Transform CX with AI at the core of every interaction

Unify fragmented interactions across 30+ voice, social and digital channels with an AI-native customer experience platform. Deliver consistent, extraordinary brand experiences at scale.

Customer Churn Analysis: Catching Churn Before It Counts

Customer loyalty has never been more fragile or more expensive to earn back.

Today’s customers operate in a hyper-competitive, digital-first environment where switching costs are low, and expectations are reset with every great experience they encounter elsewhere. A single unresolved issue, a clumsy handoff, or a repetitive service interaction can quietly trigger disengagement, often long before customers formally churn.

For enterprises, this creates a paradox. Organizations have more customer data than ever across service channels, CRM systems, product telemetry, billing platforms, and Voice of the Customer (VoC) programs — yet churn feels harder to predict, explain, and prevent.

Subscription-based businesses feel this pressure most acutely. When revenue depends on recurring renewals, churn stops being a metric and becomes an existential risk. Every lost customer compounds future revenue loss and inflates acquisition costs.

This is where customer churn analysis becomes a strategic capability, not just an analytical exercise.

Recent industry research shows the average churn rate across businesses hovering around 6.5%, more than double the commonly cited benchmark of 3% or lower. At that level, churn compounds rapidly forcing organizations to replace a significant portion of their customer base each year just to stay flat. The operational and financial strain this creates extends far beyond customer-facing teams.

Done well, customer churn analysis goes beyond historical reporting. It surfaces early warning signals across behavior, service experience, and operational friction, helping teams separate noise from true risk, prioritize intervention, and act before value erodes.

In this blog, we’ll cover:

- A modern definition of customer churn analysis and how it differs from churn reporting

- A step-by-step churn analysis process, from signal identification to intervention

- How to build a scalable customer churn analytics stack using service data, behavioral insights, and AI-driven intelligence

What is customer churn analysis?

Customer churn analysis is the discipline of uncovering why customers disengage and how early warning signals emerge long before churn becomes visible in revenue reports. It connects behavioral, experiential, and operational signals to identify risk patterns, enabling service and customer success teams to intervene while the relationship is still recoverable.

Unlike basic churn reporting, customer churn analysis focuses less on what happened and more on what is forming. It examines how shifts in customer behavior, service interactions, sentiment, and effort compound over time, signaling a decline in value perception.

In mature organizations, churn analysis is not owned solely by data science. It is an operational capability used by customer service, contact centers, and customer success leaders to prioritize outreach, redesign experiences, and align cross-functional teams around retention outcomes.

In practice, churn manifests differently depending on the business model and customer relationship structure:

- Logo-level churn: An entire account or organization exits the relationship, often driven by cumulative experience failures rather than a single event.

- User-level churn: Individual users within an account disengage, reducing adoption and quietly increasing renewal risk.

- Voluntary churn: Customers actively choose to leave due to poor experiences, unmet expectations, or better alternatives.

- Involuntary churn: Customers are lost due to failed payments, expired cards, or technical breakdowns often preventable with better systems.

- Subscription vs. transactional churn: In recurring revenue models, churn appears as cancellations or non-renewals; in transactional businesses, it shows up as declining frequency, reduced spend, or silent inactivity.

📌 Across all models, the most important insight remains consistent: churn is rarely sudden. It is the outcome of unresolved friction, missed signals, and delayed response. Customer churn analysis exists to surface those signals early before attrition becomes irreversible.

Also read: What is customer listening [+ actionable insights]

Why early churn detection is a customer service advantage

Early churn detection gives service teams the time they need to act while there’s still trust to rebuild and relationships to repair. Plus, churns rarely happen overnight. It builds gradually, along subtle signals, that when put together, tell a story:

- Product behavior: Customers use fewer features, their DAU/WAU ratio dips, or they take longer to realize value.

- Support patterns: Ticket loops and lengthy resolution times suggest unresolved frustration.

- Commercial friction: Delayed renewals or invoice disputes reveal financial hesitation.

- Experience sentiment: Declining CSAT scores or passive survey comments indicate a decline in engagement.

- Social feedback: Complaints surface in public channels long before they reach a help desk.

And then there are the silent churners, the customers who don’t complain at all. They stop logging in, stop responding, or start spending time in help centers searching for answers on their own.

These quiet signals are easy to miss but crucial to catch. For example, a sharp drop in login frequency or a sudden surge in documentation views often indicates that a customer is trying to resolve a problem before deciding to leave.

For service teams, detecting these patterns early shifts the entire equation. Instead of reacting to cancellations, they can predict and prevent them. Thus, early churn detection turns customer service from a reactive support function into a strategic driver of customer retention and revenue stability.

"We’re kicking off with customer churn analysis. What signals should we look at first, so we don’t drown in data?”

Focus first on these four signal categories:

- Engagement trajectory

Look for sustained declines in usage depth, feature diversity, or workflow completion, not just fewer logins. Momentum matters more than raw activity. - Unresolved service friction

Track repeat issues, reopened tickets, long resolution cycles, and escalation frequency. Persistent friction is one of the earliest and most actionable churn indicators. - Customer effort and sentiment trends

Monitor changes in effort, tone, and language across tickets, chats, and calls. Sentiment drift often appears weeks before customers disengage behaviorally. - Lifecycle and commercial timing

Overlay engagement and service signals with renewal proximity, onboarding milestones, or billing friction. Timing converts weak signals into urgent ones.

The rule of thumb: If a signal doesn’t clearly answer who needs to act and why, it’s noise. Start narrow, validate impact, then expand.

The customer churn analysis process

Accurate churn prediction doesn’t start with models; it starts with discipline. Specifically, a structured process that converts fragmented customer interactions into actionable retention signals. Without that structure, even the most advanced analytics can produce insights that arrive too late or fail to translate into action.

The five-step customer churn analysis process explained below reflects how churn analysis works in practice across enterprise environments.

Step #1: Data sources: Connecting signals across the customer journey

Churn detection begins with integration. Not just collecting data, but assembling a coherent view of customer behavior over time across systems that were never designed to talk to each other.

Effective churn analysis typically draws from several signal categories:

- Behavioral data, such as login frequency, DAU/WAU ratios, and feature adoption trends, that surface engagement decay.

- Transactional signals, including billing disputes, downgrades, or failed payments, that introduce friction and erode trust.

- Product usage data — module adoption, active users, API calls — that indicates how embedded the product is in the customer’s workflow.

- Experience signals such as CSAT, CES, and NPS that capture perception, not just behavior.

- Support interactions like ticket volume, repeat issues, resolution time, and escalation patterns that reveal unresolved pain

What matters at scale is not the presence of these signals, but their unification and timeliness. A drop in usage alone may be inconclusive. The same drop, combined with rising support friction and sentiment decline, is rarely accidental.

In enterprise environments, these signals are typically aggregated through ETL pipelines into data lakes or Unified-CXM platforms, with strict controls around data freshness, identity resolution, and ownership.

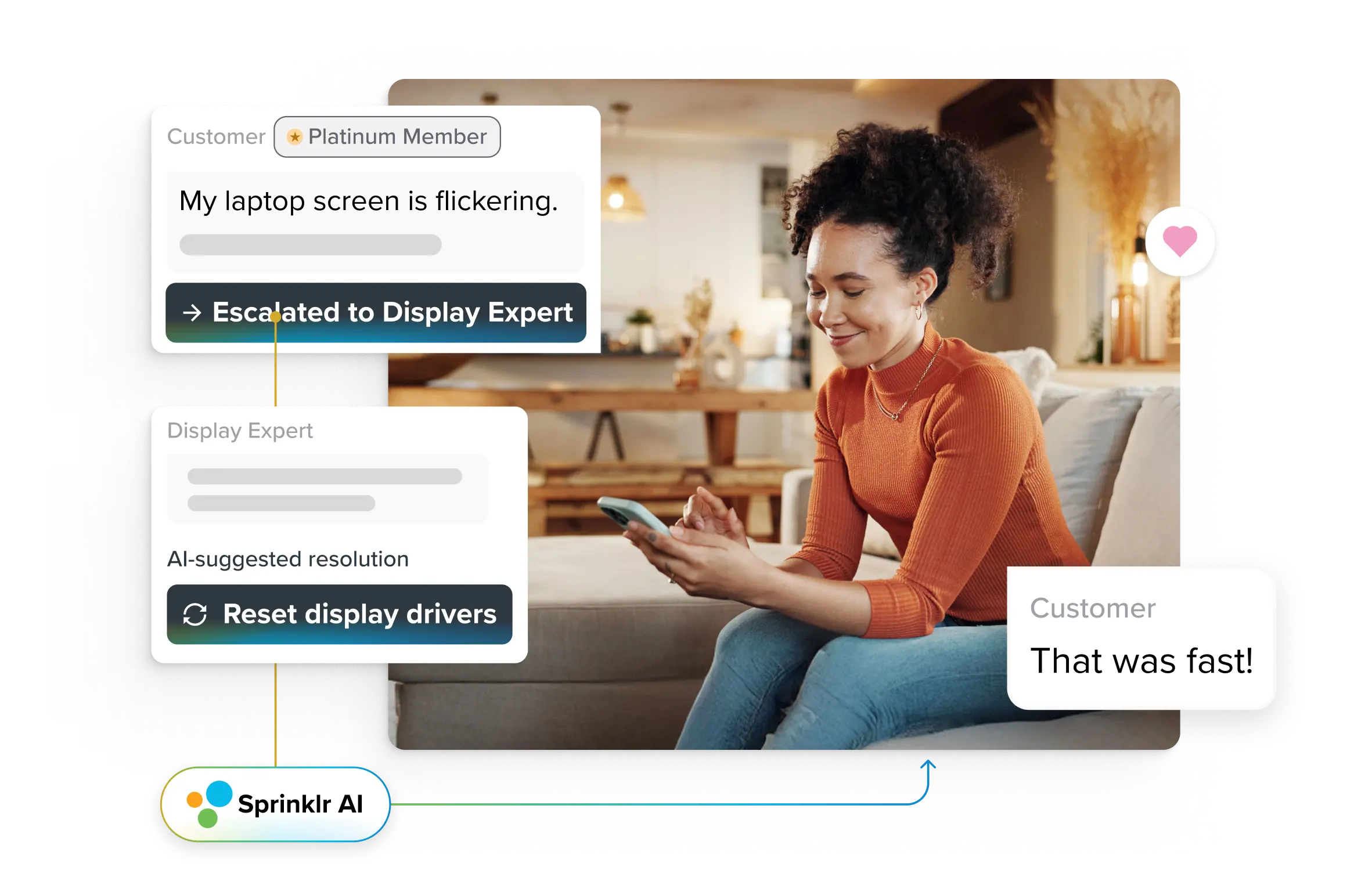

Platforms like Sprinklr Unified-CXM bring teams, tools, data, and channels together into a single intelligence layer. With AI models trained on 100M+ CX data points, Sprinklr AI is purpose-built to detect complex churn indicators such as sentiment shifts and escalation patterns that require a deep understanding of customer intent, emotion, and context across channels.

Step #2: Labeling: Defining what churn actually means

Before churn can be predicted, it must be defined precisely. This step helps you establish the rules that separate noise from true attrition risk. In a subscription business, churn typically refers to cancellations or non-renewals. In usage-based or platform models, it may be defined as sustained inactivity over a defined period. Teams also set observation windows (historical data used to identify patterns) and prediction windows (future periods where churn risk is assessed). For enterprises, churn definitions are rarely uniform. Annual contracts, free trials, expansions, and multi-product accounts often require distinct definitions governed through formal frameworks. SMBs tend to adopt simpler rules such as “did not renew” and refine them as patterns become clearer. The key is consistency. Poorly defined churn labels lead to models that explain historical data well but fail in practice.

Step #3: Feature engineering: Turning activity into early warning signals

Feature engineering is where churn analysis shifts from reporting to foresight. The goal is to translate raw activity into leading indicators of disengagement, not just descriptive metrics. Common predictors include:

- Gradual declines in usage or customer engagement velocity

- Increases in unresolved or repeated support issues

- Delays in onboarding completion or milestone achievement

- Deterioration in sentiment or effort scores over time

Individually, these signals are often weak. Combined, they become powerful. Enterprises typically generate hundreds of such features automatically, allowing models to learn subtle patterns across customer segments and industries.

Step #4: Modeling: Identifying churn risk, not certainties

With features in place, predictive models estimate churn risk across the customer base. It’s essential to understand that models don’t decide who churns; they assign probabilities. The real work lies in thresholding and prioritization. A slight dip in activity may warrant monitoring. A combination of declining usage, negative ticket sentiment, and the proximity of renewals demands immediate attention. Enterprises often run multiple models by segment, contract type, or product line, refreshing scores frequently and surfacing them through operational dashboards. Similarly, SMBs typically retrain models monthly and focus on a smaller pool of high-risk accounts. In practice, speed often matters more than sophistication. A timely, directional signal acted on early outperforms a perfect prediction that arrives too late.

Step #5: Playbooks: Turning insight into intervention

Churn analysis only delivers value when insights are operationalized. Retention playbooks define who acts, when, and how across service, customer success, and contact center teams. A typical flow might look like this:

- Trigger: Elevated churn risk combined with declining engagement

- Action: Customer success outreach → targeted conversation → resolution of blockers → confirmation of re-engagement

- SLA: High-value enterprise accounts addressed within hours; SMB accounts within defined business windows

Batch workflows run daily or weekly, ideal for tracking gradual shifts in usage or satisfaction. Streaming workflows operate in near real-time, flagging sudden events such as negative sentiment spikes or abrupt usage drops the moment they occur.

It’s not uncommon for enterprises to combine both approaches: batch scoring for continuous monitoring and streaming alerts for urgent intervention. In contrast, SMBs tend to rely on batch analysis augmented by lightweight automation.

With the customer churn analysis process framework in place, the next question is: How do you build a system that can run this analysis efficiently, at enterprise scale? That’s where the churn analytics stack comes in.

How to build the customer churn analytics stack

Building a customer churn analytics stack is not about buying “a churn analytics tool.” Enterprises already have more tools than they can operationalize. The real challenge is assembling a stack that connects signals across systems, interprets them in context, and drives timely action without collapsing under its own complexity. The most effective churn analytics stacks are designed backward from intervention, not forward from data availability. They answer one core question: What do our teams need to know, when do they need to know it, and what should happen next?

Start with signal coverage, not tool sprawl

Churn signals don’t live in one system, and note that they never will. A functional churn analytics stack pulls from four foundational layers:

- Customer activity and product telemetry: Usage depth, feature adoption, session patterns, API calls, and workflow dependency. This data explains embeddedness — how hard it would be for a customer to leave.

- Service and support systems: Ticket frequency, reopens, escalation paths, sentiment trends, and resolution friction. This is where customer dissatisfaction first shows up, often before usage drops.

- Commercial and lifecycle data: Renewals, downgrades, billing disputes, payment failures, contract terms, and proximity to renewal. These signals provide timing and urgency.

- Experience and feedback systems: CSAT, CES, NPS, verbatim feedback, call transcripts, chat logs. These don’t predict churn alone, but they explain why it’s forming.

📌 The mistake many enterprises make is over-weighting one layer (usually product usage) while underestimating service friction or sentiment decay. Churn rarely announces itself through a single signal. It emerges through correlated movement across layers.

Unify at the identity level (or nothing works)

Before analytics comes identity resolution. If your stack cannot reliably answer “Is this the same customer across product, service, billing, and success?”, churn analysis will always be approximate.

At enterprise scale, this means:

- Account-level and user-level IDs are mapped cleanly across systems

- Clear parent–child hierarchies for multi-entity customers

- Time-aligned data so events are analyzed in sequence, not in isolation

This is where many churn initiatives stall, not because models fail, but because teams argue over whose data is “right.” Mature stacks solve identity once, centrally, and enforce it everywhere downstream.

Separate storage, intelligence, and orchestration layers

High-performing churn analytics stacks follow a clear separation of concerns:

- Data foundation

Data lakes or unified CX platforms ingest structured and unstructured data with defined freshness SLAs. This layer prioritizes reliability over sophistication.

- Intelligence layer

This is where churn signals are engineered, risk scores are generated, and patterns are learned. AI and machine learning matter here, but only after signal quality is established.

- Orchestration and activation layer

The most overlooked layer. This is where churn risk becomes action routing alerts to the right teams, triggering playbooks, enforcing SLAs, and closing the loop.

Many organizations invest heavily in the first two layers and underinvest in the third. The result is accurate churn scores that never change outcomes. Remember that AI creates the most value when it operates across intelligence and orchestration layers, not in isolation.

Sprinklr AI analyzes conversations across voice, digital, social, and visual channels in real-time to identify emerging themes, sentiment shifts, and the root causes of friction. More importantly, these insights are directly connected to next-best actions, enabling service and customer success teams to respond immediately, not after churn risk has already escalated.

Design for speed

In churn analytics, latency kills value. A perfectly accurate churn model that refreshes monthly is less useful than a directional signal that updates daily or in real-time. The stack must support:

- Near real-time ingestion for service and usage events

- Daily or rolling churn risk recalculation

- Event-based triggers for sudden risk spikes

This is especially critical for contact centers and customer success teams, where intervention windows are measured in hours rather than quarters.

Make churn explainable, not just predictive

Executives don’t act on scores alone. Neither do frontline teams. Your stack must surface why a customer is at risk:

- Top contributing signals

- Recent negative events

- Trend direction, not just current state

Explainability builds trust. Trust drives adoption. Adoption is what reduces churn. Take a look at how Sprinklr AI auto-triggers notifications during a crisis.

Close the loop with outcome tracking

The final and most neglected component of the churn analytics stack is feedback learning.

Every intervention should feed back into the system:

- Was the customer contacted?

- Did behavior change?

- Was churn prevented, delayed, or inevitable?

Without this loop, churn analytics becomes static. With it, the system continuously improves —refining signals, recalibrating thresholds, and identifying which actions actually work.

- Declining engagement quality, not volume

Customers may still log in, but rely on fewer features or abandon high-value workflows, signaling weakening dependence. - Sentiment drifts in everyday conversations.

Subtle changes in tone, such as shorter responses, reduced enthusiasm, and growing formality, appear in tickets and calls well before renewals are at risk. - Stalled onboarding and value realization

Customers who plateau after initial adoption rarely churn immediately, but they become highly vulnerable at renewal. - Loss of internal champions

Reduced engagement from key stakeholders or executive sponsors is one of the strongest B2B churn predictors and one of the least tracked. - Commercial friction is treated as operational noise

Failed payments, downgrade discussions, or procurement delays often reflect declining commitment, not just billing issues.

Why these signals are missed: they live across disconnected systems and are analyzed in isolation. Mature churn analytics stacks focus on how these signals move together surfacing risk early enough to intervene.

What mature stacks get right

At scale, the most effective churn analytics stacks share a few defining traits. They are cross-functional by design, prioritize intervention speed over model elegance, and treat churn as a systemic outcome and not a failure of any single team or channel.

What enables this level of maturity is not more tools, but unification.

Most enterprises already collect meaningful churn signals across product analytics, contact center platforms, CRM systems, and Voice of the Customer programs. The problem is not data scarcity — it’s fragmentation. Signals are owned by different teams, analyzed in isolation, and surfaced only after risk has already materialized. By the time churn appears in reports, the opportunity to intervene has often passed.

This is where unified customer service software fundamentally changes what’s possible.

Sprinklr Service, built on the Unified-CXM platform, brings customer interactions across digital, social, messaging, voice, and service channels into a single, governed intelligence layer. Instead of stitching together partial views, service and customer success teams operate from a shared customer context — one that captures behavior, sentiment, and friction as they unfold.

Unification allows churn signals to move seamlessly from detection to action. Real-time sentiment and escalation models surface early signs of frustration. Smart alerts automatically prioritize high-risk accounts. Predictive insights help leaders understand where churn is forming, not just where it has already occurred. Most importantly, insights are embedded directly into service workflows, closing the loop between analytics and intervention.

For CX leaders, the value is predictability. When every interaction, conversation, and signal feeds into a single intelligence system, churn stops being a lagging metric and becomes a managed outcome, where every service moment becomes an opportunity to recover value and retain customers. To see how this operates in practice, explore a Sprinklr Service demo.

Frequently Asked Questions

Churn rate analysis measures what happened: the percentage of customers lost during a specific period. Churn analysis, on the other hand, explains why it happened and who might leave next.

Churn risk isn’t static, so reviews should align with the rhythm of your customer interactions. Weekly reviews enable operational teams to respond to short-term shifts in sentiment or engagement, while monthly and quarterly reviews reveal longer-term trends in retention and engagement.

AI helps surface patterns, such as sudden drops in engagement, tone shifts in support chats or correlations between service delays and cancellations. Machine learning models can also predict when churn is likely to occur, enabling teams to prioritize interventions at the right time.

Beyond churn rate, track time-to-value, repeat engagement, support intensity and sentiment trends. These metrics reveal customer health earlier in the lifecycle, and monitoring them together provides a leading indicator of retention.

Strong governance ensures data consistency, accuracy, and ethical handling of customer information. Leaders should standardize definitions of churn, maintain audit-ready tracking of model inputs, and regularly review bias or data drift.