The undisputed leader in social media management

For over a decade, the world’s largest enterprises have trusted Sprinklr Social for its in-depth listening, unmatched channel coverage, enterprise-grade configurability and industry-defining AI.

Social Media in Financial Services: Best Practices and Examples

Social media presents limitless opportunities for businesses to find their target audiences, improve brand awareness and engage with customers. However, the majority of financial services companies didn’t quite embrace social media platforms for various reasons for the longest time.

Fast forward to 2024, and many financial services companies have now started using social media as their go-to channel to ensure better customer experience, brand trust and loyalty. Why? It’s because creating and cultivating meaningful customer relationships will ultimately benefit their brand in more ways than one.

Having said that, talking about loans, mortgages and investments may probably not be as exciting as watching cat videos and memes for your audiences. So, how do you tackle this problem?

Well, we’ve tried to address this very question in this blog, which will hopefully empower you to use social media in financial services, to serve your customers better. We’ve also included plenty of insights into some of the most popular social media trends in your industry so you’re one step ahead of your competition and the game.

- Interesting social media usage statistics in the financial services industry

- 3 best social media platforms for financial services

- 5 social media marketing best practices in financial services

- Top social media trends for the financial services industry

- Examples of social media marketing in the financial services industry

Interesting social media usage statistics in the financial services industry

Before we get into the meat of today's topic, let's look at a few fascinating social media statistics in the financial services industry to get you going.

- A majority of Gen-Zers check out social media when they need financial information and advice, and 70% of them are already saving up for retirement

- 40% of millennials need help from a personal financial advisor to manage their money

- According to a study by the American Bankers Association, almost 9 out of 10 banks in the US are highly or somewhat active on social media

- The journey of a consumer looking for financial services often starts online with a search

- The digital advertising spending of the US financial industry was estimated to be over a whopping $30 billion in 2023

3 best social media platforms for financial services

As a business, you don't want to spend all your resources on promoting your services on all the social media platforms in the world. Instead, choosing a few platforms will allow you to pay undivided attention to only the ideal platforms for better social media ROIs.

Here are the 3 best social media platforms for financial services companies.

1. LinkedIn

With over 950 million users, LinkedIn is a great platform to find new leads as its users are primarily for professional networking, business development, lead generation, etc.

A great example of a finance services company that uses LinkedIn for growth is the London-based wealth management firm, Morrisson Wealth. It has used the Sales Navigator feature on LinkedIn to target the right audience. This strategy helped the company create personal connections with the audience and improve leads by 33.8%.

Why is LinkedIn suitable for financial services companies?

- LinkedIn is among the most trusted social media platforms to get information. As trust is a huge factor for customers when getting financial advice, you can use LinkedIn to share financial information and insights. It will improve the chances of you reaching and connecting with more customers.

- Users are 2X more likely to look for financial advice on LinkedIn than on other platforms. Thus, financial services companies can gain immense benefits when they share finance-related guidance on the platform.

- As the platform offers up to 2X higher conversion rates, financial services companies can reach their target audience faster.

Read More: A Complete Guide to LinkedIn Advertising

2. Facebook

The biggest social media platform in the world, Facebook has over 3 billion monthly active users. Facebook offers diverse options for businesses to create different types of content and connect with audiences from diverse demographics.

Apart from organic options, like publishing posts, videos, etc., Facebook also has a robust and intuitive paid advertisement platform — Meta Business Suit — to reach large audiences. On Facebook, you can use ads on news feed, inside videos, etc., to promote and sell your service offerings.

A great example of how financial services companies can use Facebook for growth is American Express. With the help of awareness-focused Facebook video ads and its standard ads, the company managed to bring down the cost of acquisition by 33%.

Why is Facebook suitable for financial services companies?

- Facebook is the most versatile social media platform for creating diverse types of content. Hence, financial services companies can use posts, images, short and long videos, etc., to reach their audience.

- With a robust ad management platform and lots of campaign options, like video ads, carousel ads, image ads and more, Facebook can help financial services companies reach different target audiences.

- Facebook lets you use short- and long-form videos for promotions, which benefits financial services companies as they can share concise or in-depth finance advice using these options.

Read More: What is Facebook Advertising and how to do it?

3. TikTok

TikTok has essentially changed the landscape of social media with short-video sharing. Since its inception, it has become the fastest-growing social media platform. The platform has now garnered over a billion users, and the chief user base of the platform comprises Gen-Zers and millennials. It is one of the best social media channels for creating and sharing entertaining, educational and informational videos for financial services businesses.

A great example of a finance services company using TikTok for growth is the UK fintech Plum, which collaborated with well-known finance influencers on TikTok. This strategy helped the fintech in gaining a 180% increase in investments.

Why is TikTok suitable for financial services companies?

- The possibility of going viral with short videos is high on TikTok. This is great for financial services companies as they can reach a larger audience quickly by strategically creating viral videos.

- Using TikTok, financial services companies can easily reach Gen-Z and millennial audiences, both of which are highly conscious about financial freedom and investments.

- TikTok is not yet saturated with ads in the way that platforms like Facebook and Instagram are. This lets financial services companies generate better campaign results and lower their acquisition cost.

Read More: 7 key trends to power your TikTok marketing campaigns

5 social media marketing best practices in financial services

Simply using social media is not enough to stay ahead in the competitive field of financial services. Doing it right is the key. On that note, here are five best practices you can adopt while using social media for your business to take it to the next level.

1. Conduct a social media audit before you begin

Social media audits help you in evaluating your brand’s online presence and the performance of all your social media handles. There are numerous advantages of performing a social media audit. Some of them are as follows:

- Such an audit lets you hunt down any imposter or fake social media accounts that are mimicking your brand's name, which could pose a serious threat and risk to your brand image and customer information. Removing such accounts is crucial to establishing a positive brand image and customer trust.

- It helps you understand your target audience, your competitors, the type of content that’s doing well in your niche, etc.

- It allows you to monitor your social media performance, find content gaps and discover potential growth opportunities.

2. Create custom content for social media platforms

Every social media platform has a personality, which also applies to its users. Therefore, having a detailed content plan for each of the platforms is crucial. Creating just one type of social media content and sharing the same across various social media will not bring you the audience and leads you’re after — you need to tailor your content for all your channels.

- If you are using TikTok or Instagram, your focus must be on short, vibrant and engaging videos.

- When using LinkedIn, the content needs to be professional, on-point and matter-of-fact, with no fluff at all.

- For Facebook, you can use different strategies for different target groups. While infotainment content can resonate well with a younger audience, a direct approach would work for an older audience.

Also Read: How to build a social media content strategy (beyond the cat memes)

3. Test and optimize social media ads for better ROIs

Apart from engaging with your audience organically, you also need to rely on ads to promote your financial services and products. You may research and target your audience before running the social media ads, but always test the ads before running them in full swing. Here is what you can do to test your ads:

- Let your ads run for a few days and gather information

- Understand how each of your ads is doing

- Collect the data and analyze it for insights

- Use the insights to optimize the ads and improve the results

For example, you may find your image ads work better for your target audience. So, push your image ads more than other ads for better results.

Source

Dive Deeper: Social media advertising: In-depth guide and proven tips

4. Engage with your audience across platforms

Despite actively posting and running ads, many financial companies fail on one front — engaging with their audience. Customer engagement is an important metric that you cannot miss.

The goal behind publishing content on social media is to bring people to your business. And if you are not engaging with them, you are pushing them away.

Here are a few things you can do to better engage with your audience:

- Check comments and questions on social media

- Respond to them with relevant insights

- Direct them to the right department

- Arrange for callbacks, if necessary

For example, if someone is enquiring about mortgage calculation, lead them to your resources section or the calculator on your site. AI-powered chatbots, like that of Sprinklr’s, can work wonders here by providing automated, intent-based responses to common queries and routing customers to knowledge bases or the ideal agents in no time.

5. Use social listening for better customer experience

Active social listening is an integral part of every financial service company’s social media strategy. It helps you gather vital, relevant industry insights from your customers.

Through social listening, you can quickly gauge whether your customers love your products and services or not. It also helps you in proactively reaching out to your audience online and providing them with whatever assistance they need to resolve their question.

Alternatively, if they share great, positive experiences with you, use such feedback wisely.

This is what you can do:

- Feature their stories on social media

- Tag/mention the customer on your posts

- Encourage other customers to do the same

- Engage with everyone who comments on your posts

- If you find more customers like this, feature them on your social media as well

Learn More: 8 best practices to ace your social media marketing

Top social media trends for the financial services industry

Understanding the current trends in social media is crucial if you want to take advantage of what’s working in the industry. A practice becomes a trend because people respond positively to it.

Keeping that in mind, here are seven trends that are working well for the financial services industry now. Use these trends in your social media campaigns for better results.

1. Hyper-personalized social media content

Personalization is an important aspect that has helped financial services companies reach their ideal customers. While this is going to continue, a new trend is shaping up in the same category — hyper-personalization.

By thoroughly understanding their audience, their preferences and their pain points, businesses can create highly targeted content, ads and user experiences for increased loyalty and lower acquisition costs.

Watch on Demand: The Human Touch: How personalised experiences can drive business growth

2. User-generated content

Content generated by users is another trend that financial services companies can use to promote their services and improve brand reputation. Ask customers to share their positive experiences with your products and services and use them in your social media. It could be short videos, social media posts or even reviews.

User-generated content (UGC) is immensely valuable for your audience as such content comes directly from users.

Read More: How Top Brands Harness UGC Marketing

3. High-value, educational content remains king

Producing helpful content has been the go-to strategy for most financial services companies to build a strong customer following online. And it continues to reap impressive benefits.

Educating your audience via content in the form of guides and how-tos is the easiest way to impress and engage the audience. For example, Humphrey Yang, who has over 3.3 million followers on TikTok, creates short-form content in the form of financial lifehacks. Having been a professional financial advisor, he touches on topics that appeal to the average Joe, with plenty of beginner’s guides and money-making methods for folks looking to invest, save money and more.

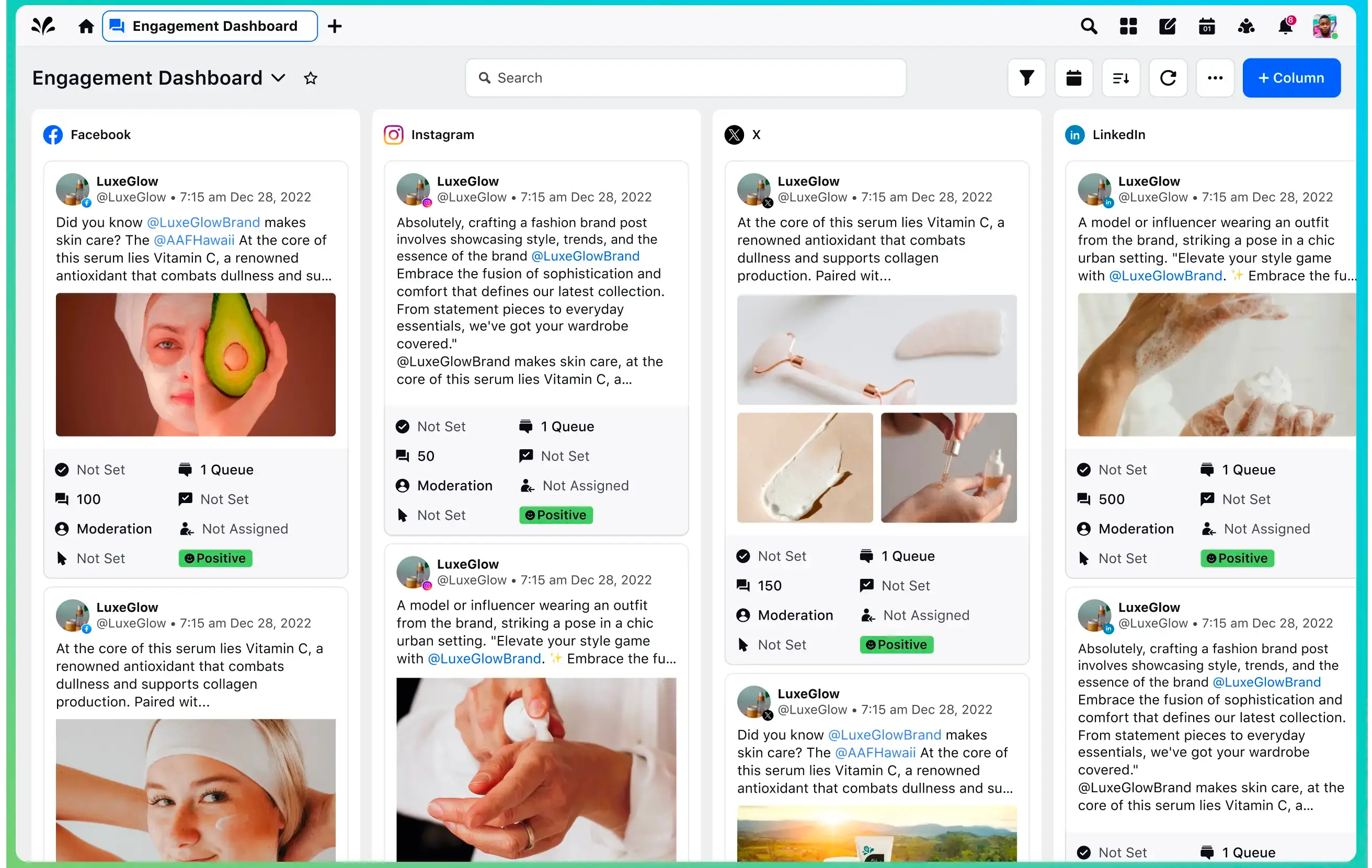

Pro Tip: Use a feature-rich tool like Sprinklr Social to manage all your social media content from one place and engage with your audience effectively.

4. Greater emphasis on customer lifetime value

Through effective and personalized content strategies, financial institutions are trying to improve the customer lifetime value of their users. Maximizing the existing customer lifetime value is extremely crucial for businesses as it is less costly compared to acquiring new customers.

To optimize the customer lifetime value, businesses need to deliver exceptional customer experiences, personalized customer support, enhanced data security, etc.

5. Influencer marketing to connect with hard-to-reach audiences

Influencer marketing has been gaining traction in the financial services industry as well. Many industries have been leveraging the same for years now, and it has driven excellent results for niche businesses.

Financial services companies and banks have also stepped up their social media game. They associate with niche influencers to reach audiences that were otherwise hard or impossible to reach. A great example of one such influencer, as we just mentioned earlier, is Humphrey Yang who makes highly informative, concise and engaging videos, like the following one that garnered about 2.5 million views!

Read More: Influencer marketing strategies to improve engagement

6. Data security remains challenging but is getting better

With increased social media usage for financial services comes the risk of data theft and privacy concerns. And customers expect that financial services companies will invest more in protecting user data.

Dive Deeper: 5 social media trends for banks to step up their social engagement strategy

Examples of social media marketing in the financial services industry

Now, let’s approach things from the practical side. We have collected 4 examples of how global financial services brands use social media to their advantage.

These brands wisely use social media to not only promote their offerings but to also establish their brand and connect with their audiences.

1. Wells Fargo Bank

One of the top banks in the country, Wells Fargo uses Instagram as its chief social media platform to market its services and products to a younger generation. The Instagram handle of the bank is full of financial advice and helpful content targeted at Gen-Zers and at people of different ethnicities.

2. Bank of America

Bank of America has an extensive social media presence. Along with useful content and financial advice, it also shares inspirational stories and customer experiences on its social media platforms. The bank also collaborates with influencers on social media, in addition to highlighting its charity work.

3. Zerodha

Zerodha is an online stock trading platform in India. It uses Facebook, Instagram and X to promote its platform and services. It also promotes responsible investment by sharing educational videos, investment tips and stock update videos. Additionally, it answers users' comments on social media promptly to ensure the best customer experience.

4. Fidelity Investments

Another financial services company in the US, Fidelity Investments has an excellent online presence. And it has created a unique content strategy that plays well with the user base of its go-to social media platforms.

Its LinkedIn profile gives a more professional, informational vibe, while its Instagram page is colorful and fun. This strategy works perfectly for Fidelity to reach its target audience on each of these platforms.

Summing it up

Having a strong social media presence is crucial for financial services businesses to grow and reach new customers. However, you need to do it strategically to get the results you expect from your social media campaigns — organic or not. This includes choosing the best platforms for your business, creating custom content and formulating customer service strategies to provide value to your consumers without fail.

Your focus must be on creating meaningful relationships and associations with your audience through your content. Deliver value to your audience. Help your audience to make better financial decisions and empower them to use their money wisely.

Along with this, you also need to have a reliable social media marketing tool like Sprinklr Social to keep everything under the same umbrella. The tool empowers you to deliver excellent brand experiences, drive high engagement and generate revenue by allowing you to strategically plan, publish and manage on-brand content across more than 30 digital channels.

So, sign up for a demo to see how it can help you make bank by building more meaningful customer relationships across social media.