Elevate CX with unified, enterprise-grade listening

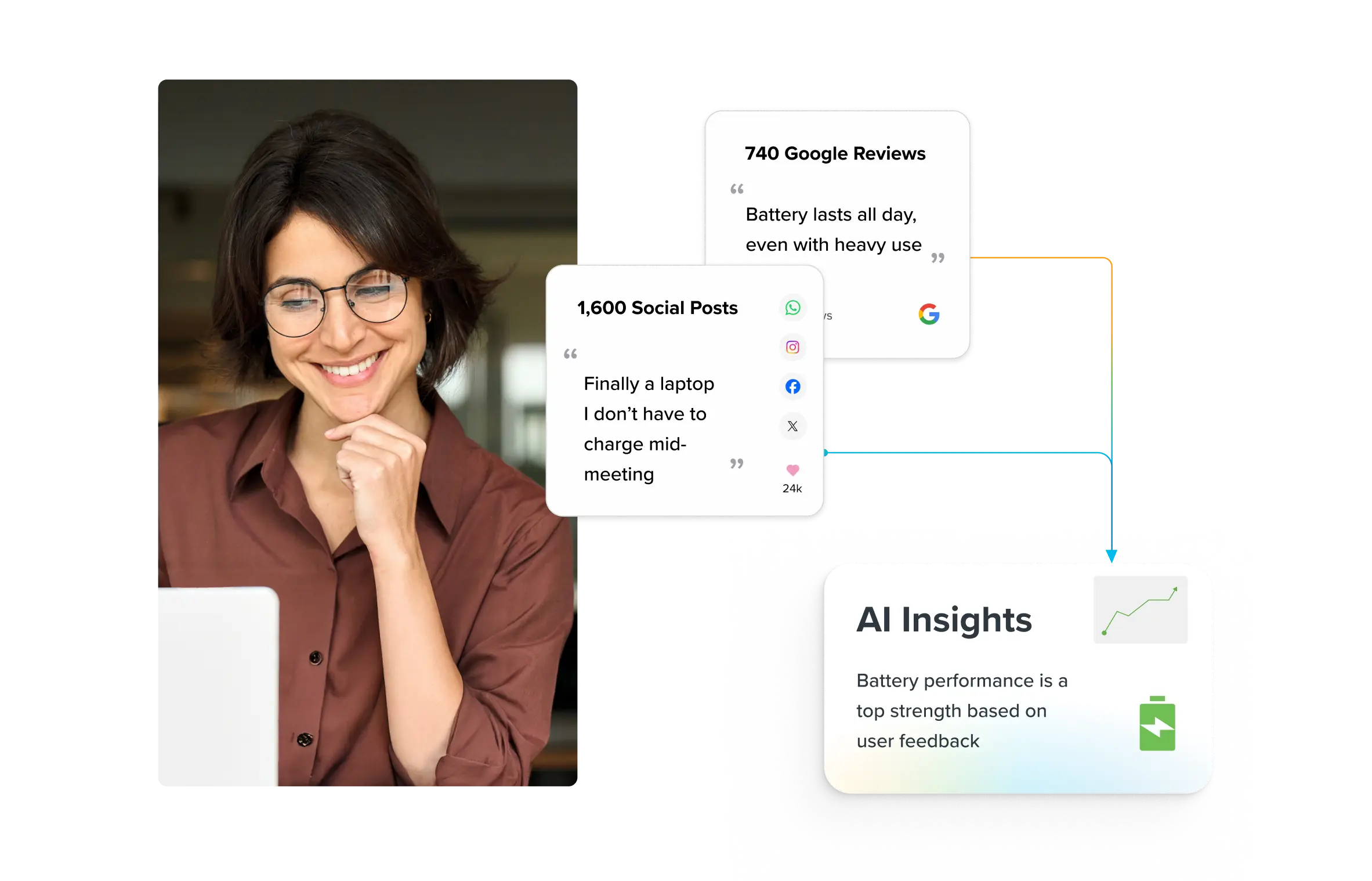

Sprinklr Insights gives you real-time consumer, competitor and market intelligence from 30+ channels without the noise. Make smarter decisions, strengthen your brand, and stay relentlessly customer-led.

Voice of the Customer Survey: Key Questions for 2025

The right questions in the voice of the customer survey capture the truth behind numbers, reviews...and silence. And when done right, it’s often the only way to see what your dashboards can’t. But most surveys miss the mark. They ask too broadly, assume too much or sound like they’re written by a machine. That’s why the right voice of the customer survey questions matters so much. A well-crafted VoC survey gives your customers room to be honest, specific and even blunt — which is exactly what you need if you’re trying to improve anything that touches their experience. But good questions don’t just appear. They’re built. They’re tested. And they come from knowing what you're really trying to understand. In this blog, we’ll break down the types of VoC survey questions that actually work.

What does the voice of the customer survey mean?

A voice of the customer survey is a structured method of collecting direct feedback from customers to understand their expectations, needs, pain points and experiences with a product, service or brand.

Unlike basic feedback forms, a VoC survey is intentional — it zeroes in on the why behind a customer’s opinion and helps bring clarity to customer sentiment, friction points and expectations. Most voice of the customer surveys combines open-ended and scaled questions to capture both measurable data and qualitative insight. Think of it as a system — not a one-off — that feeds real customer input into product development, service design, messaging and customer service workflows. It’s especially useful when you’re trying to find out usability gaps, gauge sentiment after a change or prioritize roadmap features. Whether triggered post-purchase or after a support interaction, VoC surveys help teams close the loop — with actual context, not mere guesses.

Read more: What is Voice of Customer (VOC)? Program

The strategic impact of VoC surveys

The importance of a VoC survey lies in how it tightens the connection between customer realities and business priorities. It doesn’t ask teams to overhaul everything — it gives them sharper input on where to move next and why. When the voice of the customer data flows through product planning, content workflows, customer service and performance tracking, the business stops operating in fragments. It starts thinking as one.

The benefit of a VoC survey is that it builds a system of awareness. It shows you which messages resonate, which formats fail, which moments matter most — and it does this while decisions are still being shaped, not after the fact. For teams under pressure to move fast and get it right, this kind of input makes the work easier, sharper and more grounded in what customers actually want.

PDS Health used that exact approach to overhaul its social presence across 1,000+ offices. They brought feedback into the heart of their planning process — building a centralized content system with room for local flexibility, automating review management across tens of thousands of touchpoints and using real-time insight to refine their media strategy and content mix. Such operational lift worked because the feedback wasn’t abstract — it was specific, structured and shared across teams.

A strong voice of the customer survey feeds every team in your company the context they need to shift from reactive firefighting to making proactive customer-centric strategic moves.

If the goal is to act on feedback while it still counts, this is how you build the system for it.

With real-time coverage across 900+ e-commerce sites, 30+ social platforms and over 5 million media sources — plus your own internal channels — Sprinklr Product Insights gives you a full view of how your products are being talked about. Its AI models are trained for your industry, your language and your use case. From surfacing nuanced insight to managing a brewing crisis, it’s built to keep you ready.

Let’s show you what this looks like with your data, your priorities, and your real-world pressure.

Read more: Voice of Customer Examples to Inspire You in 2025

Key voice of the customer survey questions for 2025

You can’t surface clear insights if your questions blur the line between what you want to know and what the customer actually experiences. Every ask in a VoC survey should have a job — to explain behavior, reveal blockers, spark ideas, or confirm instincts. And that job changes depending on the moment, the touchpoint and the decision you’re trying to make next. Here's how to get it right — six distinct question types, each built to serve a different part of your business.

1. Satisfaction, loyalty and retention

These questions anchor your understanding of how customers feel about their overall experience — and whether that experience is strong enough to keep them coming back. This is the foundation of any relationship worth building.

Survey questions:

- “How satisfied are you with your experience overall?”

- “How likely are you to continue using our product/service over the next 6–12 months?”

- “What’s one thing that would make you consider switching to a different provider?”

- “How would you rate the value you receive for the money you spend with us?”

- “Would you recommend us to a friend or colleague?” (NPS)

- “How confident are you that we’ll meet your needs long term?”

Structural Tip: Don’t treat loyalty like a yes/no metric — build time into your phrasing. Ask about the likelihood of staying or leaving over a defined window (3, 6, 12 months) to track shifting loyalty patterns, not just static impressions.

2. Product and service performance

This category surfaces what people actually use, what they value and where friction is building. It’s your clearest input into roadmap decisions and product-market fit.

Survey questions:

- “Which features do you use most often?”

- “Which parts of the product/service feel unnecessary or underwhelming?”

- “What challenges did you run into while using [specific feature]?”

- “How would you rate the reliability and consistency of our product/service?”

- “What is the one thing you wish this product could do?”

- “How does our product/service compare to others you’ve used recently?”

Structural Tip: Structure at least one question to explore not just what’s missing — but what’s being over-delivered. Overengineering can hurt just as much as underdelivery, especially in saturated markets.

3. Customer support and service experience

Support interactions carry disproportionate emotional weight. These questions dig into resolution quality, tone, responsiveness and confidence.

Survey Questions:

- “How satisfied were you with how quickly we responded?”

- “Was the solution clear, and did it fully resolve your issue?”

- “How would you describe the tone and professionalism of our support?”

- “Were you kept informed throughout the support process?”

- “If you had to reach out again, how confident are you that your issue would be resolved well?”

- “How would you rate your experience with our support team overall?”

Structural tip: Ask about confidence in future interactions, not just satisfaction with the last one. Customer support is a trust contract and your questions should reflect that.

4. Brand perception and competitive positioning

These questions help you understand how your brand stands in the minds of your customers — not just in isolation, but in the context of everything else they’re considering.

Survey Questions:

- “What three words would you use to describe our brand?”

- “What first comes to mind when you think about our company?”

- “How does our brand compare to others you’ve used or considered recently?”

- “What do you believe we do better than others in this space?”

- “What do you wish we did differently, that you’ve seen others do well?”

- “If you stopped using us, who would you turn to — and why?”

Structural tip: Avoid asking only for comparisons — ask for associations. Perception lives in language, tone, values and emotional connection. Get specific about the feeling, not just the function.

5. Digital and omnichannel experience

Digital friction often breaks trust before support has a chance to fix it. These questions uncover how customers interact with your systems — across web, mobile, chat and even physical touchpoints that link to digital steps.

Survey questions:

- “How easy was it to find what you were looking for?”

- “Which channels (app, web, phone, etc.) do you prefer using to engage with us — and why?”

- “Did you experience any delays, confusion, or roadblocks while using our digital platforms?”

- “Were you able to switch between channels (e.g. chat to email) without starting over?”

- “How consistent was the experience across the platforms you used?”

- “Which part of the journey felt the most disconnected or unintuitive?”

Structural tip: Don’t isolate digital into a single channel. Instead, design at least one question around channel switching — because most customers don’t stick to one mode and friction often hides in the transitions.

6. Forward-looking feedback and innovation signals

Forward-looking questions give your teams a running start. They pull signals from the edge of current needs and turn them into early-stage input for your roadmap, content strategy or service model.

Survey questions:

- “What’s one problem you expect to face in the next year that we might be able to help with?”

- “What new features or services would make your experience meaningfully better?”

- “What’s something you wish no provider had ever overlooked — but still do?”

- “What industry shifts do you think we should be preparing for?”

- “If you could design our next product launch, what would it look like?”

- “What needs are becoming more important to you over time?”

Structural tip: Position one or two of these questions as creative prompts — not diagnostics. Customers often reveal their most useful ideas when they feel they’re co-creating, not critiquing.

Read more: 50 Customer Survey Questions You Must Know About

7 best practices to optimize VoC surveys

Running a VoC survey is easy. Building one that actually shifts decisions takes a sharper kind of thinking. Here are the best practices to follow when creating a voice of the customer survey.

1. Figure out the decision you need help making

Don’t start with a question bank. Start with the choice in front of you. If you’re planning a feature update, a channel revamp or a pricing change — write questions that will give you a clearer head about that. VoC data is only useful when it’s shaped to solve something.

2. Split your survey across moments

You don’t need to cram 20 questions into one survey just to cover your bases. Customers don’t answer based on who they are — they answer based on where they are in the journey. A first-timer and a regular buyer see the same friction differently. Break your surveys up to match those shifts.

3. Ask about where things got clunky

“How was your experience?” rarely tells you where things fell apart. A better question: “Was there a point where you had to stop and figure things out?” Or, “Was anything harder than it needed to be?” More than the emotional temperature, look for moments that had customers dumbfounded.

4. Don’t treat open text like an optional bonus

That comment box is where people stop editing themselves. The real intent — confusion, praise, side-eye, suggestions — it lands there. So if you’re scanning for word clouds or counting keywords, you’re missing the point. Read for patterns. Read like you're trying to fix something.

5. Make sure the right people see the right answers

If the product team never sees feedback about friction, or the ops team never hears about delivery delays, the survey didn’t do its job. Share insights in the language of the team that’s supposed to fix it. Don’t just show numbers. Show them what’s theirs to act on.

6. Show people where their input actually changed something

If you’re going to ask, show them what you did with the answer. Otherwise, feedback starts to feel like a dead end. You need a clear moment where someone sees their comment turned into a fix, an update or a smarter process. That’s how you earn better feedback next time.

7. Pick a tool that collects and moves feedback

You don’t need a tool that shows you another dashboard. You need one that pulls in feedback from everywhere your customers speak — reviews, social, chat, email — and gets that signal to the teams who can actually do something about it. If a platform can’t get insight into the people who need to act on it, it’s just storage. Pick one that closes the loop, not just logs the input.

Sprinklr Insights turns customer voices into a growth engine

If you're building a VoC program that needs to go beyond survey links and open-text boxes, Sprinklr Insights can get you there. It pulls feedback from everywhere customers talk: social, web, reviews, media and your own internal channels. All that feedback gets pulled into one system built to separate relevant signals from the rest, using patented models for brand recognition and classification.

As trends shift, smart alerts highlight spikes in key experience metrics — and generative AI helps decode the cause with clear next steps. You can also compare customer feedback across competitors, down to specific product attributes, to see where your strengths hold and where gaps emerge.

Want to see how it fits into your setup? Book a demo and we’ll walk you through it.

Frequently Asked Questions

To keep VoC survey questions relevant, enterprises must continuously stay close to shifting customer behavior. Watch where drop-offs happen, where expectations change and where competitors gain ground. Rewrite questions based on real-time signals — not assumptions from last quarter. A static survey in a moving market just gives you the illusion of insight.

Several trends are redefining how businesses collect and act on customer feedback:

- By 2025, 60% of organizations will use AI to analyze voice and text interactions, enabling faster and more accurate feedback processing.

- Businesses integrate feedback from social media, chatbots and in-app surveys to create a unified view of the customer journey.

- Shorter, moment-based surveys will become more relevant in the coming times where static surveys won’t cut it anymore.

Absolutely. AI transforms VoC surveys by automating feedback analysis, personalizing survey experiences and predicting trends. For example, AI can group open-text feedback by theme, flag new patterns early and even suggest sharper follow-up questions based on tone or sentiment.

A well-rounded VoC survey includes a mix of question types. Ask where things got stuck. Ask what nearly made them leave. Ask what made them stay. Questions that tie to real behavior — not just opinions — give you a clearer path forward. Ratings are fine, but friction points and future needs drive action.

Start by mapping every question to a real decision — a fix to make, a feature to shape, a bet to take. If it can’t guide action, cut it. And don’t treat surveys as one-offs. Go back to past feedback, spot what keeps coming up and let that reshape your next set. That’s how your questions stay relevant — and worth answering.