The undisputed leader in social media management

For over a decade, the world’s largest enterprises have trusted Sprinklr Social for its in-depth listening, unmatched channel coverage, enterprise-grade configurability and industry-defining AI.

Six ways a distributed marketing platform can boost social media compliance for financial services advisors

The financial services industry is in the midst of a full-blown digital transformation, with social media and other digital channels squarely in the center. As a result, financial advisors are seeing unprecedented levels of success using social networks to identify prospects, reach customers, and engage more effectively with their audience. Today, 89% of advisors can attribute new client gains to their social media outreach.

Not surprisingly, financial services companies are similarly embracing digital channels as a growth opportunity — and advisors are sharing in the rewards. Nearly 90% of advisors said support from their firms made a positive difference in their use of social media by providing content to post, supportive resources, training, and more.

The benefit of this shared social media strategy is clear, including:

- Building relationships with existing and prospective clients

- Gaining key industry and customer insights

- Providing digital customer service opportunities

- Humanizing your brand with authentic engagement

But, with any reward comes risk. Because financial services brands operate in a heavily regulated industry, you need to develop a well-defined social media compliance strategy. Failure to do so can have significant consequences for your advisors, your brand, and your reputation.

Take the risk out of your social media strategy

Financial services companies and their advisors need to think about risk in two broad categories: regulatory compliance and brand compliance.

Regulatory compliance

Most financial institutions will recognize the alphabet soup of regulatory bodies that they need to comply with, depending on where they do business: FINRA, FCA, FFIEC, IIROC, SEC, PCI, AMF, GDPR, and so on. Failure to comply with financial services regulations risks severe penalties, ranging from license suspension for agents to fines that can reach millions of dollars (USD) and have an immediate and public negative impact on the offending firm.

Brand compliance

Brand compliance, on the other hand, refers to maintaining your brand voice and messaging to ensure a consistent experience for customers, no matter where you are reaching them. While brand compliance may seem less consequential than the severe fines associated with regulatory infractions, it creates an entirely different kind of risk — that your customers won’t see your engagement as authentic or credible.

Remember, the digital landscape is crowded. Chatter from brands and individuals alike means it’s increasingly difficult to stand out. When you arm your advisors with brand-compliant messages that have been proven to resonate with your customers, it increases the likelihood that they can break through the noise and make an impact.

Common compliance strategies you need to think about include:

- Ensuring compliant content at scale

- Mitigating unauthorized posting and profiles

- Capturing and archiving all social activity

- Training employees and advisors on regulatory policies

- Alerting on keyword breaches and providing real-time remediation

- Performing takedowns of non-compliant posts

- Monitoring advisor communication

Understanding these needs is one thing, but trying to deliver on them using a disjointed mix of point solutions can create more risk than it removes. A fully-featured distributed marketing platform can provide your institution with the governance, automation, and AI-powered insights that can help you and your advisors rise above the competition.

Six ways to help your advisors to stay compliant on social media

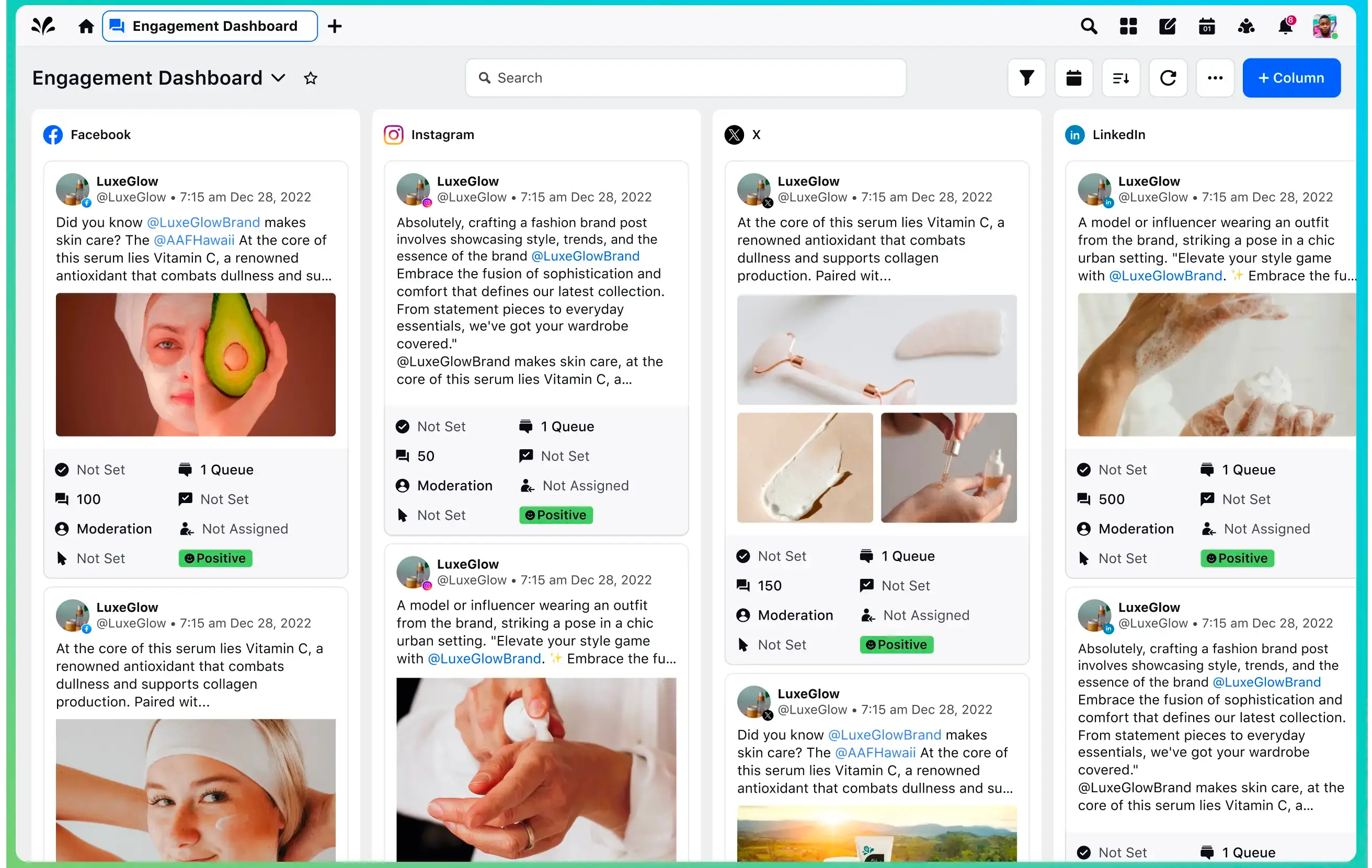

A distributed platform can help you address compliance challenges easily and at scale. Here is a rundown of the core challenges your firm may face and the type of technology solution you need to ensure social media compliance.

Challenge 1: Ensure compliant content at scale

Create and share compliant, pre-approved content and campaign subscriptions with your advisors. You can also lock content to ensure only the original, approved content goes out without any edits/changes. Additionally, features like content tagging ensure the right content is shared with the right group of advisors based on their line of business.

Smart Compliance technology is an AI-powered solution that helps advisors create brand-compliant posts. It highlights the use of non-compliant words to review or change and suggests hashtags, tonality, video optimizations, and more to help your advisors create their own compliant content.

Challenge 2: Mitigate unauthorized posting and profiles

Your distributed platform should define multi-tiered approval paths consisting of user approval, queue-based approval, or external user approval. A scalable and fully customizable rules engine will enable you to configure your approval workflow based on different requirements per line of business, business unit, region, or branches.

You also need a strong profile management capability to review and approve your advisors’ social profile additions or changes. This ensures that the advisor only adds their business profile and makes compliant updates. In addition, approvers can suggest changes where needed and any native update the advisor makes to their profile can be flagged in an alert to the compliance/admin team.

Lastly, AI technology can calculate an approval score for messages and helps approvers make better-informed decisions quickly.

Challenge 3: Capture and archive all social activity

Activity audits can ensure that you capture all activity from any user on any device so that you can store and revisit the audit trail at any time. Integration with WORM compliance tools is another feature that can help you meet regulatory needs for archival records (e.g., GlobalRelay, Smaarsh, and so on).

Challenge 4: Train employees on regulatory policies

Your platform should make it seamless to create and assign training courses and other materials to your advisors. This helps you train them on regulatory policies, brand guidelines, best practices, and more. In-platform guidance systems like WalkMe can help advisors learn and adopt best practices to stay compliant.

Challenge 5: Alert on keyword breach and real-time remediation

A distributed solution that enables keyword lists and native alerts can help you define your unique list of non-compliant keywords to monitor and alert you to keyword breaches.

Challenge 6: Regulatory and security needs

In the highly regulated financial services industry, regulatory and security features are a serious consideration, whether it’s GDPR compliance, annual security audits, or additional layers of data encryption, like message-level encryption.

See how Sprinklr Distributed enables social media compliance

Sprinklr Distributed helps some of the world’s largest financial services institutions maintain compliance, proactively protect their brand’s reputation, and empower their advisors to make human connections with customers and prospects at an enormous scale.

Download the Distributed for Finserv Visual Report and learn more about Sprinklr Distributed.