What is a customer survey?

A customer survey is a mechanism that is used to collect customer feedback from a specific group of respondents. Via a series of questions, surveys can help companies understand how well they’re serving customer needs and what they could do better.

When we talk about customer surveys in the support realm, they are mainly used by businesses to evaluate their customer satisfaction and engagement. If used effectively, the insights gathered from surveys can help enhance the overall product and support experience.

Customer feedback surveys ask one or more questions that can vary in detail, depending on whether the survey format includes:

open-ended questions

multiple-choice options

ranked choice

dropdowns

rating scales

The responses you get from customer surveys will give you a fairly good idea of what motivates, intrigues – and frustrates – your customers to pick or abandon a brand. When you consistently use surveys and act upon them, you can uplift your customer retention, experience and lifetime value in the long term.

89% of customers expect brands to ask them for their inputs. They like to feel heard by the brands they engage with.

Global State of Customer Service Report [2020]

While customer surveys are fast becoming the go-to tool for brands to gather data and experience insights, not many analysts know how and when to use surveys to maximize their impact. We will be delving into all these details below, so keep reading.

Benefits of conducting a customer survey

There’s a lot you can achieve through well-designed and well-timed customer surveys, for example, surveys can help you:

Learn about your customers continuously

Your customers’ needs and expectations from your brand and in general, are constantly evolving. Hence it becomes important to ask for their feedback and keep a finger on their pulse. Even if your customers don’t respond every time, there’s no doubt they like being asked for their feedback, so go ahead and shoot that customer survey you’ve been holding back.Gather insights for product development

Customer surveys can be an excellent tool for market research and product ideation. If you’re contemplating a new product or service, ask your customers for their thoughts. You not only get early feedback but may also manage to pre-sell your new offering to customers who show excitement. There’s also a good chance of spotting brand advocates willing to promote your product organically.

Learn More: How to turn your customers into a community of brand advocates

Identify new opportunities

When customers get a forum to air their opinions and needs freely, what you get is a treasure trove of upselling and cross-selling opportunities. You also get free and first-hand ideas to improve your products. For example, a grocery app user might say that they are seeking a new range of dairy foodstuffs added to your product catalog. You can now tie up with dairy vendors and expand your offerings as well as your revenue.Uncover problem areas

What better way to understand your shortcomings than to ask the consumers directly? Proactively seeking out feedback will surface problems before they become major challenges and eat into your business's bottom line and customer experience.

Still confused about whether your business really needs to use a customer survey?

To be honest, every customer-facing business needs a customer survey. But surveys become non-negotiable when you want to:

Launch a new product/service

Engage with your customers

Track your improvement

Gather product insights

Types of customer surveys

Based on their purpose, customer surveys can be of many kinds. Let’s take a look at some common surveys associated with different stages of the customer journey below.

1. Customer satisfaction score surveys

A Customer Satisfaction Score (CSAT) survey asks customers to indicate their level of satisfaction (very dissatisfied, neither satisfied nor dissatisfied, somewhat satisfied, or very satisfied) with your products, services, website or mobile app experience, or team members.

The survey responses can be interpreted as follows:

😊Very Satisfied: These customers most likely had a stellar experience with your brand, which is why they are extremely satisfied. Your products or services probably exceeded their expectations and turned them into vocal brand fans.

🙂Satisfied: Respondents in this category had a reasonably good experience with your business. They are satisfied, feeling that their expectations were met. However, they are not raving fans and cannot be termed “advocates” of your brand.

😐Neutral: Customers in this category had an average experience. They neither feel strongly negative nor positive about your brand. There’s a risk that these customers are easily swayed by other options.

🙁Unsatisfied: Unfortunately, these respondents had a less than satisfactory brand experience. They expected a lot more and feel disappointed by your service. It’s crucial to address their concerns and find ways to boost their experience in order to win them back.

😞Very unsatisfied: As the name suggests, these respondents had a very unsatisfactory experience. They are deeply dissatisfied and may even be angry or frustrated. If they vent out on public platforms, there’s a good chance of it denting your brand's reputation. It's critical that you address their issues promptly and effectively.

Pro-tip: While it’s virtually impossible to guess what’s going on inside a customer’s head, AI-powered surveys can predict CSAT scores with reasonable accuracy. The best part is they can gauge customer satisfaction levels during ongoing conversations in real-time so you can delight your customers on call.

🔎Point to note: Often, CSAT and NPS surveys are used interchangeably, but they aren’t the same. While CSAT surveys indicate the satisfaction level of customers with your brand, NPS indicates their likelihood to advocate your brand. Not all satisfied customers are comfortable with promoting a brand vociferously. Hence, both surveys are different and should be used selectively.

2. Customer effort score surveys

Customer Effort Score (CES) surveys measure how easy your services or products are for people to use and how much effort is required to find information or get help with a problem.

For example, a customer might be asked, “How easily were you able to get help with your problem on a scale of 1 to 5, with 1 being very difficult and 5 being very easy?”

Usability surveys can be conducted during the product development stage to assess the product gaps and the subsequent effort exerted by customers to get the product up and running. Usability surveys or tests are conducted with real users using a product under the supervision of researchers. They perform various functions with the product and help you:

Evaluate the customer experience

Detect product bugs

Compare the user experience with comparable products

3. Net promoter score surveys

The Net Promoter Score (NPS) survey can be used to measure your customers’ loyalty. These surveys typically ask a single question with a number for an answer.

For example, the customer might be asked, “How likely are you to recommend our services to a friend or family member on a scale of 0 to 10, with 0 being very unlikely and 10 being very likely?” People who give very high scores are your most loyal and satisfied customers. These are your promoters who can help you drum up new business.

Recommended reading: How to improve the Net Promoter Score of your brand

In addition to the above types, customer surveys can also be classified as conditional, custom and pre-built, based on their logic and design:

Conditional surveys

Conditional surveys use conditional branching or skip logic to lead respondents along a path of answers based on previous responses. By doing this, you eliminate questions from the survey that don’t apply to the respondent, saving them time and effort while increasing the likelihood that they will fill out the survey in its entirety.Custom surveys

Custom surveys can be built and tailored to your audience, questions, and branding. Customization allows you to make the right impression and get the exact responses you’re looking for.Pre-built surveys

If you want to save yourself time and effort, pre-built, templatized surveys that can be sent out with minor modifications should be your choice. Using these prepared templates to gather information can help surface opportunities for other questions to include that you may not have considered in the first place.

If you’re interested in sentiment analysis pertaining to a specific brand experience, you can conduct:

Event feedback surveys: Attendees to your webinars, conferences, exhibitions and other online or physical events can be asked for their feedback in an effort to improve future events.

In-store surveys: Responses are typically collected from customers by scanning QR codes in-store. You can analyze the responses to understand buyer behavior and preferences as well as inventory gaps.

Website feedback surveys: Website visitors are asked about their experience on the website to help you detect usability issues, bounce triggers and improvement areas.

How to design an engaging customer survey?

Enough has been said about customer surveys and why they exist. Now let’s get down to designing a survey that customers find engaging, low-effort and useful.

Step 1: Identify your survey goals

As you know now, different surveys have different goals. So right at the outset, determine the customer experience metrics you hope to measure using your customer survey.

Common survey goals for customer service can be:

Identifying potential brand advocates

Pinpointing your best support agents and teams

Detecting gaps in your support process

Discovering the most effective survey distribution or support channels

Remember: Focus on one touchpoint or metric at a time. Trying to gather and implement too much feedback with one survey can overwhelm your customers and agents alike.

Step 2: Develop your questionnaire

Your goals will determine the type of survey and questions you use.

Use case 1: If you want specific details about improving your customer experience, an open-ended blank field response may be the best approach as it enables the respondent to write as much as they want without limitations. However, including too many open-ended questions might make the survey too lengthy.

Use case 2: If you simply want to know how well an agent has served a customer’s needs on a scale of 1 to 5, then a rating-style survey would be the better option. But using only close-ended questions will rob you of the opportunity to gather elaborative feedback.

Therefore, ensure a good mix of questions that are clear, precise, unbiased and well-structured. Vague and unclear questions will ruin the survey experience and yield inaccurate answers.

While formulating your questions, ask yourself:

Is this question really necessary? Don’t ask for too much personal information.

Could this question be misinterpreted? If yes, adjust the wording for clarity.

Is the question too jargon-y? Remove technical terms and simplify the verbiage.

Can the question offend the respondents? Be aware of your biases and use neutral/inclusive language that doesn’t make anyone uncomfortable.

Is this a leading question? Ensure you’re not forcing or prompting answers you want to hear. Give your customers the liberty to speak out their hearts.

Besides closed and open-ended questions, there are many other question types you can pick.

Rating scales | Likert scales | Matrix questions |

Closed-ended questions that gather information about a product or topic Example: “On a scale of 1 to 10, with 1 being not likely at all and 10 being extremely likely, how likely are you to recommend our services to someone you know?” | Closed-ended questions that ask the respondent to indicate how much they agree or disagree with a statement | A group of Likert-style questions presented in a table format; the rows serve as questions, and the columns contain the answer options |

Dropdown menus | Image-choice questions | Click-map questions |

A scrollable list of answers that presents multiple choices in a cleaner and less overwhelming way | Allow respondents to select image answers to indicate favorable visual characteristics of a logo, a product or an ad | Present respondents with an image and allow them to click on elements of the picture as a way of answering the question Example: “What is your eye first drawn to on this product packaging?” |

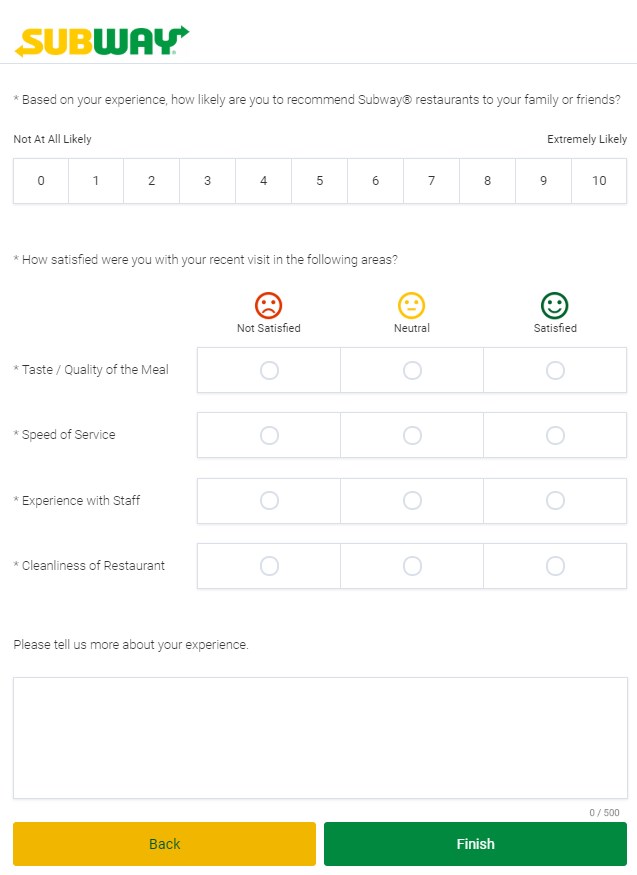

Subway’s customer support survey ticks all the boxes in terms of question variety and delivery. It allows respondents to skip the last subjective question to avoid hasty answers.

Step 3: Design and test your survey

Next, you need to package your survey aesthetically if you want to catch your customers’ elusive eyes. The colors, typography and general look and feel of your survey should be attractive as well as brand compliant. Position your logo prominently on all the pages, and don’t forget to test the survey’s interactive elements on all your devices.

Step 4: Decide your survey’s timing and targeting

Once you know what your research goals are, it’s time to home in on the right audience and the best times to hit them with your survey. Here are some tried and tested tips to get this right:

Clean your contact list: Remove all passive respondents and customers if you want surefire responses. Use metrics like last login, last purchase and last response to identify these people. Recency is key if you want the feedback to be fresh and relevant.

Adjust your timing Intelligently: Timing is everything in surveys, and it varies with industries, touchpoints and feedback type. As a general rule of thumb, decide the timing and frequency of your surveys based on these benchmarks:

Feedback type | Timing/Frequency |

NPS feedback | Every 30, 60, 90 days |

Consumer product feedback | 1 week after product sale |

Transactional feedback | Within 24 hours of the transaction |

B2B/SaaS feedback | 15 days to 2 months post implementation |

Offer incentives: You might have to sweeten the deal with incentives that can be in the form of improved product/support experience or literal awards like discounts, freebies, monetary rewards or donations to your customers’ favorite charities.

Try sampling the survey: Choose a small representative sample of your customers for a dry run of your survey and note the delivery and response rates in real-time.

Designing an engaging customer survey is only half the job done. You also need to use the right distribution channels and follow-up strategies to get your survey to the finish line. The next section talks about these aspects. Read on.

Choosing the correct distribution channel for your customer survey

Your customers are busy, so you need to respect their time and make it easy and convenient to fill out surveys in the channels they are already using avidly. They include the following but are not limited to:

1. In-product

If you’re a seller of physical goods, sneak in your survey in the customer’s package. For digital goods, a survey prompt within the product should do the trick. But try not to bombard the customer as soon as they enter your product.

Channel limitation: Showing a survey too early in the user journey (before they have got a flavor of your product) can disrupt the user’s experience to the extent that they abandon the product altogether.

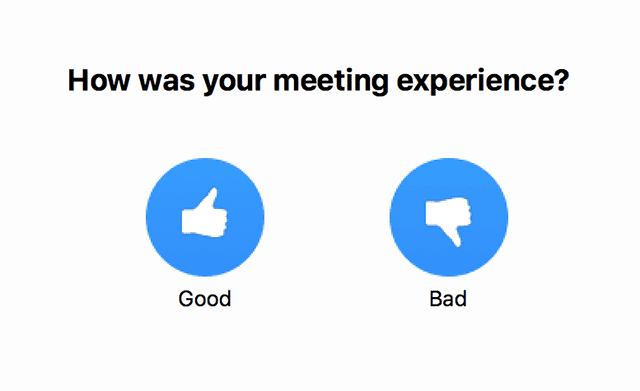

Keep these surveys short and simple, preferably one question only, with no typing requirements. Take a cue from Zoom. They shoot a short survey after every meeting, digging deeper only if you respond negatively.

2. Website

Website surveys can be used when a person enters the website or leaves it. Online surveys are cost-effective because they require minimal staffing. They also provide anonymity which increases the likelihood of honest responses.

Channel limitation: You might see an increase in errors and unanswered questions than with other survey types since digital natives have somewhat low attention spans.

3. Email

Email surveys are very popular, especially with B2B companies. To make them tick for you, try boosting your email open rates by implementing these email marketing best practices:

A/B test different subject lines

Set the context with a brief opening paragraph as to the reason behind the survey

Personalize the “From” field

Use verbal cues (“You’re almost done” “Just 1 question left”) or progress bars

Embed the survey right into the email body rather than a link that opens in another tab. Remember, the aim is to make responding easy for the customer.

Channel limitation: Email works for brands with a demonstrated history of email marketing success. With email fatigue setting in digital customers, it’s easy for your surveys to get lost in overcrowded inboxes, unless they REALLY stand out.

4. Text

SMS surveys are perfect for quick responses. These surveys should be short and straightforward. This method increases the open and response rates of feedback collection. SMS surveys are easy to deploy and are an instant way to get feedback.

Channel limitation: Many people respond negatively to unwanted texts, so procure permission before sending them.

5. Social media and chat

Social media surveys are published as links on social media platforms, and people who follow the brand can respond. These surveys are great for those looking for far audience reach and large sample sizes.

Channel limitation: Social surveys can be time-consuming and more costly than other survey methods. For each channel, you will need to customize the survey format and targeting. Plus, if you opt to do your surveys as sponsored posts, the charges are additional.

Leveraging customer survey insights for business growth

After you’ve established all of the above, it’s time to convert all that raw customer data into actionable insights and close the feedback loop. The insights can inform your product strategy, agent coaching and overarching support strategies.

If you’re analyzing your responses manually, asking the following types of questions may help you extract the answers you’re looking for:

How did most people answer X question?

Which responses have the most substantial impact on our company?

How has satisfaction increased or declined since [date range]?

What demographic is most impacted by X problem?

What is the most common complaint about X product?

What is the general sentiment about our customer service?

But manual data analytics can be time-consuming and labor-intensive, not to mention error-prone. That’s where an automated customer support platform comes into the picture.

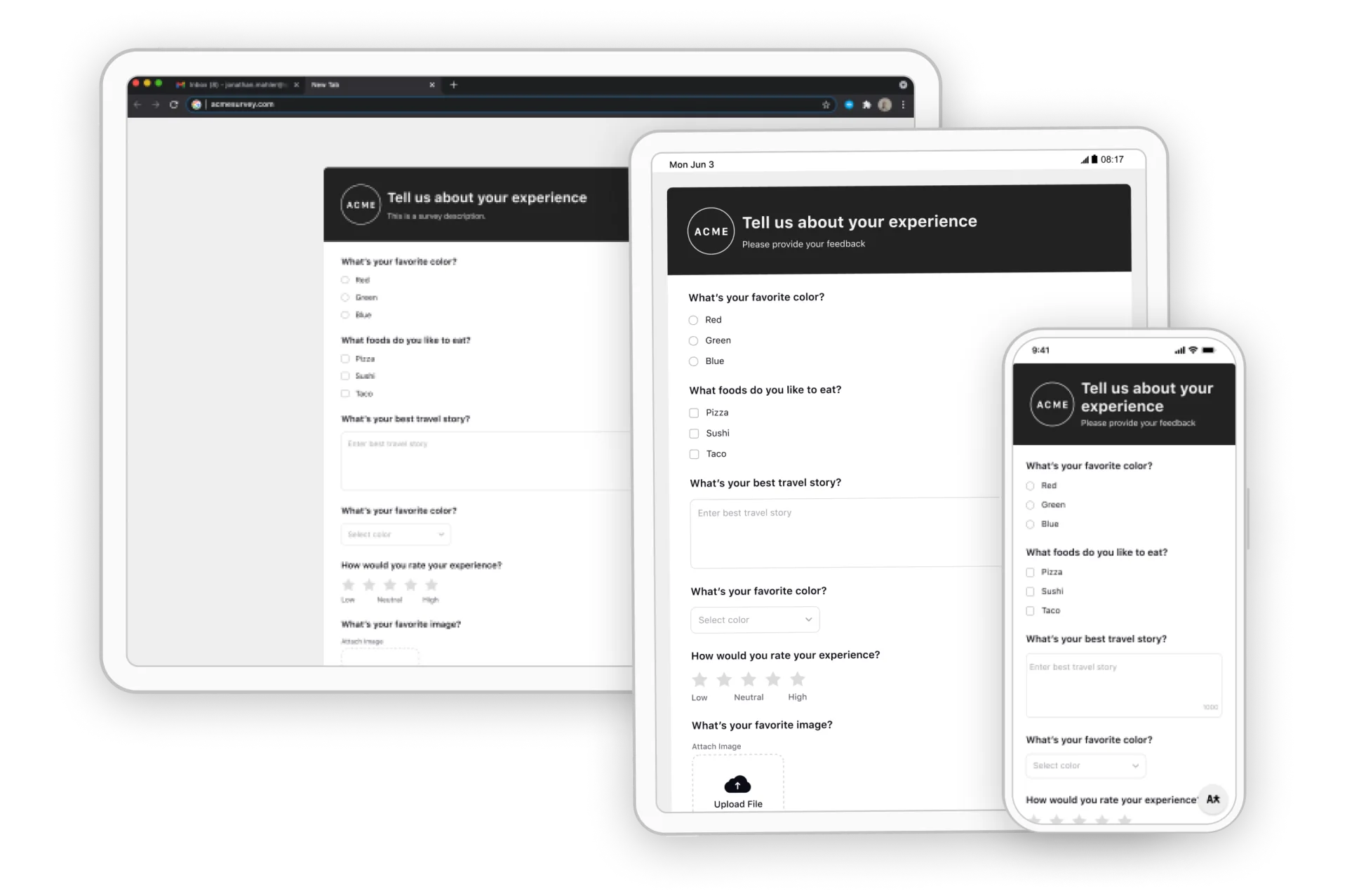

Since your customers are everywhere, it pays to invest in an omnichannel customer survey solution. Using it, you will be able to create custom surveys for any channel, schedule them for automatic distribution after an interaction with a customer and synthesize the data into information on improving customer satisfaction.

With a unified customer support platform like Sprinklr, you will be able to:

Create omnichannel, responsive and on-brand surveys with zero coding

Leverage a plug-and-play survey builder with a simple interface

Select from a range of pre-built questions for CSAT, CES and NPS

Predict CSAT, sentiment and escalation with 99% accuracy

Frequently Asked Questions

A customer survey is a mechanism that can be used to collect customer feedback from a specific group of respondents. Via a series of questions, surveys can help companies understand how well they’re serving customer needs and what they could do better.

For example, a customer might be asked, “How easily were you able to get help with your problem on a scale of 1 to 5, with 1 being very difficult and 5 being very easy?”

Thank you for contacting us.

A Sprinklr representative will be in touch with you shortly.

Contact us today, and we'll create a customized proposal that addresses your unique business needs.

Request a Demo

Welcome Back,

No need to fill out any forms — you're all set.