The global leader in enterprise social media management

For over a decade, Sprinklr Social has helped the world’s biggest brands reimagine social media as a growth driver with a unified platform, industry-leading AI and enterprise-grade scale.

How to Perform Social Media Competitor Analysis (2025 Guide)

Most enterprises track competitors on social, but few know how to turn that data into action. That’s the real problem. Leaders want clarity on where budgets are wasted, which messages resonate, and where rivals are edging ahead. The global social media analytics market is expected to surge from $13.8B in 2024 to $17.4B in 2025, growing at nearly 26% year-over-year — a clear signal that analysis done wrong is opportunity lost.

This guide helps you flip discovery into action. You’ll learn how to spot gaps competitors are ignoring, optimize spend across content, care and paid, and move with enterprise confidence.

What is social media competitor analysis?

Social media competitor analysis is the process of evaluating how other brands position themselves on social platforms (covering messaging, engagement, customer care, paid tactics, creative trends) and using those insights to refine your own strategy. It has evolved from surface-level monitoring into a core capability for leaders who need decisions backed by data.

Here are 4 key reasons to track social media competitors:

- Competitor activity on social directly influences purchase decisions, often in real time.

- Knowing where rivals invest ad dollars helps leaders allocate budgets more efficiently.

- Monitoring competitor sentiment and engagement protects your own brand from blind spots.

- Competitive benchmarking uncovers market white space that fuels innovation and faster pivots.

Manual tracking can’t keep up with this pace. Platforms like Sprinklr Insights apply AI to benchmark performance across channels, surface competitor trends early, and give leaders the clarity to act before the market shifts.

What to analyze in your competitors' social media strategy?

A meaningful competitor analysis doesn’t stop at surface impressions. The goal is to understand how their choices translate into outcomes — which formats drive engagement, which platforms deliver ROI, and where gaps in their strategy reveal opportunities for your brand.

For example, if there is a consistent performance spike from Reels but lower reach from static posts, that's a clue about platform-specific content preferences you can leverage. If their comment sections reveal frequent customer questions or complaints, you’ve just uncovered a gap in their service narrative. This is an opportunity for your brand to differentiate.

Focus your analysis on these four pillars to build a complete picture:

- Content themes and formats: Are competitors leaning into product education, thought leadership, or trend-led storytelling? And how are they packaging it — short-form video, carousels, live sessions, or long-form posts? Patterns here reveal what the market values.

- Engagement quality: Don’t just chase likes. Benchmark engagement rates, comment depth, share velocity, and even saves. These signals show what truly builds affinity, not just awareness.

- Posting frequency: Assess frequency and timing patterns. Daily cadence or campaign bursts? Inconsistent posting may suggest low resourcing, while consistency signals operational discipline.

- Platform focus: Where are they investing attention — LinkedIn for decision-makers, TikTok for awareness, or YouTube Shorts for reach? Their allocation hints at audience priorities and strategic bets.

This level of benchmarking equips leaders to see where competitors are winning attention, where they’re wasting spend, and where your brand can step in with stronger execution.

More to Read: 7 Competitive Insights to Give You an Unfair Advantage

How to conduct a social media competitor analysis (the right way)

A strategic competitor analysis on social media moves beyond superficial metrics to decode a competitor's social media goals, map their social content to funnel stages, and identify social-specific vulnerabilities to exploit. This disciplined approach transforms social intelligence into a sustainable market advantage.

Follow this step-by-step framework to execute a comprehensive social media competitor audit:

Step 1: Identify competitors beyond your category

Begin your social media competitor audit by broadening the competitive lens. On social, you’re not just competing against rival brands selling similar products; you’re battling anyone who commands your audience’s feed and attention. That includes content creators educating the market, publishers and media setting the narrative, startups reframing value, and influencers driving purchase intent. The goal is to map attention competition, not just product competition.

Types of competitors to identify:

- Direct competitors: Brands offering similar products or services, active on the same social platforms.

- Content competitors: Publishers, brands, or creators producing high-engagement content on topics your audience follows.

- Influencers and thought leaders: Individuals shaping brand perception and driving conversations.

- Disruptors and emerging brands: Players using bold content strategies or new formats to rapidly grow share of voice.

For each identified competitor, look at:

- Where they sit in the funnel (awareness, consideration, conversion)

- The formats they favor

- Engagement velocity (how quickly posts gain traction)

- Comment sentiment (positive vs. negative audience tone)

- Paid vs. organic mix (where they rely on ad spend to stay visible)

That mapping gives content, paid, and care teams clear signals on where to defend, double down, or differentiate.

To surface less obvious social competitors, use listening tools such as Sprinklr Social Listening. These platforms track share of voice, conversation drivers, and rising hashtags across 30+ channels, helping you spot new players gaining mindshare before they’re on your radar.

Step 2: Decode content strategy through a funnel lens

Once you’ve identified the players, the next move is understanding how their social content supports the customer journey. A competitor's content mix reveals their strategic priorities and investment levels. This isn’t just about “what” they post; it’s about why they post it, and where it fits in moving buyers from awareness to conversion.

Here’s a sharper way to audit:

- Awareness-stage content: High-reach plays like thought leadership on LinkedIn, meme-led engagement, or social cause storytelling. Great for visibility, but usually light on direct business outcomes.

- Consideration-stage content: Product walk-throughs, influencer explainers, comparison threads, or tutorials. These posts nurture intent and show how a solution stacks up.

- Conversion-stage content: Social proof such as testimonials, reviews, limited-time offers, or event-driven CTAs. These usually run in paid formats for targeted impact.

Now, assess the balance: are they flooding awareness channels but neglecting conversion? Do they have sophisticated mid-funnel education, or are they leaning on discount-heavy pushes? This lens helps you spot strategic blind spots — areas where your teams can outspend, out-create, or out-educate.

Pro Tip: Benchmark competitors not just by engagement but by funnel discipline, and benchmarking platforms like Sprinklr’s Competitive Insights and Benchmarking help you do just that.

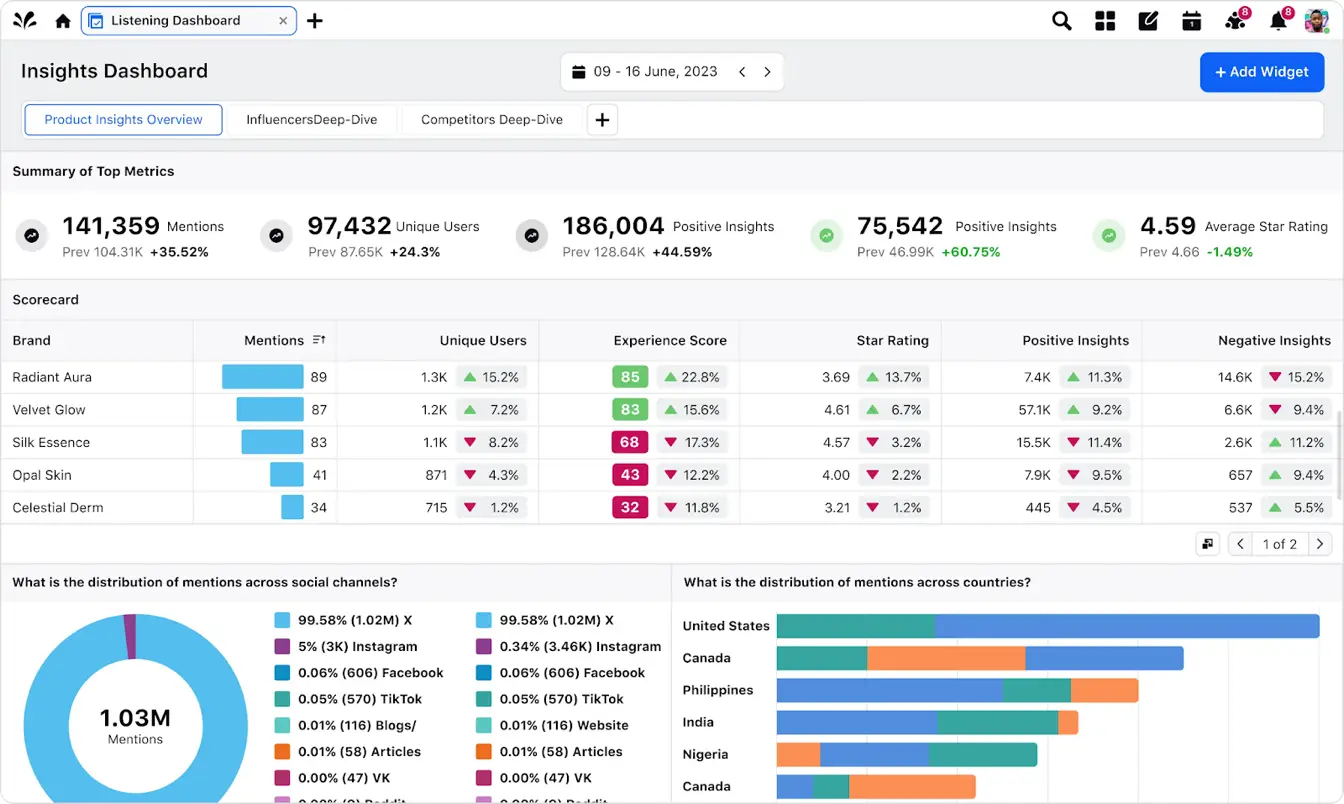

It gives you the hard numbers and context that raw engagement stats can’t. You can benchmark competitors across 8 social channels, see their top-performing posts, track executive mentions, and even break down content themes, tone, and sentiment. With that view, it’s easier to connect the dots on whether a rival’s strategy is built for reach, engagement, or conversion, and where your brand can outmaneuver them.

Step 3: Benchmark performance with business-outcome metrics

Now that you’ve mapped who you're competing with and how they structure content, you need to quantify it. Benchmarking is not about tallying likes or follower counts anymore; it involves understanding momentum, efficiency, and whether their efforts tie back to meaningful outcomes.

Start with the core metrics:

- Engagement rate: Total interactions relative to audience size — a better measure of content resonance and audience loyalty than raw likes.

- Share of voice on social media: The proportion of conversation a brand owns within a key category or topic — helping to quantify your competitors' market presence and narrative control within your industry's online conversation.

- Follower growth: A directional indicator of brand health, but only meaningful when viewed in context with engagement trends to assess true appeal.

Then layer in the advanced signals that separate surface-level tracking from real intelligence:

- Sentiment trends: Spot whether their social media messaging is winning trust or inviting backlash. Helps detect shifts in audience perception to anticipate risks or capitalize on positive momentum.

- Format performance: Break down which formats (Reels, Stories, carousels, Threads) pull the most weight. Helps to inform creative resource allocation.

- Paid vs. organic mix: See if visibility is being earned through content strength or bought through ad spend. Helps to highlight potential vulnerabilities in their model.

- Amplification velocity: Track how fast their content spreads in the first 24–48 hours — a leading indicator of relevance and impact.

The critical next step is to map these signals to concrete business outcomes (brand equity, lead generation, customer care responsiveness), so your analysis informs cross-functional priorities. Engagement rate maps to brand visibility.

A high share of voice indicates market leadership. Positive sentiment trends reduce customer acquisition costs. Understanding format performance optimizes million-dollar content budgets.

Amplification velocity can flag whether you’re looking at cultural momentum or a paid spike. That’s what makes this intelligence a unified source of truth for executive strategy, marketing execution, and product development, ensuring your organization's resources are deployed to maximize competitive advantage.

Step 4: Spot content gaps and innovation whitespace

The ultimate goal of analysis is not imitation, but differentiation. This step moves from benchmarking to strategy — finding out what others are missing out on, and owning it. Look for the places competitors under-commit, where audience needs are unmet, or where formats and channels are underused. Those are the whitespace opportunities your brand can pilot and scale.

Where to look:

- Format gaps: Are competitors avoiding long-form video, episodic Reels, or live Q&A? That’s your creative edge.

- Platform blind spots: If they focus on Instagram but barely touch YouTube Shorts or regional platforms, you can capture attention there.

- Narrative gaps: Topics or customer stories competitors ignore (product how-tos, enterprise use cases, compliance content) are fast tracks to authority.

- Community & care voids: Poor response rates or ignored complaints are openings for better support and reputation wins.

- Influencer alignment gaps: Missed micro-influencer segments or mismatched talent that doesn’t resonate with your buyers.

What to do next:

- Pick one high-value gap

- Design a small pilot with a clear hypothesis and social media KPIs (engagement lift, SOV, conversion lift, response-time improvement)

- Run, measure, iterate, then scale the winners

For example, if no competitor is using long-form how-to reels → run a 4-week educational Reels series and measure view-through, saves, and conversion to gated content. If it outperforms, scale.

This process transforms competitive intelligence into a blueprint for market leadership, allowing you to allocate resources toward innovative, high-impact initiatives rather than me-too tactics.

Step 5: Build a shareable insights dashboard for internal teams

Competitor intelligence only drives impact when it’s accessible and actionable across teams. Instead of siloing insights, create a system that integrates it directly into the workflows of every team that can act on it, from content and care to product and the C-suite.

How to set it up:

- Feed the engine: Pull real-time competitor data across key platforms using Sprinklr Social.

- Configure dashboards: Show the handful of signals teams need at-a-glance:

- Performance trends (engagement rate, share of voice, follower growth)

- Paid vs. organic visibility and media mix

- Sentiment overlays and customer conversation clusters

- Emerging triggers (influencer mentions, hashtag spikes, viral posts)

- Automate alerts & exports: Get notified on spikes/dips, schedule regular exports, and push reports to Slack/Teams or email so nothing gets lost.

Make it usable across teams:

- Creative & content: Get weekly dashboards showing top-performing posts, formats, and themes.

- Paid media: See how competitors balance organic vs. ad-driven reach, plus early conversion signals.

- Customer care: Track sentiment trends and recurring complaints competitors ignore.

- Leadership: Receive a one-page monthly snapshot with:

- Top three competitor moves and why they matter

- Share of voice and engagement trend shifts vs. last period

- One emerging threat and one whitespace opportunity

- Recommended next steps with clear owners

The result: a shared dashboard that reduces lag, eliminates siloed analysis, and turns competitor signals into coordinated action across content, paid, care, and leadership.

Dive Deep: How to Create a Competitive Intelligence Report

Step 6: Iterate using feedback loops and real-time audience signals

A single analysis provides a snapshot; sustained advantage requires a movie. The final step is to institutionalize a process of continuous learning, transforming your strategy into a living system that evolves based on real-time audience signals and campaign performance. This involves closing the loop between analysis, action, and measurement.

Start by tracking how your audience reacts to competitor-driven moves: new formats, trending hashtags, influencer tie-ins. For global brands, this means deploying AI-powered listening to track the impact of your strategic moves and the market's response across regions. With a platform like Sprinklr Social you can spot:

- Engagement lifts or drop-offs after testing competitor-inspired content

- Shifts in sentiment around shared topics or themes

- Early signs of content fatigue when formats get overused

Then, institutionalize a monthly insights loop that sharpens your playbook:

- What worked, and what didn’t in your own experiments

- Movement in competitor engagement and sentiment post-campaign

- Real-time audience response to major content shifts

- Recommended next actions for creative, paid, and care teams

Done right, this turns competitor analysis into an operating rhythm — feeding strategy, creative, and spend with a cycle of learning and refinement. The outcome: you stay agile, relevant, and ahead of audience expectations instead of reacting too late.

Story Corner: What do fries have to do with competitor analysis?

For McDonald’s, more than you’d think. The brand isn’t just watching its own mentions on social — it’s tracking the entire fast-food conversation: who’s winning the breakfast wars, what promotions are resonating, where sentiment is shifting. By keeping a close eye on competitors, McDonald’s turns insights into menu moves and marketing plays that land at scale.

Let’s just say: monitoring competitors using Sprinklr Insights didn’t just keep them in the game; it helped them change it.

4 tips to supercharge your social media competitor analysis

Once you’ve developed a solid understanding of your competitors, the next step is to extract strategic value. These four tips to supercharge your social media competitor analysis will help you move from insight to impact:

1. Activate full-funnel competitive insights

Competitor posts are just entry points. The real value comes from seeing how they move audiences across the funnel.

What to analyze:

- Funnel stage intent (Awareness, Consideration, Conversion)

- Sequencing of content and remarketing paths

- CTAs driving trials, demos or lead forms

How to apply it: Spot where competitors lose momentum — like strong awareness content with no follow-through. Then build sequencing strategies that close those gaps, tying content to paid and influencer efforts.

For example, if an explainer post drives engagement but lacks a CTA, retarget with customer proof to push trials.

Think competitor posts are the whole story? Not even close.

The real edge comes from spotting the patterns they don’t spell out — which channels actually drive conversions, where their funnel stalls, and who’s suddenly gaining share of voice. That’s where Sprinklr’s Industry Insights & Competitive Intelligence comes in. It cuts through the noise, pulls signals from 30+ digital channels, and hands you the kind of intel that usually takes teams weeks to piece together.

2. Reverse-engineer high-performing formats into creative innovation

When a format gains traction in your category, don’t copy it. Reverse-engineer why it works, then layer in your brand’s voice and positioning.

What to analyze:

- Format mechanics (visual hooks, pacing, narrative arcs)

- Platform-specific performance (Reels vs. Stories vs. Carousels vs. Shorts)

- Engagement breakdown (saves/shares vs. passive likes)

How to apply it: Don’t just “do what works.” Dissect why a format is resonating — is it humor, storytelling, or visual novelty? Then adapt those mechanics to your own brand voice and category context. This keeps you culturally relevant without blending into the noise.

For example, Duolingo famously built on TikTok trends (such as creator reactions and skits) but layered its brand mascot and tone on top. Instead of copying, it created a viral persona. This resulted in millions of followers and a younger audience segment that others struggled to reach.

3. Use sentiment trends to avoid costly mistakes

Even high engagement can mask low trust. Do social media sentiment analysis to uncover how people feel about your competitors' content, campaigns or product positioning and what that emotion tells you about market gaps or vulnerabilities.

What to analyze:

- Comment tone during launches, crisis responses, or trending conversations

- Recurring complaint themes across platforms

- Positive spikes tied to content types, phrases, or influencer collabs

How to apply it: Turn competitor missteps into lessons. If audiences are fatigued by hard-sell CTAs, refine your tone. If backlash starts brewing, act before it peaks. Quick, sentiment-driven adjustments can save campaigns and strengthen trust over time.

For example, if users repeatedly complain about confusing product tutorials, create simplified how-to content with clearer visuals and a more approachable tone.

4. Look beyond vanity metrics

Follower counts and likes don’t tell the whole story. Treat competitor analysis as a shared intelligence system, not a silo.

What to analyze:

- Overused content patterns (promo-heavy posts, copycat influencer choices)

- Platform blind spots or missed engagement plays

- Early signals of new trends, hashtags, or influencer categories

How to apply it: Integrate competitor insights into campaign briefs, creative planning and care strategies. Use Sprinklr’s competitive insights to trigger real-time alerts for sentiment shifts or competitor moves and build a monthly dashboard or playbook with examples, risks and next-step recommendations for every team. Shared insights enable faster, more aligned decision-making, and reduce the dangers of campaign duplication or tone-deaf content.

Here’s an example of how a competitive insights report could look like. ⬇️

For example, if competitor promos fatigue audiences, shift your approach towards storytelling-led content that builds engagement over time.

Bringing it all together

A high-impact social media competitor analysis is an ongoing intelligence system that guides better decisions across marketing, customer care, content and paid media. The most successful brands observe what their competitors do, analyze why it works, identify where it fails and develop strategies that outperform their competitors intentionally. They implement this knowledge across teams, platforms and workflows. The result is an improved social performance and a competitive edge built on continuous learning.

Sprinklr Social helps you scale this discipline with confidence. From AI-powered listening and real-time alerts to cross-channel governance and activation workflows, it gives teams a holistic view of the competitive landscape, and the tools to act on it. Empower your teams with enterprise-scale social competitor analysis using Sprinklr Social.

Frequently Asked Questions

Social media competitor analysis in 2025 is a continuous intelligence system that decodes how rivals shape perception, engagement, and conversion across channels. It blends sentiment analysis, share of voice, content trends, and customer care performance; giving leaders a live view of the competitive landscape.

Focus on what reveals competitive momentum: engagement rate, sentiment trends, share of voice, amplification velocity, and the paid vs. organic mix. Together, these metrics highlight not just reach, but how effectively competitors are moving audiences from awareness to action.

Maintain a monthly pulse check for key metrics, conduct quarterly deep-dives on emerging trends and risks, and keep real-time monitoring always on, especially for high-priority markets and campaigns. This balance prevents surprises and keeps planning cycles sharp.

Platforms like Sprinklr Social deliver AI-powered alerts on competitor activity, sentiment shifts, engagement spikes, and campaign launches. Built for enterprise scale, they cut down manual tracking, flag risks instantly, and support governance across multiple markets and teams.

Sprinklr enables teams to create dashboards that reveal competitor patterns, connect insights to workflows and direct alerts to relevant teams. This transforms static benchmarking into live intelligence, supporting content planning, reputation management and campaign optimization.