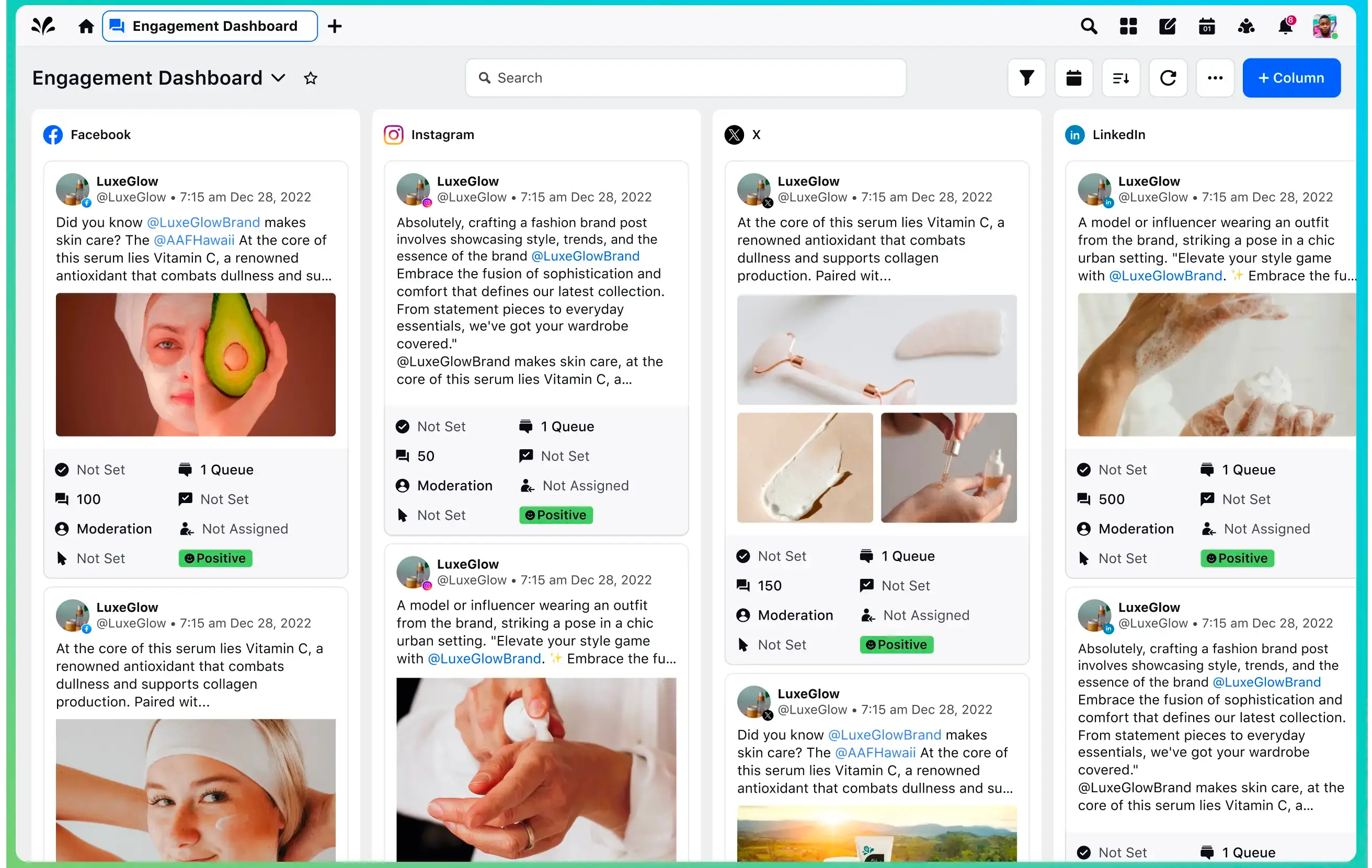

The undisputed leader in social media management

For over a decade, the world’s largest enterprises have trusted Sprinklr Social for its in-depth listening, unmatched channel coverage, enterprise-grade configurability and industry-defining AI.

4 ways financial brands can build loyalty in the digital age

Last month, I moderated an open-forum discussion with a handful of Sprinklr’s financial services customers. We set out to talk about the latest trends in social media — and how these trends impact their approach to customer service. Our discussion focused on the importance of customer loyalty and how brands are achieving this in a highly competitive market, where building strong relationships with customers is paramount.

It was an invitation-only event, so I can’t share a recording, but I have been cleared to share my top four takeaways:

1. The importance of a strong digital presence cannot be overstated

Social media provides a platform for financial services institutions to build their brands and increase their visibility among customers and prospects. With a strong social presence, banks can engage with their audiences and build brand awareness and positive reputations — leading to new customers and more business. But it's not just about attracting new customers; it's also about retaining existing ones. To earn customer loyalty, financial services brands need to listen to the needs and preferences of their consumers as expressed in social conversations. This ensures that new product offerings are always tailored to the market. It also enables banks to monitor and manage their social reputations to maintain a positive image and build trust among customers and stakeholders.

2. Engage with your customers and prospects on digital channels

A younger generation of consumers relies heavily on social media research to make their buying decisions. More than ever before, these consumers have greater information about products, services, and competitors, they are heavily influenced by what their peers are doing, and they have high expectations of the brands they do business with. Financial services institutions that have built a strong social media engagement muscle are able to meet those expectations and win the loyalty of those customers: They build strong relationships with customers by actively engaging with them on social channels, addressing complaints and issues promptly, and ensuring transparency and openness in their operations.

3. Be human at every customer touchpoint

Banks need to be human at every touchpoint to build trust, strengthen relationships, provide exceptional customer experiences, and differentiate themselves in a competitive market. Financial matters are deeply personal and sensitive, and people want to feel confident that they can trust their bank with their money and their information. By building personal connections with customers — online and in real life — banks can create a sense of trust and security that is difficult to replicate with technology alone. Financial services institutions also rely on strong customer relationships to grow business; when customers feel valued and understood by their bank, they are more likely to remain loyal and recommend the bank to others. With increased competition across the financial landscape, being human and providing personalized, exceptional customer experiences enables financial institutions to stand out from the competition.

4. Content is queen

Financial services may be an industry as old as time, but that doesn’t mean institutions can rest on their laurels: creating engaging and relevant social content for customers is critical — and especially on emerging platforms like TikTok. This is where you reach that new generation of consumers and start to build those long-term relationships. This is where you humanize your brand by creating relatable, engaging, and entertaining content. It’s also where you showcase your values and highlight your commitment to making an impact on the world with programs that support things like social responsibility, sustainability, and financial literacy. In fact, we learned in this discussion that educational content was the highest performing content for one Sprinklr customer’s FYP (for you page), which is the first page users land on when they open the TikTok app.

The financial services industry is changing rapidly, and it's important for brands to adapt to these changes. By focusing on their reputations on social media, creating authentic experiences, and prioritizing customer loyalty, financial services brands can build trust and credibility with customers and prospects and stay ahead of the curve.