Elevate CX with unified, enterprise-grade listening

Sprinklr Insights gives you real-time consumer, competitor and market intelligence from 30+ channels without the noise. Make smarter decisions, strengthen your brand, and stay relentlessly customer-led.

Customer Satisfaction Survey: How to Derive Insights

A customer satisfaction survey is supposed to be the start of a conversation, not a final report card. Every CSAT survey, every client satisfaction survey, catches real reactions as they happen — but the real story never sits neatly inside a score. Too often, these surveys are skimmed for numbers, compared like trophies and filed away, while what truly matters gets lost. You only start getting real answers when you slow down, listen without assumptions and ask better questions. A customer satisfaction survey shows you exactly where your promises land — and where they don't. In this blog, we’ll talk about how to stop treating CSAT surveys like statistics and start treating them like the raw material for strategic moves that make a visible difference.

- What is a customer satisfaction survey?

- Types of CSAT surveys

- How to extract actionable insights from customer satisfaction surveys

- Benefits of client satisfaction surveys for businesses

- Key components of effective customer feedback surveys

- Top 7 use cases for customer satisfaction surveys in 2025

- Bring serious intent to every customer satisfaction survey with Sprinklr

What is a customer satisfaction survey?

A customer satisfaction survey is a structured method of asking customers to evaluate their experience with a product, service or brand, usually through a direct set of questions designed to measure how well expectations were met.

It’s a way for businesses to stop assuming and start asking — directly, clearly and at scale. Whether delivered as a CSAT survey, a client satisfaction survey or a custom feedback form, the goal stays the same: to capture the brand perception in customer’s own words or ratings.

Unlike general market research, a customer satisfaction survey zooms into lived experiences — how the customer felt about a support interaction, a delivery process, a new feature or even the smallest service detail. It turns the intangible into something you can see, hear and eventually act on.

Types of CSAT surveys

Not every customer satisfaction survey captures the same kind of insight. The difference often comes down to two things: when you ask for feedback, and how you invite customers to share their experience.

Some surveys are tied to specific events in the customer journey. Others are shaped by the way you structure the questions and the kind of responses you seek.

Because of this, customer satisfaction surveys naturally fall into two broad paths: those that are triggered by an event and those that are driven by the method of response. Let’s look at both.

Event-driven surveys

These surveys are anchored around key customer events or experiences.

Milestone surveys

Milestone surveys are sent at critical points in a customer's journey — like after onboarding, after a renewal or after completing a major purchase. They help you understand how customers feel at key transition moments, where expectations are often at their highest or most fragile. Timing is everything here: you gather feedback while the experience is still fresh, revealing your strengths, what stalled and where support or communication needs to change.

Transactional surveys

Transactional surveys check in right after a single interaction — like finishing a support chat, receiving an order or booking a service.

They’re built to catch the immediate feeling customers walk away with: Did they get what they needed? Were they left waiting, confused, relieved, impressed? Transactional surveys show you where everyday experiences either hold strong or quietly break down.

Relationship surveys

Relationship surveys are not tied to any single event. Instead, they measure the overall health of your customer relationship over time.

Sent out periodically, they ask customers how they feel about doing business with you, from a wider vantage point.

Are you still their first choice? Are you starting to feel interchangeable? These customer satisfaction survey questions help you read the slow shifts that don’t show up in day-to-day feedback but decide whether loyalty builds or bleeds out over time.

Product experience surveys

Product experience surveys dig into what it’s actually like to live with your product.

Are the features working the way customers expected? Is it easy to use or a struggle they have to work around? This kind of customer satisfaction survey brings out the details that make or break satisfaction, giving you a clearer view of where to improve before frustration starts driving people away.

Read: How to Handle Angry Customers

Response-driven Surveys

These surveys are shaped by how you frame the questions and what you listen for.

Likert scale surveys

Likert scale surveys ask customers to rate their feelings or agreement on a sliding scale — like “strongly agree” to “strongly disagree” or “very satisfied” to “very dissatisfied.” They help you measure degrees of satisfaction in a way numbers alone can’t show. These surveys are perfect when you want to track shifts in customer sentiment over time, not just count wins and losses.

Binary response surveys

Binary response surveys keep things sharp and simple: yes or no, thumbs up or thumbs down. They’re fast, clear and leave little room for confusion. If you need a quick pulse check without wearing out the customer’s attention, this is the format that gets it done.

Categorical choice surveys

Categorical choice surveys ask customers to pick from a list — like selecting their favorite feature, preferred communication channel or most-used product line. These responses help you build customer profiles, understand preferences and tweak your offerings without drowning in scattered feedback.

Open response surveys

Open response surveys hand the microphone fully to the customer. Instead of picking from options, they get to tell you exactly what’s on their mind, in their own words. You hear what matters most to them — not just what you thought to ask about. This kind of survey is where hidden customer frustrations, unexpected praise and big ideas often come through.

Behavioral frequency surveys

Behavioral frequency surveys ask about habits — how often someone uses your app, shops at your store or reaches out for support. They shine a light on loyalty and engagement in ways satisfaction scores can’t fully capture, showing whether your brand has become a daily part of your customer’s life — or just an occasional stop.

How to extract actionable insights from customer satisfaction surveys

Collecting responses is the easy part. The real challenge is filtering out what’s useful — especially when the feedback comes in fragments, repetition, or half-truths. Here are five grounded ways to pull insights from customer satisfaction surveys.

1. Track intensity, not just sentiment.

A high satisfaction score isn’t always a strong signal. There's a difference between someone who casually clicks a 5 and someone who emphatically selects it. Track how consistently and confidently customers choose those scores. The stronger the conviction, the more reliable the insight — especially when making changes that carry risk.

2. Compare silence with response.

Don’t ignore skipped questions or empty comment boxes. Silence is data too — especially when entire segments go quiet on specific prompts. That’s where disinterest or discomfort often lives. If certain segments go quiet on specific questions, dig into that silence. Sometimes what people choose not to say is more telling than what they do.

3. Anchor feedback to customer history.

A complaint from a new user and the same complaint from a loyal, long-time customer carries a very different weight — even if the words are identical. That’s why feedback should never be read in isolation. Layer responses with context: How long has this customer been with you? What kind of plan are they on? Have they raised issues before? This helps you see whether a piece of feedback reflects a one-off frustration, a recurring pain point, or a slow decline in trust — and respond with the right level of urgency.

4. Look for contradictions across formats.

Sometimes a customer gives you a perfect score — but their written comment sounds hesitant, vague, or even disappointed. That mismatch matters. It could mean the customer didn’t want to complain directly but still felt let down. Or that they expected more, but didn’t want to lower your score. These gaps between what people rate and what they say often flag subtle dissatisfaction — the kind that doesn’t show up in metrics but can quietly erode loyalty if ignored.

5. Trace feedback back to decisions.

Insight isn’t insight unless it changes something. For every trend or comment you spot, ask: does this help us improve something, fix something or validate something? If not, it’s just noise — even if it’s well-worded.

And it doesn’t stop at surveys.

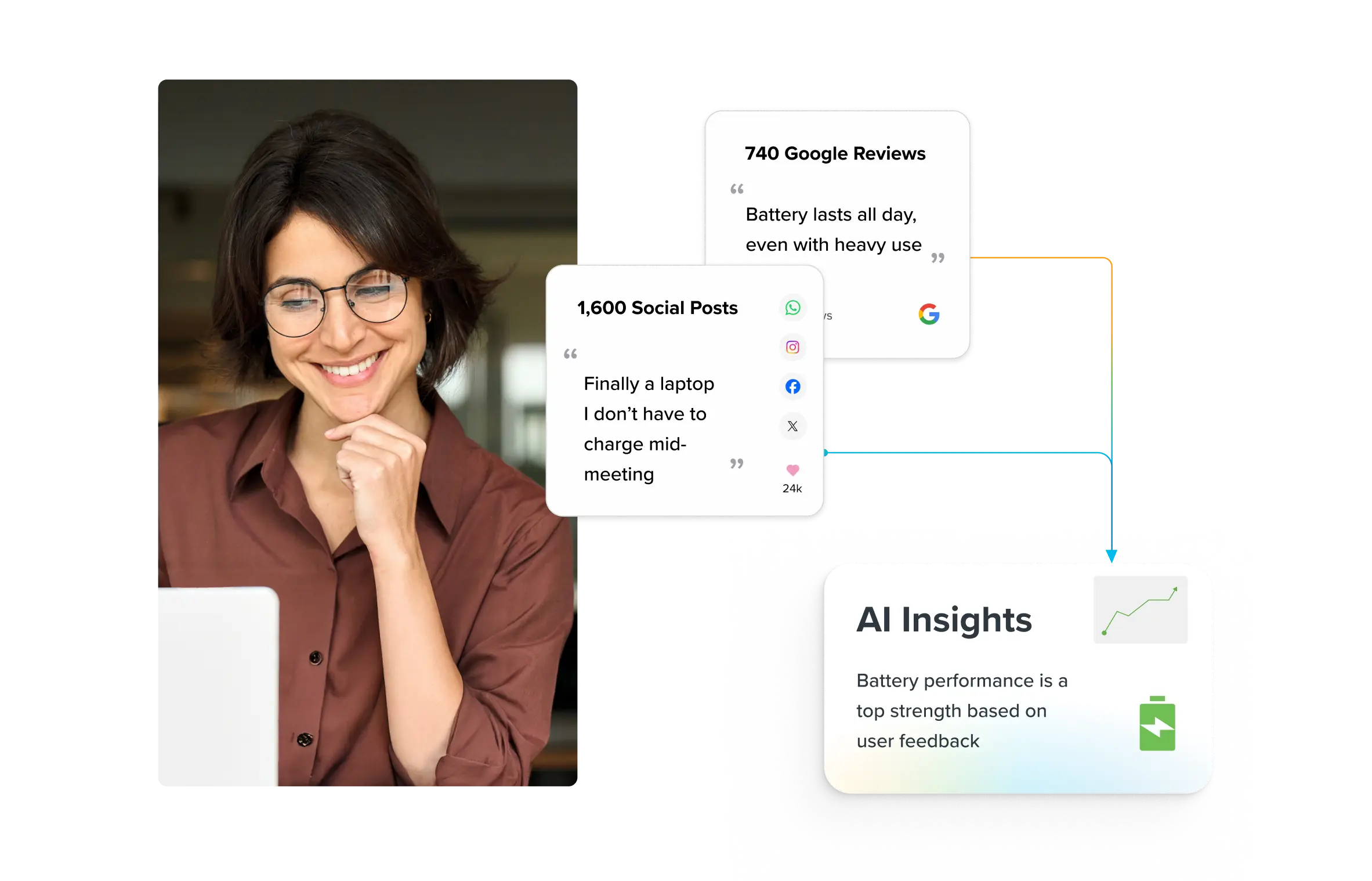

While customer satisfaction surveys give you a structured look at how customers feel, not every signal comes neatly packaged. People voice their opinions in reviews, forums and social posts — often without tagging you directly. This is where AI makes a real difference. Sprinklr AI helps you break through that noise, separating what’s just commentary from the feedback worth acting on. It pinpoints the messages that carry weight — the ones that hint at churn, reputation risk or a chance to recover trust.

Benefits of client satisfaction surveys for businesses

Customer satisfaction surveys are one of the few chances you get to hear what your business sounds like from the outside. Not what the numbers show or what internal teams assume — but what it’s like to be on the receiving end.

Whether it’s a CSAT survey after a customer interaction, a client satisfaction survey at the end of a contract cycle or embedded in your product, each one gives you a snapshot of what it’s like to deal with you — in real life.

User satisfaction surveys are valuable because they show you what people have had to figure out on their own. They shine light on small inefficiencies that pile up, the workarounds customers invent and the places where your interface stops being helpful and starts becoming work.

- Pinpoint gaps in experience that internal QA never touches.

- Expose points of barriers in processes that otherwise appear stable

- Capture signals of fading confidence, long before churn shows up.

- Identify aspects of your service that get noticed — and remembered.

Well-built customer satisfaction surveys open a path back into the customer’s reality, where your next decisions should be made.

Key components of effective customer feedback surveys

The most reliable customer satisfaction surveys are well-engineered. Every part of them, from timing to design to data structure, is built to remove friction for the respondent and ambiguity for the team reviewing the results. Below are four components of effective customer feedback surveys.

Question purpose

Good surveys don’t ask what they don’t plan to act on. Every question must have a job not to fill space or collect nice-to-have stats. It’s to expose something you need to understand to fix, improve or re-evaluate a part of the experience. Before asking anything, the team should agree on this: If we see a trend here, what are we ready to do about it? It likely shouldn't be included if that question can’t be answered.

Framing neutrality

Most surveys skew answers before a customer ever responds. Language like “How helpful was our team?” assumes there was help in the first place. Effective CSAT Surveys invite honesty by stepping out of the customer’s way. They don’t assume the outcome, they create space for approval, disappointment and everything in between.

Contextual timing

Feedback changes depending on when you ask for it — not just in tone, but in content. A client satisfaction survey sent right after resolution might capture relief, while the same survey sent three days later might surface more useful reflections. Teams often treat timing as a checkbox. But it’s a design decision. It should be based on what kind of truth you’re looking to capture — the heat of the moment or the cooler read that comes after.

Response conditions

A feedback survey is still an interaction — and the conditions in which it’s delivered shape how people respond. If a user satisfaction survey pops up in the middle of a task, you risk disrupting the experience. If it shows up buried in a transactional email footer, it disappears. Surveys work best when they are visible, respectful and easy to exit. That balance — visible but unobtrusive — is rarely hit by accident. It has to be designed with intent.

Top 7 use cases for customer satisfaction surveys in 2025

Customer satisfaction surveys work best when they’re used with intent. A CSAT Survey that’s timed well and aimed right can bring truths that no analytics dashboard or executive summary will ever surface. Here are the best use cases to plug in your next client satisfaction survey.

Use case #1: After a complex resolution

When a customer has gone through multiple back-and-forths — whether with support, delivery or product configuration — a survey can help you understand if the outcome was actually worth the effort or did it just drag the problem to a quieter place.

Use case #2: Before renewals or contract closures

Contracts that end in silence often hide weeks of quiet dissatisfaction. A client satisfaction survey sent 30–45 days before renewal creates space for feedback that wouldn’t surface in routine check-ins. You can identify if the customer felt under-supported, if expectations shifted during the term or if competitors are being considered. The timing lets you address risks without relying on assumptions or waiting for the final call.

Use case #3: During pilot programs or early rollouts

High-CSAT users are often the best people to test new offerings. They’re more likely to give honest, actionable feedback — and less likely to sugarcoat it. A well-timed user satisfaction survey during a limited release gives you early signals on usability, gaps and value alignment.

Use case #4: After a drop in engagement

When a customer slows down — skips a few check-ins, stops logging in, stops replying — it doesn’t always show up in your CRM. A simple CSAT Survey during that quiet stretch can help you find out whether they lost interest, ran into friction or just stopped seeing any reason to continue with your brand.

Use case #5: At key milestones in onboarding

Customers often make up their minds about your product within the first few days — long before onboarding is marked “complete.” A satisfaction survey at the first milestone (like account setup, first task completion or post-training) helps identify whether the early experience gave them the confidence to continue. It shows you where instructions fell short, where problems were unexpected or where early value wasn’t clear enough.

Use case #6: Following a team or process change

When internal teams restructure workflows, change tools or revise policies, the change often looks smooth internally but lands unevenly on customers. A CSAT survey sent shortly after the change helps assess how the new process is understood, whether it introduces delays or confusion, or if expectations were reset without notice. This is often the only way to verify alignment between how the process was designed and how it’s actually experienced.

Use case #7: After a drop in reviews or NPS

When public ratings or NPS scores begin trending downward, the cause is rarely obvious. A satisfaction survey sent to recent customers can help isolate reactions to specific shifts that may have triggered the drop — such as a new pricing update, a revised cancellation process that now requires agent intervention or a packaging change that led to damaged deliveries. A well-snugged CSAT survey lets you ask targeted questions tied to recent events, helping narrow the issue to something that can be acted on quickly.

Bring serious intent to every customer satisfaction survey with Sprinklr

Most surveys stop at collection. Sprinklr Insights Surveys is built for what comes after — making sure every response leads to something clear, usable and backed by more than just a score.

- Set up in plain language — Write survey flows and edit questionnaires with natural language prompts. No ambiguity, just clarity.

- Ask better follow-up questions — automatically. AI adapts survey questions based on what the customer says, so you get higher completion rates and context without chasing it.

- Bring in what customers are saying elsewhere. Compare survey results with feedback from social media, service calls and review sites to see what lines up — and what’s being said where surveys don’t reach.

Sprinklr helps you ask less and learn more — in the places where feedback matters most.

Frequently Asked Questions

Customer satisfaction surveys improve customer loyalty when responses lead to visible, meaningful changes. If a customer flags a delivery issue and sees it resolved the next time they order, they’re more likely to stay. Loyalty grows when customers feel heard and see their feedback taken seriously.

The most common mistakes in client feedback surveys include asking vague questions, using biased phrasing, overloading the survey with too many prompts and ignoring the customer’s context. Surveys that lack focus or clarity end up generating noise instead of insights — making them useless for decision-making.

AI and machine learning can improve user satisfaction surveys by analyzing open-text responses at scale, identifying recurring themes and flagging sentiment patterns your team might miss. These technologies help sort feedback into what's actionable, what’s urgent and what’s noise — especially when survey volume is high.

Businesses should track the CSAT score, response rate, repeat complaint rate, customer effort score (CES) and net promoter score (NPS). Each tells you something different — how satisfied customers feel, how easy their experience was and whether they’d recommend your brand to others.

Yes, customer satisfaction surveys surface recurring issues like missing features, UX friction or unclear onboarding — all of which help product teams identify gaps in the experience. When this feedback clusters around specific modules or journeys, it directly informs roadmap decisions, sprint planning and what gets pushed into backlog vs. what gets fast-tracked.