The undisputed leader in social media management

For over a decade, the world’s largest enterprises have trusted Sprinklr Social for its in-depth listening, unmatched channel coverage, enterprise-grade configurability and industry-defining AI.

Top 3 digital transformation strategies to make you the best fintech company

“Banking is necessary, but banks are not.” This was a prediction Bill Gates made 28 years ago!

Fast track to 2022, cryptocurrencies and cashless transactions reflect the paradigm shift in the financial services industry due to digital transformation. It’s not just limited to financial services today. It applies to fintech, insurtech, RegTech and techfin too.

Traditional banks have a long history; as financial institutions, they have evolved and withstood the tests of time. But, even the mightiest institutions fail if they don’t learn to adapt as per the changing needs of the customers.

After all, digitally-savvy consumers need digitally-savvy companies.

And herein lies the problem, are you a digitally-savvy company?

If you aren’t, start with understanding digital transformation and how it can play a vital role in revitalizing financial services.

- What is digital transformation in financial services?

- What are the key areas of digital transformation in financial services?

- How will banks succeed in digital transformation?

- 1. Collect insights and analyze data

- 2. Leverage the power of social media

- 3. Choose the right technology stack for a highly regulated industry

- How will digital transformation help your finserv company?

- What are the new trends in digital banking?

What is digital transformation in financial services?

Digital transformation in financial services is optimizing functions like accounting by using technology to build efficient operating systems for better and faster customer service.

Your customers are present across multiple channels today. Mobile phones have given them a plethora of options. For every day to day task, you have an app today, why should finance lag behind?

Some companies like JPMorgan Chase understood it sooner and recognized themselves as a technology company. They allocated a budget of $9 billion employing 40000 technologists to create intellectual property for the firm.

As a finance company, look into different aspects of your business and identify areas where technology could be leveraged to serve customers better and allocate resources accordingly.

What are the key areas of digital transformation in financial services?

Digital transformation in financial services will make banking much faster and more efficient. Though, it’s easier said than done. Implementation and execution face these three challenges:

Upskilling workforce: A significant part of your workforce would need to upskill themselves. Three out of four workers don’t have the digital skills required by organizations. Digital transformation happens when your workforce is empowered to look for solutions. They should know how to automate repetitive tasks and spend more time doing creative work.

Remote work was rarely an option in financial services, but the pandemic forced these finance companies to build a strong remote working model. Wherein the workforce has the necessary training and setup to work remotely.

Institutions like Wells Fargo and Bank of America in 2020 asked around 70% of employees to work from home. These financial institutions leveraged virtual reality to train their employees and make them more efficient at working from home. They made them adept at using digital tools and trained them on how to be a team player while working remotely.

Security and compliance: Banks and traditional financial players are prone to high-security risks. As a financial services company, you deal with a large volume of personal data and transaction records. As high risk is involved, transitioning to new technologies and meeting compliance requirements is a challenge.

COVID-19 transformed banking, increasing the adoption of digital tools and online wallets. In 2023, digitization will be viewed through different angles of security and stability. Security and risk management should be the center point for you with more investment in data infrastructure, reporting capabilities and compliance.

Digital and contactless payments: Retailers had to up their e-commerce capabilities to make sales. Customers have been shifting toward online purchasing for years, and post-2020, online payments have become a common norm. Visa reported an astonishing 150% increase in contactless payments in the US alone.

People are making transactions directly with vendors. The role of traditional banks that failed to embrace technology has drastically reduced. If you are a traditional bank, you still have an edge because they are familiar and score high on trust. However, you must focus on ensuring a secure environment for digital and contactless payments.

How will banks succeed in digital transformation?

Yes, the transition will not be smooth — especially without the right strategy. Keeping your key business objectives in mind, consider the following for building and executing digital strategies in financial services.

1. Collect insights and analyze data

Data should guide digital transformation in financial services.

Consider the enormous amount of structured and unstructured data you already have from customer interactions on your website, social media, and through your customer care team. Then supplement it with data you might be missing, such as:

- Competitive insights and benchmarking

- Customer sentiment

- Media monitoring and analytics

- Critical industry and market trends

- Product insights

Synthesizing this data into actionable insights should be the first step toward building a digital strategy in financial services. It can help you understand the following:

- Digital channels your customers prefer

- What do your customers and prospects think about your brand

- Learn what your competitors are doing and act on these insights

- How to improve the customer experience in financial services

This 360-degree view of your target audience, customer experiences, and organization will help you prioritize your business's most impactful digital initiatives.

For example, insights you gained from AI-powered social listening show that your customers prefer to do business on an app instead of in person or a website. In that case, you may want to invest more into developing a designated app to ensure a positive user experience with effortless mobile capabilities and seamless live chat or AI chatbot support.

Or maybe you learn that your customers are asking questions, sharing concerns, and giving feedback through certain social media channels — but you’re not there to address them. It, in turn, leads to negative sentiment about your brand.

You may want to allocate resources to a more robust social media strategy that includes engaging with and responding to customer interactions on these preferred channels. Regardless, let data inform those decisions if you look forward to enhancing social media marketing for financial services.

2. Leverage the power of social media

Take the example of Morgan Stanley Wealth Management, their organization roots back to 1873, but they leverage social media like modern-day startups. With massive followings across different social media platforms, in 2013, a Morgan Stanley agent used LinkedIn to get a $70 million account.

Phenomenal, right?

Social media has become the source of truth for many consumers. What about social media for financial services?

People leverage it to research and read reviews before investing time and money into a brand. Feedback, reviews, concerns, and questions are shared across social media channels. You need to meet your customers across these digital channels to ensure you get opportunities to build great relationships. That’s how you create great customer experiences by providing consistency in conversation across multiple channels.

How to improve customer experience in financial services using social media?

Customer experience goes beyond customer service. Don’t just be reactive to your customers, be proactive to their needs. Today, CX transcends excellent service at banks to being able to access their bank account through multiple channels and getting their queries answered instantly to real-time engagement with zero tolerance for data breaches.

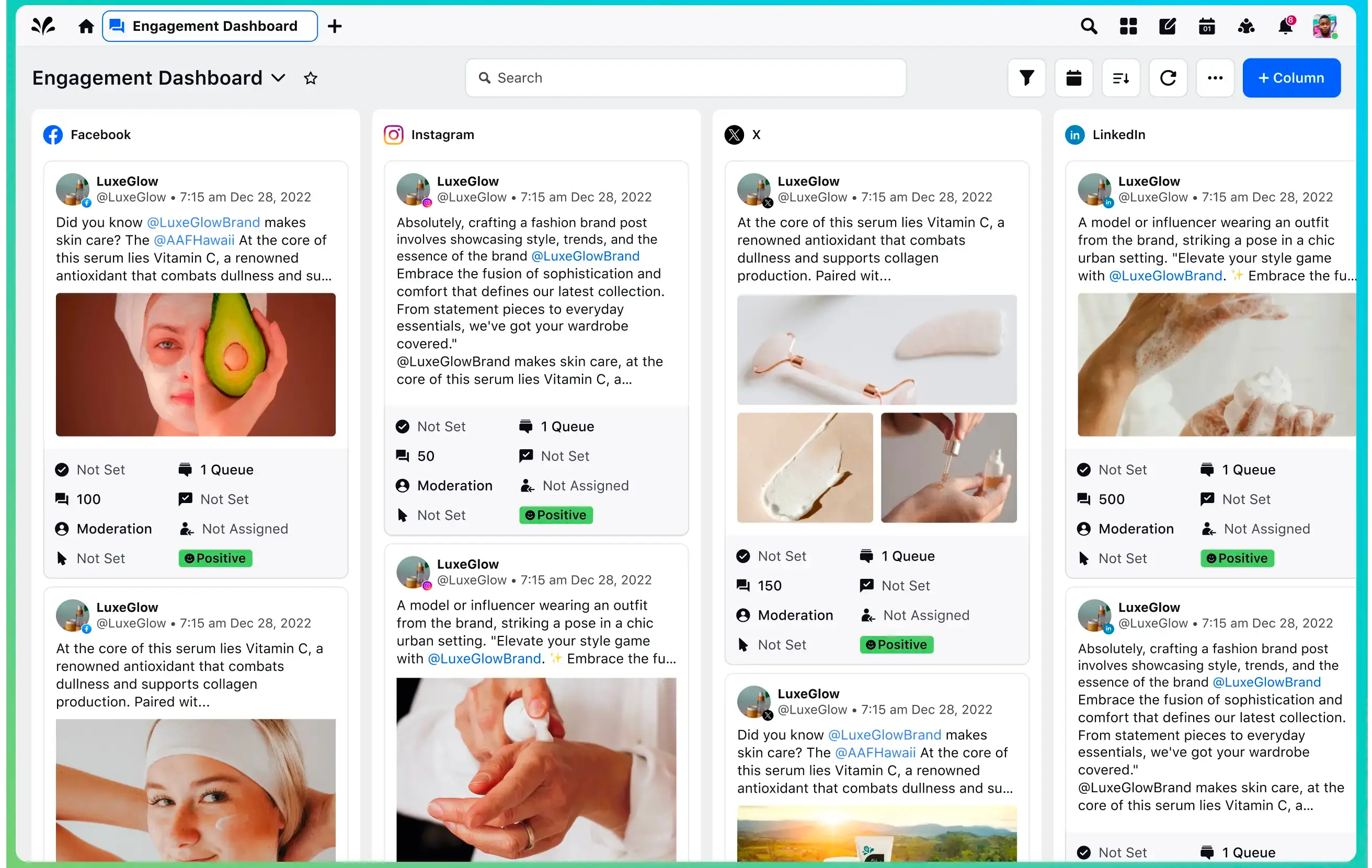

You can capitalize on social media in many ways, but posting and interacting on your corporate brand handles is the most common way. Automating social publishing and engagement is an easy way to ensure you’re engaging with your customers on the channels they prefer.

But if your brand is spread across multiple regions and locations, how would you ensure consistent messaging? What can you do to deliver a personalized experience, irrespective of location?

In financial services, though, corporate brand handles usually aren’t accessible to local branches. So, your local teams can use a local social solution to enable regional branches to reach a more targeted audience to ensure regulatory adherence and brand compliance. It will add tremendous value to your digital strategy in financial services.

And, if sales representatives are eager to speak directly with potential customers, social selling solutions can be a great way to identify, connect with, and nurture prospects.

3. Choose the right technology stack for a highly regulated industry

It is often impossible to execute a successful digital strategy in financial services. With so many regulations to adhere to, data to sift through, and tools to choose from, the right solution can make all the difference.

The mistake many companies make is selecting a different solution for each need:

- Social media managers have one tool for posting to and engaging on branded handles

- The data and analytics team has a separate tool to gather metrics and view dashboards

- The customer care team has another tool for communicating with customers and addressing their issues

Too many tools lead to silos between departments, causing confusion, misalignment, and mistakes that can lead to costly regulatory fines.

How will digital transformation help your finserv company?

Below are five advantages of digital transformation in financial services:

Better customer experience: Customers are digitally savvy, and you need to catch up. Digital transformation in financial services can help you track and engage in real-time with customers. It will also help you offer personalized products and services.

Impeccable operational efficiency: Implementing digital transformation will optimize your operations by automating repetitive tasks and streamlining data. It will save you time and money.

Precise data management: Collecting, storing, and managing data is simpler now. You can leverage this data to gather insights leading to insight-driven decisions.

Lower transaction costs: Online cashless transactions will become more mainstream. It would lead to a reduction in money spent on delivering physical cash through intermediate channels.

Real-time reporting process: With real-time data available, you are more equipped to handle customer complaints and spot problems early.

What are the new trends in digital banking?

We are talking about change and keeping a tab on the latest trends always keeps you ahead in your business. Here are three trends to look forward to in digital banking:

Trend 1: Customers are AI-ready, but building trust is essential

The impact of technology on financial services is massive – even fintech and top players in financial services are heavily investing in AI, automation and security to give better customer experiences.

As a bank, you need to show you care about your customer and build more positive experiences when it comes to technology. Only then will your customers feel comfortable discussing their financial matters with a chatbot deployed by you.

Trend 2: People love tech, but human connections still matter

Chatbots provide speed and efficiency, but what happens when your customer is frustrated? They do not need just quick solutions but an empathetic person to converse with – that’s where customer care agents become important.

Trend 3: Be proactive in finding out what the customer needs

Don’t just be reactive and wait for your customers to raise queries. Be proactive in detecting them. Nine in 10 of your customers would love getting personalized advice on finance, but only three in 10 get it. Finding customer gaps and fixing them is one of the best ways to create great customer experiences.

Newton’s first law of motion states, “an object at rest will remain at rest unless an external force is applied to it”. If you have been dormant to changing technology and customer needs till now, it’s still not late. Start by investing in the right software, a platform that will make your digital transformation journey easier.