Elevate CX with unified, enterprise-grade listening

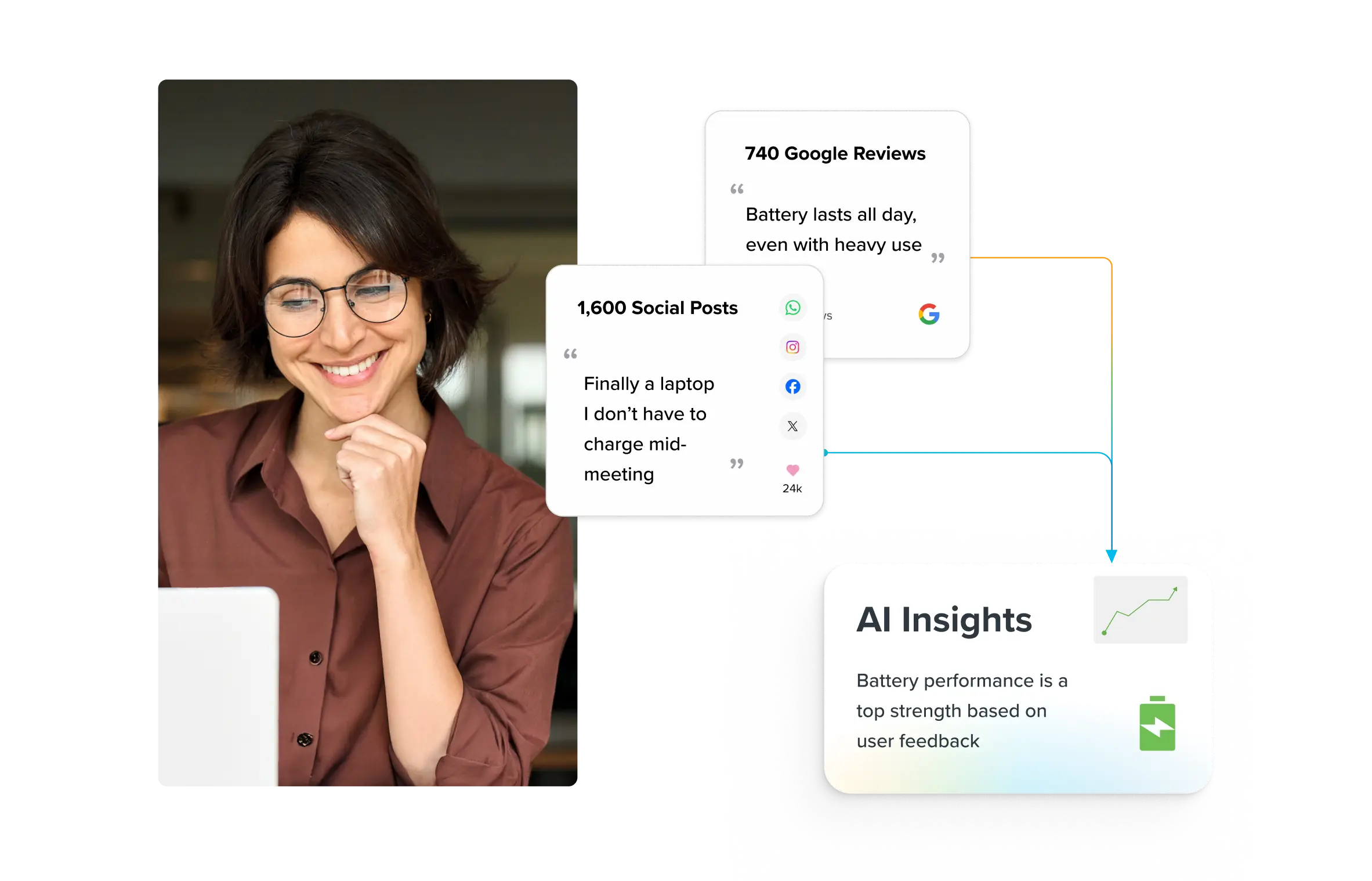

Sprinklr Insights gives you real-time consumer, competitor and market intelligence from 30+ channels without the noise. Make smarter decisions, strengthen your brand, and stay relentlessly customer-led.

The Fundamentals of B2B Market Research: Step by Step Guide

Ever sat through a strategy meeting where the loudest opinion won, because no one had the data to push back? That’s exactly what B2B market research prevents.

When you're selling high-value solutions into multi-stakeholder buying groups across regions, instinct doesn’t cut it. Neither does outdated data. You need sharp, real-time insight to spot market shifts before your competitors do, and act on them.

Google’s pivot toward AI-first search? Not a gamble. A calculated response to growing preference for tools like ChatGPT and Perplexity, backed by deep behavioral research. That’s how enterprise decisions get made: informed, fast, future-ready.

For B2B leaders, market research is how you de-risk launches, refine messaging, justify budgets, and align sales and marketing. Especially when cycles are long, stakes are high, and pressure to prove ROI never stops.

This guide breaks down the essentials: the core benefits, methods that actually work, and a step-by-step plan to operationalize market research — so strategy isn’t just informed; it’s inevitable.

What is B2B market research?

B2B market research is the systematic process enterprises use to gather, analyze, and interpret data about other businesses, usually their buyers, competitors, and the broader market landscape. Strategic research like this shapes everything from product innovation to long-term growth planning and executive-level investment decisions.

Done right, B2B research enables teams to:

- Decode evolving customer needs

- Prioritize target accounts

- Refine messaging and value props

- De-risk product launches

- Sharpen GTM alignment across marketing, sales, and product

Leading organizations operationalize research through scalable, AI-powered methodologies that drive measurable outcomes. Core elements include:

- Direct engagement: Interviews and surveys with decision-makers

- Multi-source validation: Analyst reports, customer intelligence, internal data

- Rigorous methodology: Quant + qual research for a 360° view

- Technology integration: AI and predictive analytics to accelerate insights

What sets B2B research apart is its depth and rigor. Unlike B2C, where insights are often built on emotion, convenience, or mass testing, B2B research demands precision and pattern recognition across small, specialized audiences.

Here’s how the two differ:

Factor | B2B market research | B2C market research |

Research objectives | Support strategic planning, TAM sizing, and GTM execution | Drive quick wins, brand awareness, and mass adoption |

Buyer intent | ROI-driven, often tied to long-term contracts | Influenced by emotion, convenience, social signals |

Decision complexity | Multiple stakeholders; longer sales cycles | Individual or household decision-makers |

Sample size | Smaller, hyper-targeted cohorts | Large, high-volume feedback |

Drivers | Rational, evidence-based | Emotional, trend-driven |

Take Notion for example. On the B2B side, the company engages decision-makers through 1:1 interviews, product trials, and tailored feedback loops — all designed to inform deeper functionality, security, and collaboration features. Its go-to-market strategy leans on testimonials, live demos, and peer communities to close deals with teams and enterprises.

On the B2C side, Notion’s research cycle is faster and broader. It taps into trends via social listening, leverages creator-led campaigns, and uses high-volume A/B testing to tweak features for individual users.

This showcases that, in B2B, research is less about speed, and more about certainty. The goal isn’t just to know your audience; it’s to anticipate their next move.

Benefits of B2B market research for global enterprises

Data-driven decision making is just one aspect of B2B market research. Explore a few more advantages it offers for your enterprise.

- Smarter supplier decisions and stronger partnerships: Enterprises rely on multiple sources to evaluate suppliers, surrounding reliability, scalability, and strategic alignment. B2B research blends traditional channels (like industry events and sales interactions) with digital sources (like third-party portals and review platforms) to surface credible supplier intelligence. This helps de-risk procurement decisions, improve vendor performance visibility, and build long-term, value-driven partnerships.

- Continuous performance improvement through market alignment: Enterprises that embed market orientation into their operating model consistently outperform peers. According to Emerald Insight, this advantage compounds when companies pair external research with internal benchmarking. The result? Innovation that’s grounded in market need not gut feel, and performance metrics that actually reflect real-world shifts.

- Precision in digital marketing and tech investments: When research reveals how different audiences behave, marketing can finally stop guessing. For instance, intent data and audience analysis might show that enterprise buyers in healthcare engage most with webinars, while IT leaders respond better to whitepapers and peer reviews. That level of insight helps allocate digital spend more effectively — from ad platforms to landing page content. Platforms like Sprinklr Insights make this scalable — tracking real-time digital behavior across markets to refine spend and content strategy. Trakya University research confirms: companies that tie digital moves to real buyer insights adapt faster and convert better.

- Real differentiation in crowded markets: In saturated industries, incremental moves don’t cut it. Competitive analysis helps surface gaps that matter, and close them fast. LogisMe, a logistics player, used deep client interviews and internal analytics to design hyper-relevant solutions. Frameworks like Porter’s strategy and the NICE mix weren’t just theoretical — they translated into stronger networks, sharper messaging, and clear business wins.

Key B2B market research methods

Effective B2B market research at the enterprise level blends primary and secondary data with the right balance of qualitative, quantitative, and observational methods, tailored to strategic goals like market expansion, product innovation, or go-to-market refinement.

The right mix of methods depends on your business objectives, available resources, and the complexity of your target market.

Below is how each works, and when to use the right mix.

Primary research

Primary B2B market research directly collects original data from your target audience, typically buyers, partners, or key influencers. It includes interviews, executive surveys, and advisory boards. It is highly customizable and delivers first-hand insights that are current and relevant to your unique business context.

When to use it: For high-stakes decisions — new product launches, market entry, messaging validation, or when existing data falls short.

Why it matters: Delivers fresh, tailored insights specific to your context.

Trade-offs: Resource-intensive and slower, especially for niche C-suite segments.

Example:

Adobe used targeted surveys and in-depth interviews with digital marketing leaders and enterprise decision-makers to explore perceptions and uncover gaps in its positioning as an enterprise solution provider.

Insights from these primary research methods shaped its “Creativity for All” campaign, which featured personalized content and keynote webinars built on real customer use cases. This direct feedback guided Adobe to align its messaging and product strategy more closely with enterprise needs.

Secondary research

Secondary research gives enterprises rapid access to existing market intelligence, drawn from analyst reports, competitor data, internal CRM data, and trusted third-party studies.

This approach allows enterprises to access large volumes of market intelligence quickly, benchmark competitor positioning in key markets, and identify emerging trends without starting from scratch.

When to use it: Benchmarking against industry standards, sizing markets, or validating observational and primary findings.

Why it matters: Fast, broad, and efficient. Great for spotting opportunities or emerging trends.

Trade-offs: Imprecise/outdated and sometimes generic; not specific to your product or target personas.

Example:

Sprinklr demonstrates the value of secondary research at scale. It regularly leverages insights from analyst reports like the Gartner Magic Quadrant and Forrester Wave to benchmark its product suites, identify whitespace opportunities, and refine its go-to-market strategy.

These evaluations help Sprinklr align its roadmap with evolving enterprise needs — whether in content marketing, customer service, or digital customer engagement.

For instance, Sprinklr’s consistent recognition as a Leader in Gartner’s Magic Quadrant for Content Marketing Platforms, and a Strong Performer in Forrester’s CCaaS evaluations reflects how it uses external intelligence to validate positioning and drive innovation.

Want access to the latest analyst reports that power these insights? Download them right here!

Once you’ve determined the source of your data — primary or secondary — the next step is to consider the technique used to analyze or interpret it. These core approaches help define the depth, scale, and context of your insights:

Factor | Quantitative research | Qualitative research | Observational research |

Definition | Collects structured, numerical data for statistical analysis | Explores deep motivations, perceptions and reasoning | Observes actual behaviors and interactions in real-world settings |

Typical methods | Surveys, analytics, structured polls | In-depth interviews, focus groups, open-ended workshops | Field studies, digital journey mapping, session replays |

Data output | Measurable trends, benchmarks, forecasts | Narrative insights, quotes, context | Actionable patterns and process bottlenecks |

When to use | Forecasting demand, validating concepts, pricing studies | Uncovering why decisions are made, shaping messaging | Refining user experience, identifying process gaps |

Why to use | Statistical confidence, scalability, performance measurement | Strategic clarity, innovation, executive buy-in | Realistic view of pain points and operational realities |

Sample size | Large, representative groups | Smaller, targeted participant sets | Select stakeholders or teams, often a limited sample |

Limitations | May miss nuance or hidden needs; reliant on strong survey design | Not easily generalizable; can be subjective | Privacy concerns; can be resource-intensive |

Enterprise example | Gartner conducts annual CIO surveys to track global IT priorities and budget allocations | McKinsey uses expert panel interviews and qualitative workshops to inform digital transformation roadmaps | Deloitte applies in-depth process mapping and direct observation to optimize enterprise compliance programs |

Ideal for | Performance benchmarking, KPI tracking, campaign impact assessment | Innovation workshops, repositioning, customer journey mapping | Service design, process re-engineering, compliance validation |

When should mixed methods (triangulation) be used?

Combining quantitative, qualitative and observational techniques provides cross-validated insights for critical enterprise decisions, such as global product launches, M&A evaluations, or entering new markets. Triangulation reduces bias, increases reliability, and helps build executive confidence in both findings and next steps.

The best enterprise teams start with qualitative discovery, validate with quantitative measurement, observe real behavior to adjust assumptions, and benchmark everything with secondary sources like analyst reports.

How to conduct enterprise-grade B2B market research

Getting meaningful insights from your market research requires a clear, structured approach. While the exact process can vary based on your objective, industry, or maturity, these 8 core steps offer a reliable playbook for enterprise teams.

Step 1: Set clear research objectives

Start with clarity: What business decision will this research inform? Are you trying to validate a product idea, identify new segments, test a hypothesis, or understand buying behavior in a specific region or vertical?

At a high level, research objectives fall into two categories:

Objective type | Description | When to use |

Exploratory | Open-ended, designed to uncover unknowns, trends or pain points | Early-stage innovation, new markets, and problem discovery |

Specific | Targeted, focused on a defined hypothesis, metric or business goal | Product validation, market sizing, campaign assessment |

The key is to tie your research directly to a business priority — whether that’s market entry, pricing strategy, or customer experience improvement. Strong alignment increases executive buy-in and ensures the findings won’t just sit in a deck; they’ll actually shape decisions.

Avoid vague goals like “gather customer feedback.” Instead, get precise: “Identify the top three reasons enterprise buyers are churning in the APAC region.” That kind of focus drives sharper analysis, more usable insights, and clearer ROI.

Step 2: Identify the high-value segments and decision-makers

A well-defined target segment makes the difference between generic insight and real strategic value. In enterprise B2B, that means going deeper than job titles and mapping the full decision-making ecosystem.

Here’s how to identify the right targets:

- Segment accounts using firmographics (industry, company size, geography), buying behavior, and business potential.

- Map the buying committee. Enterprise deals usually involve a mix of decision-makers, budget holders, end users, and technical evaluators.

- Use internal data. Sales and CRM insights can help pinpoint patterns in high-value accounts and repeatable buyer behavior.

💡Use broad sampling

Don’t rely on one stakeholder’s perspective. Enterprise decisions are rarely made by a single person. To get an accurate picture, validate insights across multiple roles — marketing, product, procurement, compliance, and beyond.

Key questions to answer:

- Who are the real decision-makers, influencers, and approvers?

- Who tends to champion your solution, and who blocks it?

- Are there niche roles (legal, IT, procurement) whose feedback is essential?

💡 Pro tip: Use LinkedIn, analyst events, and customer advisory boards to identify and validate contacts. And keep your target list dynamic — org charts change fast.

For sharper targeting, you can also tap into Sprinklr’s AI-powered audience insights, which help build custom panels based on live social signals and sentiment-level data. It’s a faster, more contextual way to identify the decision-makers that actually matter.

Step 3: Choose the right methodologies and tools

The methodology you choose should reflect your research objective, the kind of data you need, and how easily you can reach decision-makers. There's no one-size-fits-all. Most enterprise research blends multiple methods to get a fuller picture.

Choose the right research method:

- Quantitative for validation and forecasting

- Qualitative for motivation and context

- Observational for what users actually do

Evaluate tools with an enterprise lens. Your platform must:

- Comply with your security, data privacy, and governance standards

- Integrate with systems like CRM, ERP, and analytics stacks

- Scale across global teams, markets, and business units

- Handle both structured (survey) and unstructured (verbatim, open-text) inputs

- Offer AI features like automated sentiment analysis, dashboards, and real-time trend detection

Example: You might combine a structured survey to gauge market demand, executive interviews to interpret that demand, and AI-powered tools to spot patterns in real-time conversations — all using research platforms approved by your IT and compliance teams.

Sprinklr’s unified platform checks every box; offering secure, AI-powered research across regions and data types, with native CRM integration and advanced analytics built in.

Step 4: Frame research questions for business impact

Strong research starts with sharp questions. The more directly your questions connect to enterprise goals, the more useful and actionable your findings will be. Vague asks get vague answers. Specific, business-driven questions are what leaders actually act on.

How to frame high-impact research questions:

- Tie every question to a clear business decision like market expansion, pricing, product roadmap, or messaging strategy

- Use executive-level language that’s crisp and jargon-free

- Focus on what will move the needle, not just what’s interesting

Examples of strong B2B research questions:

- What are the top three purchase criteria for enterprise buyers in the U.S. healthcare vertical?

- Which operational bottlenecks most often delay onboarding or implementation for our B2B customers?

- How do CXOs define ROI when evaluating digital transformation solutions?

Well-framed questions focus your research, speed up stakeholder alignment, and lead to insights that actually influence GTM and executive decisions.

Suggested Read: 50 Customer Survey Questions You Must Know About

Step 5: Recruit, screen and validate B2B research participants

Your research is only as credible as the people you include, especially when you're targeting senior decision-makers or niche experts.

How to find and vet the right participants:

- Tap into professional networks like LinkedIn, industry communities, and client referrals to identify decision-makers, technical evaluators, and influencers

- Apply rigorous screening criteria based on role, industry, seniority, decision-making authority, and past behaviors

- Validate participant identities pre-interview questionnaires, public profile checks, red herring questions, or referrals

Techniques to reach hard-to-access stakeholders:

- Offer executive-level incentives — like access to industry benchmark reports or early insights. Cash rewards often need to reflect participant hourly value.

- Partner with B2B-focused recruitment agencies or expert panels that specialize in enterprise segments

- Be flexible — short, structured interviews (30–60 mins) and considerate timing are more effective for CXOs.

Why it matters: Enterprise decision groups have grown significantly. Today the averages include 10–11 stakeholders and well over 52% consist of VP-level decision-makers or above. One person’s perspective won’t cut it. Skipping quality often results in biased, misleading data, and bad business decisions.

🔑 Pro-tip: Use snowball sampling (ask recruits for referrals), especially for roles that are difficult to reach. Treat participants like a trusted community — follow the 6Cs of B2B recruitment: clarity, compensation, consideration, coordination, closure, and community

Step 6: Collect, validate and analyze the data

High-quality research depends not just on how you gather, validate, and interpret your data. In enterprise B2B, collecting data is just the start — how you validate, segment, and analyze it determines whether your insights can drive real business decisions.

Best practices for data collection and validation:

- Use secure, compliant platforms (GDPR, CCPA, ISO 27001-certified) that support both digital and hybrid formats. This matters especially when working across regions or handling sensitive data from senior stakeholders.

- Validate responses using techniques like cross-referencing, triangulation, and AI/ML-powered outlier detection. This helps flag inconsistencies or duplicate responses; a common issue in panel-based research.

- Segment the data by region, industry, company size, role, and buying stage. The more precise your segmentation, the more targeted your GTM and product decisions will be.

Analyzing data for strategic value:

- Stay aligned to your original business questions and KPIs. Don’t let interesting-but-irrelevant data dilute focus.

- Merge quantitative feeds with qualitative context (e.g. survey scores + interview themes + sentiment) for full-spectrum insight.

- Use AI-powered dashboards and advanced analytics to surface trends, outliers, risks, and opportunities. Bonus: automated visualizations make it easier for executives to digest and act on findings.

Why it matters: Without rigorous validation and insight framing, research distracts more than it directs. Trusted data builds confidence and buy-in.

Step 7: Report insights for executive buy-in and GTM execution

Insights are only valuable when leaders act on them. Your reporting should elevate findings to strategic clarity; connecting research directly to decisions around market entry, product strategy, or sales enablement.

How to report insights for maximum impact:

- Prioritize what moves the business. Use business-focused language to summarize key takeaways, not just interesting findings.

- Tie every insight to a strategic decision — whether it’s market entry, product pivots, or sales enablement.

- Present insights visually using dashboards, summary charts, and clear narratives that help executives grasp patterns at a glance.

Sprinklr’s AI-powered dashboards and Insights Assistant automate this process. They identify trends, surface root causes, and package findings into board-ready visuals; saving leaders from information overload.

Executive reporting roadmap:

- Executive summary: Top takeaways linked to business goals.

- Segmented analysis by region, vertical, or persona.

- Actional recommendations: owners, timelines, and KPIs defined.

- Risk/opportunity assessment — quantitative where possible.

Tips for winning executive buy-in:

- Frame research as risk mitigation and strategic acceleration, not just innovation

- Quantify results (e.g., cost savings, pipeline lift, time‑to‑decision gains)

- Preempt likely questions with backup data and rationale

For context: 60–90% of noble strategies fail due to poor execution or alignment, and many initiatives stall not for lack of insight, but poor connection to action.

Working with B2B research services: When to outsource and what to expect

Not every enterprise has the time, tools, or in-house expertise to run complex B2B research, especially across markets or senior stakeholder segments. That’s where outsourcing makes sense.

Outsource when:

- You need access to niche decision-makers or global panels

- You’re short on time, tools, or in-house expertise

- You want independent validation to build internal alignment

Expect from a good partner:

- Clear research design tied to business goals

- Vetted B2B participants, not general panels

- Strategic recommendations, not just raw data

Many enterprise leaders take a hybrid approach: outsource the execution, keep the strategy and insight integration in-house. That’s where platforms like Sprinklr Insights come in — operationalizing the insights across your GTM, CX, and product workflows to drive real business outcomes.

Top B2B market research tools in 2025

Surveys & feedback platforms

These tools help gather structured insights directly from your target audience; ideal for validating hypotheses, measuring satisfaction, or exploring product-market fit.

Top picks: Qualtrics | SurveyMonkey | Typeform | Sprinklr Insights

Social listening & sentiment analysis tools

Understand what decision-makers are saying across digital channels in real time. Track sentiment shifts, emerging trends, and brand mentions across regions and industries.

Top pick: Sprinklr Insights

CRM & customer intelligence platforms

These platforms centralize customer data — from purchase history to engagement behavior, to help you segment audiences, identify patterns, and drive data-backed decisions.

Top picks: Salesforce | HubSpot

Web & behavioral analytics tools

Track how users behave on your site or app. Great for identifying friction points, content performance, and buyer intent signals.

Top picks: Google Analytics | Hotjar | Mixpanel

Conclusion & next steps

“The goal is to turn data into information, and information into insight.” That quote from Carly Fiorina (American businesswoman and former CEO of Hewlett-Packard) still holds up — but in 2025, insight alone isn’t enough. What matters is action.

The most effective B2B teams aren’t just running research cycles. They’re building insight engines: systems that continuously sense, learn, and respond to market change. They know that in a noisy, fast-shifting world, the edge goes to those who ask better questions, faster.

Sprinklr Insights gives you that edge. Trusted by leaders at Prada, IKEA, Microsoft, Uber, and more, it brings AI-powered research, social listening, and omnichannel feedback into one enterprise-ready platform. You get one source of truth, backed by real-time data and visualized for decisions.

For hard-to-reach audiences, complex segments, or mission-critical bets, it’s worth bringing in the right partner. Not to outsource thinking, but to sharpen it.

Ready to see what better B2B research looks like? Request a demo and let’s get to work.

Frequently Asked Questions

B2B market research focuses on business buyers, longer sales cycles, and multi-stakeholder decision-making. It's driven by logic, ROI, and operational impact. B2C research, on the other hand, targets individual consumers; typically shorter buying cycles, emotionally driven choices, and fewer decision-makers.

Use online surveys, social media listening, free analytics tools (like Google Trends or Meta’s Audience Insights), and competitor website analysis. Industry forums and LinkedIn groups are also solid channels for gathering directional feedback at low cost.

Prioritize agencies with proven B2B experience, especially in your sector. Look for a consultative approach, strong client testimonials, clear methodologies, and the ability to deliver customized, insight-rich reporting, not just data dumps.

Vague objectives, single-source data, skipping stakeholder validation, and ignoring compliance risks are classic pitfalls. Also avoid generic reporting: insights must be tied to actual business decisions and revenue impact.

AI accelerates data collection, detects non-obvious patterns, and removes manual bias. It enables faster segmentation, sentiment analysis, trend forecasting, and anomaly detection; especially across large, unstructured datasets like social and voice-of-customer data.

AI-powered analytics, real-time data monitoring, precision targeting (ABM), and mixed-method approaches are rising fast. There’s also growing adoption of predictive modeling, dynamic dashboards, and integration with CX, CRM, and marketing automation systems to drive faster GTM execution.