The undisputed leader in social media management

For over a decade, the world’s largest enterprises have trusted Sprinklr Social for its in-depth listening, unmatched channel coverage, enterprise-grade configurability and industry-defining AI.

Scale your BFSI business by creating a consistent CX using distributed marketing

Are your financial advisors, wealth advisors, bankers, and brokers good at social engagement across geographies and channels? And are they equipped to engage with social-media-savvy prospects and customers at every stage of the sales funnel?

If you answered no, you are surely losing prospects to competitors.

Without the right resources and support systems, you cannot expect your distributed team to sell effectively on social media platforms. This is why we recommend that banks and insurance companies empower advisors with automated marketing tools that deliver powerful, personalized, and targeted sales content.

Organization-wide access to on-brand advisory and experiences, powered by better collaboration between your corporate (central) and local (regional) teams, is key to lasting sales success.

At the same time, your communication on social platforms must be fully compliant to avoid fines and legal action.

- What’s going on in the financial services industry?

- Introducing Sprinklr’s Distributed for financial services

- Growing sales numbers

- Improving productivity

- Avoiding compliance breaches

- The way forward in financial services

- 1. Empower advisors with relevant content and social engagement capabilities

- 2. Ensure governance and brand compliance across touchpoints

- 3. Better collaboration between corporate and field sales teams

- Do all of the above on the go

What’s going on in the financial services industry?

Sixteen percent of the 6 Million new accounts opened by retail investors in 2020 belong to Gen Z investors. And, by 2050, nearly 50% of the total wealth will fall into the hands of Gen X and Y. This makes young investors one of your most valuable customers.

Another trend that is hard to ignore is that Gen Z (86%) and millennial (87%) investors across the globe prefer social media to interact with their financial advisors. They rely on the wisdom of their peers and social media influencers to make investment decisions.

Do you wish to improve your understanding of these new-age investors and effectively capture their share of wallet while keeping your sales communication persuasive and compliant?

Then, know that an overwhelming majority of advisors (92%) find social media helpful in securing new clients. To grow your leads and sales pipeline, focus on how your advisors pitch financial products on these social platforms.

It's crucial to note that in 2020, Financial Industry Regulatory Authority (FINRA) sanctions alone totaled $94 Million. This represents a 34% increase in fines from the previous year. Thus, the cost of compliance is a heavy burden for businesses operating in the financial services sector.

Luckily, it can be totally avoided with the right tools and planning.

Introducing Sprinklr’s Distributed for financial services

Social engagement is the fuel that powers growth in future-ready financial services companies.

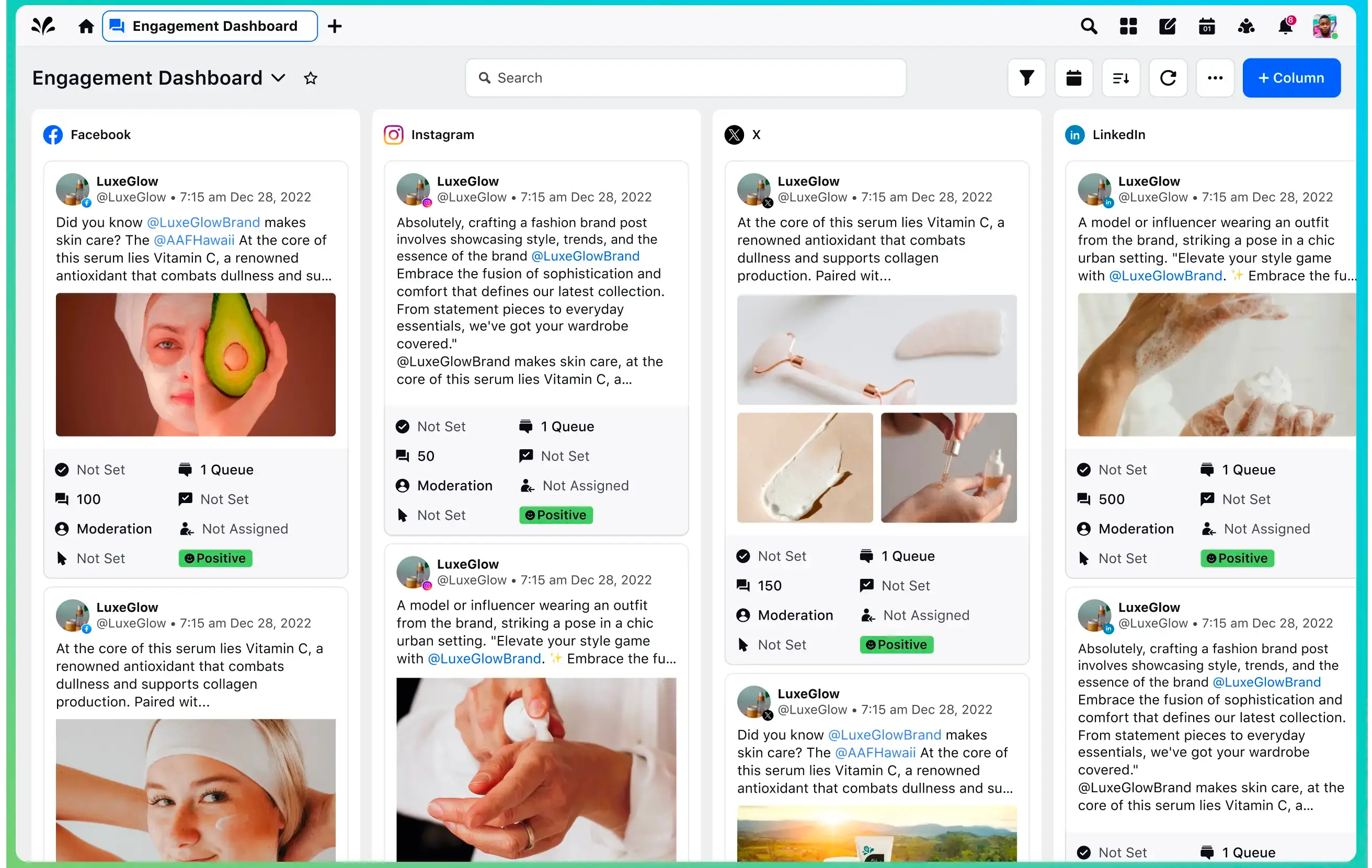

No matter how many markets or channels your business expands to, Sprinklr’s Distributed makes it possible to localize marketing efforts and ensure regulation and brand-compliant customer experiences across 24+ social and eight messaging channels.

Purpose-built for enterprises, our unified AI-powered distributed marketing platform can accelerate digital transformation and produce tangible outcomes for your business by:

Growing sales numbers

Generate more leads and optimize engagement through tools that enable collaboration and improve content capabilities as Sprinklr supports your network of local advisors across channels.

Improving productivity

Offer advisors easy access to pre-approved content with just a few clicks on the mobile app. The corporate team can then review and edit the content on the go. The platform automatically monitors and publishes social posts while your team focuses on selling.

Avoiding compliance breaches

Put forth honest, transparent, and consistent messaging to your customers, thanks to capabilities like Delegate Management, Smart Assist, and Shared Assets. This protects your brand’s reputation and helps you save thousands of dollars in fines.

The way forward in financial services

1. Empower advisors with relevant content and social engagement capabilities

Many still consider the financial services sector a ‘low-tech’ industry.

Advisors often lack solid social engagement capabilities and access to real-time consumer insights to improve communication effectiveness. Since manually creating, personalizing, and managing content across multiple channels is time-consuming and inefficient, advisors end up spending more time marketing and less on actual sales.

Now, onto the good news: with the right marketing tech support, it is possible to maximize the efficiency of your social engagement strategy.

It can arm your advisors with content tailored to the specific preferences of each prospect or customer. At the same time, it helps continuously track the performance of the marketing efforts and uses the resultant insights to improve the messaging and targeting.

How Distributed helps

Distributed offers a content library with easily discoverable, approved, editable, high-quality assets and templates. This enables each local team to develop strong connections with a new breed of investors who expect real-time and personalized online engagement. Our AI-powered suggestions allow your advisors to choose the best content and times to publish.

Distributed teams may also sign up for campaign subscriptions. This allows the relevant content to be automatically published according to schedule, thus saving time.

Thanks to our real-time listening and performance insights, your advisors can access social media marketing, customer, and industry insights, enabling them to deliver the highest advisory and customer experience.

2. Ensure governance and brand compliance across touchpoints

Customers trust you with their money. To retain their trust, your business needs to avoid compliance breaches by bringing transparency to marketing and sales communication. Your online ads and communication cannot offer misleading or false claims, target the wrong audience, or miss out on disclaimers.

Non-compliance with regulations or misinformation can cost your business millions of dollars in fines and lead to your advisors’ suspension. That, along with publishing off-brand, inconsistent, and unapproved content on social channels, will destroy your customers’ trust.

Most companies are also unable to maintain audit trails of social media activities, which means non-compliant activities cannot be easily traced back to their source. Additionally, it isn’t easy to delegate and ensure seamless governance and fool-proof brand compliance when you use several disparate point solutions.

How Distributed helps

Tired of erroneous and non-compliant social media posts sneaking up on you? Distributed helps establish proactive compliance workflows and share brand-approved content with advisors.

Powered by our Proactive Lexicon Matching technology, any content that local teams wish to publish online is routed to the central team for approval (Tiered Approvals). Non-compliant messaging is detected and stopped from being published automatically.

Our solution also automatically pulls up published posts for the compliance teams to review and suggest edits. Additionally, it flags changes made to the native platform content.

Meanwhile, the Profile Management capability ensures that advisors’ social profiles are brand compliant.

3. Better collaboration between corporate and field sales teams

Does it take forever for your advisors to get approval on the content they wish to share with prospects? Do you hear complaints from advisors about not receiving the latest sales assets and guidelines on time?

Then you need to improve the frequency and quality of communication with your teams situated on the edges of the organization. To this end, adopting an AI-powered collaboration platform is key.

Most banks and insurance companies have very limited control over marketing and sales efforts in different territories because approved customer insights and content suggestions from the corporate often don't percolate efficiently to the field teams.

And even if the advisors secure hot leads, there is no mechanism to route them to the next level in the sales funnel. Then, there is the issue of advisors not having access to live support to resolve their sales-led concerns or queries. And because the sales and central teams use different and disparate software, there tend to be major challenges in collaboration.

How Distributed helps

To offer a consistent brand experience, a collaboration between advisors and corporate teams is non-negotiable. Distributed enables the central team to seamlessly share digital assets, which can be personalized and reused by the field teams.

There are also RSS and brand feeds for advisors to gain access to the latest collateral and stay up-to-date with messaging from the corporate. And in case the local advisor has a concern or query, the tool manages incoming messages through a unified inbox and uses Macros for escalation to central teams.

Success Story

Before adopting Sprinklr, a leading bank used another social engagement vendor. Their vendor couldn’t grow the bank’s advisor base and cover new channels. Also, it didn’t help as the platform was slow to innovate and meet the client’s unique needs.

Additionally, the client wished to boost advisor productivity and clear-cut sales and revenue goals. Hence, they switched to Sprinklr’s highly scalable and configurable distributed marketing platform.

Once the client adopted Distributed, the flow of information from its corporate headquarters to individual branches, agents, and advisors was streamlined to ensure on-brand messaging.

We helped them secure greater channel coverage and offered a lot of innovations within the tool, which were huge value additions. Ultimately, we enabled them to maximize engagement with their local customers and grew the count of advisors in their social engagement program from 1300 to 2500.

Do all of the above on the go

Not just customers’ but even your advisors’ expectations are shaped by everyday interactions on smartphones and other digital devices. Hence, they expect to access sales and marketing platforms on the go.

The Sprinklr Empower mobile app lets you and your field teams plan and publish on 30+ channels directly from your mobile devices. No matter where you are, you can manage content and assets, send them to the local team, and review every post’s performance.

Ultimately, we make it possible for you to grow your customer base by 50 to 90% through

- Social media management on the go: helps advisors plan campaigns, publish, share, and approve posts on social media, from anywhere and anytime, with just a few taps on an intuitive mobile app.

- Better collaboration: offers sales teams working on the edge of the organization access to consistent messaging in the form of approved content from the corporate team at scale.

- Governance and compliance support: enables regular audits and absolute control over sales content shared within the organization and on social media. Thus, advisors may conduct customer interactions without worrying about regulatory infractions, lack of alignment with the central team, a risk to brand reputation, or confidentiality breaches.