Unified-CXM

Make customers happier with a unified customer experience.

How to Measure CX ROI and Win Over the CFO

In today's enterprise boardrooms, the question is no longer "Is our customer experience good enough?" but rather "What is it delivering back to the business?"

Subjective sentiments around CX — however well-intentioned — don't hold up in front of CFOs or investment committees. What matters is the measurable return on your CX initiatives: the customer experience ROI.

Customer experience ROI quantifies the business impact of every dollar, hour, or resource your enterprise allocates toward enhancing customer interactions, whether through AI-enabled agent assistance, proactive service models, or end-to-end journey orchestration.

Studies suggest that 89% of businesses compete primarily on customer experience in today's market, and the CX management sector is projected to be worth $52.54 billion by 2030. As more companies invest heavily in CX to stay competitive, CFOs and CX leaders are under mounting pressure to demonstrate measurable returns, making it essential to calculate the ROI of customer experience initiatives.

In this article, we'll unpack the modern architecture of customer experience ROI from proven, CFO-approved calculation models to strategies that enterprise-grade companies use to maximize returns on CX investments. We'll also surface common pitfalls and spotlight brands that have successfully translated CX excellence into measurable business outcomes.

- What is customer experience ROI and why is it a strategic priority for CFOs?

- How customer experience ROI connects to business outcomes

- How to calculate customer experience ROI

- Strategies to maximize customer experience ROI

- Common challenges in calculating and proving CX ROI and how to overcome them

- Why calculated CX investments matter now more than ever

What is customer experience ROI and why is it a strategic priority for CFOs?

Customer experience ROI is the quantifiable return your enterprise earns from investments made to improve the customer journey. It translates CX from a qualitative aspiration into a measurable business discipline, capturing gains in revenue, retention, cost efficiency, and brand equity.

For CFOs, the value of CX ROI lies in clarity. It answers the critical question: “Are we extracting meaningful business outcomes from the capital we’re deploying into CX?”

Here is a simple formula to calculate customer experience ROI:

Take this scenario: Customer churn has reduced, and more customers are staying. But new customer acquisition has slowed. That signals a performance mismatch. Customer experience ROI doesn’t just highlight feel-good wins; it reveals which experiences are driving business growth, and which ones are quietly eroding it.

Instead of diluting your CX budget across every customer touchpoint, customer experience ROI enables targeted investment in high-impact areas. Think: optimizing the most cost-intensive stages of the journey, reducing average handle times with AI, or doubling down on experiences that drive lifetime value.

More than soft metrics, it’s about:

- Revenue lift from repeat business

- Margin expansion through customer self-service or automation

- Operational efficiency gains at scale

- And a customer experience strategy that earns board-level credibility

For CFOs and CX leaders alike, CX ROI is the connective tissue between experience design and enterprise performance. And in today’s economic climate, that linkage is non-negotiable.

How customer experience ROI connects to business outcomes

For C-level leaders, the value of CX investments lies not just in sentiment, but in cause-and-effect clarity. The ability to connect initiatives such as improving first-contact resolution or deploying AI for call deflection to specific, measurable business outcomes is what earns CX a seat at the strategy table.

Below is a breakdown of how specific CX initiatives translate into financial outcomes that matter in board-level conversations:

CX investment focus | Business outcomes |

Revenue growth via experience-led journeys | Higher conversion rates, increased purchase frequency, and greater share of wallet |

Cost-to-serve optimization | Lower operational costs through AI, automation, and channel deflection |

Retention and loyalty | Higher customer lifetime value (CLV), reduced churn risk |

Agent efficiency and service speed | Improved productivity, lower average handle time (AHT), faster resolutions |

Brand trust and intangible value | Greater pricing power, lower CAC, and stronger investor confidence |

How to calculate customer experience ROI

Suppose you’ve just wrapped a six-month rollout of agent assist and revamped your digital self-service journey. Early signs are promising — AHT is dropping, customer satisfaction is climbing, and the feedback from your frontline teams is strong.

Then comes the inevitable boardroom question: “This all sounds good, but what’s the ROI?”

This is the moment where many CX strategies stall, not because they aren’t working, but because they weren’t framed with the CFO in mind. To get that strategic buy-in, you need more than performance anecdotes. You need financial logic that withstands executive scrutiny.

Here’s how you can build a CFO-ready case for customer experience ROI — step by step.

Step 1: Start with the investment breakdown

CFOs don't speak in "initiatives." They speak in capital allocations. So, your first job is to identify what the business actually spent on the CX improvement you're measuring. This includes license fees, implementation costs, internal resources, customer service training, and any support overhead.

For example, if you rolled out a new AI-powered chatbot, was it part of your OPEX or CAPEX? Is it a one-time setup or an annual contract? Distinguishing these matters because your CFO needs to assess depreciation, ongoing obligations, and how this impacts the financial run rate.

If you can't precisely outline what was spent, no CFO will take your returns seriously.

Step 2: Tie the investment to specific business goals

Next, you need to establish what the initiative was designed to improve, and these cannot be vague outcomes. It's not enough to say "better CX." The CFO wants to know: Did it reduce customer churn? Did it improve agent productivity? Did it increase digital containment? Did it improve conversion on a specific customer service channel?

Let's say you implemented agent assist across voice and live chat. Your goal might have been to bring down average handle time (AHT) by 20%. But here's the key: set this up as a pre-post measurable gain. Provide clean data that compares performance before and after the initiative. Or better — use control groups. CFOs love evidence of causation, not just correlation.

Step 3: Quantify the business gains in financial terms

Now comes the most important (and most overlooked) step: translating CX success into dollars.

If AHT dropped by 40 seconds per call, and your team handles 4 million calls a year, what does that mean in terms of agent hours saved? What’s the cost per hour per contact center agent? Multiply it. That’s a direct OPEX impact.

Or let’s say your churn rate dropped by 2% in your premium segment. What’s the average lifetime value (LTV) of that customer segment? Multiply by the number of customers retained. That’s protected revenue.

The CFO isn’t interested in the percentage drop alone — they want to know what it’s worth.

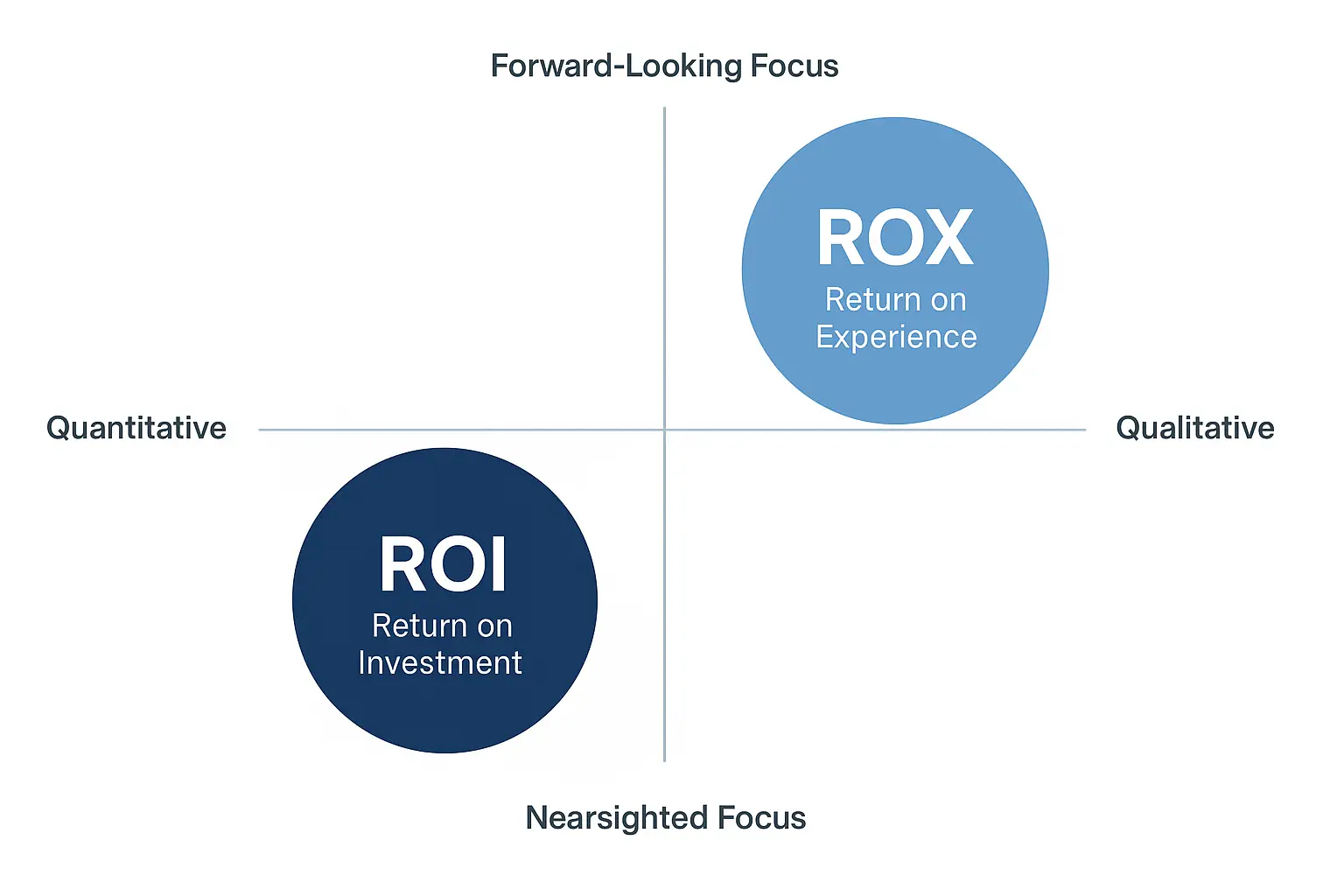

➕ Bonus tip: Don’t ignore Return on Experience (ROX)

While ROI focuses on the direct financial return from CX investments, return on experience (ROX) evaluates how improvements in customer and employee experiences translate into long-term business value, such as brand advocacy, retention, and productivity.

Think of it this way: ROI tells you what you earned back; ROX tells you why customers keep coming back.

How it’s measured: ROX doesn’t follow a rigid formula like ROI. Instead, it combines qualitative indicators (such as customer satisfaction, ease of use, and digital customer engagement) with quantitative metrics (such as retention rate, LTV, NPS, and productivity gains).

Example: A CX initiative that improves first-contact resolution and reduces agent burnout may not immediately show ROI but may yield high ROX by driving long-term loyalty and internal cost savings through better employee performance.

Why CFOs should care:

Because ROX acts as a leading indicator of ROI. In forward-looking enterprises, CFOs are beginning to track ROX alongside ROI to anticipate future business outcomes and justify investments in areas like employee training, journey orchestration, or customer experience automation.

Step 4: Run the ROI equation and share the margin story

Now you’ve got your inputs. Let’s say:

Your CX investment: $1.2M

Your gains from churn reduction, AHT improvements, and increased digital deflection: $4.8M

Your ROI = [(4.8M – 1.2M) / 1.2M] × 100 = 300%

That’s the kind of math CFOs respect.

But don’t stop there. Walk them through the margin story. For example, “By deflecting 15% of Tier 1 queries to self-service, we reduced cost-to-serve while maintaining NPS. That gain compounds as volumes scale without scaling headcount.”

This is where you reposition CX as a profit lever, not just a service function.

Step 5: Layer in strategic value without losing credibility

You've built a solid financial case. Now, it's time to round it out with the qualitative value customer experience brings, but only if you can tie it back to strategy.

Say your NPS jumped significantly after launching personalized onboarding. That alone won't convince the CFO. However, if you demonstrate that high-NPS customers have a 2x referral rate and higher repeat purchase rates, you're then translating sentiment into real growth.

Or if improved CX reduced agent burnout and turnover, link that back to HR costs saved or onboarding time reduced.

The CFO doesn't need you to speak their language perfectly. But they need to see that you're thinking like theydo in terms of capital efficiency, scalability, and return profiles.

Strategies to maximize customer experience ROI

Obtaining the CFO's approval is only the first step. Now comes the real challenge: proving that every dollar spent delivers outsized returns — not just in operational savings, but in customer retention, loyalty, and long-term growth.

For CXOs, that means thinking beyond one-off improvements and focusing on systemic strategies that use technology, data, and intelligence to drive sustainable ROI. Here's how today's forward-looking CX leaders are doing exactly that.

1. Intelligent automation, but human in the loop

Automation is a no-brainer when it comes to ROI. But the difference between a cost-saving chatbot and a value-generating one lies in context.

Modern CXOs are investing in AI-powered conversational experiences that go beyond static FAQs. Today’s Conversational AI platforms can understand customer intent and automate resolutions across voice, chat, and social, seamlessly handing off to human agents with full context when needed.

What’s the return?

- Lower cost-to-serve through digital containment

- Higher resolution rates without human intervention

- Increased CSAT through seamless hand-offs and continuity

💡Pro Tip

Focus your automation strategy on Tier-1 queries and high-volume interactions. Utilize AI to triage intent and free up your agents to focus on moments that truly matter. Read: Conversational AI: Use Cases, Implementation Steps and Future Trends

2. Customer data unification across touchpoints

Fragmented data is the silent killer of CX ROI.

When customer history, sentiment, and preferences live in silos, your agents spend more time searching than solving. And your insights teams struggle to connect customer feedback to action. That’s why more CXOs are prioritizing data unification strategies, bringing together voice, email, chat, and social interactions into a single customer view.

Sprinklr’s Unified-CXM platform does just that, consolidating data from 30+ digital and traditional channels, enriched with AI-driven customer insights, all in real time. Here’s how:

- Faster resolution due to contextual customer intelligence

- Improved FCR (first contact resolution) and agent efficiency

- More personalized experiences, leading to higher LTV

A unified platform reduces integration costs, eliminates redundant tools, and boosts team productivity, making tech consolidation a smart cost-saving move.

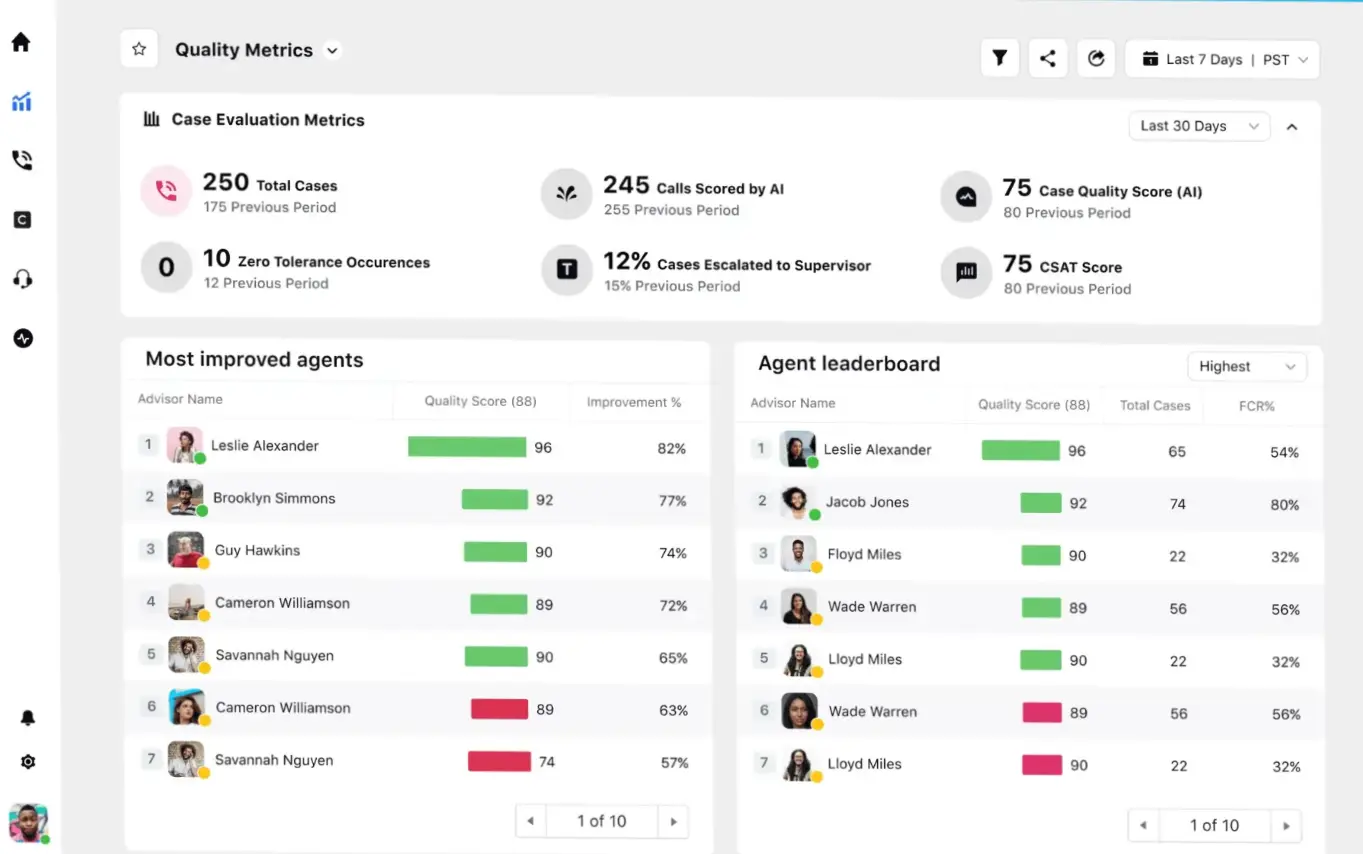

3. Real-time quality assurance and coaching

Traditional QA models fall short in today’s high-velocity service environment. Reviewing a random sample of customer interactions after the fact is like trying to steer a ship by looking at yesterday’s weather. By the time quality issues are flagged, the damage to customer trust or compliance standing may already be done.

Modern CX leaders are shifting from retrospective analysis to real-time performance intelligence. That means surfacing sentiment shifts, behavioral red flags, or compliance risks as they happen, not after.

How Sprinklr helps

With Sprinklr AI-powered quality management software, you can automatically score every single customer interaction, not just a few. You can flag high-risk moments instantly and empower supervisors to intervene mid-call, whispering to agents if needed, and prevent a negative experience from escalating.

Real-time QA enhances agent productivity, reduces churn, and shortens ramp-up time, resulting in measurable OPEX savings.

4. Turning customer feedback into predictive signals

Collecting customer feedback is the easy part. The real ROI comes from analyzing and acting on it, systematically and at scale.

Leading CXOs are integrating Voice of Customer (VoC) analytics directly into their operational workflows. That means moving beyond passive listening to active interpretation: turning customer survey responses, social mentions, support tickets, and product reviews into predictive signals that influence decisions across product, marketing, and service functions.

Modern VoC programs use AI and natural language processing to detect sentiment, emotion, and intent in real-time, revealing friction points, unmet customer needs, and silent churn signals that traditional metrics might miss.

When feedback loops are closed efficiently, customer trust grows. When insights are routed to the right teams, product journeys evolve faster. And when patterns are flagged early, CX leaders can shift from reactive firefighting to proactive experience design.

Key takeaway

Operationalize VoC insights by feeding them directly into your product and customer journey optimization cycles. Track impact by tying feedback-driven changes to reductions in complaints and increases in customer lifetime value.

💡Good Read: 6 Voice of the Customer Strategies To Turn Feedback into Action

5. Adopting a unified agent desktop to eliminate swivel-chair syndrome

Every second an agent spends toggling between tools is a hit to ROI. By centralizing tools, channels, and customer service workflows into a single interface, you can significantly reduce handling time and lower training overhead.

This not only improves agent satisfaction but has a real business impact:

- Shorter AHT

- Lower agent attrition

- Faster ramp-up for new hires

💡 Key business outcome

Unified desktops reduce licensing sprawl, boost productivity, and minimize rework — all driving operational ROI. See how the Sprinklr unified agent console works.

6. Designing journey-led metrics to measure what matters

CXOs often track dozens of customer experience KPIs, but without alignment to end-to-end journey outcomes, those metrics can mislead more than they inform. To maximize ROI, smart leaders are adopting customer journey analytics, which map out entire customer experiences (onboarding, support, and renewal) and pinpoint moments of friction or drop-off.

For example, Sprinklr’s customer journey analytics capabilities enable you to visualize and quantify how customers flow across channels, where they encounter bottlenecks, and what drives conversion or churn.

Want proof that the right CX strategy delivers measurable ROI? Here’s how one enterprise got it right.

TSB Bank elevates CX while cutting costs

TSB Bank, a major UK retail bank serving over five million customers, unified customer experience management on Sprinklr to drive efficiency, insight, and measurable returns.

📈 Key ROI wins:

- 86% improvement in first-response SLA (from 2+ hours to under 21 minutes)

- $240K earned media value via employee advocacy

- Over 1,000 agent hours saved annually through workflow automation

🔭CX strategy in action: By centralizing digital care, social media engagement, listening, and marketing into a single platform, TSB empowered agents with AI to achieve faster response times and a reduced operational load. They transformed customer feedback into predictive insights and replaced manual processes with automation, gaining real-time visibility, enhanced compliance, and unified reporting.

🎯 The impact: TSB’s approach, apart from improving CX, also slashed costs, boosted agent performance, and generated meaningful business value across marketing and customer service operations.

Common challenges in calculating and proving CX ROI and how to overcome them

Regardless of the strategies, tips, and steps discussed, a lack of a comprehensive understanding of the challenges and errors in calculating and communicating customer experience ROI will hinder your ability to secure the board's confidence.

Challenge | Implication | Solution |

Relying on vanity metrics to tell the ROI story Teams often showcase high NPS or CSAT scores without linking them to financial value | Stakeholders see these as surface-level wins with no business justification | Prioritize outcome-driven metrics (retention rate, CLV lift, cost savings) when presenting ROI to executives |

Treating ROI as a one-time calculation instead of a continuous discipline CX programs report ROI after implementation but fail to monitor it post-deployment | ROI impact plateaus or erodes over time without ongoing optimization | Establish continuous ROI tracking using real-time customer experience dashboards and recurring reviews tied to performance targets |

Focusing only on direct ROI and ignoring secondary business effects ROI calculations often miss second-order benefits like increased referrals or a reduction in employee attrition | Undervalues the full impact of CX, leading to underfunding or incorrect prioritization | Expand models to include indirect financial implications, such as advocacy behavior, brand equity or employee efficiency gains |

Assuming all positive CX outcomes are attributable to CX programs External factors like product-market fit, pricing shifts or seasonal behavior are mistaken as CX-driven results | ROI claims lose credibility when challenged by finance or board members | Apply control groups or benchmarking to isolate and validate the actual impact of CX-specific interventions |

Reporting ROI in isolation without comparison to other initiatives CX results are often reported without benchmarking against competing investments (e.g., sales enablement or IT ops) | Makes it more challenging for CFOs to justify CX spend over other enterprise priorities | Present ROI in a comparative context, showing relative efficiency and strategic alignment vs. other investments |

Overloading ROI reports with technical CX language CX teams use experience terminology that doesn’t resonate with finance leaders | Creates communication gaps and reduces executive confidence in the ROI data | Translate all findings into business terms, linking metrics to cost savings, revenue growth or margin impact |

Why calculated CX investments matter now more than ever

Customer experience has evolved into a core business function, one that directly influences revenue growth, operational efficiency, and long-term customer value. Yet many enterprises still rely on a fragmented tech stack that dilutes CX impact and obscures ROI visibility.

Disconnected systems result in duplicated efforts, inconsistent data, and poor coordination among teams. This not only stalls CX performance but also makes it difficult for CFOs and CXOs to align on what’s working and what’s not.

To deliver meaningful returns, enterprise leaders need to be deliberate about their customer-facing technology stack. The goal is to move beyond point solutions and adopt an integrated, data-driven approach that connects every channel, team, and insight.

Sprinklr’s Unified-CXM platform offers a purpose-built foundation for this shift. It brings together every touchpoint, such as voice, chat, email, social, and messaging, into a single AI-powered platform with advanced analytics, automation, and real-time visibility built in. This reduces the complexity and cost of managing siloed tools, while enabling faster decision-making and more measurable outcomes.

With one unified view of the customer and one continuous feedback loop between experience and performance, CX leaders can finally tie their strategy to financial impact with confidence. And it all starts with a demo.

Frequently Asked Questions

CX ROI calculators, business intelligence dashboards and integrated platforms like Sprinklr help measure ROI. They combine experience metrics with financial data to show real impact. Use tools that offer real-time analytics, cost tracking and automated attribution.

ROI measures financial return from CX investments. ROX (Return on Experience) tracks how experience quality drives long-term value, like loyalty or advocacy. ROI is about dollars. ROX is about behavior that leads to those dollars.

How does customer experience ROI influence long-term business strategy?

CX ROI shows which experience initiatives drive revenue, reduce cost or increase loyalty. This insight helps leaders prioritize high-impact programs, justify budgets and align teams. It turns CX from a soft initiative into a growth engine.

Key metrics include cost per contact, customer acquisition cost (CAC), customer lifetime value (CLV), churn rate and retention rate. These link CX efforts directly to revenue growth and cost efficiency.

Start with clear goals, use trusted models like CBA or TEI and link CX outcomes to financial metrics. Keep it simple, data-driven and tied to business KPIs. Show how the investment improves margin, efficiency or revenue.