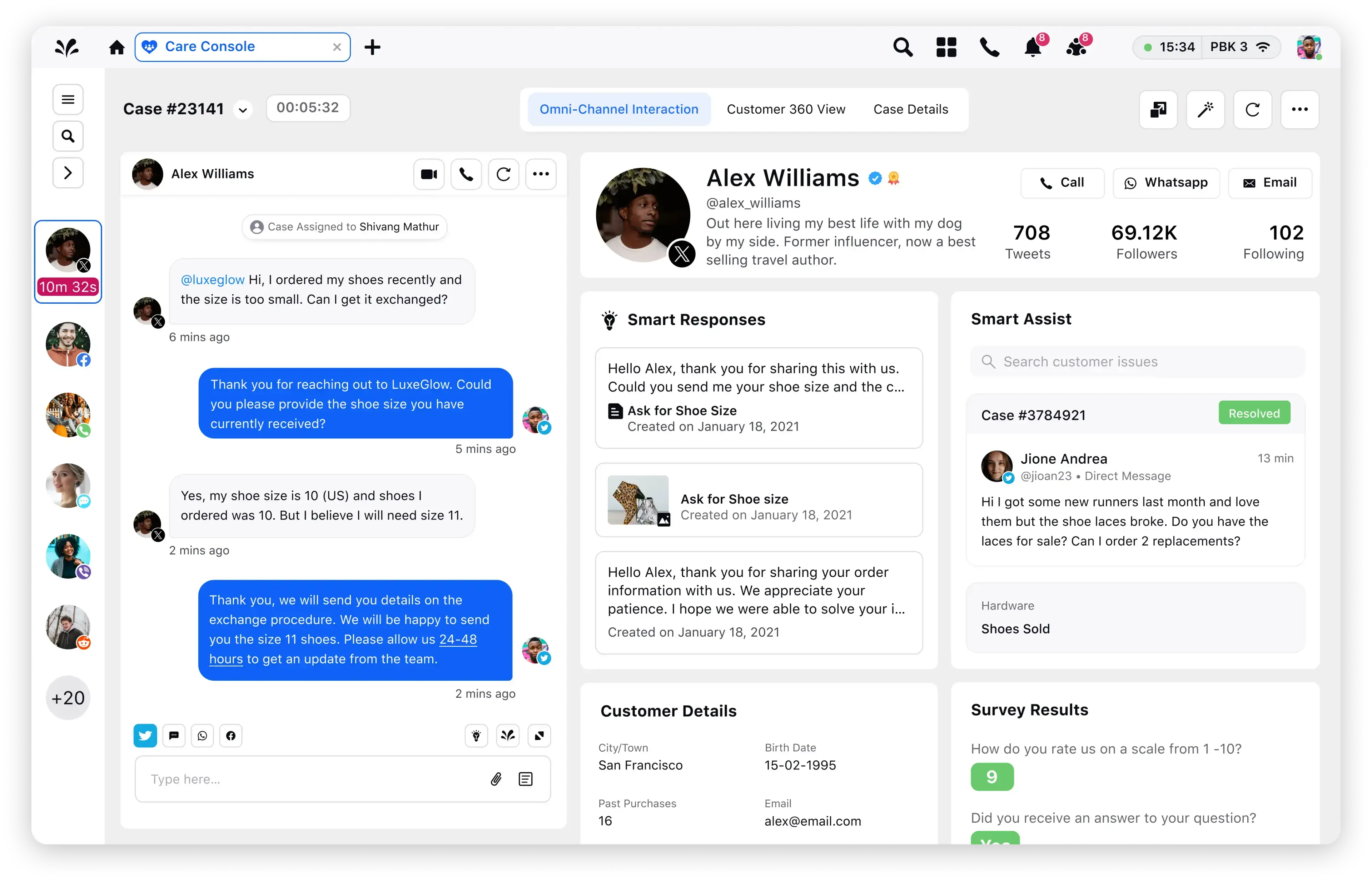

The AI-first unified platform for front-office teams

Consolidate listening and insights, social media management, campaign lifecycle management and customer service in one unified platform.

The 4 best competitive benchmarking strategies for the pharmaceutical industry

When the COVID-19 pandemic hit, pharmaceutical leaders found themselves under tremendous pressure to develop a vaccine for a novel, dangerous, and highly contagious virus. The all-hands-on-deck effort required active collaboration with crucial stakeholders like governments, competitors, lawyers, and manufacturers — without losing sight of daily business priorities.

The disruption in the industry hasn’t slowed, making it even more critical to leverage benchmarking data to track performance internally and against competitors to identify opportunities and navigate threats.

The internet, mobile, and social media have reshaped how and where consumers give feedback and talk about a brand. Unfortunately for companies, it’s not always a conversation on an owned channel. Many times, feedback comes in the form of reviews on review sites and posts on personal social media channels.

1. Evaluate where your company stands

Tracking sentiment is essential to understanding where your pharmaceutical company stands with your customers. AI-driven listening capabilities enable brands to easily track who’s talking about your brand and how they’re talking about your brand. Is your company more loved than others in the pharmaceutical space? According to Sprinklr data, among the top pharmaceutical companies, Pfizer leads in total number of engagements, but Sanofi leads in positive sentiment.

Don’t limit yourself to using these powerful features to only listen to conversations about your products and services. You can also leverage AI to get ahead of the competition. AI-driven listening can help you keep a constant eye on consumer trends and preferences — a crucial step in deriving insights to fuel innovation.

Learn more about Social Listening.

2. Expand beyond social media channels

When it comes to digital listening, too many pharmaceutical companies make the mistake of focusing primarily on Facebook, X, formerly Twitter, and LinkedIn. Whether you’re there to listen to and engage with them or not, your customers are talking about and interacting with your brand on a variety of additional channels, such as apps, chats, and review sites. Broaden your view by leveraging an AI-powered media monitoring tool. You’ll have further insight into what your customers are saying about your company, what matters most to them, and how you’re performing.

Your listening strategy isn’t the only thing that requires broadening — your data should also represent the full story. Instead of zeroing in on owned social channels, expand your insights to track and measure behavioral data from your website and review sites. You’ll have a more holistic point of view that informs the business and assists with crisis management.

3. Respond to customers

Only 3% of pharmaceutical companies respond to customers within one hour. And even worse, 64% either take over one week to reply or simply don’t respond at all. That’s not an ideal customer experience.

Customers expect an instant response when they engage with a company. In order to meet this need, pharmaceutical companies should conduct a gap assessment to evaluate whether or not there’s a need to increase employee headcount to meet demand. Also make sure to forecast engagement in case you need to build in a budget for additional staff to ensure you’re delivering the best possible customer experience.

Negative comments or questions that require answers shouldn’t be the only responses customers receive from your company. Consumers are twice as likely to view user-generated content as authentic compared to content created by brands themselves. Engaging with customers who have had a positive experience has been shown to increase user-generated content (UGC) and reach. An easy way to drive customer engagement and loyalty is by responding to and sharing positive customer comments.

4. Share and amplify your content

It’s critical for pharmaceutical companies to create customized, consistent, and relevant content that’s shared widely. Top pharmaceutical companies leverage listening and tap into metrics to identify what resonates with their customers and what doesn’t. But it doesn’t matter what content you post if you’re not posting on the right channels. You should also evaluate where your audience is and recalibrate your content marketing strategy to ensure you’re meeting your customers where they are.

Key stat: 54% of pharmaceutical companies spend $300,000 or more to promote and amplify their content

It’s not enough to share content organically — it’s easy to get lost in the noise. Amplify your content through paid promotion. Optimize your paid spend by evaluating performance metrics. And when it comes to those metrics, avoid focusing on vanity metrics such as likes and reactions. Instead, your top key performance indicators should be around engagement and sentiment. The rate at which consumers are socially engaged is a strong indicator of powerful content and meaningful impressions.

Key stat: 77% of pharma companies are focusing on competitor sentiment

Sprinklr’s Pharmaceutical Industry Benchmarking Report for Digital Unified-CXM is a data-driven assessment of how well global pharmaceutical companies are managing digital customer experiences. The report provides an outside-in and inside-out perspective that digs into listening to, responding to, and posting content.

Download the full report to find out how your company compares to others in the pharmaceutical industry.