Elevate CX with unified, enterprise-grade listening

Sprinklr Insights gives you real-time consumer, competitor and market intelligence from 30+ channels without the noise. Make smarter decisions, strengthen your brand, and stay relentlessly customer-led.

How to Create a Competitive Intelligence Report

Ever wondered how AI leaders like OpenAI, Google and Anthropic keep launching products that outpace one another? When OpenAI rolls out a new ChatGPT feature, Google answers with a Gemini update. Anthropic follows with its own improvements. That’s not coincidence, it’s strategy.

These companies aren’t just innovating. They’re watching the market closely and acting on what they learn.

That’s where a competitive intelligence report comes in. It helps you track how your competitors are positioning themselves, what’s working for them and where you have a chance to outperform.

These reports go beyond the usual KPIs. For example, B2B companies with higher customer satisfaction are 1.5x more likely to outperform peers, but do you know how your competitors are doing on CSAT? And what’s driving that?

A competitive intelligence report helps you find those answers, so you can respond with confidence, not assumptions.

This blog walks you through building a competitive intelligence report that works for enterprises like yours. You’ll discover its benefits and practical steps to create one.

What is a competitive intelligence report?

A competitive intelligence (CI) report is a structured document that analyzes your competitive landscape, tracking how your competitors are positioned, what they’re prioritizing, and where the market is headed. It transforms fragmented data into clear, strategic insights that help you take action.

Unlike one-off competitor comparisons, a CI report connects the dots across products, campaigns, customer sentiment, pricing, market share and growth signals. It’s designed to guide long-term planning, not just quick reactions.

These reports typically pull data from multiple sources — social media, digital campaigns, customer reviews, pricing databases, analyst insights, and distill them into a comprehensive view of how your brand stacks up. The goal isn’t just to see what competitors are doing, but to understand why, anticipate their next move, and respond with confidence.

According to Gartner’s Tech Marketer Role Survey, 74% of technology and service providers identified competitive and market intelligence as a top priority to address within the next 12 months. It’s become critical for enterprises navigating global, fast-moving markets.

Here’s an example of a competitive intelligence report presented visually, focused on organic research. 👇

Strategic benefits for global brands

For enterprise teams, competitive intelligence supports:

- Faster, more informed decision-making

- Better risk management in volatile markets

- Sharper positioning in crowded industries

- Future-ready planning aligned with market signals

Whether it's adjusting pricing, forecasting demand, or identifying whitespace, CI reports help large brands stay proactive and competitive.

Many confuse CI with basic competitor research, but they serve different goals. Here’s how they compare:

Aspect | Competitor research | Competitive intelligence |

Scope | Narrow: Focused on a few products or brands. For example, checking the prices of Samsung phones vs. Apple phones. | Broad: Looks at market trends, rivals, and disruptions. For example, understanding the smartphone market shifts due to Apple's AR glasses release. |

Purpose | Tactical: Short-term moves (e.g. pricing reactions) | Strategic: Long-term planning (e.g. future market shifts) |

Data type | Mostly quantitative (e.g. follower count, ad spend) | Combines quantitative + qualitative insights (e.g. sentiment, roadmap cues) |

Decision-making | Reactive: Responds to competitor actions | Proactive: Anticipates and plans around future risks/opportunities |

Timeframe | Short-term, tactical and immediate | Long-term, strategic, forward-looking |

Fuel Your Basics: What is Competitive Benchmarking and How Do I Get Started?

Competitor intelligence report best practices

A competitive intelligence report that’s hard to interpret doesn’t get read, let alone acted on. If you want your report to drive decisions at the executive level, these best practices matter:

1. Base your insights on credible, contextual data

Executives need facts, not assumptions. Every insight should be backed by reliable, current and clearly sourced data.

- Use verified market data, customer analytics or industry benchmarks.

- Be intentional about source selection — leverage a mix of public reports, expert interviews and analyst data.

- Always show why a data point matters, don’t leave interpretation to chance.

- Distinguish between known facts and areas of uncertainty.

2. Make insights actionable

Insight without a next step is just noise. For every finding, clearly outline its implications and the strategic move it demands.

- Tie data to decisions. ("Competitor X gained 20% market share" → "Reassess pricing in this segment.")

- Call out risks and opportunities plainly.

- Prioritize recommendations so execs know what to act on first.

- Ensure insights ladder up to broader business goals — whether that’s improving positioning, refining product features or gaining market share.

3. Structure reports for executive clarity

Design the report around what your stakeholders care about, not what your analysts discovered.

- Start with a concise executive summary that highlights key trends, risks and next steps.

- Organize the body of the report around competitor themes (product, pricing, marketing, customer sentiment, etc.).

- Use templates to maintain consistency — competitive scorecards, SWOT tables or side-by-side product comparisons make insights easier to absorb.

- Visuals should highlight, not overwhelm. Prioritize clean charts and labeled graphics that support quick scanning.

Also Read: Social Media Reports: 9+ Templates & Examples

4. Customize for audience and objective

Not every report is for every stakeholder. Align your scope and depth based on who will use the insights.

- Identify decision-makers early — CPOs, CMOs, GTM leaders, and tailor accordingly.

- Choose competitors strategically. Focus on a mix of direct players and emerging threats based on market activity, not just industry overlap.

- Frame the report around key exploratory questions: “What’s changing?”, “Who’s gaining ground?”, “Where are we falling behind?”

5. Keep it concise and decision-ready

Clarity beats complexity. Make your insights easy to digest, share and use.

- Use crisp language and short, direct sentences.

- Label all visuals clearly and avoid data-dense clutter.

- Highlight key takeaways at the top of each section.

- Maintain a modular format — separate tabs or sections for different competitors or themes can help with digestibility.

How to build your competitive intelligence report

A great competitive intelligence report turns raw insights into clear, strategic direction. Here’s what to include, and how to structure it, so stakeholders can act on it fast.

1. Create an executive summary comprising key insights and actions

This isn’t an introduction. It’s your report in miniature.

Start with the most critical insights: What’s changing in the competitive landscape? What are the urgent threats or time-sensitive opportunities? What immediate actions should leaders take?

Make it crisp, visual and focused. Bullet the top takeaways. Avoid overexplaining known context or market history — executives won’t read past the first paragraph if you bury the lead. Instead, spotlight:

- 3–5 key insights that demand attention

- Any emerging disruptors or declining trends

- Strategic actions broken down by owner or function

Executives may only read this page, so make it unmissable.

2. Highlight current market shifts and trends

Your market overview sets the stage for why competitive moves matter. Frame competitor activity within the broader context of macroeconomic trends, evolving customer expectations, regulatory changes and industry disruption. It’s about interpreting why it matters and what it could mean for your business.

Avoid generic facts or stale stats. Instead:

- Call out new market entrants or fast-growing niches

- Highlight changing buyer expectations or emerging technologies

- Show where the market is cooling or heating up, and why that matters

The goal is to connect the dots between what’s happening in the market and how your competitors may respond or are already responding. For enterprise audiences, this helps contextualize risk and opportunity across product lines or geographies.

Want a faster read on market shifts?

Use social listening to surface real-time trends, spot emerging sentiment and benchmark brand health — all in one place.

A consumer intelligence tool like Sprinklr’s Social Listening lets you track evolving conversations, compare competitor performance, and connect the dots before the next move hits the headlines.

Because when the market moves, you don’t want to be the last to know.

3. Clearly define your competitors

You can’t outrun a competitor you haven’t identified. Start by mapping:

- Direct competitors (same products, same audience)

- Indirect competitors (different offerings solving the same problem)

- Emerging disruptors (startups, new entrants, global players entering your space)

For each, explain why they’re relevant. Are they gaining share in your core market? Are they resonating with a buyer segment you’re losing? Are they scaling faster with a different go-to-market model?

Don’t just list names, analyze their threat or opportunity level. This makes it easier for teams to prioritize responses.

4. Identify where your brand stands compared to your competitors

This is your baseline. How does your brand perform relative to competitors across visibility, perception and influence?

Use metrics like:

- Share of voice

- Sentiment trends

- Channel-by-channel engagement

- Earned media and influencer traction

- Follower growth and community health

But go beyond reporting. Interpret:

- Are your competitors winning Gen Z attention on TikTok while you dominate LinkedIn?

- Are their product launches generating more media buzz or positive feedback?

- Is your engagement high but sentiment low?

Use a competitive benchmarking tool (e.g. Sprinklr’s Competitive Insights and Benchmarking) to compare across KPIs like reach, engagement, impressions and share of voice. Benchmarking sharpens your focus on the channels, segments and metrics that actually move the needle.

5. Evaluate strengths, weaknesses, opportunities and threats clearly

A SWOT analysis isn’t a box-ticking exercise. It’s a clarity tool that helps you distill complex intelligence into simple, actionable categories that guide strategic moves.

Start internally:

- Strengths: What’s working for your brand (e.g. “Top-rated for usability in G2 reviews”)

- Weaknesses: Where are you lagging? (e.g. “Slow feature adoption among enterprise users”)

Then look externally:

- Opportunities: Which markets or segments are underserved by your competitors?

- Threats: Where are others gaining ground or innovating faster?

Avoid vague statements like “rising competition” or “strong brand.” Use precise, observable signals. This clarity helps execs make trade-offs and plan investment decisions based on real dynamics, not guesswork.

6. Compare your offerings directly against competitors’

This is where intelligence becomes actionable for sales, product, and customer success.

Go beyond feature lists. Compare value:

- What do customers care about most, and who delivers better?

- Are you easier to adopt, more affordable or more scalable?

- Do competitors offer a faster onboarding experience, better SLAs or more responsive support?

Use side-by-side tables or matrices to show what matters.

For example: “Competitor A offers 24-hour onboarding and 30-day risk-free trials. Ours takes 7 days with no early-exit option.”

Highlighting these gaps helps functional teams quickly prioritize fixes, differentiators or positioning angles.

7. Review and highlight how competitors position themselves in the market

Understanding how your competitors position themselves isn’t just about slogans or taglines; it’s about how they frame their value, who they target and what emotional or functional triggers they use to win attention.

Look at their messaging across channels. Review:

- What promises are your competitors making?

- Which pain points or benefits do they emphasize?

- What tone, voice or identity do they adopt—and does it resonate?

Are they pushing affordability or premium value? Are they winning trust with transparency or disrupting with bold claims?

For example, Liquid Death positions itself as rebellious, irreverent, and sustainable with its edgy tagline, "Murder Your Thirst," targeting Gen Z and younger millennials. It uses humor, bold visuals, and recyclable cans to stand out in a traditionally polished category.

This is a sharp contrast to Evian or Fiji, which emphasize purity and luxury through serene branding and upscale messaging. While those brands have started integrating sustainability messaging, they struggle to match Liquid Death’s cultural relevance. This kind of positioning insight reveals where legacy players are vulnerable, and where new entrants can win with tone, not just product.

Brand Learning: How McDonald’s uses competitive insights to stay ahead of the curve

8. Break down financial results

Competitor performance isn’t always visible, but financial signals tell a story. Revenue trends, profit margins, funding rounds and customer acquisition costs all tell that story, and your job is to decode it.

Track:

- Revenue growth YoY

- Profitability and margin shifts

- Burn rate and runway (for startups)

- Capital raised and how it’s being allocated (e.g. product, sales, expansion)

- Customer acquisition cost vs. lifetime value

- R&D vs. marketing spend

Use this data to identify strategy inflection points: Are they investing for growth or trimming back? Scaling sustainably or bleeding cash? Entering new markets or protecting core ones? These insights are critical when pitching to the board or recalibrating strategy mid-quarter.

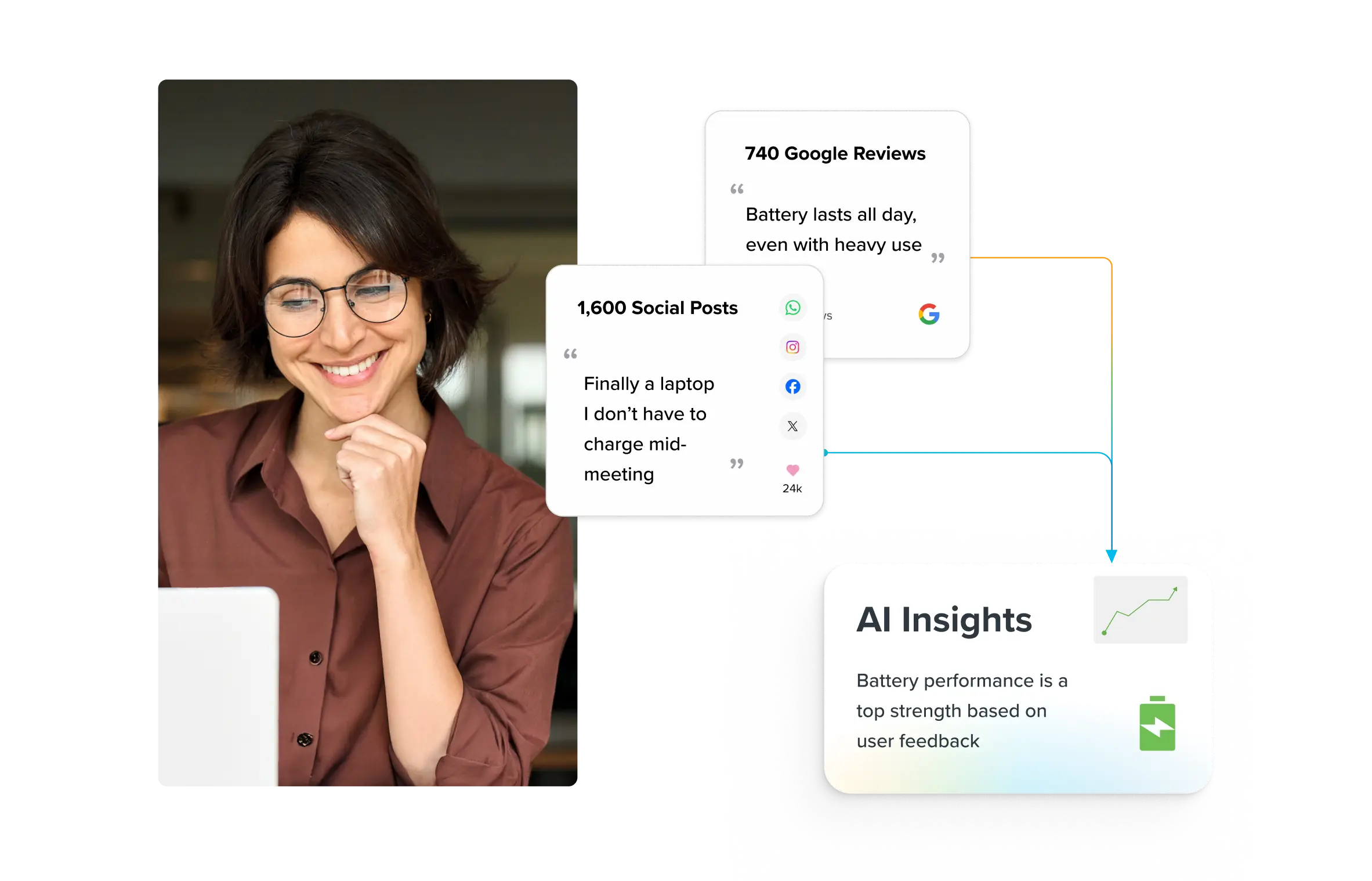

9. Uncover what customers really think

Customer sentiment is where the truth lives. What people say about your brand and competitors matters more than what you claim in your messaging.

Forget polished brand decks. The truth lives in the comments.

Tap into:

- Reviews (G2, Trustpilot, App Store)

- Social media and forums (X, Reddit, LinkedIn)

- Support tickets and chatbot logs

- Community groups or dark social channels

Use AI-powered social listening tools to spot sentiment trends, rising complaints, unmet needs or moments of delight. Compare:

- Are customers frustrated by your competitor’s customer service but love their UX?

- Are you delighting users with performance but falling short on post-purchase engagement?

This qualitative layer often reveals a competitive edge or risk sooner than quantitative trends.

💡 Expert tip: Listening is just the start. Want deeper clarity on what your customers really feel? Ask them — smartly.

With Sprinklr’s AI-powered surveys, you can go beyond ratings to capture real-time sentiment, detect tone and spot emerging patterns fast. They’re easy to build, work across any device, and give you the “why” behind the feedback.

Directly tap what’s going on in your customers’ minds. Get a free demo right away.

Recommended Read: What are Customer Surveys - Types and Benefits

10. Define specific next steps based on the insights

Don’t leave your stakeholders wondering what to do next.

Translate insights into clear, prioritized and function-specific actions:

- Marketing: “Update mid-funnel messaging to counter Competitor B’s new positioning.”

- Sales: “Create battle cards around onboarding time and self-service options.”

- Product: “Accelerate launch of freemium trial to address gap in customer acquisition.”

- Leadership: “Assess go-to-market spend relative to top 3 competitors by Q3.”

Add timelines and accountability. Include quick wins and longer-term moves. Your report should be a launchpad, not just a look-back.

The best reports don’t just reveal where you stand. They tell you how to move forward. This is how you turn intelligence into a competitive advantage.

A competitor intelligence report template

Creating a comprehensive competitive intelligence report requires the right tools but having a solid starting point matter just as much.

The template below gives you that foundation.

Download it, explore the structure, and replace the demo content with your competitors’ data to start generating strategic insights.

Download the complete competitive intelligence report template here -> Click Here.

📖 How IKEA uses real-time insights to stay ahead

With 460 stores in 62 markets, IKEA doesn’t just monitor mentions — it tracks a constant stream of global conversation. On average, the brand sees 8 to 12 social media mentions every minute. And every post, review or headline has the potential to shape perception.

Manual monitoring couldn’t keep up. So, IKEA turned to Sprinklr Insights to centralize and scale its listening.

What changed with Sprinklr:

- One unified view: IKEA now tracks what customers are saying — locally and globally across social, reviews, forums and media.

- Real-time visibility: Their teams spot spikes, surface emerging issues and respond fast, before small signals become big problems.

- Custom impact scoring: With Sprinklr, they built a Media Impact Score using five key signals: relevance, engagement, sentiment, syndication, and amplification. This helped them measure PR effectiveness with clarity.

The result? Less time sorting through noise. More time making smart, strategic decisions.

Don’t just build a competitive insights report. Act on it

A competitive intelligence report is a decision-making advantage. But only if it’s built to surface what actually matters: shifts in customer behavior, competitive blind spots and early signals of market disruption.

As Andy Grove, former Intel CEO, once said: “Only the paranoid survive.” The smartest enterprises don’t just watch competitors. They stay two steps ahead.

With Sprinklr Insights, you can cut through the noise and bring everything together — social listening, benchmarking, surveys and real-time signals into one unified, enterprise-ready view. No more spreadsheet fatigue. Just sharper insights, faster action and better decisions.

Ready to level up your competitive intelligence?