Elevate CX with unified, enterprise-grade listening

Sprinklr Insights gives you real-time consumer, competitor and market intelligence from 30+ channels without the noise. Make smarter decisions, strengthen your brand, and stay relentlessly customer-led.

Consumer Insights: Decode What Buyers Really Want

Picture this: The marketing team of a large enterprise has the perfect dashboard — click rates, dwell time, NPS scores — yet their campaign flops. Why? Data shows the what, but never the why. In 2025, consumers leave subtler clues: a hesitation before checkout, a rage-click on pricing pages, a silent shift toward competitors.

In today’s hyper-digital landscape, traditional research methods fall short of capturing fast-evolving consumer expectations. For enterprises, the challenge isn’t access to data — it’s translating signals into strategy.

This blog breaks down how to uncover deep consumer insights, decode buyer motivations, and turn intelligence into measurable brand impact.

What are consumer insights and why are they important?

Consumer insights are actionable interpretations of data that reveal the deeper motivations, needs, and behaviors driving customer decisions. These insights go beyond surface-level analytics, empowering leaders to anticipate market shifts, personalize experiences at scale, and make strategic decisions that drive growth and loyalty. When done right, they become the foundation for innovation, differentiation, and measurable ROI.

Why consumer insights matter for brands

Actionable consumer insights turn data into strategy — aligning marketing, customer experience, and digital transformation with what buyers truly want. In 2025, they’re non-negotiable for enterprises aiming to lead, not follow. Here’s why:

- Smarter, data-backed decisions: Enterprises that use data-driven insights are 23x more likely to acquire customers, and 19x more likely to be profitable. Customer intelligence helps align teams, optimize investments, and reduce guesswork.

- Elevate CX through personalization: Brands that excel at personalization are 71% more likely to retain customers. Consumer insights enable this by decoding intent, emotion, and context across channels — powering relevant, timely experiences that increase engagement, reduce churn, and grow lifetime value.

- Sharper product-market alignment: By understanding the “why” behind purchase decisions, you can uncover unmet needs, test solutions earlier, and de-risk new product development. Insights bring the voice of the customer into strategic decisions, accelerating go-to-market success and improving alignment with evolving market demands.

- Proactive trend adoption: Insights reveal early shifts in consumer behavior, allowing you to anticipate market trends and adapt strategies before competitors — staying future-ready and innovative.

- Stronger cross-functional collaboration: Consumer insights serve as a shared language across marketing, sales, product, and service teams, building alignment and accelerating execution while keeping the customer front and center.

Consumer insights vs. Customer data vs. Market research

Confused by consumer insights, customer data, and market research? Each term represents a unique yet complementary aspect of market understanding. Here’s how they differ and why they matter to your enterprise’s bottom line:

Dimensions | Consumer Insights | Customer Data | Market Research |

Definition | Deep, qualitative understandings derived by analyzing customer data and market research | Raw, quantitative facts about customer actions and attributes | Broad analysis of market trends, competitors, and segmentation |

Scope | Explains the “why” behind consumer actions and preferences | Describes the “what” — transactions, visits, demographics | Provides the “what” and “who” in the broader market context |

Example | Discovering that EV buyers value tech prestige as much as sustainability | A customer’s purchase history or time spent on a product page | A regional survey on EV adoption trends and brand preferences |

Strategic value | Drives innovation, brand positioning, and long-term growth | Captures raw data that enables segmentation, personalization, and operational efficiency | Identifies market opportunities, guides expansion, and mitigates risk |

Understanding these distinctions empowers you to use the right insights at the right time. In 2025, winners merge all three: Customer data feeds AI models, market research validates hypotheses, and insights reveal the “why” behind every decision.

Types of consumer insights

Understanding the different categories of consumer insights helps enterprises tailor strategies that are not only data-informed but also deeply human. These insights fuel smarter segmentation, sharper messaging, and more agile decision-making across the organization.

1. Behavioral insights: These insights delve into consumer actions, such as browsing patterns, product usage, and purchasing behaviors, across digital and physical touchpoints.

For instance, Best Buy leverages browsing history, purchase behavior, and abandoned cart data to deliver hyper-targeted product recommendations and follow-up emails. By dynamically retargeting users with ads based on their on-site actions, it not only reduces churn but also boosts conversions and long-term loyalty.

2. Sentiment insights: These insights capture consumer emotions and attitudes toward a brand or product, often derived from social media, reviews, and surveys.

Nike’s Colin Kaepernick campaign is a standout case. Despite initial backlash, Nike tracked real-time sentiment shifts across millions of social mentions. Using aspect-based sentiment analysis, the brand identified which campaign elements drove outrage and which deepened brand affinity. The result? A $6 billion boost in brand value, proving that decoding emotion, not just metrics, can drive decisive brand wins.

3. Purchase intent insights: These insights predict future purchase behavior based on consumer signals, such as search queries, wish lists, and pre-orders.

Google uses search trend data to anticipate demand for new products or services, helping businesses optimize their inventory and marketing strategies.

4. Competitive insights: These insights analyze consumer perceptions of your brand relative to competitors, identifying strengths, weaknesses, and opportunities.

McDonald's constantly monitors competitor promotions and menu changes to adjust its own offerings and marketing campaigns.

5. Market trends insights: These insights track macro shifts in consumer behavior, preferences, and cultural movements — helping brands stay ahead of the curve.

Netflix uses data on viewing habits to identify emerging trends in content consumption, informing its decisions about original programming and content licensing.

Now that we’ve seen how consumer insights can be classified, let’s dive into different methods and tools that can be used to gather and collate them.

Interesting Read: 7 Social Media Insights to Improve Engagement in 2025

Methods to collect consumer insights

The way enterprises gather consumer insights has evolved — moving from static surveys to real-time, AI-powered intelligence. Here are the key methods used today:

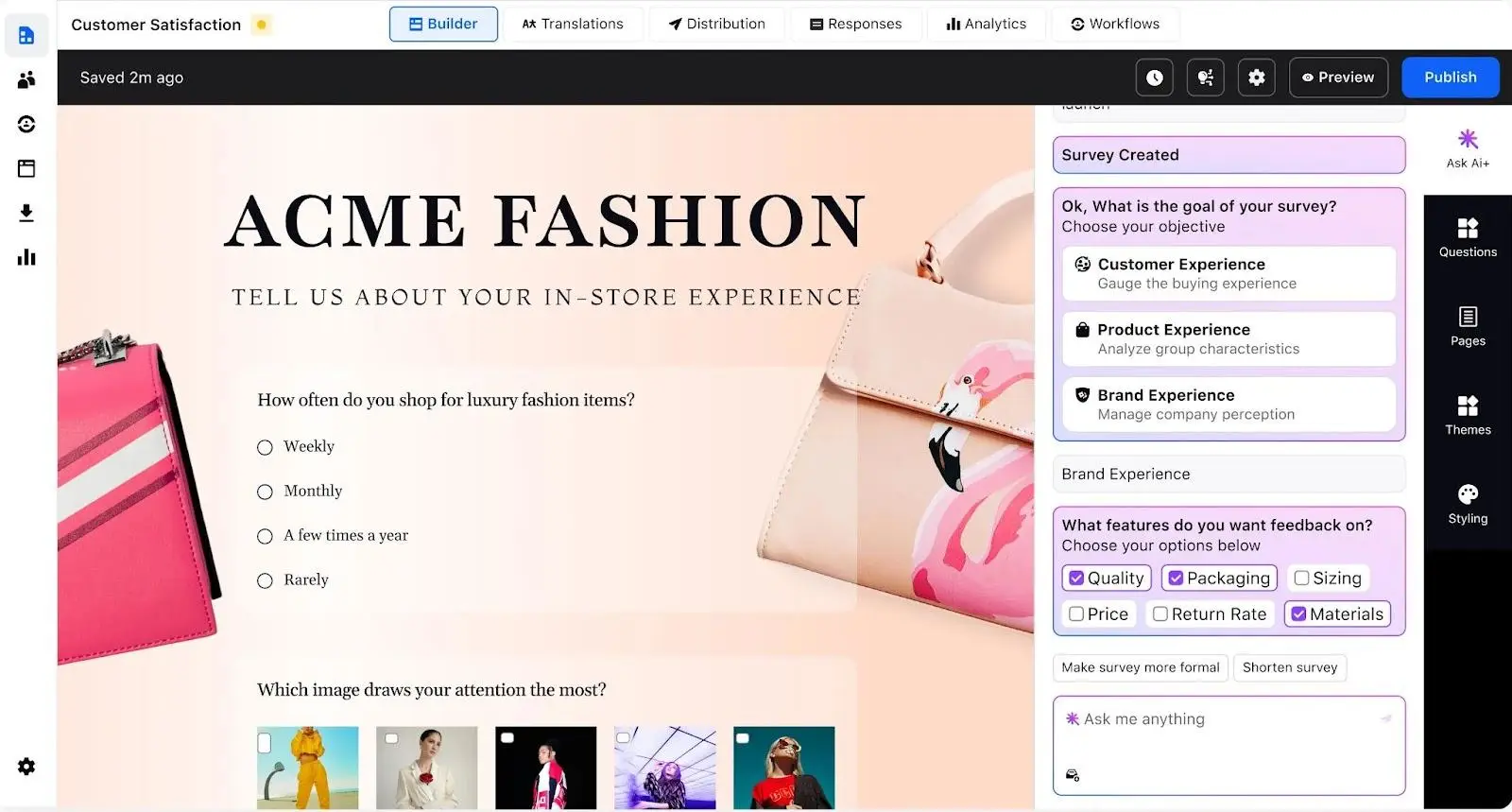

Surveys and feedback

Direct input from customers through structured surveys, polls, and feedback forms helps capture both quantitative and qualitative insights — capturing opinions and satisfaction levels.

Uber has operationalized feedback as a core input into both customer experience and workforce quality. After every ride, both drivers and passengers are prompted with in-app surveys. This two-way system isn’t just a formality — Uber uses the data to inform deactivation decisions, validate service quality, and continuously optimize the rider and driver experience. After identifying gaps in open-text feedback collection, it upgraded its survey UX to capture nuanced, contextual input, ensuring that critical insights don’t get lost in generic form fields.

🛠 Top tools you can use: Qualtrics, SurveyMonkey, Typeform

Pro Tip: Don’t stop at forms and feedback buttons. Leading brands are using AI-powered surveys that talk to customers like humans — asking smarter questions, adapting on the fly, and uncovering insights traditional tools miss.

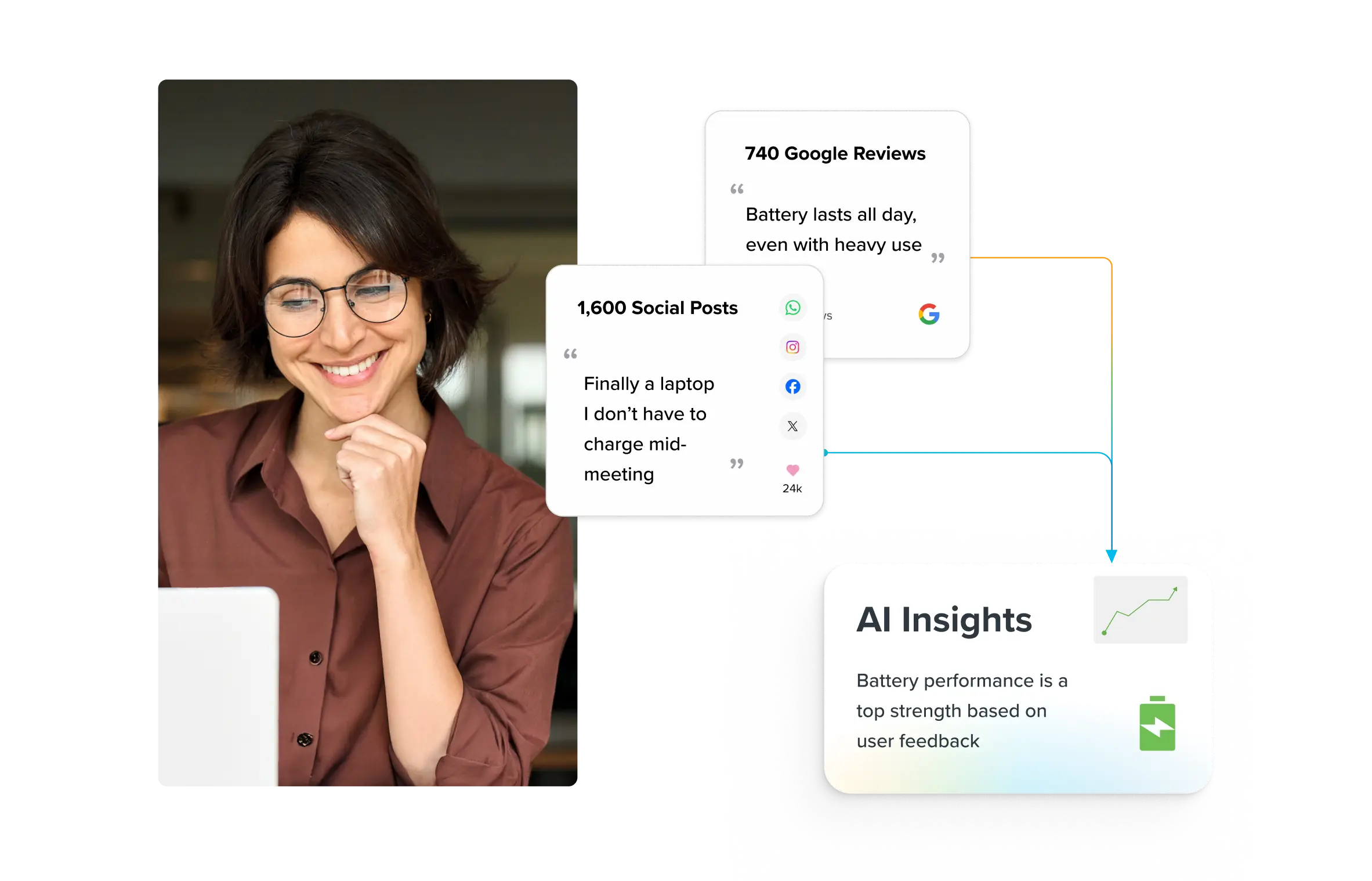

Sprinklr's AI-powered Surveys goes a step further by blending that direct feedback with what customers are saying across social, reviews, and support channels — so you're not just hearing what they say, you're understanding what they mean.

Want to see how it works? Request a demo and meet the future of voice-of-customer intelligence.

Social listening and online reviews

This involves monitoring social media platforms, forums, and review sites to uncover unsolicited feedback and sentiment. It helps brands track real-time conversations, identify brand advocates and detractors, and respond to emerging issues.

For example, when Chick-fil-A replaced its Original BBQ sauce, fans erupted online using #BringBackTheBBQ. Using Sprinklr’s Social Listening platform, the team spotted the shift in sentiment early and acted accordingly, responding to over 5,000 fan messages and orchestrating a full-scale campaign to relaunch the beloved sauce.

The result? Fan sentiment flipped from 73% negative to 92% positive within days.

Intrigued? Book a demo now to explore Sprinklr in action. ⬇️

🛠 Top tools you can use: Sprinklr, Brandwatch, Talkwalker

Website and app analytics

Web and app analytics provide a clear picture of how users interact with digital assets — including heatmaps, bounce rates, drop-off points, and conversion paths. This data helps optimize UX and drive engagement.

Etsy, for instance, uses Google Analytics to monitor how buyers and sellers navigate the site. By studying user behavior across search, checkout, and post-sale touchpoints, the platform fine-tunes homepage layouts, personalizes product displays, and improves discoverability — increasing customer retention and cart conversions.

🛠 Top tools you can use: Google Analytics, Hotjar, Mixpanel

Purchase behavior and transaction data

Analyzing transaction history, loyalty data, and purchase frequency reveals buying patterns and customer lifetime value. These insights help personalize offers, optimize pricing, and forecast demand.

Kroger uses its massive loyalty program data to analyze consumer buying patterns across 150 million touchpoints. The insights fuel highly personalized offers, delivered via 1.9 billion custom coupons. This approach not only improves redemption rates but also drives basket size and repeat purchase frequency.

🛠 Top tools you can use: Salesforce Commerce Cloud, Adobe Commerce, Oracle CX

Focus groups and interviews

These qualitative methods involve in-depth discussions with small groups of consumers or individual interviews. They offer deep context into customer motivations, emotional triggers, and product perceptions, often surfacing insights not captured through quantitative data. For enterprise organizations, these methods are vital during early product development, message testing, or when entering new markets.

For example, Spotify’s recommendation engine, widely regarded as best-in-class, was built on a foundation of rich qualitative research, far beyond just usage data. Through extensive user surveys, focus groups, behavioral analysis, and A/B testing, Spotify’s team uncovered a core user behavior: listeners crave variety but often default to familiar tracks. This insight led to the creation of the “Discover Weekly” feature, which blends collaborative filtering, natural language processing, and audio analysis to nudge users toward new music in a personalized, low-risk way.

🛠 Top tools you can use: UserTesting, Dscout, FocusVision

AI and predictive analytics

AI and predictive analytics allow enterprises to move beyond reactive strategies and instead anticipate customer needs in real time. These technologies analyze vast datasets — from browsing behavior and purchase patterns to external signals like economic indicators or social chatter; to forecast trends, detect churn risks, and personalize marketing at scale. This method is particularly powerful for global brands that operate across diverse markets and customer segments.

H&M uses predictive analytics to track real-time social media conversations around emerging fashion trends and customer preferences. By processing this data at scale, the brand identifies rising styles and sentiment shifts early, enabling faster product development cycles and highly responsive marketing strategies. This agility helps H&M stay relevant in a fast-moving industry and avoid overproduction, aligning trend adoption with actual customer demand.

🛠 Top tools you can use: Sprinklr Insights, IBM Watson, SAS Customer Intelligence

Once insights are collected, the next step is activation — using them to shape strategy, personalize experiences, and drive measurable business outcomes.

How to decode consumer insights to know what buyers want

Understanding what drives customer behavior isn’t just about data points — it’s about decoding the “why” behind them. True consumer insight combines emotion, motivation, behavior, and intent to paint a complete picture of what buyers value, what they reject, and what influences them to act.

Here's how enterprise brands can turn raw insight into strategic action:

1. Decode emotional triggers to drive engagement

Purchase decisions are rarely logical. Emotions like pride, nostalgia, relief, excitement, or even fear of missing out, often drive consumer action — especially in saturated markets. Forward-thinking brands go beyond tracking sentiment; they uncover the emotional undercurrent behind preferences and actions.

Use qualitative methods like focus groups and sentiment analysis to uncover the “why” behind those emotions. Go beyond surface-level data by implementing advanced sentiment analysis tools on social media, review platforms, and customer feedback surveys. Focus on identifying the emotional language and underlying feelings expressed by consumers.

Always #LikeAGirl campaign is a standout example. The brand challenged a negative stereotype by reframing the phrase “like a girl” into something empowering and positive. Based on insights about how adolescent girls’ confidence drops during puberty, the campaign sparked a cultural conversation, improved brand perception, and significantly boosted engagement and loyalty. By aligning with emotional truths, Always turned customer sentiment into a compelling brand purpose that resonated globally.

💡The takeaway? Emotional insights, gathered from open-ended feedback, social conversations, and NLP-powered review analysis, can help marketers craft messaging that resonates on a human level, not just a functional one.

2. Connect behavior and intent to predict what’s next

Intent signals, like repeat visits to a product page, high engagement on content, or increased searches for a competitor, are the digital breadcrumbs that reveal a buyer’s next move. But isolated signals don’t tell the full story. Enterprises need to analyze these actions in context, combining behavioral, transactional, and third-party data for predictive power.

The intent needs to be decoded by triangulating signals — search behavior, content engagement, and competitor comparisons. This layered approach helps predict what buyers are likely to do next and how to meet them there.

UK-based Bloom & Wild exemplified this in its “No Red Roses” campaign. The insight? 79% of customers found red roses cliché, and 58% preferred thoughtful, unconventional gifts. Acting on this, the brand repositioned its Valentine’s campaign — breaking category norms and driving record-breaking sales and brand affinity.

💡 This kind of intent analysis goes beyond clicks and conversions. It maps why buyers behave a certain way and gives brands a blueprint to proactively meet evolving expectations.

3. Personalize customer experience with precision

Generic experiences don’t cut it anymore. The brands leading in customer loyalty are those that use insights to anticipate needs, remove friction, and deliver relevance at scale.

Delta Air Lines exemplifies this approach with its AI-powered "Delta Concierge" feature. Integrated into the Fly Delta app, this tool uses generative AI to provide personalized, contextual insights and experiences throughout the customer's journey. From anticipating needs to offering real-time assistance, Delta Concierge enhances the travel experience, building greater customer satisfaction and loyalty.

Also read: From Noise to Narrative: How to Extract Actionable Insights from Billions of Social Conversations

Bonus insight: Decode subconscious motivations with neuromarketing

Some leading brands are also turning to neuromarketing, analyzing unconscious responses to stimuli, to better understand how customers perceive ads, packaging, and digital experiences. For example, Google applies EEG, eye-tracking, and implicit association testing to test how users emotionally and cognitively respond to YouTube ads and search layouts. These neuromarketing techniques help refine ad design, messaging clarity, and emotional impact — leading to more intuitive, effective campaigns.

Why decoding buyer behavior is important

Decoding consumer behavior isn’t just a marketing advantage — it’s a growth imperative. From surfacing unmet needs to shaping real-time customer experiences, actionable insights help enterprises build deeper loyalty, accelerate innovation, and invest where it matters most.

Sprinklr Insights makes this possible at scale. Powered by proprietary AI, it unifies data across 30+ digital and traditional channels, turning unstructured feedback into strategic clarity. Trends? Detected. Sentiment? Benchmarked. Gut-feel decisions? Officially retired. No wonder Gartner named Sprinklr a Leader in the 2025 Magic Quadrant™ for Voice of the Customer Platforms. So yeah, the future of insights? It’s here.

Curious? Request a demo and see what your data’s been dying to tell you.

Frequently Asked Questions

Sprinklr’s AI-powered Smart Insights unifies data from 30+ channels into a real-time, 360° customer view. It detects emerging trends, sentiment shifts, and anomalies — enabling faster, data-backed decisions. Brands can also run predictive analytics to anticipate buyer behavior and market movements.

By analyzing structured and unstructured data, from social posts to purchase histories, consumer intelligence tools reveal behavioral patterns, emotional drivers, and buying intent. These insights fuel more precise segmentation, predictive modeling, and data-led decision-making.

AI delivers scale, speed, and depth that traditional market research can’t match. It processes unstructured data in real time, uncovers predictive trends, and eliminates manual inefficiencies — enabling brands to personalize at scale and stay ahead of evolving consumer behavior.

They surface real-time audience preferences, competitor strategies, and cultural signals — enabling highly targeted campaigns that drive engagement and ROI. Advanced tools also analyze emotional tone and intent, allowing marketers to refine messaging and creative strategy.

Sprinklr combines enterprise-grade AI with real-time, omnichannel data from 30+ platforms — delivering unified insights, competitive benchmarking, and early warning signals from a single platform. With predictive analytics and anomaly detection, it empowers brands to act fast, stay relevant, and lead with intelligence.