The AI-first unified platform for front-office teams

Consolidate listening and insights, social media management, campaign lifecycle management and customer service in one unified platform.

Conversational AI in Banking Guide: Application & Examples

AI in banking is not a new concept. Ever since the first ATM emerged on the banking horizon, transactions have moved from offline to online at an astonishing pace. With AI enrichment, online banking has become more affordable and accessible for banks and customers, respectively.

Conversational AI in banking, or “conversational banking” marks a shift from impersonal, robotic interactions to personable bank-bots that juggle multiple requests with a human touch. The key to banking success remains stellar customer experience.

Today, 81% of bankers believe the ability to unlock the power of AI will be the key differentiator between successful and not-so-successful banks.

FinServe is one of the top 3 industries to experience maximum gross value added (GVA) by implementing AI solutions.

Are you behind the curve on this one? Then this article will give you the confidence to navigate conversational AI in banking use cases and use it to your advantage. Read on.

- The evolution of conversational AI in banking and finance

- Top applications of conversational AI in banking

- 1. Individualized financial advice

- 2. Uninterrupted transactional assistance

- 3. Easy document collection and sharing

- 4. Customer onboarding

- 5. Query analysis and intent detection

- 6. Strong compliance and governance

- 7. Competitive benchmarking

- Ace conversational banking with end-to-end digital solutions by Sprinklr

The evolution of conversational AI in banking and finance

COVID-19 disrupted the banking ecosystem, shaking bankers out of their state of inertia. Almost overnight, customers defected from their long-standing preferred bankers to new entrants that offered personalized and convenient banking from the comfort of home.

From retail to education, most industries went online during the pandemic. Customers expected the same agility and convenience from banks and financial institutions – an expectation that accelerated FinServe’s AI adoption and digital transformation.

In addition, open-source projects from players like Google and Amazon have proliferated AI skills and made it a household name. Today, we have conversational AI tools like:

- Gen AI that converses with users like live agents

- Voice bots that interpret voice queries in multiple languages

- Conversational IVR that enables customer self-service at scale

Top applications of conversational AI in banking

Conversational AI in banking has manifold applications and use cases, including:

1. Individualized financial advice

Conversational banking generates a wealth of insights pertaining to the customer’s:

- financial goals

- investment preferences

- risk tolerance

- repayment history

Armed with all this intel, banks can make smart recommendations on investment products and retirement plans for each user. When recommendations and messaging are targeted and tailored to user needs and preferences, conversion and retention rates multiply. Strategic AI-led campaigns yield better results than random, spray-and-pray kinds and also breed customer loyalty, repeat sales and high customer lifetime value (CLV).

2. Uninterrupted transactional assistance

Chatbots and virtual agents on websites and apps can provide quick assistance in routine banking tasks like checking account balances, revising credit card limits, transferring funds and paying bills. Conversational AI enables them to read customer intent accurately, presenting them with relevant troubleshooting options in the first go.

What’s more?

For out-of-scope complex queries, bots either pull contextual help articles from the integrated knowledge base or route cases to a live agent. This way, customers get 24/7 transactional assistance without in-person visits or lengthy phone calls, invariably boosting customer satisfaction (CSAT). That’s not all, chatbots can send instant alerts to customers when refunds are issued, high-value withdrawals and deposits are made, checks are dishonored, or payment due dates are near, enabling quick action and preventing missed deadlines.

If you’re looking for a truly smart FinServe chatbot, consider Bank of America’s Erica. The intuitive bot sends proactive financial advice based on the user’s spending pattern and content around financial literacy, keeping users on track with sound investments.

3. Easy document collection and sharing

The majority of banking tasks revolve around documentation. From loan applications to value-added service activation, everything requires tons of documents from the customer. That’s where conversational AI banking tools like chatbots enter the picture and make life easier.

But how?

Chatbots can share forms and document lists with customers and send automated reminders for missing documents and approaching deadlines. Gathering approvals and digital signatures are also within the bot's purview.

Automation of this initial step of document collection and sharing can save a lot of grief. Imagine a customer’s loan application repeatedly gets denied owing to some absent document or the other. In the absence of chatbots and conversational AI, they would be left with no option but to trudge into the bank to complete paperwork. But with virtual assistants at their fingertips, all of this can be done friction-free from the comfort of their home, which substantially reduces customer effort score (CES).

4. Customer onboarding

Smooth, frictionless customer onboarding is crucial for business growth and revenue generation. Successful onboarding improves product adoption and usage, ensuring customers don’t churn in the early days. With conversational AI platforms assisting along the way, time to value decreases and new customers start yielding a bankable revenue stream quickly.

For instance, a new credit card owner can approach your FAQ chatbot to inquire about things like card usage charges, loyalty programs, cashback schemes, penalties, etc. The chatbot can share terms and conditions and other company policies, familiarizing the user with the company and product.

Learn more: How to optimize user onboarding and shorten time to value

5. Query analysis and intent detection

FinServe brands typically experience a surge in incoming traffic, especially during taxation and investment windows. That’s when conversational AI’s sentiment analysis and intuition moderation capabilities help keep case queues uncluttered and capture missed opportunities.

How does that happen?

With the proliferation of digital channels, customers have started interacting with financial brands on a spate of customer touchpoints, including social media. It’s easy for customer support agents to lose track of priority queries in the deluge of incoming messages – all marked URGENT and IMPORTANT!

Conversational AI’s algorithms can segregate engageable messages from the noise, determining their sentiment and severity objectively and prioritizing them in the queue.

Need an example? A prominent financial institution in the APJI region was struggling to filter sales and engagement opportunities amidst banal social media messages. Lack of automation was breeding low agent productivity and operational inefficiency, reducing their contact centers to mere cost centers. Additionally, there were lapses in case routing and prioritization, as well as holistic reporting.

The solution: The brand found refuge in Sprinklr’s product suite, specifically Sprinklr Insights and Sprinklr Service. The former used social listening to reveal insights into the intent and sentiment of customers and prospects as well as their preferred channels. Thereafter, the latter sprung into action, routing engageable messages to appropriate channels and agents, delivering speedy and personalized responses with minimal manual effort.

The outcome: Post-implementation, there was a weekly spike of 110% in relevant inbound messages, with Sprinklr’s intuition moderation closing 45% of the cases agent-less. The company was able to cater to an ever-expanding user base in online customer service channels without overwhelming agents or compromising service quality.

6. Strong compliance and governance

Digital transformation is challenging in a highly regulated industry like Finance owing to evolving customer expectations, regulatory requirements and public scrutiny. The complexity gets compounded when different teams use disparate tools for managing customer data and interactions.

While modern channels like social media platforms enable 1:1 interaction, they also pose unprecedented challenges in data security, governance and compliance. Interacting with customers, prospects and leads in a compliant way is arguably the biggest challenge for financial brands.

85% of people expect compliant yet customer-centric experiences akin to Amazon and Google, from FinServe brands

- Source

Conversational AI un-siloes teams, data and processes, raising alerts when compliance is breached on any channel. It assesses potential risks, establishes risk-mitigation frameworks and regularly updates existing systems to ensure they are compliant with ever-changing regulatory requirements.

The result?

Robust brand reputation management and enhanced customer trust in an era of heightened public awareness and scrutiny.

7. Competitive benchmarking

Competitive benchmarking is another facet of banking where conversational AI drives insights by omnichannel signal processing.

What does this mean?

It entails collecting data from varied touchpoints, including internal CRM systems, social platforms, website behaviors and more. Thorough customer profiling informs strategic decision-making, targeted campaigns and tailored messaging, making inroads into a competitive industry that thrives on personalization and customer-centricity.

Conversational AI drives digital transformation in FinServe by yielding competitive insights broadly categorized as:

- C2C (consumer to consumer)

- B2C (business to consumer)

- C2B (consumer to business)

In C2C, AI-powered social listening tools track mentions of your brand and competitors, identifying broad sentiment as positive, negative or neutral. AI can also predict the fate of thematic campaigns before launch and gauge audience sentiment around topics/campaigns/products that are in the pipeline.

Via B2C and C2B insights, banks can locate – and target - customers who are “in the market” for finance products. They can also form strategic partnerships with complementary product vendors to reach potential customers and sell more aggressively. For example, a university student looking for houses on a real-estate portal will be eligible for a housing loan, becoming a marketing-qualified lead for a bank.

Ace conversational banking with end-to-end digital solutions by Sprinklr

Traditional banking brands must deliver exceptional customer value in order to stride ahead of emerging players and stay viable in an ecosystem fraught with pricing and regulatory upheavals. End-to-end digital solutions enable banks to pinpoint customer friction points and innovate solutions that are future-ready and cost-efficient.

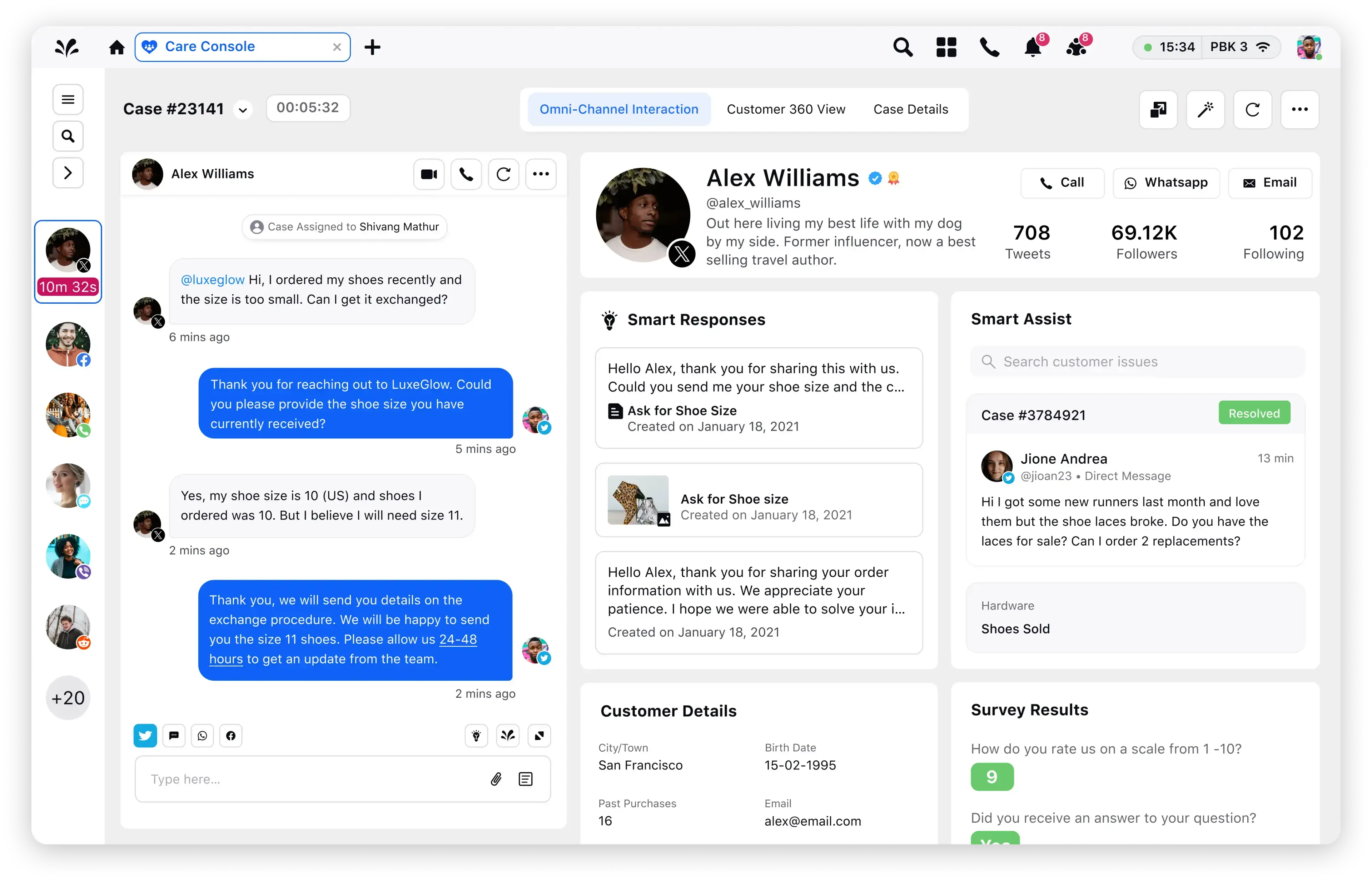

Sprinklr’s Unified Customer Experience Management Platform is the answer.

How so?

With an industry-leading conversational AI platform that extracts granular insights, locates selling opportunities, delights users with human-like answers and flags non-compliance at the first turn, Sprinklr is a strategic partner for progressive banking brands.

Request a demo of Sprinklr for your unique business use cases.

Frequently Asked Questions

Conversational AI in banking has varied applications, including:

- Customized financial advice

- 24/7 transactional assistance

- Fraud prevention and identity detection

- Query analysis and intent detection

- Competitive benchmarking

- Compliance and governance

Security is a major concern for highly regulated secyors like banking, and conversational AI ensures it by encrypting and masking sensitive data and storing data in databases requiring authentication and access control. Moreover, when conversational AI applications integrate with third-party tools, secure APIs crafted with industry best practices are used. Lastly, all AI applications are regularly tested and audited for loopholes and security.

The speed of implementation is governed by varied factors like the bank’s existing AI infrastructure and application complexity. However, there are out-of-the-box solutions like Sprinklr Service Self-Serve that come with no-code, customizable chatbots for quick deployment. Try it now, it’s free for 30 days.