The next generation of CCaaS is here

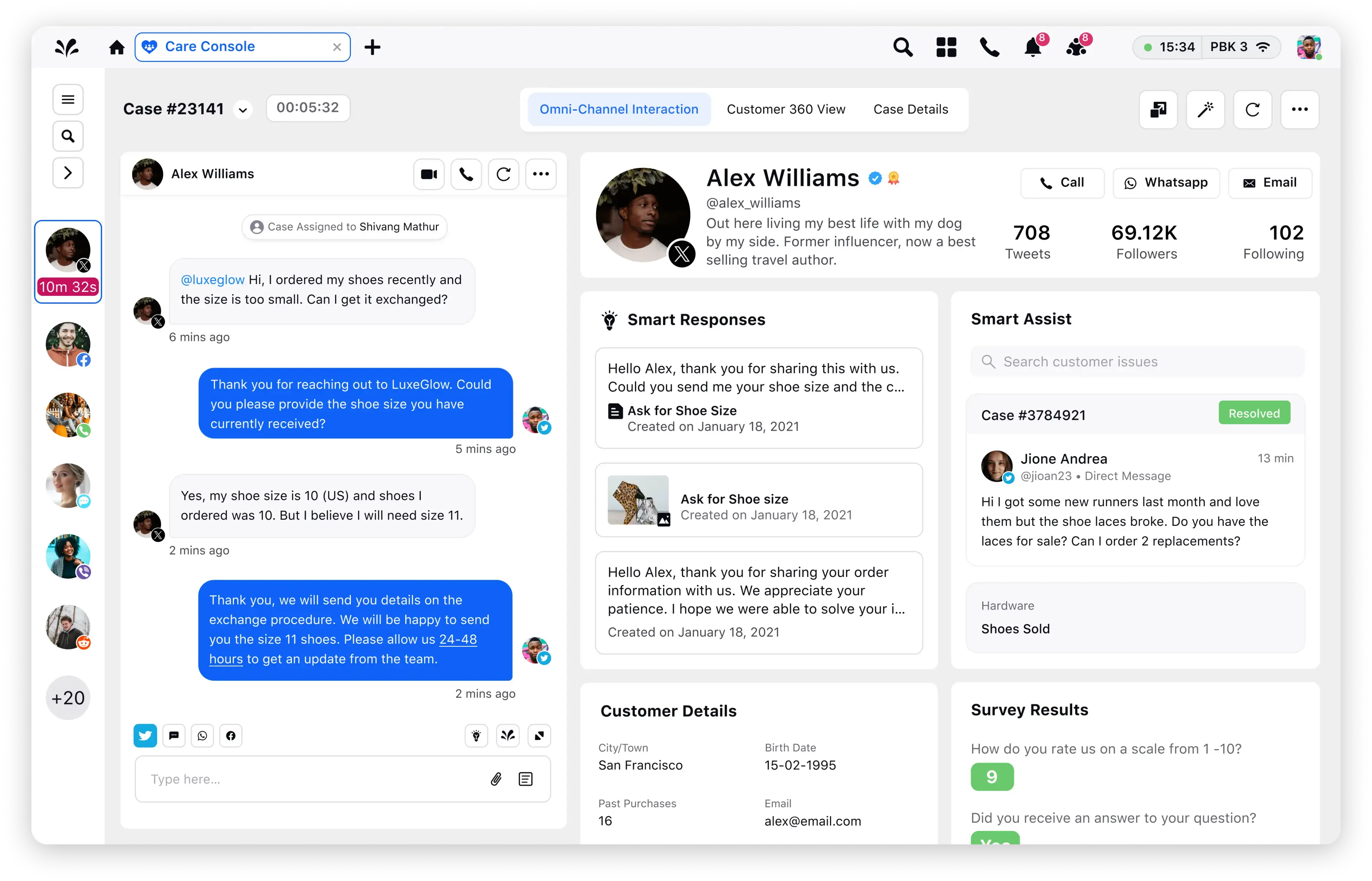

Digital-first customer service, enterprise-scale voice support. Redefine customer service with an AI-powered platform that unifies voice, digital and social channels. Power channel-less interactions and seamless resolution no matter the channel of contact.

Contact Center Fraud in 2024: 5 Signs (+Prevention Tips)

We've all heard of contact center fraud, online calling scams and impersonation attacks. Now, imagine a fraudster posing as your company, calling your customers, stealing their sensitive financial data and obliterating your brand's goodwill—all in a flash. This scenario represents the worst nightmare for any business, doesn't it?

Gartner advises that contact centers adopt a layered, cross-channel strategy to combat contact center fraud effectively. In this blog, we will delve into the essentials of contact center fraud, examining its various types, underlying causes, key indicators of an attack and the most effective strategies for fortifying your contact center against these pervasive threats. Let's begin.

What are contact center frauds?

Contact center fraud encompasses a range of malicious activities in which fraudsters exploit contact centers to gain unauthorized access to sensitive information, financial assets or customer data. These attacks can take various forms, including social engineering, account takeovers and call spoofing, which we will cover in the following sections.

The impact of these frauds extends beyond financial losses. They erode customer trust, damage brand reputation and can result in regulatory penalties. As contact centers handle a large volume of sensitive customer interactions daily, they are prime targets for fraudsters seeking to exploit any vulnerabilities in security protocols.

Understanding the various types of contact center fraud is the first step in developing robust strategies to combat them.

Why does contact center fraud happen?

Here’s why contact center fraud is a frequent occurrence.

- Human element: Contact center agents are human and can be susceptible to manipulation. Social engineering attacks exploit this human element, as fraudsters use psychological tactics to deceive agents into providing confidential information.

- Inadequate security measures: Many contact centers may not have robust security protocols, making them easier targets for fraud. Insufficient training, outdated technology and lack of multi-factor authentication are common weaknesses fraudsters exploit. Also, as contact centers evolve from multichannel to omnichannel to dynamic channel strategies— which integrate various communication methods like phone, email and live chat support — they may fail to adopt a layered, cross-channel approach to customer identification and verification.

- Pressure to deliver quick service: Contact centers often face pressure to resolve customer inquiries quickly. This emphasis on speed can sometimes lead to lapses in security protocols, as agents might skip verification steps to expedite customer service.

- Complexity of fraud detection: Fraudsters continually evolve their tactics, making it challenging to detect fraudulent activities. Advanced techniques like voice modulation and sophisticated impersonation can bypass standard security checks, complicating the detection process.

Importance of addressing the contact center fraud

Fraud schemes evolve and bad actors adapt. They constantly employ novel technologies and methods to probe and compromise your organization's defenses. Consider these compelling reasons to defend your digital perimeters and tackle contact center fraud in 2024:

Protecting customer trust: Customers expect their interactions with your company to be secure. Any breach of this trust due to fraud can lead to a significant loss of customer confidence. Maintaining robust security measures in your contact center helps preserve and strengthen this trust.

Preserving brand reputation: A single fraud incident can tarnish your brand reputation, leading to long-term damage. In the age of social media, where negative publicity and customer backlash can spread like wildfire, the consequences can be detrimental to your company's image, impacting your brand reputation management efforts the most. Proactively addressing contact center fraud helps safeguard your brand's reputation and public perception.

Preventing financial losses: Fraudulent activities can result in substantial financial losses, both directly and indirectly. Direct losses include stolen funds and fraud-related costs, while indirect losses stem from customer churn, increased regulatory scrutiny and potential legal liabilities. Sounds highly undesirable, right?

Regulatory compliance: Contact centers must comply with various regulations and standards designed to protect customer data, such as GDPR, CCPA and PCI DSS. Failure to address fraud can lead to non-compliance, resulting in hefty fines and legal consequences, something you would never want to be a part of.

Operational efficiency: Mitigating fraud risks allows your company to streamline its operations, reducing the time and resources spent addressing fraudulent activities. This will enable you to focus more on providing proactive customer service and business expansion than languishing in highly complex legal battles.

Mitigating future risks: By taking a proactive approach to fraud prevention, you can identify and mitigate emerging threats and reduce the risk of future attacks. This allows you to adapt to the evolving threat landscape and focus on business expansion rather than being caught up in complex legal battles.

Types of contact center fraud

Let’s explore the different types of contact center fraud affecting your transactions and communication channels.

Type of fraud | Description |

Social engineering | Fraudsters manipulate contact center agents into divulging confidential information by pretending to be legitimate customers, using psychological tactics to exploit human vulnerabilities. |

Account takeover | Fraudsters obtain enough personal information to bypass security measures and gain control over customer accounts through phishing, data breaches or social engineering. |

Call spoofing | Fraudsters disguise their phone numbers to appear as if they are calling from a trusted source, deceiving agents and customers into believing the call is legitimate. |

IVR hacking | Fraudsters exploit vulnerabilities in IVR systems to gain unauthorized access to customer accounts. This can involve an unusual volume of calls to the IVR system, multiple failed attempts to navigate the IVR or abnormal patterns in the options selected. |

Identity theft | Using stolen or fabricated identities, fraudsters access customer accounts or create new ones to conduct fraudulent transactions or exploit the account for other malicious purposes. |

Vishing (voice phishing) | A type of phishing attack conducted over the phone, where fraudsters pose as representatives from legitimate organizations to extract personal and financial information. |

Synthetic identity fraud | The creation of a fictitious identity using a combination of real and fake information to open accounts, secure credit and commit various forms of financial fraud. |

Data breaches | Fraudsters target contact centers to exploit vulnerabilities in data storage and transmission, gaining access to large volumes of sensitive customer information. |

Deep fake | Fraudsters use AI-generated synthetic voices or videos to impersonate legitimate customers or company representatives, deceiving agents and gaining unauthorized access. |

Internal fraud | Fraud originating from within the contact center, where employees exploit their access to customer data for personal gain or to assist external fraudsters. |

Top 5 warning signs of contact center fraud

Contact center fraud warnings are observable by vigilant contact center agents and advanced security systems. Also, regular training and robust security protocols can empower agents to detect potentially fraudulent activities. Here’s what to look for to detect suspicious activities in your contact center environment:

Warning #1: Frequent requests to change sensitive account information

When a caller makes multiple requests to change sensitive information such as passwords, contact details or banking information in a short period, consider it a red flag. Legitimate customers usually do not need to make frequent, rapid changes. Fraudsters, however, may attempt to gain control over an account and alter its credentials swiftly to lock out the rightful owner.

To overcome these challenges, cloud-native enterprises require multiple security measures, such as two-factor authentication and behavioral biometrics. This allows you to ask customers to confirm a transaction over a phone call and a one-time password (OTP) via text before proceeding.

Warning #2: Usage of social engineering techniques

Fraudsters often use social engineering to manipulate contact center agents by pretending to be legitimate customers. They may provide stolen credentials to bypass security checks and gain unauthorized account access. So, you must train your agents to recognize and respond to social engineering tactics effectively.

Action plan to combat social engineering

📝 Research and compile a list of common social engineering tactics such as phishing, pretexting, baiting and tailgating.

📚 Share real-life examples and case studies to illustrate how these tactics are used in practice.

🔍 Look for examples that are recent and well-documented in your knowledge base.

📂 Utilize advanced knowledge base software to streamline the entire information management process, from creation and collection to organization, analysis, discovery and optimization.

Deep Dive: Must-have Features for Free Knowledge Base Software

Warning #3: Attempts to manipulate contact center agents for special treatment

Callers seeking special treatment or requesting exceptions to standard operating procedures (SOPs) without a valid reason may be committing fraud. This could involve asking for faster processing of questionable transactions or waivers of specific verification steps.

Scammers may use emotional stories or urgent requests to prompt your agents to skip standard verification procedures. It's important to be cautious as skipping these procedures can potentially harm our customers and the company. Such tactics can involve callers claiming they are in a crisis situation, such as having lost their wallet while traveling or needing immediate access to their account to pay for medical expenses. The scammers aim to elicit empathy and quick resolutions, encouraging your agents to forgo routine security checks.

Warning #4: Difficulty in answering verification questions

When callers take unusually long pauses before answering security questions or are searching for information, it suggests they do not have the answers and could be consulting stolen data or notes. Additionally, if a caller takes time to answer security questions that require intimate knowledge of the account holder, it should trigger alerts in your security systems.

For instance, if a caller struggles to answer routine knowledge-based authentication (KBA) questions or their answers are inconsistent with previous interactions, it may indicate a lack of genuine knowledge about the account. Authentic customers usually do not hesitate to provide personal information registered with enterprises for verification purposes. KBA questions may encompass topics such as your mother's maiden name, the model of your first car or the location of your alma mater. Sensitive inquiries on personal information are designed to be answered only by the actual customer or someone very close to them, safeguarding personally identifiable information (PII). Such lines of inquiry ask for verification details encompassing a range of personal identifiers and historical information. It usually includes:

- Personal address and phone number

- Social security number

- Driver's license

- Passport number

Financial service contact centers may ask security questions that require numerical responses, such as "Please state the current balance of your account." It's okay for the answer to have a small margin of error, as not many people know their exact account balance off the top of their head. Therefore, it's important to customize your security questions based on your specific industry. If the questions delve deeper and result in longer pauses before replies, there's a higher likelihood of detecting fraudulent calls to your contact center.

Warning #5: Repeated access attempts with incorrect information

If a caller repeatedly tries to access an account with incorrect or changing information, it may suggest they are testing different combinations. This behavior is uncommon for legitimate users but typical of someone attempting to breach an account.

Read More: Role of quality management in contact center to mitigate risk and ensure compliance

How to prevent contact center fraud

Monitoring the signs listed above should be a continual effort within your contact center, integrated into the daily responsibilities of all agents and supported by advanced fraud detection technologies. In this section, we explore strategies to prevent fraud proactively to safeguard your contact center.

Tip #1 Identify callers

Identifying callers is the first line of defense against contact center fraud. By verifying the identity of callers, you can prevent unauthorized access and protect sensitive information. Here's how to effectively identify callers:

- Use personally identifiable information (PII): Utilize personally identifiable information (PII), such as social security numbers or driver's license numbers, to verify the identity of callers. Reconcile the information provided by the caller against known registered data to validate customer identity accurately.

- Flag discrepancies early: Be vigilant for any discrepancies in the caller's information and flag them early to prevent unauthorized access. For instance, if a new customer calls in, your system should require additional identity verification steps before proceeding with any requests, especially those involving significant account changes.

- Implement dynamic AI-powered systems: Deploy advanced inbound contact center software with configurable systems that dynamically identify callers. These systems leverage AI to analyze caller information and surface customer histories, providing context for efficient customer case management.

Tip #2 Assess fraud risk

Assessing fraud risk is crucial for preemptively identifying and mitigating potential threats in contact center interactions. To achieve this, utilize passive methods and modern technologies. Passive methods involve analyzing device-specific information and voice biometrics to discern anomalies in interactions, such as irregular speech patterns, response speed or mismatches in accent and tone.

Additionally, leverage advanced technologies to track the origins of calls, pinpointing associations with previous fraudulent activities like known fraud hotspots or flagged IP addresses. Upon detecting calls from high-risk areas or unrecognized devices, scrutiny levels are automatically escalated by flagging such interactions for manual review.

Implement more rigorous security measures, such as additional authentication protocols and security questions, to verify the identity of callers from these flagged sources. By employing these proactive measures, you can effectively assess fraud risk and bolster security measures within your contact center operations.

Tip #3 Verify everything

Ensuring the authenticity of end-user identities is paramount in customer service security. Implement a multi-layered verification approach utilizing two-factor authentication, PINs and identity-proofing strategies such as knowledge-based authentication (KBA). KBA involves users answering personal questions or providing document verification through ID scans.

This comprehensive approach verifies that the individual engaging with the contact center is indeed who they claim to be. For instance, upon providing a password, a customer may receive a one-time PIN via SMS, which they must provide during the call to authorize any transactions.

By rigorously verifying user identities through multiple customer service channels, contact centers can significantly reduce the risk of fraudulent activities and safeguard sensitive customer information.

💰 Two cents from Sprinklr

Optical character recognition (OCR) technology presents a powerful tool for streamlining the verification process in contact centers. OCR minimizes errors and accelerates verification procedures by accurately extracting data from digital ID scans. Look for watermarks and holograms on ID documents to ensure authenticity and integrity.

It's crucial to prioritize data security during the verification process. Encrypt all collected data to safeguard sensitive information from unauthorized access or breaches. Additionally, leverage advanced capabilities like Sprinklr's AI-powered image detection to unlock insights from visual data beyond text analysis.

For instance, integrating OCR into Sprinklr's conversational AI platform enables intelligent translation for images containing text. This innovative approach enhances operational efficiency and elevates the customer experience.

Do you know: A leading technology company successfully integrated OCR into Sprinklr's platform, leveraging vision technology as an intelligent translator for images with text. Following this implementation, the company witnessed a remarkable 43% increase in customer satisfaction scores.

Tip #4 Implement behavior analytics

Utilize customer interaction analytics to identify patterns indicative of fraudulent behavior. These tools can detect anomalies in call behavior, such as rapid account changes, unusual transaction patterns or inconsistencies in customer information. Leverage predictive analytics to identify potential fraud risks and take preventive measures proactively.

Action plan to counter suspicious login attempts

❗Monitor user activity to detect any patterns of repeated access requests or failed login attempts.

🔍 Analyze the login patterns, such as unusual login times or locations.

🔒 Set up account lockout mechanisms that temporarily disable accounts after a certain number of failed login attempts.

📲 Your legitimate customer should receive a notification from your system if their account is blocked due to login attempts they did not initiate, prompting them to reach out to your business.

Tip #5 Train agents and customers

Invest in comprehensive training programs for your contact center agents to equip them with the skills and knowledge necessary to detect fraudulent activities. Train agents to recognize patterns of suspicious behavior, identify voice stress and spot inconsistencies in caller information. Consider establishing a specialized team of agents trained to handle potential fraud calls, enhancing overall security measures.

Agents should also be hired with specialized skills, including advanced questioning techniques and the ability to analyze nonverbal cues. They can identify subtle signs of fraud, such as hesitation in providing personal details or inconsistencies in the caller's story, flag suspicious activities and take appropriate action.

It is also important to educate customers on common fraud. Encourage customers to remain vigilant and verify the legitimacy of requests before providing personal information or engaging in financial transactions over the phone.

Interesting Read: Using AI scoring in contact centers to tailor agent training programs

Tip #6 Deploy cross-channel analytics

By aggregating data from multiple contact center channels, such as phone calls, emails and live chats, cross-channel analytics can identify patterns and anomalies indicative of fraudulent activities that might otherwise go unnoticed.

Real-time contact center reporting enables immediate response to fraudulent incidents, enhancing security measures and minimizing potential losses. The platform improves fraud detection accuracy by leveraging machine learning and adapting to emerging fraud trends. Additionally, it provides comprehensive insights into customer behavior across different contact center channels, facilitating personalized interactions while mitigating fraud risks.

Tip #7 Regular customer verification updates and internal audits

Implement a strategy where regular updates and verifications of customer information are mandated. Periodically confirm and update customer profiles, including contact details and security preferences. This can help ensure that customers' records are current, reducing the risk of fraudsters exploiting outdated or incorrect information.

For example, your contact center could set a policy where, every six months, customers are asked to confirm or update their PII during a service call or through a secure online portal. This helps keep customer data up to date and significantly lowers the chances of data hacking.

How Sprinklr AI+ helps

With Sprinklr AI+, you can address security concerns head-on, protecting sensitive information during live customer interactions with agents and chatbots. Sprinklr AI+ goes beyond basic data protection by intelligently masking dates and times, email IDs, URLs, IP addresses, driving licenses, common medical license numbers and more.

With its advanced regex masking capabilities, Sprinklr AI+ offers a high level of customization to meet your specific requirements. This ensures compliance and data privacy across all customer touchpoints, giving you peace of mind and the assurance that your data is protected.

Tip #8 Strengthen data security measures

Enhance data security measures within your contact center to protect sensitive customer information from unauthorized access or breaches. Implement encryption protocols for data transmission and storage, restrict access to confidential data on a need-to-know basis and regularly update security protocols to address emerging threats. Conduct regular security audits to ensure compliance with industry regulations and standards.

😊 Good to know:

At Sprinklr, safeguarding customer information is our top priority. Our stringent security standards, encompassing robust web applications, optimized infrastructure and governance across all modern channels, underscore our unwavering commitment to minimizing customer risk.

Our dedicated detection and response team excels in threat detection engineering, vulnerability management, incident response and crisis communication. Their expertise ensures the security of our product operations, business systems and all corporate assets. With Sprinklr, you can trust that your information is in safe hands.

Combat contact center fraud with Sprinklr Service

Handling sensitive customer data, whether it's financial information or health-related inquiries, makes contact centers prime targets for fraudsters using tactics like social engineering. These attacks do more than just cause financial losses—they can damage your reputation and erode customer trust. The solution is clear: robust security measures are essential to safeguard your contact centers, monitor agent behavior and prevent bad actors from exploiting vulnerabilities.

Sprinklr offers a comprehensive solution to these pressing issues. Leveraging advanced AI and a centralized dashboard, Sprinklr Service enhances both the security and efficiency of your contact center operations. From intelligent risk and compliance management to meeting the latest security standards and regulatory requirements, Sprinklr empowers you to run your contact centers confidently without the fear of security breaches.

Why not go beyond just reading about it? Book a demo and get a live Q&A session with our team to discuss your security concerns and see how Sprinklr can help.

Frequently Asked Questions

To prevent contact center fraud, implement authentication processes, such as two-factor authentication and knowledge-based authentication, to ensure that those who claim to be customers are indeed who they say they are. Regularly train your agents to recognize and handle potential fraud, as well as use technology to monitor and analyze customer interactions for unusual activities that could indicate fraud. Additionally, keep customer information updated and verify identities periodically to close gaps that fraudsters might exploit.

Modern technology tools such as voice biometrics can identify callers with unique voice prints and machine learning models that detect anomalies in customer behavior. Fraud detection systems can also include real-time monitoring of all customer interactions across various channels, providing a holistic view that can pinpoint suspicious activities. Integrate these advanced technologies to stay one step ahead of fraudsters.

Regularly review your contact center's fraud prevention strategies—at least annually or as often as new threats emerge. This frequent reassessment ensures that the measures in place evolve with the changing tactics of fraudsters. It's also beneficial to conduct these reviews after any major fraud incident or when significant changes in technology or business operations could impact security protocols.

Yes, implementing a multi-layered security strategy helps combat contact center fraud. Use various defense mechanisms at different points in the customer interaction process, including initial caller authentication, transaction verification and continuous monitoring of account activity. Layer these defenses to make it difficult for unauthorized users to access accounts. Each layer provides a new barrier that a fraudster must overcome.