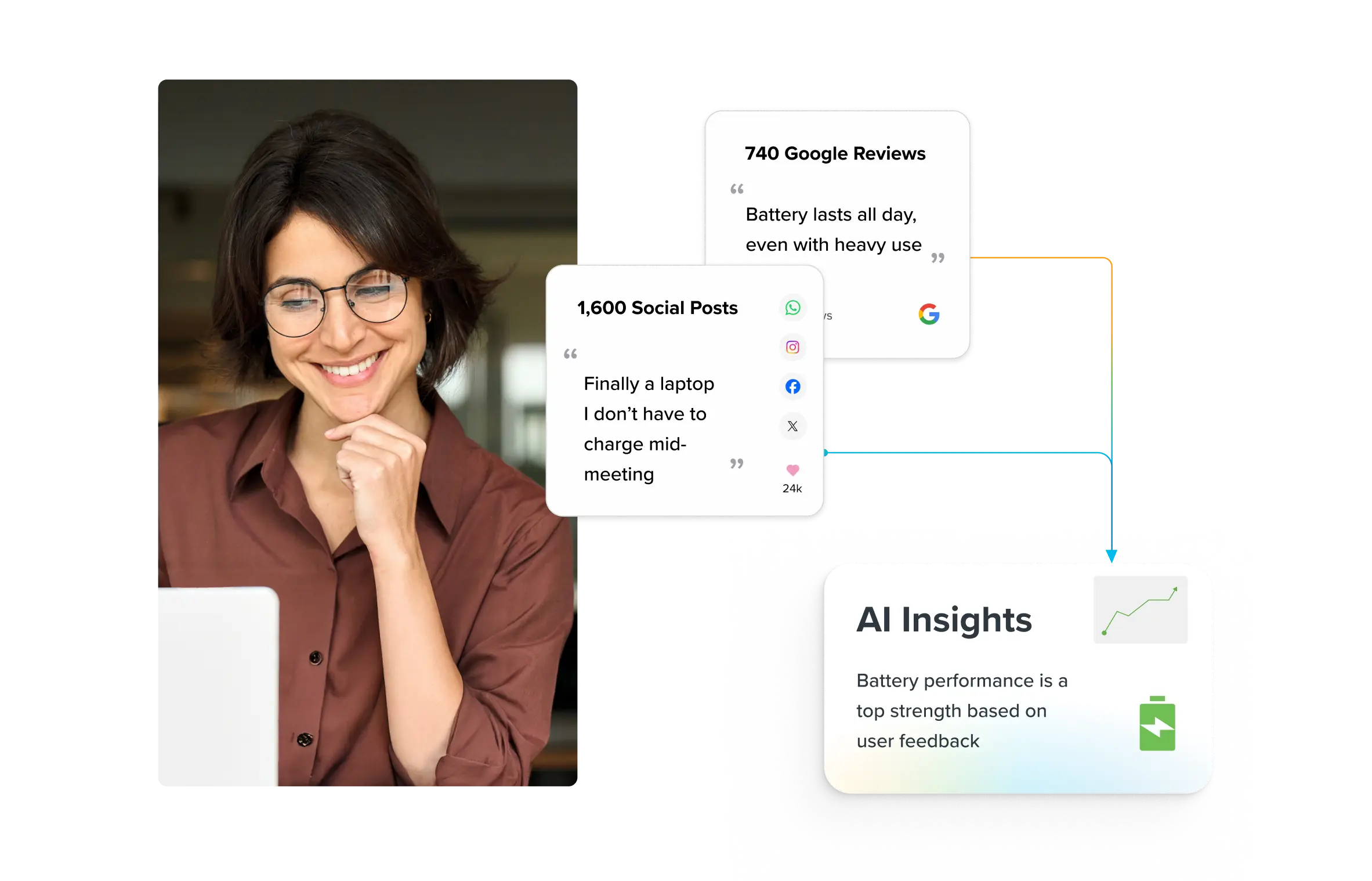

Sprinklr Insights gives you real-time consumer, competitor and market intelligence from 30+ channels without the noise. Make smarter decisions, strengthen your brand, and stay relentlessly customer-led.

Voice of the Customer Program Maturity: 2026 Benchmarks

Your brand already collects customer feedback. The real gap today is how far you’ve matured that feedback into strategic intelligence. Recent data shows that companies with mature voice of the customer (VoC) programs spend 25% less to retain customers and see 15–20% higher cross-sell and upsell success. These outcomes don’t come from collecting more feedback — they come from advancing across clear voice of the customer program maturity benchmarks that separate reactive programs from predictive ones.

Now imagine this: instead of reacting to the latest survey, your teams are anticipating the next trend; linking customer signals directly to board-level metrics and reallocating investment based on what your highest-value customers are signaling for tomorrow.

That’s what true VoC maturity looks like. It’s not about more feedback; it’s about feedback that leads. In the following pages, we’ll unpack the four stages of VoC program maturity, and the eight capability dimensions that define world-class performance. This is your roadmap to turning customer voice into enterprise-grade advantage.

- Why does voice of the customer program maturity matter?

- How to measure voice of the customer program maturity: 2026 benchmarks

- Level 1: Foundational listening

- Level 2: Operational integration

- Level 3: Accountable execution

- Level 4: Transformational intelligence

- VoC program maturity benchmarks that teams can act on

- How Sprinklr Insights drives advanced VoC programs

- How can you make VoC insights immediately actionable?

- Conclusion

Why does voice of the customer program maturity matter?

60% of organizations with VoC programs are expected to gain deeper insights by analyzing customer voice and text interactions by 2025 — a clear sign that VoC program maturity has shifted from operational to strategic. The enterprises making this transition are seeing faster decisions, stronger cross-functional collaboration, and measurable impact on retention and revenue.

In other words, the value isn’t in collecting more feedback. It’s in what you do with it. Mature programs turn insights from customer interactions into actions that influence product strategy, CX improvements, and bottom-line growth.

Case Study: Turning fragmented feedback into strategic customer intelligence

A leading automotive brand struggled with fragmented customer feedback across social, review, and service channels — insights were delayed, disconnected, and underused.

By adopting Sprinklr Insights as its unified Voice of the Customer platform, the brand connected every customer touchpoint into a single, real-time view. This shift enabled faster detection of product issues, better collaboration across product, marketing, and CX teams, and data-driven decisions.

Results:

- Social purchase rate up 173%

- Engagement up 800%+ on X (formerly Twitter) and 115% on Instagram

- Response time dropped 82%, saving $52K annually in reporting costs

In less than a year, the brand moved from reactive listening to predictive intelligence; a textbook leap in voice of the customer program maturity.

How can enterprises use maturity models to stay competitive?

Reactive VoC programs are no longer enough. Leading enterprises today treat VoC data as strategic intelligence, not operational housekeeping. They’ve moved from asking, “How many surveys did we send?” to “Which product decisions will increase customer lifetime value by 20%?”

Mature VoC organizations treat every customer signal as enterprise learning:

- Product teams use conversational patterns to guide development priorities.

- Marketing teams shape campaigns around verified customer needs.

- Executives connect sentiment shifts directly to retention and revenue outcomes.

In short, mature enterprises turn individual feedback into organization-wide learning.

Pro Tip: Mature VoC programs rely on intelligence that connects customer sentiment, market signals, and emerging risks — all in one view. Sprinklr Insights helps enterprises do exactly that. Its AI analyzes unstructured data across text, video, audio, and images to uncover hidden patterns, trends, and emotion shifts in real time. With built-in automation and Sprinklr Copilot, teams can benchmark against competitors, detect early churn risks, and route insights instantly to the right teams.

How to build VoC maturity strategically in your enterprise?

Moving from basic feedback collection to strategic VoC maturity doesn’t happen by chance — it requires deliberate capability building across data, people, and process.

Here’s where to focus your effort for maximum impact:

1. Map feedback channels to Customer Lifetime Value (CLV)

Not every signal deserves equal attention. Prioritize feedback channels that capture insights from your highest-value customers and ensure those signals reach product and strategy teams first.

For example, if a feedback audit shows that your top 20% of revenue contributors rarely engage with your CX team, you’ve uncovered a high-value visibility gap, and a clear opportunity to strengthen your listening coverage.

Also Read: Customer Feedback Analysis: Steps, Trends and Metrics

2. Create feedback-to-action workflows, not just reports Most VoC programs fail between “we learned something” and “we changed something.” The fix: automated workflows that turn feedback into triggers for specific actions. For instance:

- Auto-create a task for the regional VP if sentiment drops 15% for enterprise accounts in that region.

- Alert the product strategy team if competitor mentions spike five times a week.

- Notify the ops team if ticket volume rises sharply before it becomes a public issue.

Pro Tip: Use Sprinklr Insights (and Service) to convert feedback into action with built-in automation. With its unified listening across 30+ channels and AI-powered analytics, Sprinklr can automatically detect sentiment drops, spikes in issues or feedback volume — and trigger cases, alerts, or ticket routing to the right teams.

3. Track feedback influence, not feedback volume Activity metrics (surveys sent, responses collected, sentiment scores) reveal effort, not impact. Mature programs track influence metrics — the real measure of VoC effectiveness. Ask questions like:

- What share of roadmap decisions stem from customer feedback?

- How many campaigns were adjusted based on VoC insights before launch?

- Which executive decisions cited customer voice as supporting evidence?

Build a monthly “feedback influence scorecard” that measures how insights shaped actual outcomes — what you built, marketed, or invested in differently because of customer voice.

Read more: Metrics and dimensions supported in Listening

How to measure voice of the customer program maturity: 2026 benchmarks

Below is a four-stage maturity model for evaluating your VoC program. Each stage builds on the last. The model evaluates eight key dimensions:

Signals coverage | Data quality & governance | Time-to-insight | Time-to-action SLA | Closed-loop coverage | AI/text/speech depth | Integration into operations | Financial linkage

Using these dimensions, you can score your program 0-5 in each. A high VoC benchmark signifies the evolution from reactive feedback collection to predictive, financially linked customer intelligence.

Let’s see how your brand can climb the voice of customer maturity model ladder:

Level 1: Foundational listening

At this stage, organizations collect customer feedback inconsistently, often in response to specific issues. Data is siloed (typically in support tickets or occasional surveys), analysis is manual, and insights rarely influence strategic decisions. There is no process for aggregating insights to identify patterns or guide VoC strategy.

How to assess your maturity level at this stage

Create a baseline scorecard across these eight core dimensions. Honest scoring exposes capability gaps and clarifies what needs to mature next.

Dimension | What this looks like at Level 1 |

Signals coverage | Feedback comes from 1–2 channels (typically email or support tickets). No social, chat, or call center data included. |

Data quality and governance | No standardized tagging or data hygiene. Feedback exists as raw text in multiple tools. |

Time-to-insight | Reports take weeks or months to compile manually. No real-time visibility. |

Time-to-action SLA | Fixes are ad hoc. No escalation or accountability system. |

Closed-loop coverage | Customers rarely get a follow-up after sharing feedback. No formal closure process. |

AI / Text / Speech depth | Manual reading of comments; no NLP, keyword, or sentiment analysis tools in use. |

Integration into operations | Feedback disconnected from CRM, product, or marketing systems. |

Financial linkage | No measurable connection to revenue, retention, or churn. |

Note: Digital-first enterprises rarely stay at this stage for long, while branch-heavy or legacy organizations often remain here due to fragmented systems and manual feedback handling.

Level 2: Operational integration

At this stage, organizations have implemented formal feedback collection mechanisms and connected multiple data sources into unified systems. Cross-functional access has become standard, with different teams monitoring high-level metrics that combine data from multiple sources. The feedback stops being owned exclusively by one department and starts becoming a shared resource. Indicators include:

- Post-interaction surveys run consistently.

- NPS measurements happen quarterly.

- Teams share VoC dashboards across functions.

However, integration is often technical rather than cultural. The systems are connected, but the workflows aren't fully mature. There's no formal process to ensure complaints are prioritized in Sprint planning or while considering product development.

Dimension | What this looks like at Level 2 |

Signals coverage | Multiple channels integrated: surveys, support tickets and social listening feed a shared dashboard. |

Data quality and governance | Consistent tagging and metadata hygiene begin. Duplicate or incomplete data is gradually reduced. |

Time-to-insight | Insights are available within days or weeks, and dashboards refresh automatically instead of requiring manual compilation. |

Time-to-action SLA | Some SLAs exist, but follow-through varies by team, and there are no unified accountability metrics yet. |

Closed-loop coverage | Follow-ups happen in some departments but not enterprise wide. |

AI / Text / Speech depth | Basic sentiment and keyword analysis are applied, with minimal predictive or contextual understanding. |

Integration into operations | Feedback is visible across departments (product, CX, marketing), though action still relies on individuals. |

Financial linkage | There is some correlation between feedback trends and retention or churn metrics, but it is not yet formalized. |

How to use this benchmark

If your enterprise generates insights in days instead of months, you’ve reached Level 2. The next leap is cultural — moving from “some teams do this sometimes” to “every team does this consistently.”

Note: Digital-first firms typically hit Level 2 faster because their data flows from integrated systems. Branch-heavy sectors, like retail banking or utilities, struggle to unify offline and online feedback.

📖 Read more: Voice of Customer: 5 Examples to Learn From (+ How to Start Yours)

Level 3: Accountable execution

This stage marks the transition to a truly strategic VoC program. Feedback is automatically routed to the correct teams with context, enabling swift, measurable action. Cross-functional teams use defined alerts to adjust strategies in near real-time. Success is measured by impact on key business metrics like customer lifetime value, not just VoC survey volume.

Dimension | What this looks like at Level 3 |

Signals coverage | Unified collection across all major channels: surveys, support, social, chat, CRM and voice transcripts. |

Data quality and governance | Centralized taxonomy, standardized tagging, and governed datasets with audit trails. |

Time-to-insight | Automated dashboards provide near real-time visibility, with sentiment and topic trends refreshing daily. |

Time-to-action SLA | Defined SLAs for each signal type (e.g., critical issues routed within 24 hours). |

Closed-loop coverage | 80-90% of actionable feedback leads to documented response or resolution. |

AI / Text / Speech depth | Machine learning surfaces emerging issues and predicts potential churn triggers. |

Integration into operations | Feedback integrated into CRM, product management and CX tools; insights drive sprint planning and campaign decisions. |

Financial linkage | Feedback linked to retention, LTV, and adoption in quarterly reviews. |

How to use this benchmark

Level 3 represents VoC operational excellence. Audit your maturity against each dimension:

- Are you capturing all key channels?

- Are insights updated daily, not monthly?

- Do 80–90% of customers receive follow-up?

- Is VoC data cited in quarterly reviews?

Each “no” defines your next improvement target.

Note: Digital enterprises often automate routing and SLAs early through cloud-native workflows. In contrast, traditional industries may reach this stage only after restructuring processes across regions or franchises.

Level 4: Transformational intelligence

At this stage, customer feedback becomes predictive intelligence that shapes future strategy before problems materialize. While Level 3 organizations respond quickly to emerging issues, Level 4 enterprises predict them weeks or months in advance using AI-driven models that analyze historical VoC patterns.

Machine learning algorithms process millions of customer interactions to identify subtle shifts in language tone, earlier chat drop-offs or changes in question frequency that signal future churn, product adoption rates or market sentiment shifts. It also correlates your feedback with competitor mentions, industry trends and external signals, enabling executives to make proactive decisions rather than reactive fixes.

Therefore, in this stage:

1. Product teams prioritize roadmaps based on forecasted demands and risk, not only current complaints.

2. Customer success teams proactively engage accounts predicted to churn, resolving issues before they escalate.

3. Revenue teams quantify the value of prevented churn, expansion uplift from proactive outreach, and operational costs avoided by intervening early.

4. VoC ROI explicitly includes the value of proactive decisions and scenario-planning, not just reactive fixes.

Dimension | Threshold |

Signals coverage | 15+ channels, including behavioral, transactional, third-party. |

Data quality/governance | Real-time data validation, >95% accuracy, full lineage. |

Time-to-insight | Real-time pattern detection, predictive alerts. |

Time-to-action SLA | Automated response for defined triggers, >90% adherence. |

Closed-loop coverage | 85-95% of feedback receives personalized follow-up. |

AI/Text/Speech depth | Advanced NLP, predictive churn models, competitive intelligence. |

Integration into operations | Enterprise-wide dashboards and strategic planning input. |

Financial linkage | Direct revenue attribution, VoC ROI tracked quarterly. |

Note: Digital-first enterprises with unified data architecture achieve predictive VoC maturity sooner. For branch-heavy models, achieving this level usually requires consolidating legacy infrastructure and retraining teams for data-driven decision-making.

Pro Tip: Adopt an AI-driven VoC platform like Sprinklr Insights to unify solicited and unsolicited feedback from 30+ channels, including social, reviews, support tickets, and voice into a single actionable view.

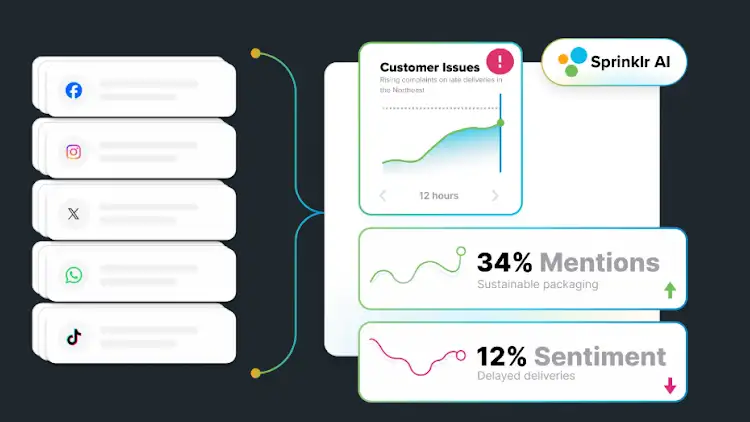

Powered by advanced NLP and machine learning, Sprinklr detects subtle sentiment shifts, predicts churn risks, and correlates customer signals with competitor trends and market dynamics. Its real time alerts and automated workflows enable proactive engagement, while predictive modeling links insights directly to revenue, retention, and product decisions.

Capturing and analyzing customer voice across the entire lifecycle and acting on predictive insights turns VoC into a strategic growth engine, helping enterprises prevent crises, protect revenue, and accelerate innovation.

Very few enterprises reach what we define as Level 4 maturity, making it a rare differentiator. That gap is your competitive advantage. VoC maturity isn’t a dashboard metric — it’s an organizational capability. The sooner you build the right intelligence, the faster your enterprise moves from listening to leading.

To operationalize, apply these steps across departments:

1. Conduct a VoC maturity audit: Score each function (CX, product, support, marketing) against the eight dimensions above to pinpoint where maturity lags.

2. Deploy root-cause detection: Use AI-driven tools like Sprinklr Insights to uncover recurring issues in high-value customer segments and prioritize systemic fixes.

3. Track cross-functional adoption: Ensure product, CX, and marketing teams act on shared insights, not parallel data sets. Maturity depends as much on collaboration as on analytics.

4. Calibrate investment: Align maturity goals with executive KPIs — retention, LTV, revenue growth to secure budget and accountability for VoC evolution.

VoC program maturity benchmarks that teams can act on

Mature programs measure what drives behavior, not vanity metrics. Here are the benchmarks that matter most:

Benchmark | What it measures | Why it matters |

Closed-loop completion rate (by severity) | % of customer issues with documented resolution/follow-up, segmented by impact tier | Demonstrates feedback‑to‑action effectiveness |

Time-to-detect + time-to-decide | Time from signal → recognition → decision | Tracks organizational agility |

Repeat-contact delta | Change in % of customers repeating complaints on the same issue | Reflects root‑cause resolution quality |

Content gap MTTR (Mean Time to Repair/Recover) | Time to fix missing/inaccurate help content (FAQs, macros) after customer feedback | Measures internal responsiveness |

Coaching impact | Performance lift linked to feedback‑driven training | Demonstrates how VoC insights enhance human performance and culture. |

Financial linkage | % of VoC insights tied to revenue, retention, or LTV metrics | Connects VoC to tangible business outcomes |

Quick tip: Set minimum n per cohort, apply confidence bands, and flag seasonality. Normalize by segment and channel mix to avoid biased decisions; tie analysis to pre/post baselines for defensible attribution.

How Sprinklr Insights drives advanced VoC programs

Building VoC maturity requires a platform capable of managing enterprise-scale feedback across every channel, applying intelligence, and enabling immediate action. Sprinklr Insights, recognized as a Leader in Gartner’s 2025 Magic Quadrant for Voice of the Customer Platforms, delivers that through a unified, AI-native system designed for speed, accuracy, and scale.

Key capabilities:

- Omnichannel feedback aggregation: Collects data from 30+ social, digital, support, and review channels; giving you a complete, real-time view of customer sentiment and emerging themes.

- AI-driven analysis: Uses advanced natural language processing (NLP) and emotion detection to identify root causes, spot anomalies, and surface trends across unstructured data — from chat logs to social media to voice transcripts.

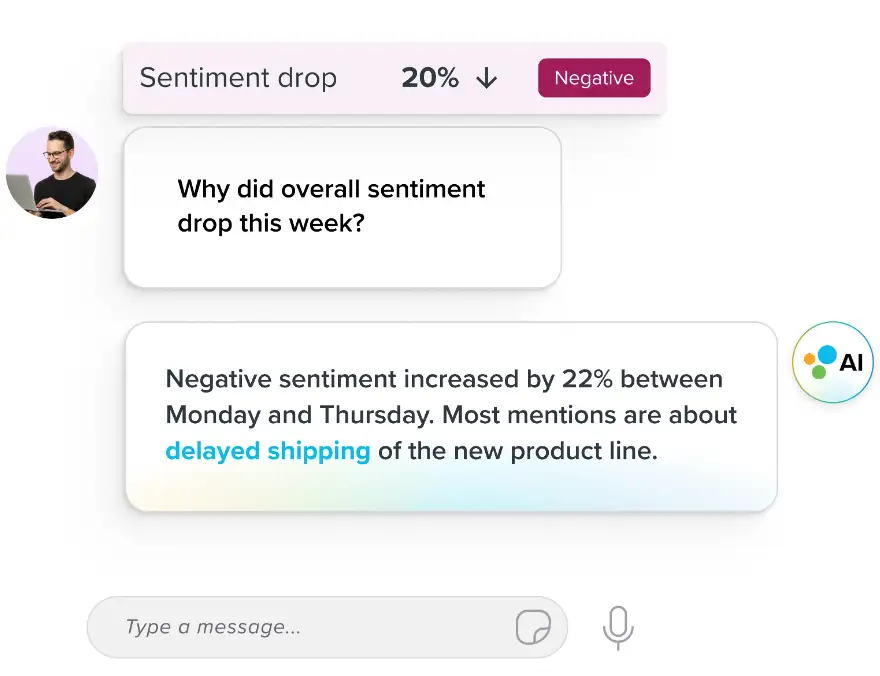

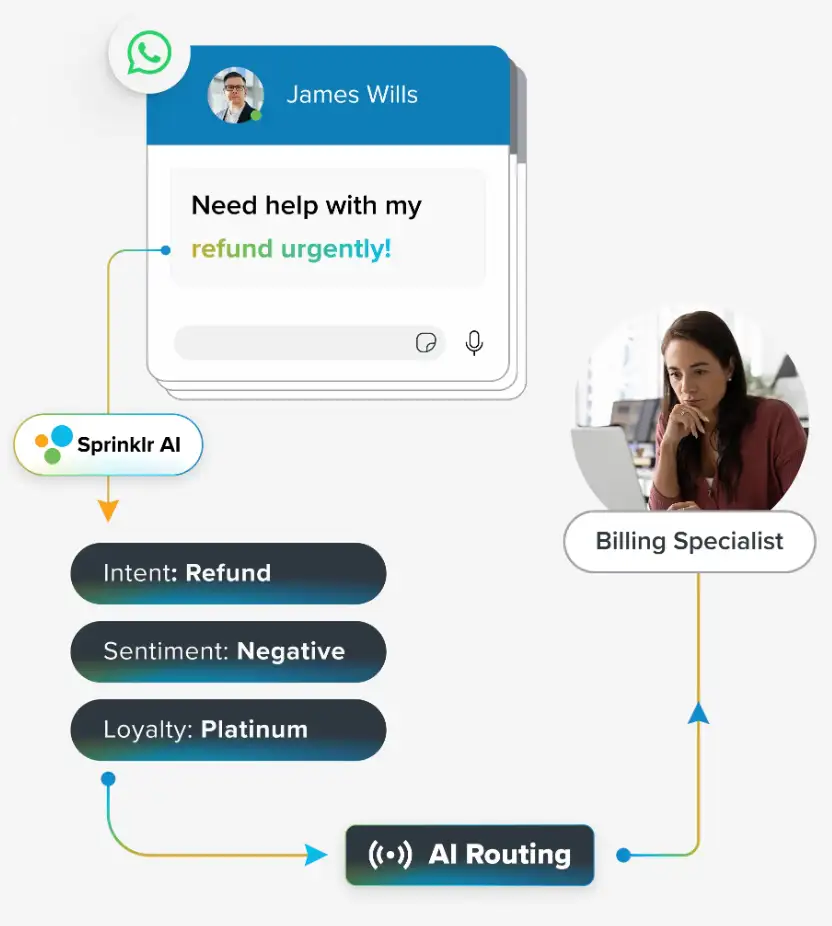

- Smart alerts and automated routing: Configurable alert rules automatically flag spikes in negative sentiment, issue surges, or trending topics. These alerts can instantly generate cases or route tasks to the right teams; helping you to act before small issues become crises.

- Integrated VoC workflows: Feedback connects directly to ticketing, product management, and marketing systems, ensuring that insights trigger measurable actions.

How can you make VoC insights immediately actionable?

- Set anomaly alerts for negative sentiment spikes by segment/region, including affected accounts and recommended actions.

- Prioritize root causes with tasks auto‑assigned to owners based on frequency × business impact; add SLAs.

- Use benchmarking data to target gaps in response times, sentiment accuracy, and closed‑loop coverage — focus on changes with the highest revenue effect.

Conclusion

You now hold the map. The path from fragmented data to intelligence is clear. This journey culminates in the ultimate strategic differentiator: a mature VoC program that doesn't just report on the past but actively shapes your future.

This is where Sprinklr Insights empowers your brand. We move you beyond reactive feedback, transforming millions of customer signals into a predictive, actionable intelligence asset. It’s the engine that allows your entire organization to operate not on hunches, but on a profound, collective understanding of human need, turning empathy into your most powerful, scalable advantage.

The future belongs to the most customer intelligent enterprises. The time to build yours is now. Elevate your VoC program in 2026 with Sprinklr! ⬇️

Frequently Asked Questions

A mature Voice of the Customer (VoC) program unifies feedback from every customer channel, applies AI to automate analysis, and connects insights directly to financial outcomes like revenue growth and retention. It operationalizes customer sentiment to guide strategic decisions across the brand.

Evaluate your program across eight key dimensions: signals coverage, data quality and governance, time-to-insight, time-to-action, closed-loop coverage, AI/text/speech depth, operational integration, and financial linkage. Use a 0–5 scoring scale to identify capability gaps, then focus investments on your weakest dimensions to move up the maturity curve.

Yes. Digital-first enterprises typically advance faster in automation, real-time analytics, and AI integration. Branch-heavy organizations, on the other hand, excel in relationship-led service models and financial linkage; often outperforming in customer trust and retention depth.

A VoC maturity model measures how deeply customer insights shape enterprise strategy and cross-functional decision-making. A survey scorecard, by contrast, only tracks surface-level metrics such as response rates or NPS performance.

Track retention improvement, customer lifetime value growth, churn reduction, and adoption rates of features informed by VoC insights. True maturity shows when feedback-driven decisions demonstrably improve revenue, efficiency, or customer experience ROI.