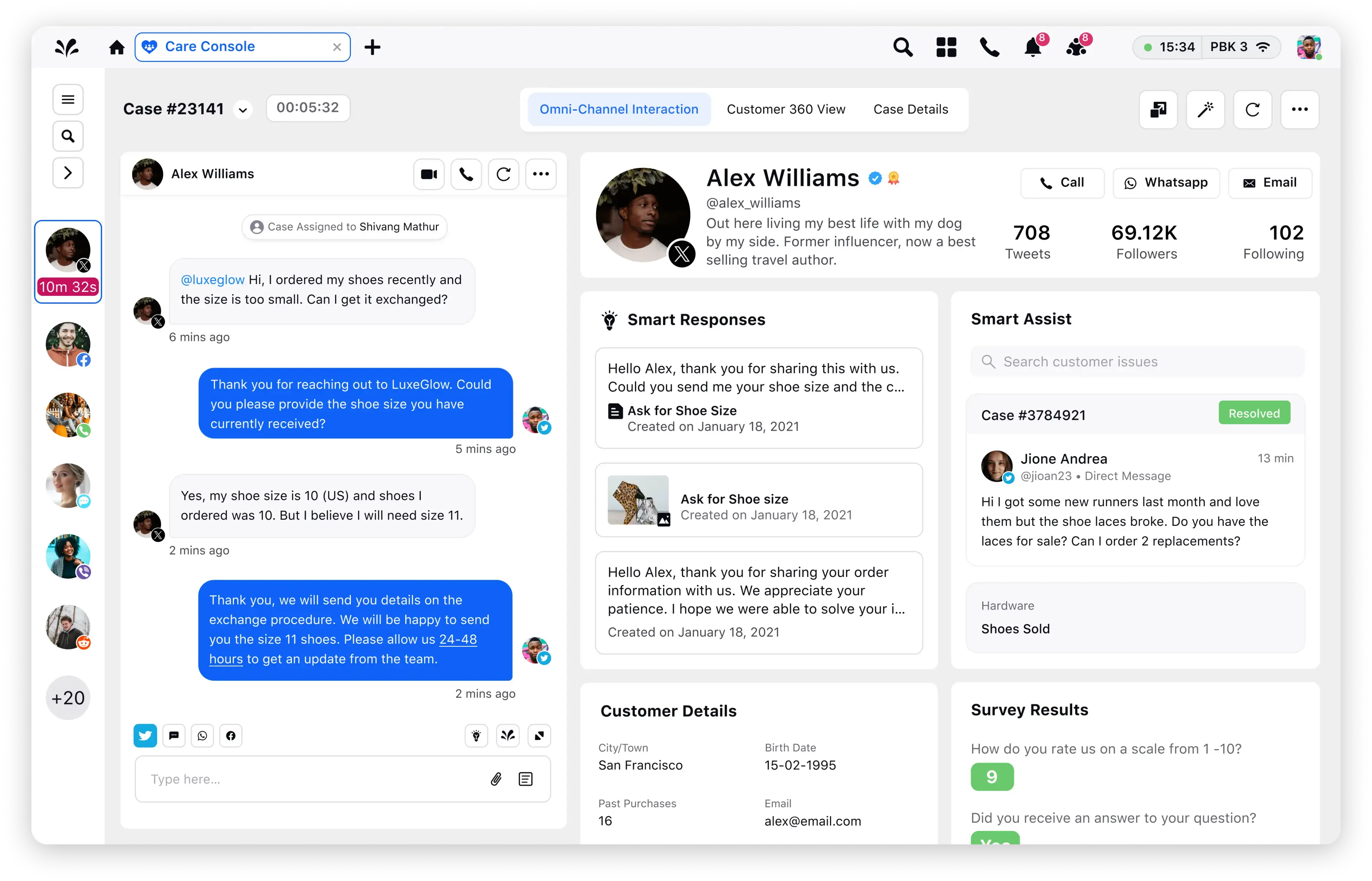

The next generation of CCaaS is here

Digital-first customer service, enterprise-scale voice support. Redefine customer service with an AI-powered platform that unifies voice, digital and social channels. Power channel-less interactions and seamless resolution no matter the channel of contact.

Average Customer Retention Rate by Industry

Customer retention.

It is what differentiates good brands and great brands. Think about it. Nike, Adidas, Apple, Zappos. These legendary brands are like customer magnets. Once an Apple customer, always an Apple customer. It’s as if these brands have demystified the secret suce of brand success – customer retention.

But have you?

If you are spending dollars on customer acquisition, and not spending enough on retaining your existing customers, unfortunately you’ve got it all wrong. Because no matter how great your products are or how well packaged your brand, there will always be someone who does it better.

But if you’ve learned the strategies of customer retention, you need not lose sleep over competition or brand perception. Your customer will stay and be your mouthpiece and advocate.

In this article, we will cover the basics of average customer retention, benchmarks for different mainstream industries and more. Let’s get started.

What is customer retention?

Customer retention is the ability of a business to retain customers over a given period. It is a critical measure of your business's long-term success.

Customer retention is typically expressed as a rate, computed over a period of one year. Let’s understand it better with an example.

Say your variables are:

A: Number of customers at the beginning of a specific period

B: Number of customers at the end of the period

C: Number of new customers at the end of the period

Then, your average customer retention rate can be calculated by the formula:

Customer retention rate = (B-C)/A x 100

However, customer retention is not as straightforward as it might seem. It is impacted by a number of direct and indirect factors, including:

- Customer satisfaction: Customers who are happy with a company's products or services are more inclined to do business with them again. Businesses may improve customer satisfaction and raise retention rates by promptly responding to issues and customer complaints and providing quick resolutions.

- Loyalty programs: Programs that reward customers for their recurring business and encourage them to stick with a certain brand are referred to as loyalty programs. Some examples of loyalty programs include discounts, special deals or point-based systems that customers can use to earn rewards.

- Exceptional customer experience: Exceptional customer experience can have a significant impact on customer retention if it's delivered at every touchpoint, from pre-purchase contacts to post-purchase assistance.

Also read: A detailed guide on customer experience management

How customer retention rates are calculated across industries

Take a look at customer retention rate computation in some of the mainstream industries.

Retail

To determine customer retention rates, retail organizations often divide the total number of customers at the end of a given period by the total number of customers at the beginning of that period. Retention in retail hinges on parameters like:

- Product diversity

- Competitive prices

- Customer service quality

- Store ambience

The retail business has a low retention rate compared to other mainstream industries. High levels of competitiveness and ease of exit are the root cause. In addition, customers in the retail sector are almost inundated with options.

Want to be a Retail CX leader? Download our FREE Retail CX Benchmarking report.

Consumer packaged goods (CPG)

CPG businesses frequently monitor average customer retention rates by looking at recurrent buying patterns. They track the proportion of returning clients over a specific period.

In this industry, keeping customers happy depends heavily on:

- Product quality

- Marketing strategies

- Brand loyalty

Is your Digital CX up to the mark? Check the CPG benchmarks in this report.

Technology

Customer retention rates in the technology sector are based on contract or subscription renewals or recurring income. Depending on the kind of technology being used, the industry average for client retention varies greatly.

Customer retention in the technology sector is reliant on:

- Product dependability

- Regular upgrades

- Customer support speed

- Competitive pricing

How does your CX stack up to the competition? Check the benchmarks here.

Banking and financial services

In the BFSI industry, customer retention rates are determined by the number of customers who remain with the same bank or financial institution over a given period. Personalized financial advice, accessible digital banking services, competitive interest rates and confidence in the institution's security procedures affect retention rates in the BFSI industry.

Assess your compliance-centricity here.

E-commerce

Online retailers use data on customer lifetime value, repeat sales and website visits to calculate customer retention rates. Ease of use, tailored suggestions, quick delivery, easy returns and customer feedback affect the average customer retention rates in e-commerce.

Customer retention rates: A comparison across industries

Now that you understand how average customer retention rates are measured in various industries, it’s time to learn industry averages and take inspiration from retention champions.

A. E-commerce

The market for online buying is continuously expanding, which makes it challenging for e-commerce companies to retain customers for long.

Average retention rate: The average customer retention percentage in e-commerce is around 38%, meaning just three out of 10 customers stick with one single brand for more than one year.

Top performers: Prada’s customer retention rates shoot through the roof, thanks to their prompt customer support on all digital channels – live chat, email and social – using a unified support solution. Read the full story here.

Tips: To delight customers into staying, leverage personalized product/content suggestions and loyalty programs designed for the online buying environment.

B. Banking and financial services

Maintaining customers is essential for long-term success in the regulated world of banking and financial services.

Average retention rate: The typical client retention rate in the BFSI is around 78% - one of the highest in the group we studied.

Top performers: Wells Fargo exceeded industry retention benchmarks by providing individualized services, prompt communication and effective problem-solving help explain their success. Read the full story here.

Tips: Streamline your digital banking experiences, nurture lasting relationships with customers through tailored financial advice, streamline your customer onboarding procedures and deliver proactive communication to maximize your customer retention rate.

C. Telecommunications

Long-term contracts and customer loyalty incentives have helped the telecommunication industry to retain a high customer base.

Average customer retention rate: Telecommunications businesses often attain average customer retention rates of 78%. This demonstrates the industry's capacity to preserve a sizable consumer base despite intense competition.

Top performers: In the telecommunications sector, the best performers have attained retention rates above 75%.

Tips: Telecom firms should focus on giving quick customer service, offer enticing bundle packages and use data analytics to tailor communication. All this can help boost retention over time.

D. Subscription-based services

In recent years, the sector for these services has experienced enormous expansion.

Average retention rate: Retention rates for subscription-based services are generally 40%-45% on average. This demonstrates the effectiveness of business strategies in maintaining a substantial portion of its subscription base.

Tips: Businesses can increase client retention even further by consistently providing value-added services, providing adaptable subscription alternatives and using tailored suggestions to ensure consumers are engaged and happy.

E. Hospitality and travel

Customer retention is a key success factor in the changing world of hospitality and travel.

Average retention rate: In the hospitality and travel sectors, the typical client retention percentage ranges around 55%.

Top performers: Outstanding hospitality and travel businesses have retention rates as high as 50%. Excellent customer service, individualized advice, loyalty programs and enduring experiences are their areas of expertise.

Tips: Prioritize developing unique visitor experiences, customizing guest interactions and offering loyalty programs with privileged access to benefits and prizes to further increase client retention.

Conclusion

Businesses looking to navigate the ever-evolving terrain of customer loyalty can consider benchmarking average customer retention rates by industry as a critical compass. They can build solid relationships with customers and spur long-term growth by putting effective strategies into practice. Retaining customers is an investment in the long-term profitability of your company.

In your journey to foster client retention, Sprinklr Service can partner with you by uncovering insightful customer data to personalize offerings and loyalty programs. With cutting-edge AI and sector knowledge, we have a demonstrated history of helping brands boost their customer loyalty and retention. Take Sprinklr on a spin for 30 days and watch your rates soar.