The next generation of CCaaS is here

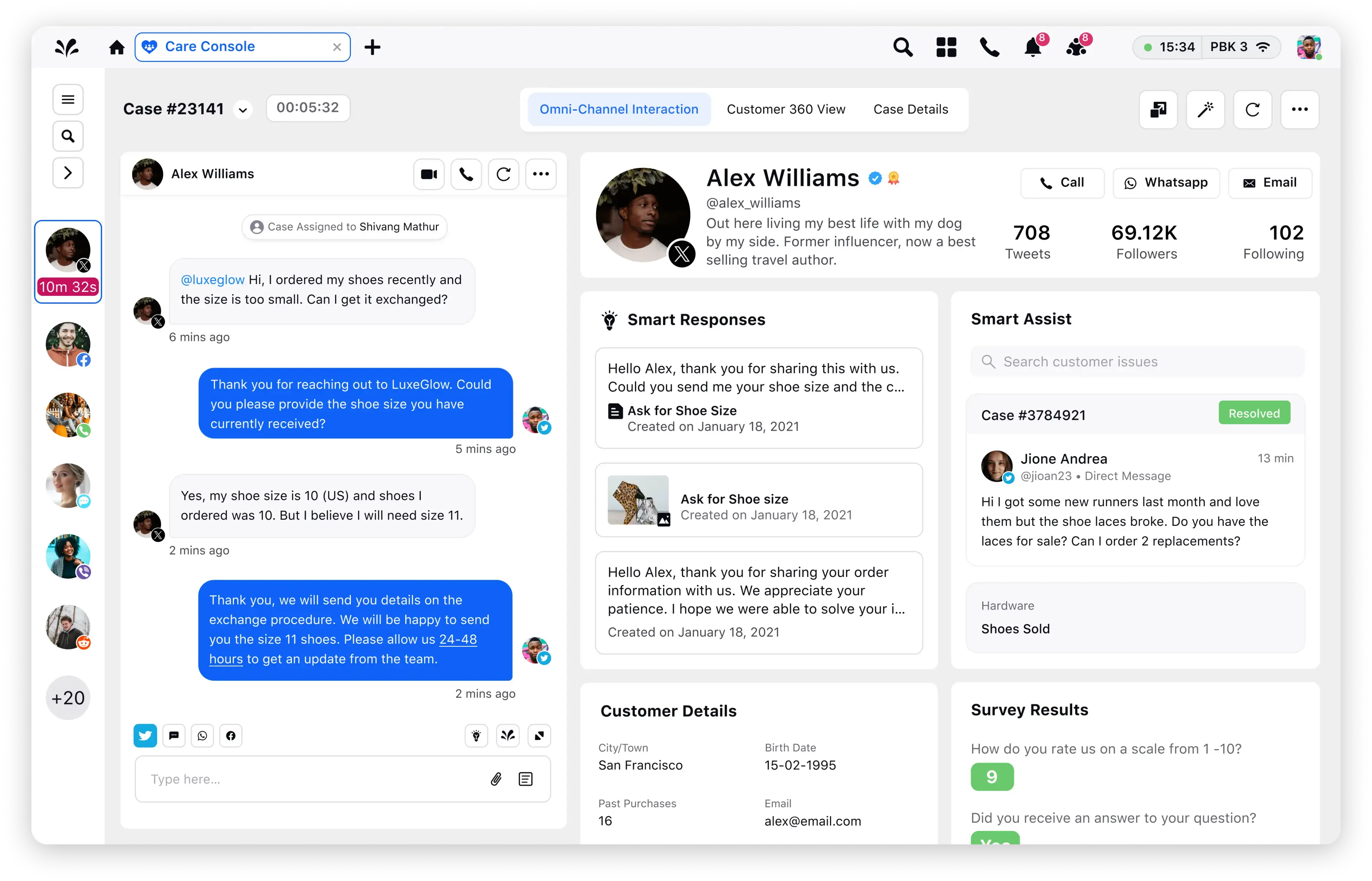

Digital-first customer service, enterprise-scale voice support. Redefine customer service with an AI-powered platform that unifies voice, digital and social channels. Power channel-less interactions and seamless resolution no matter the channel of contact.

Improving customer experience in insurance using social media (2023)

Customer acquisition in insurance is 9x more expensive than customer retention. Therefore, insurers must increase their presence on social media channels to keep policyholders satisfied and engaged.

So, what does this best-in-class insurance customer care look like?

It’s personalized, cross-platform, and immediately accessible from customers’ preferred social channels.

Let's explore how leading insurance brands leverage social media channels to deliver customer experiences that inspire loyalty and attract new customers.

Why is social media marketing important for insurance businesses?

Here are the top three reasons to consider social media marketing for insurance companies.

1. Offer customer support

Social media allows users to connect directly with their insurance companies over a message or a tweet. Your customers no longer need to wait in long queues to address their queries over a call or an email.

Lesser response time on social media enhances customer experience, builds strong relationships and creates customer loyalty.

2. Build trust and credibility

Statista suggests that only 48% of customers trust insurance companies. Due to the high risk associated with insurance policies and poor claims experiences, policyholders lack trust in insurance companies.

Social media channels act as a goldmine to address trust issues and build credibility. For example, since the devil is in the details, most customers get confused about what their insurance policy covers. A renowned Indian insurance brand came up with the campaign #Coveredhai to call out their offerings.

3. Social listening

Social listening allows insurance brands to monitor social channels and act on what people are saying about your brand, products, and competitors. It gives you insights into brand perception and customer satisfaction. You can create content that resonates with your followers and customers.

Sprinklr's AI-powered social listening tools tap into millions of conversations over 30+ channels and offer actionable insights. We help brands identify the trends, topics, and influencers that matter most to insurance customers and use those insights to drive better business decisions.

How do insurance companies use social media?

Resolving customer issues on social media costs only 1/6th of the contact center resolution and increases revenue by 20-40%. A strong social media strategy for insurance companies would ensure the following action items:

1. Awareness

Insurance companies must craft social media posts to spread awareness and ease prospects by offering educational content. For example, Geico insurance leverages X, formerly Twitter like a pro to engage and inform its customers. The posts are simple and informative with a direct CTA.

2. Reviews & testimonials

Posting reviews and customer testimonials prove helpful in building trust. Due to the high risk, positive word of mouth goes a long way in customer acquisition for these insurance brands.

3. Business updates

Insurance companies must keep their customers updated to help them make informed choices. For example, any changes in the working hours during the holiday season, revised policy terms must be transparently communicated on social media.

4. Frequently asked questions (FAQ)

To answer frequently asked questions insurers must leverage the concept of micro-learning and put up FAQ posts or bite-sized videos for better understanding.

5. Entertainment

Social media trends change quickly, and every now and then insurers need to join the bandwagon to remain relevant and engaging.

Best social media channels for insurance companies

Every social channel yields different results and is suitable for different types of content and posts. It's better to choose the most relevant channels for the insurance industry for effective engagement.

Here are the four most preferred social media platforms for insurance agents:

1. Facebook

Facebook has over 2.89 billion monthly users, and is a critical platform for insurance agents and companies. Instead of boring static images, Facebook allows users to create a mix of text, images, and videos for better engagement.

For example, IDI insurance leveraged Facebook campaigns to improve brand awareness and manage customer relationships. The campaigns resulted in a 2.3x increase in car insurance quote requests and a 25% decrease in cost per acquisition.

2. X, formerly Twitter

People don't like making small talk, but they definitely appreciate bite-sized content. X, formerly Twitter is the most preferred platform for posting short-form content. Seven out of 10 Americans use it as a news source.

Insurance companies can put out creative posts and link them back to their sites for additional information. With the character limit increasing from 200 to 4000, insurance brands will be able to leverage the platform better.

3. YouTube

Video is the most consumed content form. YouTube is the most powerful, engaging and trusted video-based platform with over 2 billion monthly active users. Insurers can embed the youTube video in other forms of content to make them more interactive.

For example, the Unskippable ad campaigns run by Geico insurance were a creative way of communicating how its customers can save up to 15% on car insurance in mere 5 seconds. The ad even won the Film Grand Prix at the Cannes Lions International Festival.

4. Instagram

Instagram has over 1 billion active users and it allows insurance agents to use picture-based content. Given that more users are shifting to Instagram from Facebook, it is a smart choice for customer outreach.

4 Insurance brands that excel at social media customer care

Here are four insurance brands that deliver superior customer care on social media.

1. AXA

Paris-based insurance company AXA understands the benefits of providing social care. As CEO Thomas Buberl said, “The key is to be where customers are.”

After AXA France launched its customer care operation on Facebook Messenger, it saw 81% of questions on social media come through that channel and reduced negative comments on the AXA France Facebook page by 53%.

AXA uses Facebook to share new insurance policies and links to informative blog content, and to answer customer questions – even in the comments sections of posts, as with this exchange:

AXA also continues to be transparent about their customer care on Facebook, proudly posting updates like this

Responding to queries within an hour is no small feat. According to a study by Convince & Convert, 42% of customers expect a response within an hour and 32% expect a response within 30 minutes. Brands that don’t deliver will be left behind for those – like AXA – that do.

2. Allstate

In 1950, an Allstate general sales manager coined the motto “You’re in good hands” after his wife told him their ill daughter was “in good hands” with her doctor. Almost 70 years later, the motto still holds strong – today reflecting the high level of care that Allstate provides on social media.

Allstate has a separate X, formerly Twitter account, dedicated just to providing customer service on the platform. Care representatives respond quickly and include their initials on each post so customers know there is a real person behind each interaction. They also use Twitter’s DM prompt feature, inviting customers to switch to a private chat with just one click.

Allstate proves that you don’t need to be a startup or tech company to make an effort on social channels. By launching social care channels, insurance companies can reach customers where they’re already active and provide real-time care.

3. Progressive

Progressive mascot and fictional salesperson Flo isn’t just the star of the insurance brand’s commercials. She also has her own Twitter account and Facebook page where she responds to customers' queries.

The main Progressive X, formerly Twitter account also responds to customers’ comments and concerns:

Further Progressive ensures the conversation doesn’t end on X, formerly Twitter. It provides follow-up communication channels and links to content from the #ProgressiveAnswers site, which includes helpful articles like “Should I add my teen driver to my policy?” and “Do accidents affect insurance rates?”

4. Country Financial

Country Financial knows its customers. With “roots firmly planted in agriculture,” the company has steadily grown its insurance range to meet the needs of rural America – from fire and lightning protection to hail crop and farm equipment insurance to life insurance.

Founded in 1925, Country Financial has come a long way since those early days of paper rate books filled in with pencils. The company has a lively, interactive social media presence. The brand handle on X, formerly Twitter responds to customers on a 1:1 basis and even takes part in Tweet Chats.

Not knowing where your 💰 is going? That’s stressful. ☝ word answer: budgeting. If the thought of a budget is overwhelming, try the 50-30-20 rule:

https://t.co/JkJ9tGXJCE#InsureYourLoveChat

— COUNTRY Financial (@hellocountry) February 7, 2019

#RealTalk…You may be surprised how affordable life insurance can be. Tips 👉 https://t.co/sEhtDXgoLP#InsureYourLoveChat

— COUNTRY Financial (@hellocountry) February 7, 2019

By answering questions and contributing to financial planning discussions, Country Financial shares helpful information while keeping its brand top-of-mind among potential customers.

Conclusion: care trumps cost

Call centers and support emails are important, but insurance companies must provide care on social media, if they want to retain their customers and attract new ones.

McKinsey found that settlement amount ranked 12th among factors driving customer satisfaction with auto insurance company claims. The critical factors were employee courtesy and ease of communication. Meaning customers cared more about the quality of their service than the cost of their payment.

Therefore, companies like Allstate, Progressive, and AXA are ahead of the game – making social an integral part of their care operations and creating interactive experiences that keep customers invested.